In 2023, the global Bitcoin mining industry will gradually recover from the bottom of the "crypto winter" in 2022. Various economic indicators show a positive turn: Bitcoin prices are up 154%, the listed mining company stock index is up 246%, and network transaction fees (largely dormant since mid-2021) have once again become an important part of miners' income. . In addition, energy, hosting and hardware-related costs have declined to varying degrees.

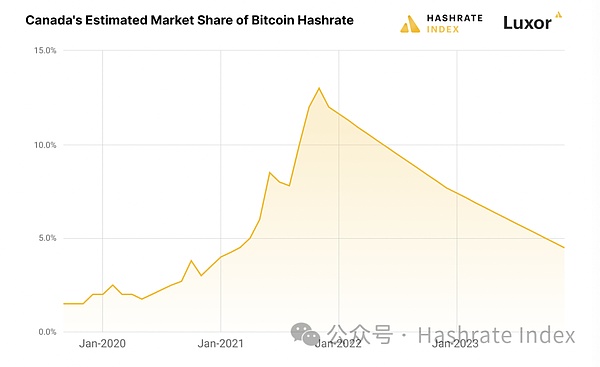

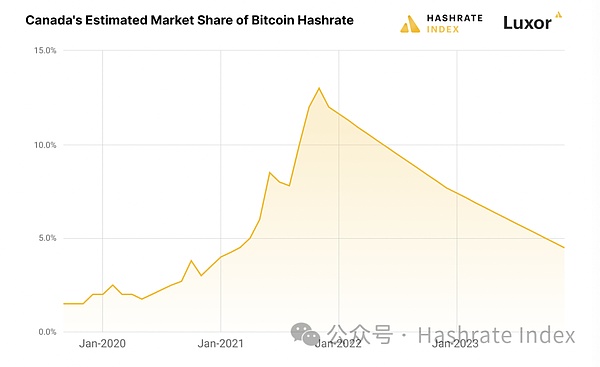

However, the situation of Bitcoin mining in Canada is slightly confusing. The government applied pressure in 2022 and implemented a number of policies that clearly targeted and discriminated against the industry, and these policies remain in place in 2023. This puts the entire industry on the defensive (with the exception of Alberta). Because of this, major players in the industry have begun to shift their attention overseas to seek more favorable opportunities. In this regard, Canada's share of Bitcoin's global network computing power is expected to drop from 7%-8% to 4%-5% at the end of 2022. Compared with 2021, the decline will be as high as 13%.

Figure 1: Canada’s global share of Bitcoin computing power

< strong>2023, when the economy will significantly improve, and 2024, which will be shrouded in "black clouds"

The global Bitcoin mining industry has experienced a difficult period After 2022, a turnaround finally occurred in 2023. The chart below shows that the price of Bitcoin has increased by 154%, almost equalizing the decline for the entire year of 2022.

Figure 2: Bitcoin price and mining difficulty trend chart

True The biggest surprise comes from the resurgence of transaction fees on the Bitcoin network. Due to the development of ordinal numbers and inscriptions, the benefits received by miners in the transaction fee part have been greatly improved. Data shows that transaction fees accounted for 7.6% of block rewards in 2023, while in 2022 it was only a pitiful 1.5%.

Figure 3: Changes in transaction fees as a proportion of block rewards

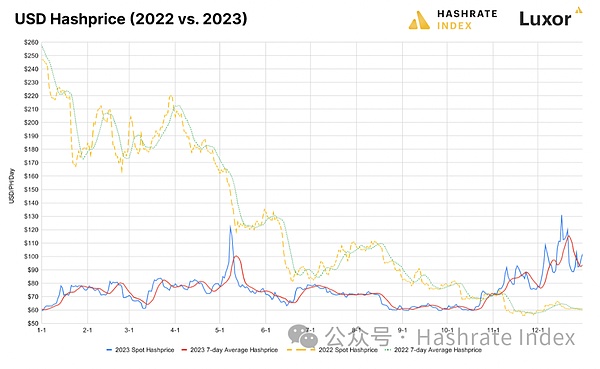

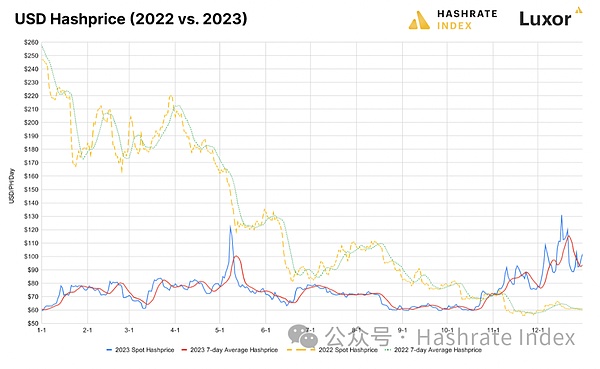

As A comprehensive measure of Bitcoin miner revenue per unit of computing power, the price of computing power rose from $59/PH/day to $101/PH/day, an increase of up to 70%, due to significant fluctuations in transaction fees in May and December. . The average computing power price in 2023 is US$75/PH/day.

Figure 4: Overview of computing power price changes under the US dollar standard

Although 2023 The year is relatively good, but the sky in 2024 does not seem to be so clear, and a "black cloud" is floating in the sky - the Bitcoin halving. This is an event that occurs every four years. The direct impact is to halve block subsidy revenue. The second-order impact is full of uncertainty and controversy, whether it is on Bitcoin price, network difficulty or transaction fees. Some believe that the halving event will push up the price of the currency; others point out that the network difficulty will decrease due to the decline in computing power (due to the shutdown of some less profitable miners). If transaction fees can continue to be high (as they were during the last halving event) then this could also offset some of the revenue losses caused by the block subsidy halving.

However, the main impact of the halving is certain. That is, Bitcoin miners will suffer a significant negative revenue hit in the short term. The halving event is currently expected to occur around April 21, 2024.

Government regulation continues to harm the mining industry, hindering development across Canada

< p style="text-align: left;">The occurrence of truck driver protests in 2022, coupled with the trough of the encryption winter at that time, Canadian mining companies were specifically targeted and subject to extremely unfair industry policy supervision. In essence, policymakers at all levels of government made the wrong decision to separate mining rigs from other types of computers and impose specific taxes, electricity rates, and interconnection regulations on them. Therefore, in 2023, the Canadian mining industry changed its completely defensive stance and began to work on establishing serious, long-term and coordinated advocacy organizations for the mining industry.

Unfortunately for the Canadian economy, poor public policy has resulted in the country losing jobs, investment and tax revenue. At the national level, the Canadian government has shown great skill in creating uncertainty, damaging jobs and investment in the process. In February 2022, the Ministry of Finance proposed a “clarification” amendment, without prior notification to the mining industry, declaring that digital asset mining does not constitute a “commercial activity” in Canada. The proposal would make it impossible for all digital asset mining companies to receive the input sales tax credit available to all other export businesses. This unprecedented proposal would create a hidden tax of 5%-15% on the cost of Bitcoin mining in Canada and cause irreparable harm to Canadian companies competing in a globally competitive market.

Fortunately, with the efforts of the newly established Digital Asset Business Council and member companies such as Hut8, Hive, Bitfarms, Iris Energy, Argo and DMG, corresponding The solution is out. Although the proposal became law, lawmakers made an amendment that would have resulted in miners being entitled to an input sales tax credit if the Canada Revenue Agency determines in a case-by-case review that they are selling computing services similarly to regular data centers. way to sell computing power to overseas mining pools, which should apply to almost all industry players in Canada. With hundreds of millions of dollars in tax credits, jobs and investments hanging in the balance, the industry is still awaiting feedback from the Canada Revenue Agency and a case-by-case decision on these issues. An update is expected to be released in early 2024.

In British Columbia, Manitoba, Quebec, New Brunswick and Newfoundland and Labrador, in 2022 The ban on new interconnections remains in effect. These regions have the cleanest, cheapest and most abundant electricity resources in the world, attracting investment from the global mining industry. But these provinces unexpectedly chose to close the door to this business rather than use the opportunity to do the work necessary to streamline application assessments and increase the flexibility of the grid system. Provinces have expressed concerns about peak electricity use, ignoring (or failing to understand) the mining industry’s inherent flexibility in energy use. But these bans do not apply to any other type of computing industry, regardless of energy use.

In British Columbia, Conifex Timber sought to invest in the mining industry and took legal action against the province's ban. In a publicly released white paper, Conifex outlined that the provincial cabinet's actions broke the law, interfered with the regulatory system and effectively violated the government's own economic, carbon reduction and reconciliation goals.

Alberta is a clear outlier in this challenging environment. Elected officials in the province recognize the benefits of the digital asset mining industry, particularly in terms of creating high-tech jobs, especially in rural and remote areas, as well as its potential for environmental and energy system sustainability. They are actively seeking investment and encouraging economic development. In July, Prime Minister Danielle Smith and Minister Dale Nally attended the Stampede Canadian Blockchain Alliance’s Bitcoin Mining Trade Exchange, while Minister Nate Glubish spoke about the benefits of mining at the “Bitcoin Rodeo.” Minister Dale Nally even participated in the Canadian Blockchain Alliance’s second annual Texas Trade Exchange Conference.

In Ontario, the Ministry of Energy appears to have abandoned plans to exclude cryptocurrency miners from participating in the ICI in 2022. ICI is an electricity conservation program that allows participants to reduce their electricity demand during five peak electricity hours, thereby reducing their global adjustment costs.

Canadian miners are resilient and open up new markets

Policies Poor management cannot prevent Canadian companies from innovating and entering new markets.

Perhaps most notably, Hut8 completed the largest M&A transaction in industry history in November, an all-stock merger with US Bitcoin Corp. The combined company, New Hut, will be based in the United States and become one of the largest operators of autonomous mining and high-performance computing facilities in North America with a total generating capacity of approximately 825 megawatts.

Other clean energy-focused miners such as Hive and Bitfarms have expanded operations outside of Canada. Bitfarms secured a license to use a 100MW mining facility in Argentina and a hydropower contract for up to 150MW in Paraguay, while Hive completed the acquisition of a hydropower data center in Sweden at the end of the year.

On the hardware side, we see some noteworthy collaborations in 2023. Hive deployed BuzzMiner powered by Intel's Blockscale ASIC in January after months of planning, engineering development, implementing factory processes, field testing and global collaboration. Later in the year, Toronto-based ePIC Blockchain announced a partnership with Chain Reaction to produce ePIC’s next-generation mining system for Bitcoin mining.

Mining companies enter new areas of revenue growth in 2023. DMG expanded its business by venturing into the field of inscriptions and ordinal numbers and became the leader in this market. Hut8 has signed an agreement with Interior Health in southern British Columbia to provide secure co-tenancy services, demonstrating its expansion beyond Bitcoin mining. At the same time, Iris Energy has begun to expand into the artificial intelligence market, demonstrating its commitment to expanding its products and expanding its high-performance computing data center strategy.

BlockLAB has introduced an innovative system that, since piloting in 2022, has provided greenhouse operations with a solution by harnessing the excess heat generated during the Bitcoin mining process. An environmentally friendly and low-cost heating solution. Additionally, container manufacturers like Upstream Data, CryptoTherm, Bit-Ram, and Intelliflex continue to maintain their leadership in innovative air and water cooling systems in North America.

Figure 5: Canadian Bitcoin Mining Industry News in 2023

In 2024, Bitcoin miners must meet challenges and seek opportunities

Although the rebound in Bitcoin prices and transaction fees has provided miners with much-needed Ease, but the upcoming halving event will focus the industry’s attention on the ultimate profit and loss. While the direction of Bitcoin price, network difficulty, and transaction fees remains uncertain, the block reward halving is certain and will be a significant negative revenue hit. To survive, companies need to reduce costs, increase efficiency and protect profits.

In terms of policy, except for Alberta, the possibility of improvement in other regions is not very high. Unfortunately, the federal Liberals do not see the digital asset industry as an economic opportunity, but rather as an opportunity to attack their opposition party. A rebound in Bitcoin prices may change the electoral calculus, but according to polls, Justin Trudeau and the Liberals will continue to attack Pierre Poilievre and the Conservatives for their support of the digital asset industry. At the provincial level, bureaucratic inertia will make overturning the ban in 2024 unlikely. It will still take a lot of time and effort to get provincial governments and grid operators to understand the industry's benefits.

Nonetheless, we believe that building serious, long-term, and coordinated advocacy in Canada is an enterprise worth investing in. Ultimately, Canada is naturally attracted by its abundant, low-cost, and sustainable energy; its highly skilled workforce; its cold climate; its underutilized industrial infrastructure, especially in rural areas; and its relatively stable, secure political environment. Positioned as a leader in the cryptocurrency mining industry and other power-intensive computing industries.

If the polls are any indication, it's that political change is coming. To take advantage of this opportunity, the mining industry must continue to demonstrate its value and miners should create more jobs, including hardware manufacturers, infrastructure providers, and software engineers. They will bring investment to local communities, particularly in rural or remote areas where opportunities are limited and industry infrastructure is underutilized. In addition, miners are making full use of waste natural gas that is burned or emitted, supporting grid stability through demand response and enabling the construction of new renewable energy generation assets, which undoubtedly improves the efficiency and sustainability of the environment and energy systems. Perhaps most importantly, they transport Canada’s trapped energy to international markets without the need for physical power lines or pipeline infrastructure because computing power is sold over the Internet.

Canada’s success in cryptocurrency mining in 2024 and beyond will depend on the industry’s ability to realize benefits by reducing costs and increasing efficiency. And whether we can continue to educate the public and policymakers about the benefits of sensible cryptocurrency mining and try to accept it.

Cheng Yuan

Cheng Yuan