Author: Carter Johnson, Anya Andrianova, Bloomberg; Translator: Tao Zhu, Golden Finance

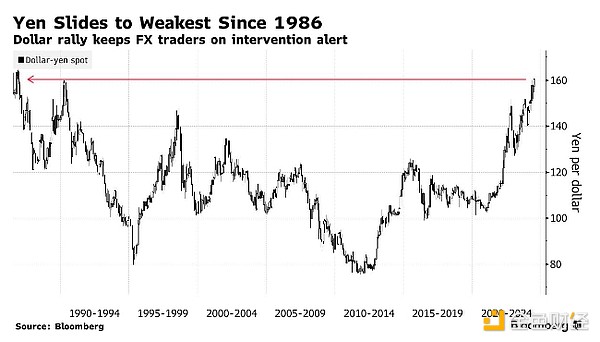

As the yen plunges to milestone levels in rapid succession, Japanese authorities face a stark reality: The decline won’t stop unless the Federal Reserve eases its long-running policy path. They have no control over it.

Investors around the world are realizing this as they analyze how still-high U.S. borrowing costs are boosting the dollar and its impact on the rest of the world. The yen’s continued plunge is an extreme manifestation of U.S. financial dominance in the global currency market, which trades $7.5 trillion a day.

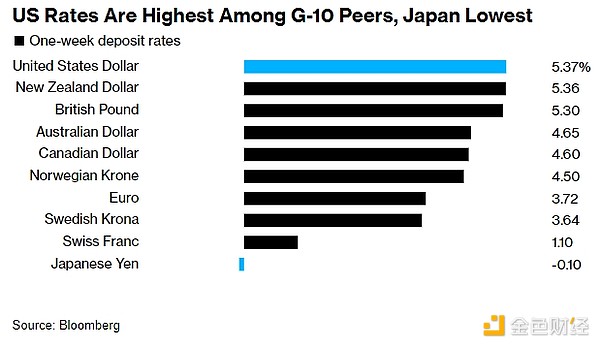

“This is all about the Fed. Long-term higher means keeping the front end of rates very high, attracting capital flows into the U.S. and keeping the dollar strong,” said Andrew Brenner, head of international fixed income at NatAlliance Securities LLC. "For Japan, that's a problem."

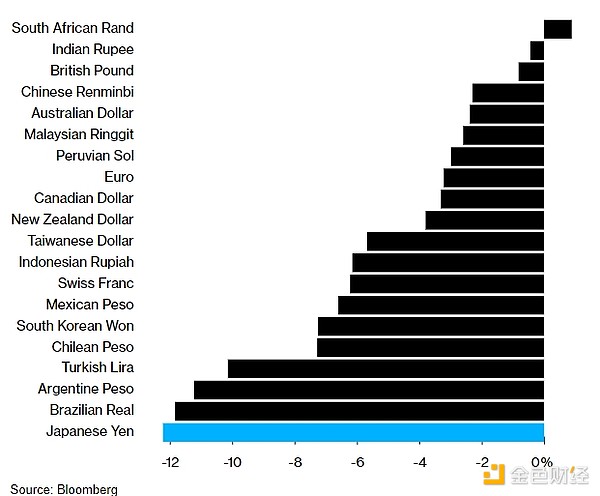

The Fed's high interest rates reverberate in foreign exchange markets, with many major currencies weakening against the dollar this year on the interest rate differential

The United States' dominance in global financial markets was on full display Wednesday. A key dollar gauge closed at a year-to-date high, weighing on other currencies around the world. U.S. stocks are set to have another strong quarter, while the Treasury Department had no trouble finding buyers for its auction of $70 billion in notes.

It was a different story for the yen, which fell 0.7% to $6.50 against the dollar. The yen fell to an all-time low of 171.80 against the euro. Among the moves, Japan’s top monetary official, Masato Kanda, reiterated that authorities were urgently considering foreign exchange markets and would take appropriate measures as needed.

The problem is that efforts by Tokyo officials to support the yen have so far made no progress. Strategists say the yen has been in the spotlight since the Asian nation spent a record 9.8 trillion yen, more than 600 billion yen, on a massive stimulus package. The yen has weakened in the weeks since the United States’s $1.6 billion (US$1.6 billion) foray into foreign exchange markets, and further intervention is likely to be equally ineffective.

“Until the Fed really eases monetary policy, I don’t think these measures will have any effect,” said Bob Savage, head of market strategy and insight at Bank of New York Mellon Capital Markets. “In the big picture, you have to reduce Japan’s demand for dollars. You either have to get long-term rates high enough or U.S. rates low enough. Neither of those has happened. ”

Asset managers have been heavily shorting the yen, according to Commodity Futures Trading Commission data released on Monday, with last week’s reading being the most bearish since 2006.

The yen is in a state of flux, with the dollar rising 0.1% in the green, and the yen falling 0.2% in the green.

The huge interest rate gap between Japan, where borrowing costs remain near zero, and the U.S. has been a major driver of the yen’s weakness this year.

Things haven’t quite worked out as expected. At the start of the year, traders expected the Federal Reserve to lead a global easing trend with a series of rate cuts, while the Bank of Japan would go the other way and break with its ultra-low rate policy. Instead, a strong U.S. economy and sticky inflation have kept the Fed on hold while the Bank of Japan has modestly raised rates.

“The yen should have risen this year as interest rates in Japan have risen,” said Kathy Jones, chief fixed-income strategist at Charles Schwab. But now, "the wait continues," she said.

The Fed's preferred U.S. inflation gauge, released on Friday, is now the next big catalyst for the yen. Economists expect core personal consumption expenditures inflation, a measure that excludes the volatile food and energy categories, to slow, which could support the Fed's move to cut borrowing costs this year.

Japan faces a lot of risks. Citigroup estimates the country has $200 billion to $300 billion to finance any further intervention, which would require selling dollars and other currencies held in its cash reserves and even government bonds around the world to buy yen.

What Bloomberg Strategists Say…

“A breakout above 163 yen this week could be a boon for the Japanese Ministry of Finance as it would push realized volatility above 10% and give the pair a gain of about 10 yen from its May 16 low.”

— Vassilis Karamanis, currency strategist

For Dominic Konstam, any intervention is more about “slowing down the process of an eventual bottom for the yen” as the Bank of Japan normalizes monetary policy.

“The problem they have is that they’re intervening in the wrong way,” the head of macro strategy at Mizuho Securities USA told Bloomberg Radio on Wednesday. “They have limited reserves and they can’t spend hundreds of billions of dollars defending the currency.”

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin JinseFinance

JinseFinance JinseFinance

JinseFinance