Author: Revc, Golden Finance

Foreword

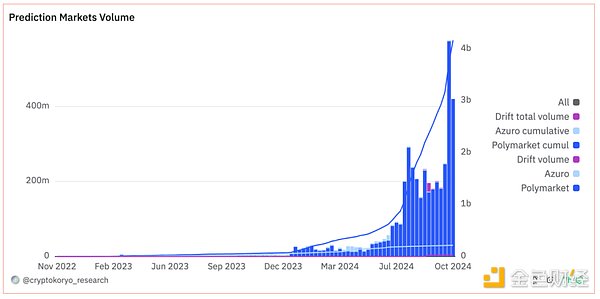

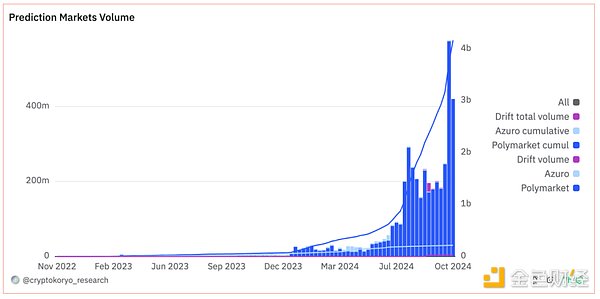

The prediction market continues to be hot, and trading volume has repeatedly hit new highs. In the last week of September, Polymarket and Azuro had a trading volume of $570 million. The track showed a vigorous development potential, and innovative products continued to emerge.

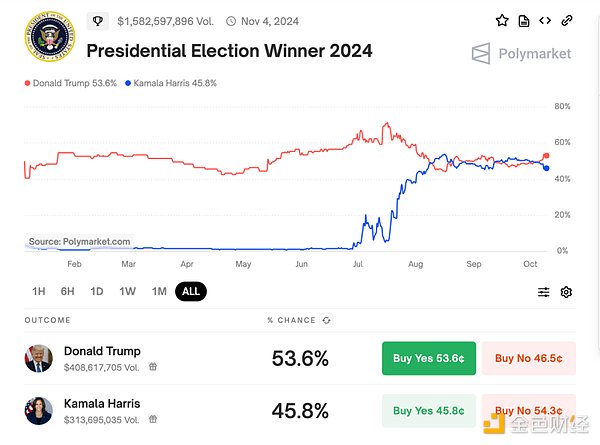

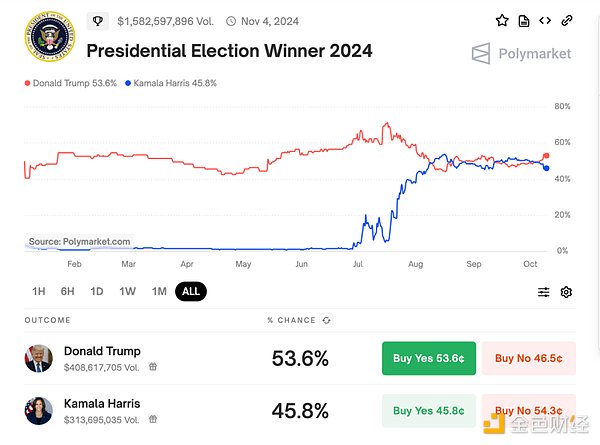

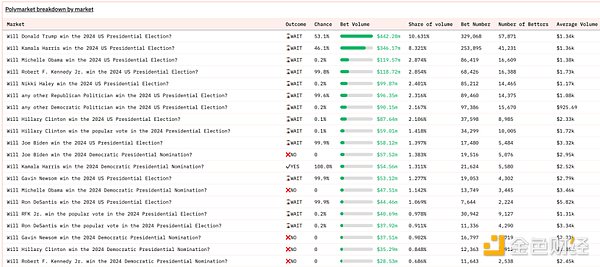

In the short term, the US election has played a key role in the development of the prediction market. Including the congressional election, the total expenditure of this election may reach nearly $16 billion, which is the most concerned event by the American people. However, the market is generally not optimistic about the performance of the prediction market after the election.

PolyMarket

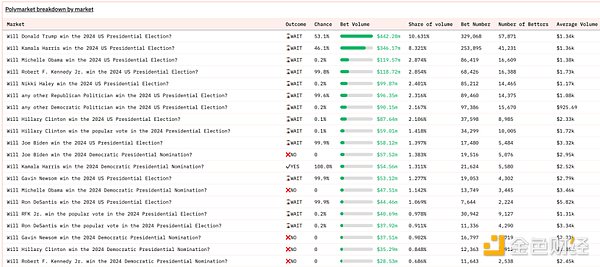

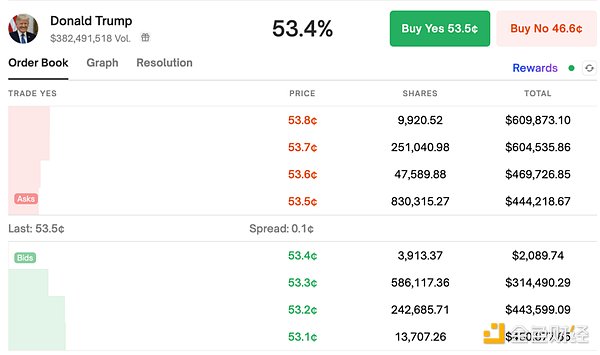

According to Dune data, Polymarket's total trading volume has exceeded $4.1 billion, and users have generated nearly 5.2 million transactions in total.

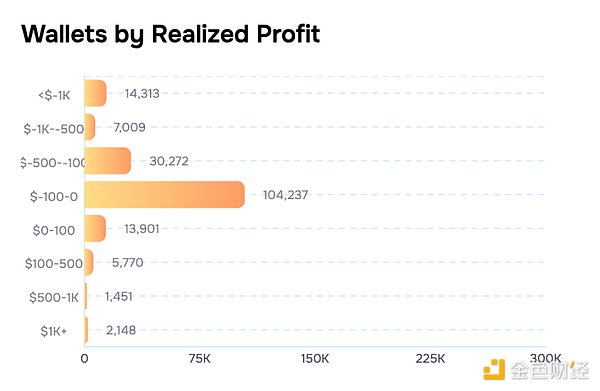

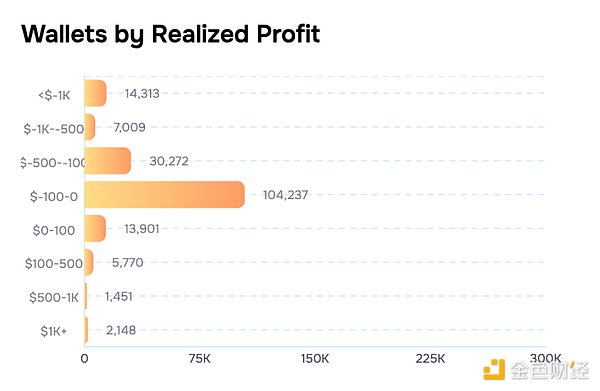

However, the overall profit level of users is not optimistic. According to the data of the on-chain analysis tool Layerhub, 149,383 (87.3%) of the 171,113 crypto wallet addresses on Polymarket are not profitable. There are 21,730 wallets that have been confirmed to be profitable, accounting for 12.7% of all participating crypto wallets. Among the wallets that reported profits, only 2,138 users made profits of more than $1,000, and most of the profits were between $0-100.

The above situation may change with the settlement of the largest prediction event, and the current betting volume for the 2024 presidential election has exceeded 720 million US dollars.

Let's review the design mechanism of Polymarket:

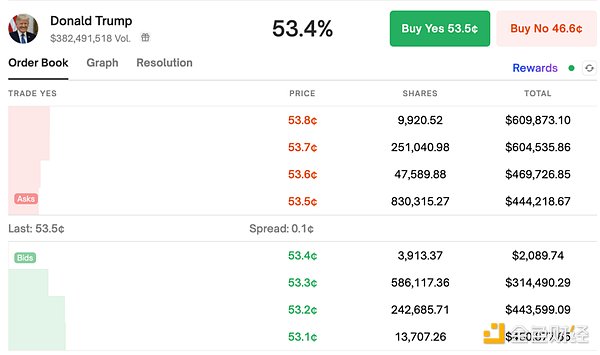

1. Polymarket converts binary results on the Polygon network into ERC1155 tokens. Allows collateral to be split into result tokens and re-merged after the event results are announced (that is, the probability becomes 0 or 1).

2. Polymarket uses a hybrid decentralized order book model, also known as a central limit order book (CLOB). Operators provide off-chain matching and sorting services, but the actual settlement and execution of transactions are performed on-chain in a non-custodial manner. In addition, users can also choose to trade through an automated market maker (AMM).

3. Polemarket resolves market disputes through UMA's optimistic oracle. If there is a dispute over the outcome of an event, UMA token holders vote to determine the correct outcome.

Polymarket charges a 2% fee from winning bets to reward liquidity providers. So far, Polymarket has paid more than $3 million in USDC rewards to liquidity providers to enhance market liquidity.

However, since the transaction price of the predicted event (probability) will approach 0 or 1, which is different from the price change logic of traditional assets, liquidity providers face a higher risk of impermanent loss, so a more complete reward mechanism is needed to cover the capital cost and impermanent loss of liquidity providers.

What is a high-quality predicted event?

Polymarket's success benefited from the US election. Currently, the top predicted events in terms of trading volume are all related to the election, and the product outbreak overlaps with the election cycle. Under the background of strong local regulation in the United States, people's trading needs are released in Polymarket.

High-quality forecast events are the core of the forecast market to maintain competitiveness, and usually require the following factors:

1. The social media influence of people related to the event, such as Musk's halo as CEO X and the world's richest man, who helped Trump's election.

2. Huge social popularity. As mentioned above, the campaign expenditures of the two parties in the election year were nearly 16 billion US dollars.

3. Prediction events with relatively balanced probabilities, equivalent potential of the relevant parties, many game-influencing factors, and a limited set of choices. That is, it can attract sufficient liquidity aggregation, reduce the initial loss of users (information asymmetry loss) and the impermanent loss of liquidity providers.

4. Contrary to the third point, the prediction events are superimposed and mixed, increasing the randomness of the results and the entropy of the entire process, catering to the needs of users with higher risk preferences.

New Development Trends in the Prediction Track

The prediction market is currently mainly innovating in the direction of liquidity and user participation, but the innovation is limited, and future competition will mainly be carried out at the event operation level. Micro-innovation is mainly reflected in the following aspects:

1. Through the point-to-pool liquidity model, concentrate funds to meet market demand and ensure that even niche markets have sufficient liquidity. However, according to the degree of information dispersion, the prediction market itself has the characteristics of random free liquidity.If excessive attention is paid to liquidity and its costs cannot be reasonably covered,it will affect the development of the prediction market in the long run.The aggregation of liquidity means a certain degree of market distortion.

2. Allow users to make more complex leveraged bets to increase market attractiveness, but pay attention to risk management.

3. Use social media for promotion, integrate specific scenarios, and increase user participation.

In addition, the application potential of AI in event selection, information aggregation and analysis, and automated trading is also worth developing. The process of pricing information is essentially to spread information. The main line of the development of the prediction market is to make information dissemination more efficient and maximize economic benefits.

Regulatory impact

The CFTC (Commodity Futures Trading Commission) stipulates that any contract involving illegal or contrary to public interest activities is not allowed. In 2024, the CFTC introduced a new rule prohibiting the trading of contracts on the results of political events, considering it to be against the public interest. This has an impact on platforms that rely on political prediction markets such as Polymarket, PredictIt and Kalshi. Elizabeth Warren even publicly asked the CFTC to completely ban these election prediction markets, fearing that they would interfere with the democratic process.With increasingly stringent regulation, platforms urgently need to adapt to the new environment, otherwise their business development will be restricted.

Prediction markets are reshaping the boundaries between politics and business and providing new possibilities for social decision-making. Although it currently provides economic freedom, its social and political influence has been eroded. The key to the problem is not the prediction behavior itself, but the regulators’ lack of adaptation to the emerging technology business model. Prediction markets that can leverage regulatory space and innovate business models will have better development.

Summary

According to Layerhub data, Polymarket currently has nearly 180,000 independent users. Although it has not yet had a significant impact on the overall user scale of the crypto market, as an economically reasonable Web3 product with excellent user experience, it has built a complete set of crypto trading solutions, which is worthy of reference by the industry.

With the end of the US election cycle, the prediction market still faces many challenges. In the short term, its role in decision-making and collective wisdom has not yet emerged, and problems such as insufficient market demand and liquidity need to be solved urgently. In addition, the constant changes in regulatory policies have also brought uncertainty to the development of the prediction market.

The prediction market has a positive significance in improving the transparency of social information, especially in the context of the declining credibility of traditional information channels. Its success story also provides inspiration for other Web3 projects: focus on segmented scenarios for medium-term sustainable development to meet a wider range of user needs.

Joy

Joy