Author: jolestar Source: X, @jolestar

The waterfall washes my face, the group wails, and I am no longer excited on Twitter. I calm down and review this bull market in stages.

This bull market has not seen a replicable application model. There is no grand occasion like ICO in 2017 and DeFi in 2020, where various projects were launched at the same time, so I always think that the real bull market has not yet arrived. However, there have been many attempts at new types of asset issuance models, new asset protocols on Bitcoin (Inscription, Atomicals, RGB/RGB++), inscription protocols on various chains, Meme Coin, Picture Coin, SFT, etc.

As a Builder, I look at the problem from the perspective of whether there is an opportunity to build an application. What are the revelations of these attempts? I have summarized two points.

CSV mode assets have been preliminarily verified

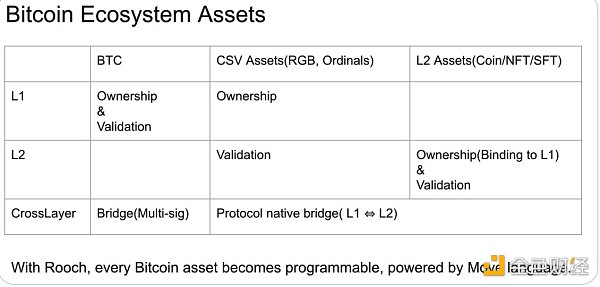

First, Bitcoin's Inscription verifies that the model of defining asset data on the chain and verifying legality off the chain is feasible. It indicates a new way of issuing assets and expanding capacity, which I mentioned at https://twitter.com/jolestar/status/1732711942563959185. All protocols derived from Bitcoin, including RGB/RGB++ and Atomicals, belong to this paradigm and can be called client-side validation in a broad sense. This type of asset is between L1 and Offchain (L2). It can define a bridge within the protocol to realize the migration of assets from L1 to Offchain. This has been preliminarily verified by the RGB++ protocol, which is its transition mechanism. This capability indicates that one way of blockchain expansion is that assets overflow from Bitcoin to the infrastructure of Offchain (including other public chains), thus bringing prosperity to the entire blockchain ecosystem.

Attached is a picture I shared at the Bitcoin Layer2 Conference organized by @BTCSCYLab in Hong Kong:

This model is different from the ecological paradigm of Ethereum. The application scenarios of assets are no longer limited to the smart contract environment provided by L1, but are provided through the smart contract environment of Offchain, so that the construction of applications has no technical bottlenecks.

The asset-first application startup model is being verified

If the technical bottleneck of building applications is broken, another problem is how to start the application. The traditional way is to build applications, attract users, and then issue assets. The way this wave of new asset issuance models wants to verify is that assets come first, build communities, and then build applications based on communities to provide usage scenarios for assets. This model has been initially verified to attract users and build communities, but application startup still needs to be explored, and there are several problems that need to be solved:

1. Fair distribution can easily attract users and reduce fraud, but how to solve the initialization cost of building applications.

2. Building applications takes time, and assets with too high liquidity may not wait until the application is born. Therefore, it is more appropriate to initially issue low-liquidity assets, and then become high-liquidity assets after growth, but how to switch seamlessly is a direction of exploration (ERC404, Movescriptions).

Although there are many difficulties, the advantages of this model are also obvious:

1. Assets come first, and applications are derivatives of assets, not vice versa, so that the life cycle of assets can exceed the life cycle of applications.

2. Only in this model can there be a combinable scenario where the same asset is used in multiple applications, and this combination capability is the most critical point that distinguishes blockchain applications from Web2 applications.

3. In this model, application teams do not need to issue assets, but can directly benefit by providing scenarios for assets, thereby solving the compliance issues faced by Web2 application development teams.

The combination of the above two exploration directions will promote the emergence of a large number of assets and applications. At that time, a hundred flowers will bloom, and it will be a real bull market.

JinseFinance

JinseFinance

JinseFinance

JinseFinance cryptopotato

cryptopotato cryptopotato

cryptopotato Coindesk

Coindesk Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist