Source: Block Rhythm Jaleel Kaori

This is a historic moment worthy of being highlighted in the history of Bitcoin and even the entire crypto market. The spot Bitcoin ETF has finally passed and Bitcoin has opened up. A new page.

01 List of 11 approved spot Bitcoin ETFs

At 4 a.m. Beijing time on January 11, the United States The Securities and Exchange Commission (SEC) also approved 11 spot Bitcoin ETFs, including:

1) Grayscale Bitcoin Trust

2) Bitwise Bitcoin ETF

3) Hashdex Bitcoin ETF

4) iShares Bitcoin Trust

5) Valkyrie Bitcoin Fund

6) ARK 21Shares Bitcoin ETF

7 ) Invesco Galaxy Bitcoin ETF

8) VanEck Bitcoin Trust

9) WisdomTree Bitcoin Fund

10) Fidelity Wise Origin Bitcoin Fund

11) Franklin Bitcoin ETF

Six of the ETFs will be listed on the Chicago Board Options Exchange (CBOE), three will be listed on the New York Stock Exchange (NYSE), and two will be listed on the Nasdaq Gram transaction.

Among these approved lists and applicants, Grayscale (GBTC) stands out with its approximately US$46 billion in assets under management, and Blackrock’s iShares also stands out with its huge US$9.42 trillion. U.S. dollar assets under management rank among the industry leaders. Following closely behind is ARK 21Shares (ARKB) with approximately $6.7 billion in assets under management. By comparison Bitwise (BITB), while smaller, still has around $1 billion in AUM.

Other significant players include VanEck, which has approximately $76.4 billion in assets under management; WisdomTree (BTCW) with its $97.5 billion in assets under management; Invesco Galaxy (BTCO) and Fidelity (Wise Origin), managing US$1.5 trillion and US$4.5 trillion in assets respectively.

Among them, BlackRock and ARK Invest’s spot ETF applications have been the most talked about in the market.

Looking back in 2023, BlackRock’s application for a Bitcoin spot ETF is regarded as an important turning point in the bull-bear trend of the crypto market. As an asset manager with more than $10 trillion in assets under management, BlackRock manages far more assets than even Japan’s 2018 GDP of $4.97 trillion. BlackRock, Vanguard Group, and State Street were once known as the "Big Three" and controlled the entire index fund industry in the United States.

More importantly, BlackRock has an impressive track record of success in getting its ETF applications approved by the SEC. Based on historical data, BlackRock has successfully received SEC approval for its ETFs by a ratio of 575 to 1, meaning that of the 576 ETFs it applied for, only one was rejected.

Therefore, when BlackRock submitted a spot Bitcoin ETF document to the US SEC in June, it caused a lot of heated discussion in the community. The community generally believed that BlackRock’s entry , which means that the adoption of Bitcoin spot ETF is inevitable.

Most recently, BlackRock invested $10 million in seed funding for its Bitcoin Spot ETF on January 3, 2024, a significant increase from the $100,000 seed funding initially invested in October. This move demonstrates BlackRock’s commitment and anticipation for the launch of a Bitcoin spot ETF. The ETF, named iShares Bitcoin Trust, will trade on the stock market under the symbol IBIT once launched.

In addition, BlackRock is actively communicating with the U.S. Securities and Exchange Commission (SEC) to resolve regulatory issues surrounding its Bitcoin spot ETF application. They filed an updated/revised Form S-1 after discussions with the SEC and have met with the SEC multiple times over the past month. BlackRock has also adjusted its approach from an in-kind to a cash model to comply with SEC requirements, demonstrating their flexibility and aggressiveness in adhering to regulatory standards.

At the earliest In this batch of lists, Ark Invest is among them as everyone guessed.

On October 12 last year, Bloomberg senior ETF analyst Eric Balchunas said on social platforms that ARK had submitted an updated prospectus for its Bitcoin spot ETF. At the time, he said that although approval may not be immediate Coming, but this "back and forth" with the SEC is a very positive sign.

At the same time, starting from August last year, Ark Invest began to gradually reduce its position in GBTC. At that time, many people speculated that the reason why the shrewd wooden sister began to reduce her position in GBTC may be for herself. Prepare for the Bitcoin Spot ETF Fund.

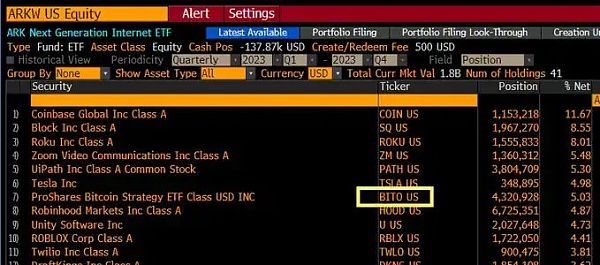

According to ARK Fund position data, ARK Fund reduced its holdings by a total of 146,242 GBTC in October without any purchases. In September, 11,249 GBTC were bought, but 67,494 GBTC were sold. In August, 106,413,910 GBTC were bought, but 108,776,240 GBTC were sold.

By December, according to Bloomberg analyst monitoring, ARK Fund had sold more than 2 million shares of Grayscale Bitcoin Trust (GBTC), cleared all its remaining GBTC positions, and used 100 million About half of the money in dollars bought shares of the ProShares Bitcoin Strategy ETF (BITO).

ARK purchased ProShares Bitcoin Strategy ETF (BITO) stocks

ARK purchased ProShares Bitcoin Strategy ETF (BITO) stocks

02 Spot ETF passed, Bitcoin and cryptocurrency entered a new starting point in history

The importance of Bitcoin spot ETF is mainly reflected in two aspects. One is to improve accessibility and popularity. As a regulated financial product, Bitcoin ETF Providing access to Bitcoin to a wider investor base. With a Bitcoin spot ETF, financial advisors can begin to guide their clients to invest in Bitcoin, which is significant for the wealth management community, especially those who have not been able to directly invest in Bitcoin through traditional channels.

The second is to gain regulatory recognition and enhance market acceptance. SEC-approved ETFs will alleviate investors’ concerns about safety and compliance because it provides more comprehensive risk disclosure. , a more mature regulatory framework will attract more investment, and this regulatory clarity is crucial for market participants to help them conduct business in the cryptocurrency industry.

The approval of the Bitcoin spot ETF undoubtedly brings Bitcoin and cryptocurrencies to a new starting point in history, and we can also perceive it through data such as Bitcoin spot ETF market size estimates and Bitcoin price performance estimates. Current market sentiment.

< p>ProShares’ Bitcoin strategy ETF BITO has exceeded US$2 billion in assets under management. BITO will attract a net inflow of US$506 million in 2023 and an inflow of US$30 million in the first eight days of 2024. From this, Bitcoin The gold-absorbing ability of currency spot ETFs is evident.

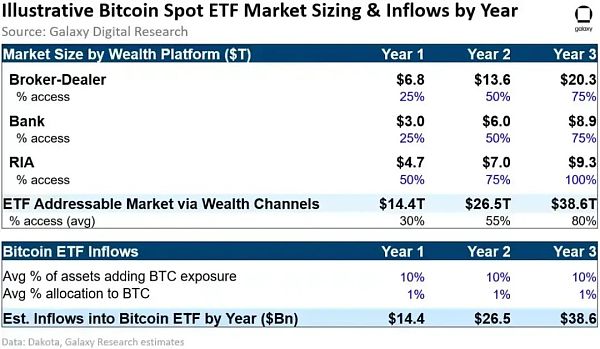

According to an October 2023 report by Galaxy Digital, the approval of a Bitcoin ETF could have a direct impact on the U.S. wealth management industry. The market available for Bitcoin ETFs and the indirect impact and reach of Bitcoin ETF approval will extend far beyond U.S. wealth management channels (such as international markets, retail markets, other investment products and other channels) and may attract more Multiple funds flowed into the Bitcoin spot market and investment products.

If we assume that Bitcoin is adopted by 10% of the total available assets in each wealth channel, with an average allocation of 1%, then the Galaxy Digital report estimates that after the launch of the Bitcoin ETF In one year, $14 billion will flow in, rising to $27 billion in the second year, and to $39 billion in the third year after launch.

Bitcoin Spot ETF Market Size and Inflow Illustration by Year

Bitcoin Spot ETF Market Size and Inflow Illustration by Year

In addition, the second-order effects of Bitcoin ETF approval may have a larger impact on global Bitcoin demand, which is expected to Other countries will follow the U.S.'s lead and approve and launch similar Bitcoin ETF products tomeet a wider range of investor needs. In the long term, as Bitcoin is monetized, its market share among different asset classes is likely to increase, thereby expanding Bitcoin's market size.

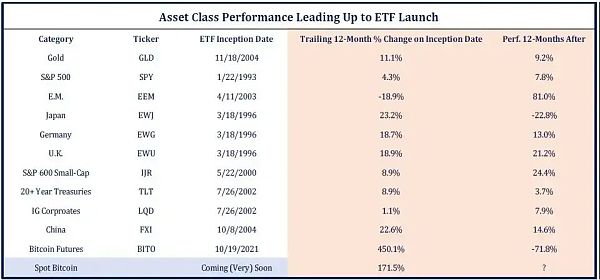

Bitcoin is known as "digital gold", and both are considered a means of storing value. Due to this connection, the market generally believes that studying the development history and historical market trends of gold ETFs is important for predicting the future trend of Bitcoin ETFs. significance.

In October 2004, the SEC approved the StreetTracks Gold Trust (GLD), the first gold ETF in the United States. The price of gold continued to surge slightly after the approval. In November of the same year, the U.S. gold ETF GLD was officially listed on the New York Stock Exchange. The market fell by about 9% in the two months after it began trading, once falling below the price when the ETF was passed. After nearly 8 months of consolidation, gold began to enter a high-speed upward cycle. In the following years, gold ETF products triggered a subscription boom around the world and became a mainstream gold investment tool, attracting a large amount of funds. The market generally believes that the passage of gold ETFs directly promoted the subsequent 10-year bull market in gold.

Asset class performance before ETF launch

Asset class performance before ETF launch

As of September 30, 2023, according to data from the World Gold Council, global gold ETFs held a total of approximately 3,282 tons (approximately 1,980 billion in assets under management), accounting for approximately 1.7% of global gold supply. At the same time, the total amount of Bitcoin held in investment products including ETPs and closed-end funds was 842,000 Bitcoin ($21.7 billion in assets under management), accounting for 4.3% of the total issued supply.

The Galaxy Digital report shows that based on the price in October 2023, the market value of gold is 24 times that of Bitcoin, while the fact that the holdings are 36% less than Bitcoin, assuming the same amount The impact of capital inflows on the Bitcoin market is 8.8 times that of the gold market. This estimate suggests that if inflows were $14.4 billion in the year following passage, Bitcoin prices could rise by 6.2% in a month and by a cumulative 74% in a year.

Yesterday, Valkyrie Investments co-founder Steven McClurg predicted as much as $200 million to $400 million would flow into his ETFs in the week following passage, with the overall market hitting $5 billion in the first few weeks of trading. When asked how Valkyrie plans to make money with such low fees, Steven McClurg said that such products may lose money in the early stages and that's okay, and Valkyrie expects its ETF to be profitable in the first year of trading.

03 An own incident in the application process of Bitcoin spot ETF

As the most surprising thing in the global cryptocurrency market Looking forward to the progress, every move of the spot Bitcoin ETF product extremely controls this already fragile market. Everyone has been waiting for too long, and there have been many "fake passes" in the past.

In the early morning of January 10, the U.S. SEC officially announced on social media that the Bitcoin spot ETF was approved. This tweet instantly received millions of views. The emotions have accumulated to this point, and coupled with this news that the cryptocurrency industry has been waiting for for several years, no one will think that there will be any problem with these few lines.

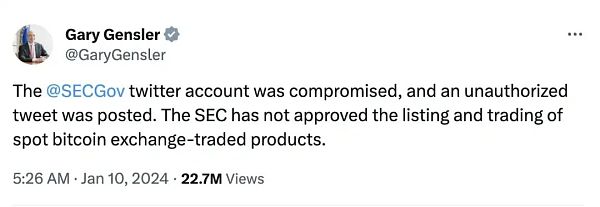

SEC Chairman Gary Gensler said a few minutes later that the "spot ETF was approved" was false news. The reason is that the SEC’s official Twitter was stolen, and the tweet just now was sent by a hacker.

Translation: @SECGov Twitter account was compromised and unauthorized tweets were posted . The U.S. Securities and Exchange Commission has not yet approved the listing and trading of spot Bitcoin exchange-traded products.

Translation: @SECGov Twitter account was compromised and unauthorized tweets were posted . The U.S. Securities and Exchange Commission has not yet approved the listing and trading of spot Bitcoin exchange-traded products.

Affected by false news, the price of Bitcoin fluctuated violently. After rising to nearly $48,000, it quickly dropped below $45,000, with a short-term fluctuation range of nearly 10%. According to Coinglass data, the Bitcoin market liquidated $56.2 million in the past hour, with long positions accounting for about 60%.

But this is not the first time that a Bitcoin spot ETF "fake pass" happened.

In October last year, the veteran cryptocurrency media Cointelegraph published the news on social media that the Bitcoin ETF was approved by the SEC in all capital letters. In less than half an hour, this The tweet has been read nearly 1.5 million times, showing the huge interest in the cryptocurrency industry. The market also responded quickly. Bitcoin, with a market value of US$550 billion, broke through multiple round digits, and the price once exceeded US$30,000, which seemed to indicate the return of the bull market.

Translation: Breaking news: SEC approves ISHARES Bitcoin spot ETF.

Translation: Breaking news: SEC approves ISHARES Bitcoin spot ETF.

However, the market quickly realized that something was not right. Because of big news like a Bitcoin ETF, mainstream media outlets like Bloomberg didn’t give any coverage. James Seyffart, an ETF analyst at Bloomberg, said on social platforms that the news is likely to be false and that there is currently no evidence to confirm this.

Subsequently, along with various refutations of rumors, the price of Bitcoin fell back to above US$27,000. After this madness that only lasted about 10 minutes, nearly $100 million was paid for the fake news in the market, with short positions liquidated at $72 million and long orders liquidated at $26 million. Now it seems that these "fake" news that were once passed are more like real news that was revealed in advance.

As we live in this era, we have not only witnessed the birth of a financial product "Bitcoin Spot ETF", but also witnessed a new era of encryption.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin CaptainX

CaptainX CaptainX

CaptainX CaptainX

CaptainX JinseFinance

JinseFinance cryptopotato

cryptopotato