Author: Bitke; Source: Koala Finance

February 14th is Valentine’s Day. It’s another day to win the God of Wealth on the fifth day of the lunar month. For the crypto community, today marks the most exciting day during the Spring Festival of the Year of the Dragon - Bitcoin successfully broke through the resistance level of US$51,000, and its market value also exceeded US$1 trillion.

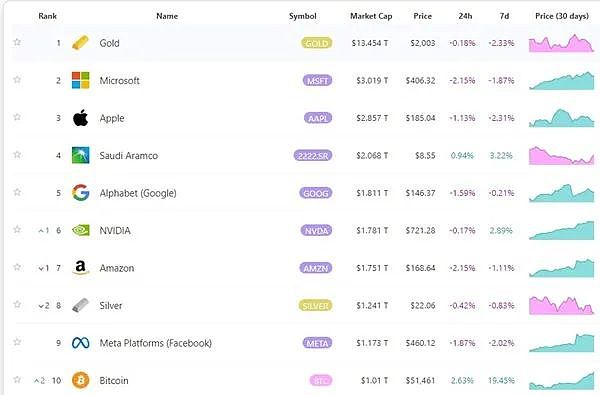

So far, the market value of the top ten assets in the world, including Bitcoin, has now exceeded US$1 trillion, specifically: gold (US$13.459 trillion) , Microsoft ($3.019 trillion), Apple ($2.857 trillion), Saudi Aramco ($2.065 trillion), Alphabet ($1.811 trillion), Nvidia ($1.781 trillion), Amazon ($1.751 trillion), Silver ($1.242 trillion), Meta ($1.173 trillion), Bitcoin ($1.012 trillion).

Why is the wealth password of the Year of the Dragon Bitcoin?

The password for wealth in the Year of the Dragon is Bitcoin. The main reasons may be as follows:

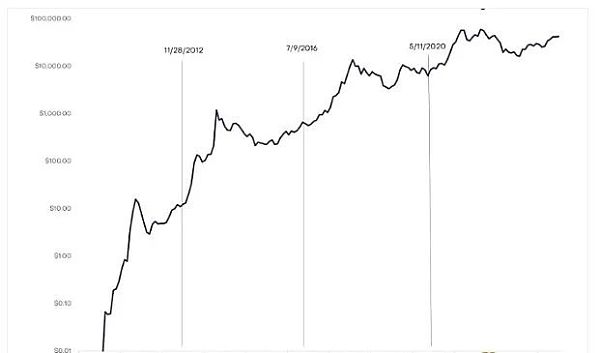

The first is the upcoming Bitcoin block reward halving event. The Bitcoin halving is a fundamental aspect of Bitcoin's economic design and occurs approximately every four years (or every 210,000 blocks mined to be exact). This event marked a decrease in the rate at which new Bitcoins are created and released into circulation. Specifically, halving cuts the reward for mining new Bitcoin blocks in half.

According to the history of Bitcoin’s past halving cycles, a Bitcoin bull market occurred after the first four halving events. The first bull run occurred in November 2012, when BTC prices were around $12. The most recent halving occurred in May 2020, when the BTC price was US$8,755, and it rushed towards US$69,000 in 2021. Comparing Bitcoin profitability before and after each halving can help predict expectations in 2024 and beyond:

December 2012 Halving:

Pre-halving: In the 13 months before the halving, the price of Bitcoin increased by 560%.

After halving: In the next 12 months, there was a staggering 9120% growth.

Halving in August 2016:

Before halving: within 12 months, the increase reached 369%.

After halving: Over the next 17 months, the value of Bitcoin increased by 3300%.

June 2020 Halving:

Halving expected in 2024:

As of January 2024, Bitcoin has risen 207% from the bottom, with four months left before the next halving. This increase is more conservative compared to the surge before the halving in previous cycles. Prior to past halvings, the average Bitcoin price increase was around 420%, making gains in 2023 and early 2024 seem miniscule on a cyclical average basis. The average growth rate after the halving is approximately 4353%, indicating that the strongest growth phase is yet to come.

Secondly, the spot Bitcoin ETF triggered an inflow of funds into the crypto market. Data shows that the Bitcoin ETF received a net inflow of US$1.8 billion in the first month of its launch. Last week, the cumulative net inflow reached US$1.2 billion, which is almost half of the total inflow so far. Analysts say this strong buying pressure is driving prices higher and is the main reason for the recent growth. Jeff Kendrick, head of digital asset research at Standard Chartered Bank, has previously said that if ETFs continue to flow in at this rate, adding approximately $1 billion per week, Bitcoin will rise every day.

In addition, the options market has reached a new high of $75,000 in strike prices. Deribit data shows that call options with strike prices of $65,000, $70,000, and even $75,000 have begun to change hands. Call options give investors the right to buy the underlying asset at a specific price before a specified date, while put options give investors the right to sell. . Call option buyers are implicitly bullish on the market. The heavy buying of higher strike price calls reflects bullish sentiment among experienced market participants.

Bitcoin on-chain and exchange activity is strong

Assessing Bitcoin’s on-chain activity can provide important information into understanding the health, adoption, and growth of the network. However, despite strong price performance, a counter-intuitive phenomenon occurred, with the number of active entities falling to a cycle low of 219,000 per day, according to Glassnode data. Transfer volumes, on the other hand, remain very strong, with approximately $7.7 billion in economic transactions processed daily. The disparity between "active entities" and growing transfer volumes highlights the rise in large entities active in the market, with the average transaction volume per entity soaring to $263,000 per transaction, indicating increasing institutional investors and capital flows .

Exchanges remain the main venue for trading activity, with deposit and withdrawal volume growing significantly, reaching $6.8 billion per day. Currently, exchange-related deposit and withdrawal activity accounts for approximately 88% of all on-chain trading volume. The current trading volume in and out of exchanges is comparable to the peak during the 2021 bull market, with only 68 trading days (1.5%) with trading volume above the peak (based on the 30D-SMA method), once again highlighting the market participants’ desire for Bitcoin Interest in the currency continues to expand.

Final Thoughts

The approval of spot Bitcoin ETF is a development of the digital asset industry In a major milestone, institutional funds are openly flowing into the asset class. Capital inflows are currently accelerating as investors rebalance to the long-questioned GBTC ETF product, despite a serious oversupply problem.

Bitcoin has not only weathered the storm of the bear market, but has grown stronger over the past year, challenging outdated notions. While Bitcoin has long been hailed Digital gold, but recent developments suggest that Bitcoin is evolving into something more significant. Driven by a surge in on-chain activity, supported by significant market structural momentum, and supported by its inherent scarcity, Bitcoin has It shows its resilience.

Finally, I wish the crypto community can "raise its head" in the Year of the Dragon and find its own wealth code.

Wilfred

Wilfred

Wilfred

Wilfred Wilfred

Wilfred Wilfred

Wilfred JinseFinance

JinseFinance Weiliang

Weiliang Alex

Alex Sanya

Sanya Hui Xin

Hui Xin Olive

Olive Olive

Olive