Author: Zoltan Vardai, CoinTelegraph; Translator: Wuzhu, Golden Finance

Bitcoin's foundational document, the white paper written by its founder Satoshi Nakamoto, has been around for 16 years.

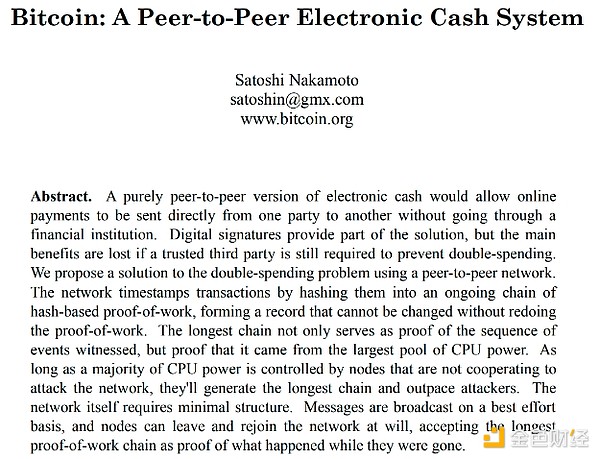

On October 31, 2008, Satoshi Nakamoto shared the white paper "Bitcoin: A Peer-to-Peer Electronic Cash System" on a cryptography mailing list, proposing a decentralized, peer-to-peer network that prevents double payments through proof-of-work consensus.

Bitcoin White Paper. Source: Bitcoin.org

Just three months later, Satoshi Nakamoto mined Bitcoin’s first block, the Genesis Block, rewarding 50 Bitcoins and launching what is now the world’s largest cryptocurrency network.

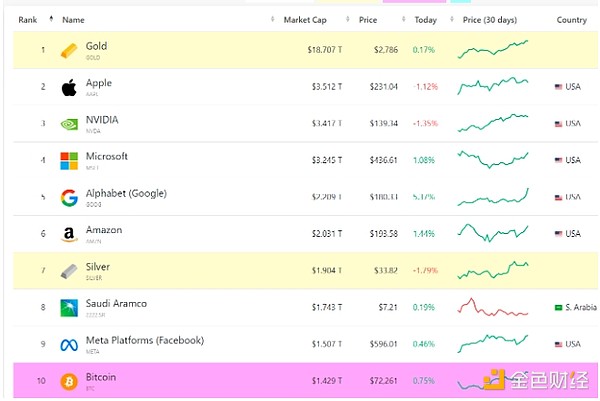

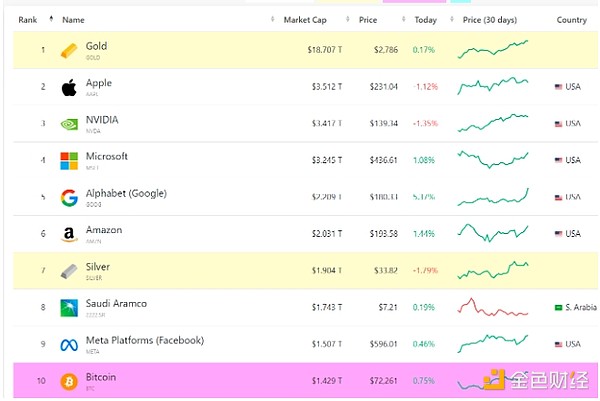

Sixteen years later, Bitcoin’s market capitalization has surpassed $1.42 trillion, making it the world’s tenth-largest asset, according to CompaniesMarketCap.

Source: CompaniesMarketCap

In the days leading up to the anniversary of the white paper’s release, the price of bitcoin climbed to a seven-month high above $73,600, just $200 away from a record high that some analysts expect to come after the U.S. presidential election.

Bitcoin: Becoming the new "digital gold" for institutional investors in just 16 years

Velar co-founder and CEO Mithil Thakore said that Bitcoin's growth has been driven by investor confidence and institutional adoption of its value storage function.

Velar noted:

"Bitcoin has grown from a niche digital experiment to a global asset class that can rival traditional value stores such as gold. But unlike gold, which took thousands of years to gain a foothold, Bitcoin has successfully attracted institutional attention, sparked regulatory debates, and promoted the global decentralized finance movement - all in just 16 years."

Thakore believes that Bitcoin's maturity is reflected in the increase in long-term institutional holdings, its deep integration with traditional financial markets, and its growing popularity as an inflation hedge.

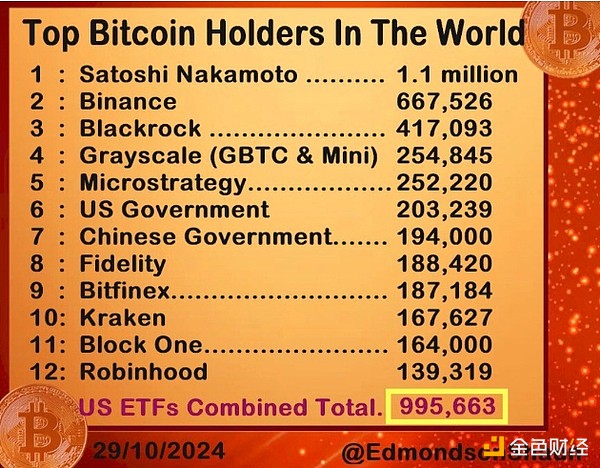

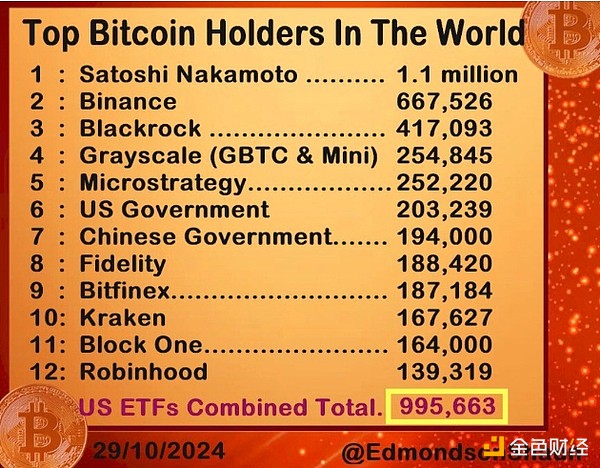

World's largest Bitcoin holders. Source: Eric Balchunas

On October 30, BlackRock, the world's largest asset manager, held more than $30 billion worth of Bitcoin through its spot Bitcoin exchange-traded fund (ETF), highlighting the interest of institutional investors.

The growing attention to Bitcoin ETFs highlights Bitcoin's transformation from a niche digital currency to a major financial asset.

Tether CEO Paolo Ardoino says Bitcoin is the best currency to achieve "financial freedom"

Paolo Ardoino, CEO of Tether, the world's largest stablecoin issuer, said Bitcoin has grown into the best currency in the world.

"I am a Bitcoin enthusiast. I believe Bitcoin is the best currency in the world, but not everyone is ready. People are facing greater difficulties in life, and they don't have time to invest in Bitcoin at the moment. But I believe the role of USDt also lowers the threshold for these people to enter Bitcoin."

Ardoino added that Bitcoin has unique value as an alternative to traditional fiat currencies facing inflationary pressures, calling it "the ultimate choice for financial freedom" in a turbulent economic environment.

Nexo Chief Product Officer Elitsa Taskova noted that while some consider Bitcoin to be in its teenage years, the asset’s resilience and 16 years of growth are remarkable compared to most technological developments that fade due to rapid innovation:

“The longevity of a technology like Bitcoin is extraordinary these days — think of it as a company from the 1970s that is still a market leader today. In a world where most innovations fade within a decade, Bitcoin’s 16 years of impact is equivalent to 50 years of dominance a few decades ago.”

Catherine

Catherine