Daily Digest - 16 June 2023

Coinlive

Coinlive

Author: WolfDAO

This week, the market sentiment index remained unchanged, with a mixed market of long and short positions. Bullish factors such as stable market confidence and the structure of call options chips make 62,000 a key observation point; the issuance of stablecoins and the continuous inflow of BTC ETFs on the capital side. Among the popular tracks, BTC's breakthrough of $60,000 led to a general rise in altcoins, and sentiment needs to be further improved.

Positive factors:

Market confidence remains, and the structure of call option chips remains stable

The high-multiple short orders above have a greater attraction to the price, and 62,000 will become an important observation point

Negative factors:

As expected, the U.S. stock market has experienced a correction. Although it is still within a safe range and has not fallen below the moving average, it remains to be seen whether it will fall below the moving average in the future;

The narrowing of ETF inflows has no obvious support for the currency price;

The PCE data will be released next Friday, and some risk aversion is expected to occur in the market;

1. Funding: Stablecoins continue to be issued, and the growth rate has slowed down, but the absolute value is still good, BTC ETFs continue to flow in

2. Chip side: no obvious changes, although there are more chips above the price, but the resistance may be small

3. Technical side: with the help of the speech, break through the 62,000 suppression and enter the offensive trading rhythm

BTC broke through 60,000 US dollars again, the alt market ushered in a general rise, and many tokens rose gratifyingly;

The sentiment has been repaired, but the trading volume is still underwater, so we need to wait for the sentiment to further return to the greed range;

The track shows a multi-party trend, but it is basically based on following the rise of BTC, and the fundamentals and liquidity have not been decisively improved.

Binance launches SYS 1-50x USDT perpetual contract

Expectations for small-cap altcoin contracts

Altcoins that are not currently listed on contracts

Whether they match the law of contract pull-up

Market sentiment towards contract casinos

-- (The following content is a detailed interpretation)--

SPDR S&P 500 ETF TRUST Index Fluctuation Source: Tradingview - @10xWolfdao

Nasdaq 100-Day Index Source: Tradingview - @10xWolfdao

As mentioned last week, the U.S. stock market has experienced a large retracement, and the decline is mainly concentrated in technology stocks. If the Nasdaq daily level does not fall below MA55, the decline will still be viewed as a short-term retracement. If it does not fall below MA55, you can go long moderately. For BTC, the current retracement of the U.S. stock market has not been reflected in the price behavior, and the chips are relatively stable

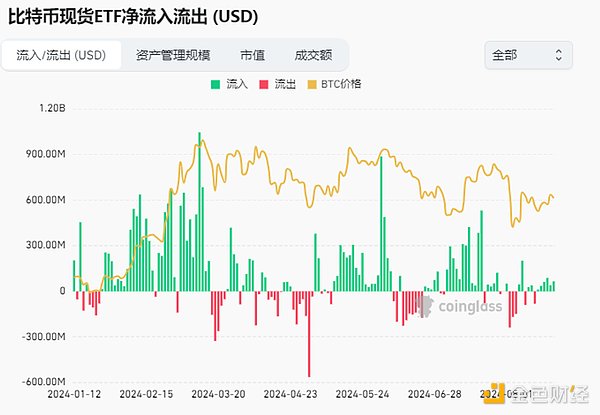

1.1 ETF capital inflow/outflow

Bitcoin spot ETF net inflow and outflow (USD) Source: Coinglass - @10xWolfdao Compiled

Bitcoin ETF trading volume Source: Coinglass - @10xWolfdao Compilation

As price fluctuations narrowed, ETF inflows also shrank significantly. Volume reduction is generally an important stage for choosing future directions. We need to pay special attention to abnormal inflows and outflows before interest rate cuts, which may become an important sign of the market launch

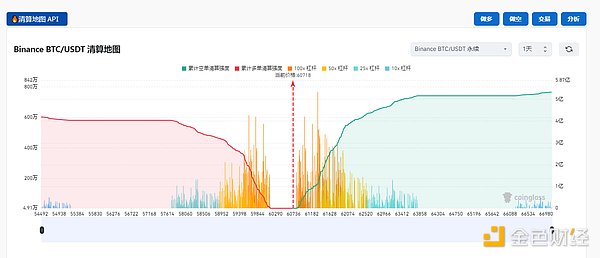

1.2 USDC & USDT stablecoin circulation

Source: Glassnode - @10xWolfdao

The number of stablecoins on Thursday was 152.349 billion. This week, 1.281 billion stablecoins were issued following last Thursday. Although it continued to decrease compared with 1.811 billion and 1.66 billion in the previous two cycles, it still maintained a level of more than 1 billion, and the total value hit a new high. ETFs have inflows of 290 million in the past 5 trading days (16-22), and the overall funding situation is good

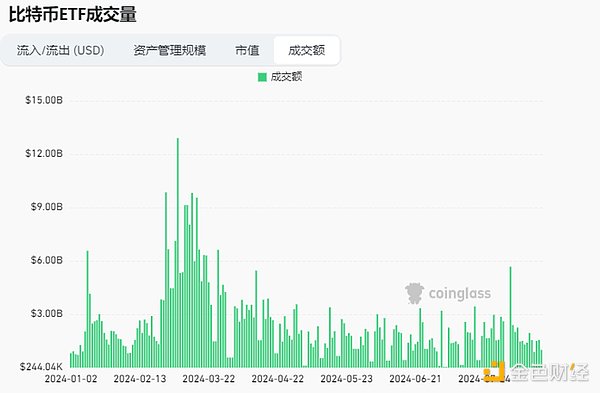

1.3 USDC&USDT OTC discount and premium

USDT& USDC OTC premium Source: OKX-@10xWolfdao 整理

The premium level of stablecoins has fallen slightly since Monday (19th)

2.1 BTC market analysis

Source: Tradingview - @10xWolfdao

1. The current price is at the lower track of Gann box, around 0.618, which is relatively weak. The key point needs to pay attention to whether it can stand above 0.618

2. Currently, a chip peak has formed near 63,600. As the key resistance level of the current price, if it can break through, it will continue to rise to the upper edge of the Gann box near 72,000

Source: Tradingview - @10xWolfdao Consolidation

The 4h line is currently suppressed by ma360 and ma55, and ma120 and ma20 form support below. It is necessary to focus on whether it can stand above 61500 and then start an upward trend. If it falls below 59000, it will continue to maintain a weak trend.

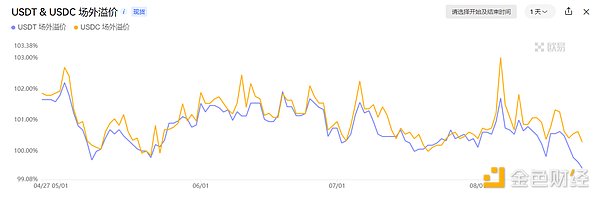

2.2 BTC contract market data

Binance BTC/USDT Liquidation Map Source: Coinglass-@10xWolfdao

1. The lower liquidation chip peak is concentrated near 59500, so this point is more attractive for the downward trend of prices

2. The upper chip peak is concentrated near 61600, and the upward price attraction is currently maintained at this point

3. On the whole, it is more attractive to clear the high leverage of short orders when the price goes up, so the possibility of the price going up to 61000 is greater. It is necessary to observe whether it will continue to rise after reaching 61000 or turn around and liquidate long orders after a false breakthrough

2.3 Option market data

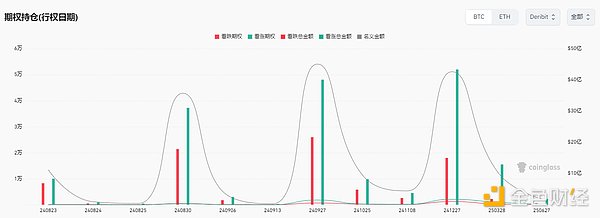

BTC option positions (exercise date) Source: Coinglass-@10xWolfdao sorted

From the exercise date, there are a large number of options concentrated in the delivery contracts at the end of August, the end of September and the end of December. Among them, the options in September and the end of December are mainly based on the expectation of interest rate cuts, forming a bullish consensus, and the overall option structure is relatively stable

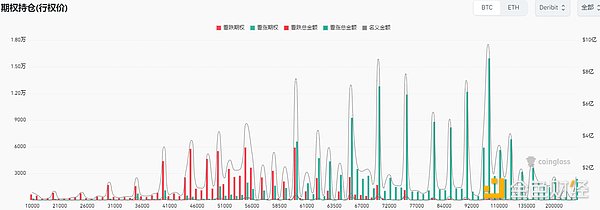

BTC option positions (strike price) Source: Coinglass-@10xWolfdao Consolidation

The position structure has two peaks. The first one is concentrated at the upper edge of the 72,000 box, waiting for the second pull-up after the wide range of fluctuations. The other part is concentrated on the heavily out-of-the-money options at 100,000, and most of them are call options, which shows that the market's expectation of reaching 100,000 by the end of the year is still firm.

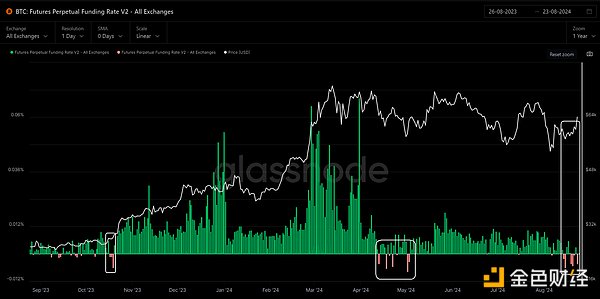

Contract rates and positions are normal, and sentiment is not significantly high. It is still dominated by spot in stages.

Source: Glassnode-@10xWolfdao 整理

Source: Glassnode-@10xWolfdao 整理

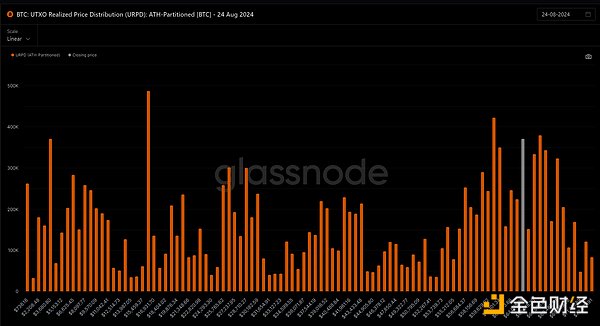

2.4 BTC on-chain address quantity data and chip distribution data

BTC account balance is greater than 1000 Address number fluctuates Source: Glassnode- @10xWolfdao 整理

Source: Glassnode-@10xWolfdao

The current price range is 64,000. As we mentioned in the last issue, a wide range means greater resistance. The chips above 65518-68462 account for 7.88% of the current chips, but firstly, the current price is on an upward trend, and secondly, according to our previous observations at different prices, many chips in this range have become non-short-term chips, and they did not leave the market when they suffered a large loss (for chips entering the market at 67,000 when the price was 55,000, a loss of 18%), so the resistance above is lighter, and the chip structure is still in a good situation.

As mentioned last Friday, logically, Saturday and Sunday should be the rebound area, and long positions should be maintained within one or two days. If there is no smooth rebound and it breaks through 62,000, it will be weak, and you may try to short according to the suppression of 62,000. If it cannot fall below 57,000 within three or four days (Monday and Tuesday this week), it may be in a chaotic trend. Then there was indeed no upward breakthrough last weekend, and it did not fall below 57,000 on Monday and Tuesday. Then on Wednesday and Thursday, the volatility of the BTC market narrowed, forming a triangle technically.

The external market, US stocks and gold are both trending Well, altcoins also saw a certain degree of general rise, the capital side was also favorable, and the chips side was normal, but BTC did not rise, and ETH and SOL did not move abnormally, and there was a divergence, so it was very strange, either the market was weak or it was corrected (the most common situation that triggered the correction was certain events). The technical side formed a suppression of 62,000, so the important event time point this week was Powell's speech on Friday night. After the news was released at 10 o'clock last night, the K-line inserted a needle of about 1,500 points, but fortunately the second one of the 1-hour line did not continue, and the 4-hour line closed with a real positive line, stabilized, and then continued to surge and broke through 62,000. The current market outlook is to break through 62,000, and now it has reached 64,000. The 1-hour level has begun to adjust. There is no adjustment signal at the 4-hour level and the daily line. Continue to maintain a strong mindset. From an analytical perspective, the upper side may see 68,000-70,000.

Source: @10xWolfdao

Source: @10xWolfdao

Abstract

1) BTC broke through $60,000 again, and the altcoin market ushered in a general rise, and many tokens rose gratifyingly;

2) The sentiment has been repaired, but the trading volume is still underwater, so we need to wait for the sentiment to further return to the greedy range;

3) The track surface shows a multi-party trend, but it is basically based on the rise of BTC, and the fundamentals and liquidity have not yet been decisively improved.

BTC bullish trend initially returns, altcoin market generally rises

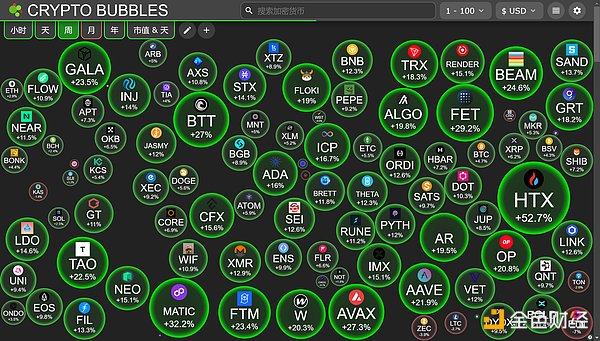

BTC dropped to $56,000 last Thursday, and withstood the selling pressure this week, breaking through $60,000 again, and the bullish trend initially returns. The altcoin market followed closely, with an overall increase of 5-30%, and HTX even increased by more than 50%.

This week's crypto market performance Source: CryptoBubbles - @10xWolfdao

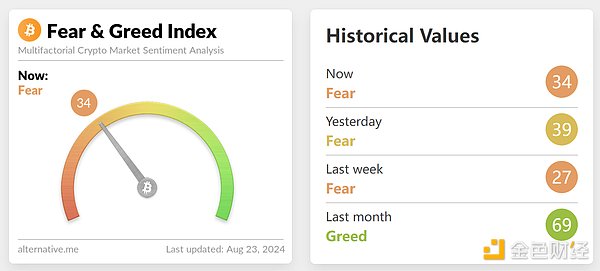

The sentiment index has rebounded from last week, but is still in the panic range

The sentiment index on Friday was 34, up 25% from 27 last week. As BTC broke through 60,000 again, market sentiment improved slightly.

This week's crypto market panic index Source: Alternative - @10xWolfdao Compiled

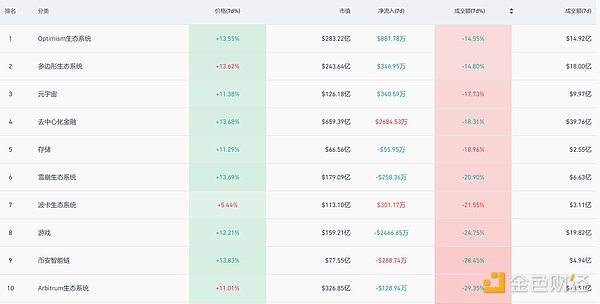

The funding situation improved during the week

The transaction volume of all tracks remained relatively weak during the week, with the transaction volume of all currencies at -41%. The 7-day transaction volume of all sectors was still negative, but it improved compared with last week.

This week's track data performance Source: Coingecko - @10xWolfdao sorted

Unlike the underwater trading volume, all currencies had a net inflow of US$123 million during the week, with a net inflow of more than US$10 million for DeFi and OP ecosystems, and positive inflows for Polygon ecosystem, Metaverse, Polkadot ecosystem, and storage.

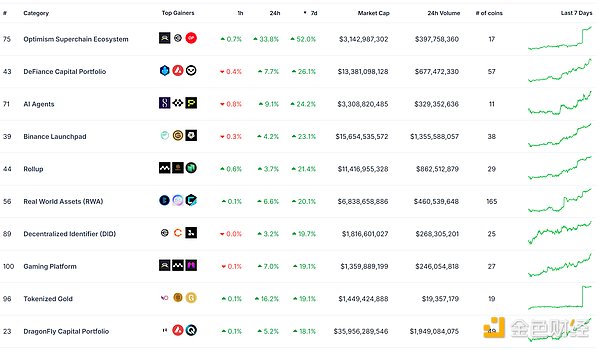

The trend of the in-market copycat is good, and the increase in many tracks is around 20%

According to the track increase within 7 days counted by Coingecko, the top ten tracks with the highest increase are relatively scattered, which is a significant improvement compared to the previous few weeks, and has a certain reference in terms of the degree of rebound.

After eliminating some tracks that are not referenceable, the following tracks need to be paid attention to this week:

1) OP Superchain Eco: 52%

2) AI Agents: 24%

3) Rollup: 21%

4) RWA: 20%

5) Gaming Platform: 19%

Source: Coingecko - @10xWolfdao

1) OP Superchain Eco:

The overall market value of the OP ecosystem is relatively small. The increase in the two targets of OP and WLD has brought huge gains to its ecosystem, and other targets in the ecosystem have also followed suit.

OP rose 21.7% in 7 days, with a 24-hour trading volume of 167 million; WLD rose 13.7% in 7 days, with a 24-hour trading volume of 176 million US dollars.

2) AI Agents:

In terms of AI Agents, FET and AGIX both rose by more than 25% during the week. As the two largest targets in the Agents track, their leading gains will inevitably drive the gains of the entire track.

FET rose 26% in 7 days, with a 24-hour trading volume of 312 million US dollars; AGIX The 7-day increase was 28.8%, and the 24-hour trading volume was 1.24 million US dollars. Since the ASI token will be merged, the trading volume is concentrated on FET, while AGIX is less.

3) Rollup:

In the Rollup track, Polygon rose 37% during the week due to its upcoming name change and Coinbase announced that the renamed POL token would enter the coin listing roadmap. Metis, Nervos Network, Immutable, etc. have all increased by about 15%. Syscoin has continued to appreciate due to the impact of Binance's online contracts, and has doubled this week.

4) RWA

The RWA track as a whole has not seen a large increase, but the trading volume is still considerable. The trading volume of ONDO, OM, PENDLE, RSR, POLYX and other targets is above 10 million US dollars. Among them, RSR and GFI have the best growth, 39.5% and 27.1% respectively, but no specific positive news has been found in the sector as a whole.

5) Gaming Platform:

The overall increase in the game track is possible for two reasons:

Due to the popularity of the game brought by Black Myth Wukong, the main force immediately cooperated with the BTC bull trend to make markets;

A professor at Yale University proposed the concept of ServerFi, pointing out new ideas for the development of GameFi.

GALA, PYR, NAKA, MYRIA, PDA and other tokens have risen well.

Overall, the logic of the rise of altcoins during the week is still mainly to follow the rise of BTC. There is no obvious improvement in the fundamentals. From the perspective of funds, it can be seen that the transaction volume in the market is still underwater, and it is still necessary to wait for liquidity to return. In the medium term, we should pay more attention to the performance of BTC in Q4. If the interest rate cut comes as expected and CZ is successfully released from prison, it may be able to greatly boost the confidence and liquidity in the circle, thereby ending the trend of shock callbacks and hopefully opening the second half of this bull market.

1️⃣Syscoin (blockchain based on PoW consensus)

Reasons for popularity:

Binance launches SYS 1-50x USDT perpetual contract

Expectations for small-cap altcoin contracts

Recommendations for attention:

Whether the altcoins that are not listed on the contract are in line with the law of contract pull-up

Market sentiment towards the contract casino

Syscoin is a blockchain based on PoW consensus. It is based on a two-layer blockchain: the core is the Syscoin blockchain itself, and running with it is a NEVM (Network Enhanced Virtual Machine) Ethereum Virtual Machine (EVM) layer that provides smart contract functions.

Binance small-cap altcoins (mainly GameFi) + pseudo-narratives caused by contract expectations have caused market reactions

This week, the game track and other small-cap altcoins have seen a general rise, which has attracted attention. The most aggressive ones are the game targets on Binance, and the entire increase list was once occupied by games. This wave of games and other small-cap altcoins is a bit puzzling. There are no particularly decent games on the basic analysis, and it is more like a dealer pulling the market. The targets that are strongly associated with Binance have risen sharply, which may be related to Binance's previous delisting of altcoins.

Binance has listed small-coin contracts $SYS $RARE $SYN. These coins generally have low market capitalizations and concentrated chips. They are quickly pulled up by listing contracts, causing market reactions. At present, it is just driving up prices, not a real trend in the currency circle and narrative. It is recommended to either make arrangements in related small currencies in advance, or enter and exit quickly when good news such as contracts comes out.

Why are so many users pouring into Binance Futures Casino?

The first reason is that the money-making effect of the Solana ecosystem has deteriorated. A large number of users have left the market in the PVP game of PumpFun, and the market's focus has shifted to Binance Futures in cooperation with the dealer to pull the market.

Decrease in inflow:

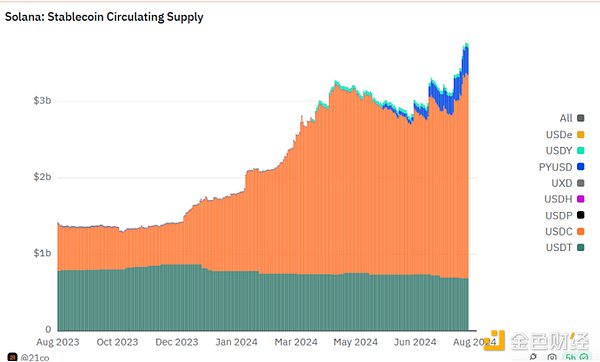

On August 16, 250 million USDC were newly minted on the Solana chain. At present, not only the supply of USDC but also the total supply of stablecoins on the Solana chain has reached ATH.

Solana's stablecoin supply Source: Dune-@10xWolfDAO

Lack of power:

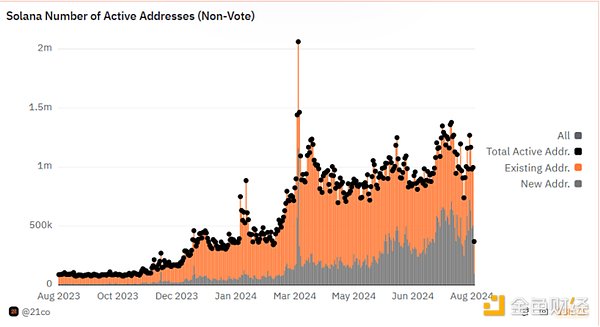

Solana chain active address number Source: Dune-@10xWolfDAO

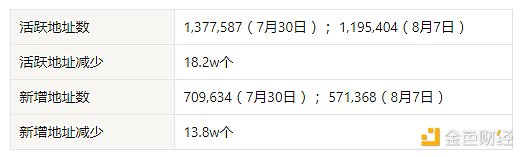

It can be seen that the number of new addresses and active addresses are in a rapid decline, but the number of txns is increasing or changing little during the same period. It shows that the old players are leaving or PVP is involuted, and the newcomers are lacking interest.

The Matthew effect is obvious and unfavorable to novices

According to on-chain data and surveys by relevant bloggers, only 3% of people in pump fun can make money:

If you make more than $1,000,000 in profit from trading Pump Fun tokens, you are among the top 70 traders (accounting for 0.0028% of all wallets).

If your income exceeds $100,000, you are among the top 924 (accounting for 0.037% of all wallets).

If your income exceeds $10,000, you are among the top 11,936 (accounting for 0.477% of all wallets).

If the income is more than $1,000, then it ranks in the top 76,587 (accounting for 3.061% of all wallets).

Due to the lack of new narratives and market hotspots, Binance has driven market sentiment by launching small-cap altcoin contracts, and the market makers have pulled the market. At the same time, because a large number of users left the PVP game of pumpfun and poured into the Binance contract casino, it caused further FOMO of related altcoins. For related tokens with spot but no contract or with contract but no spot, there may be certain opportunities in the current market.

Rally retracement

On August 14, Binance Futures launched BANANA USDT-margined perpetual contract.

On August 15, Binance Futures launched G and RARE perpetual contracts with a maximum leverage of 50x.

On August 16, Binance Futures launched SYN 1-50x USDT perpetual contracts.

On August 20, Binance launched SYS 1-50x USDT perpetual contracts.

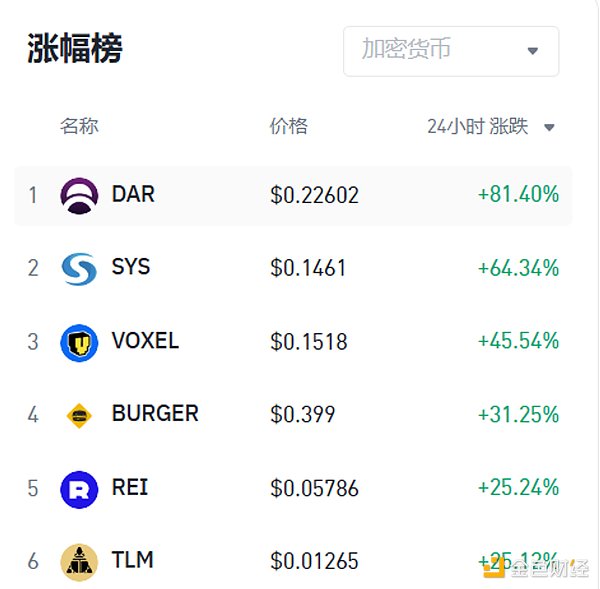

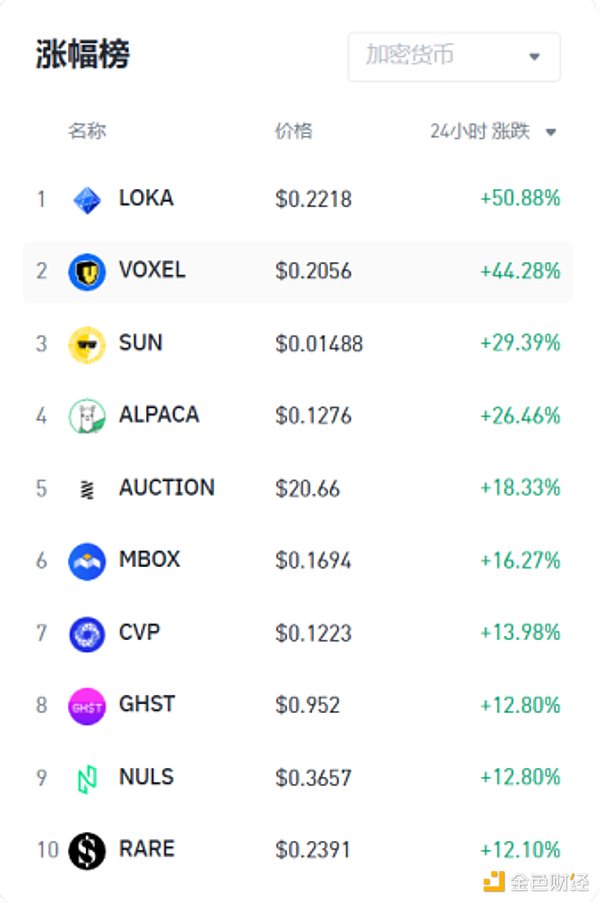

8.19 Binance Gain List Source: Binance - @10xWolfdao Compiled

It can be seen that on August 20, some currencies with large gains have pulled back, while others are not as fast as before. There is still a lack of actual positive support from the fundamentals, and all are manipulated by the market makers. For example, the $RARE token has been sideways at the bottom for more than 2 years, and the main market makers have absorbed a large number of chips during this period. Later, they cooperated with Binance to launch contracts to pull the spot, and at the same time built positions to attract retail investors. After a large number of retail investors come in, the main force will close their positions in the contract market, and the direction of the currency price increase is completely determined by the market makers.

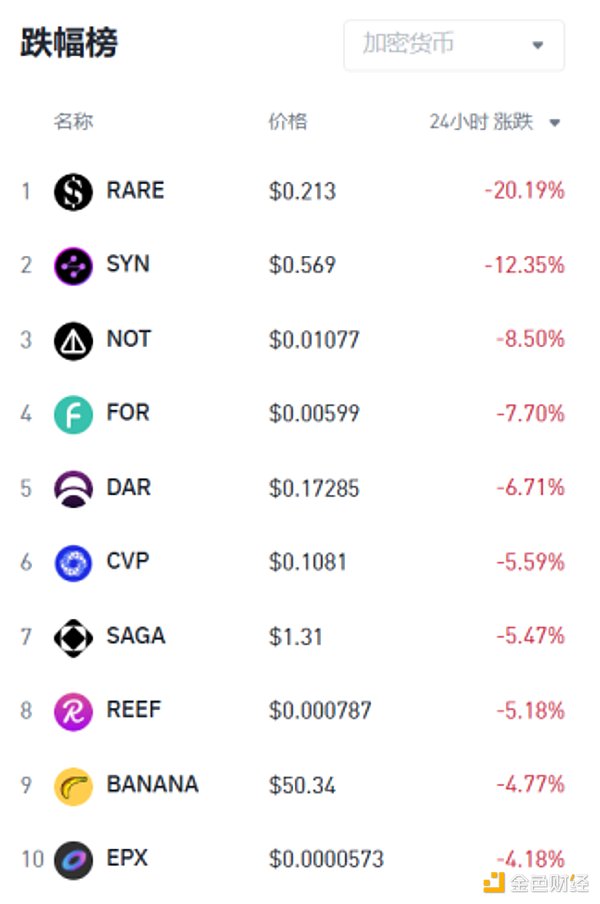

Binance's decline list on August 20 Source: Binance - Compiled by @10xWolfdao

On August 20, Binance launched VOXEL 1-50 times USDT perpetual contracts.

Binance Gain List on August 21 Source: Binance - Compiled by @10xWolfdao

After Binance announced the launch of VOXEL contracts on the evening of August 20, it did usher in a wave of explosive pulls, but the fundamentals of the entire project have not changed. In the subsequent BRETT, POPCAT, SUN and ALPACA this week, they also ushered in explosive pulls after the contracts were launched, so the strategy is to make early arrangements for the currencies that are currently listed on the spot but not on the contracts among the small-cap altcoins.

Coinlive

Coinlive Check out important crypto news from the last 24 hours.

Coinlive

Coinlive Check out important crypto news from the last 24 hours.

Coinlive

Coinlive Check out important crypto news from the last 24 hours.

Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive Check out important crypto news from the last 24 hours.

Coinlive

Coinlive  Coinlive

Coinlive Check out important crypto news from the last 24 hours.

Coinlive

Coinlive

Please enter the verification code sent to