Jessy, Golden Finance

The bear market in mid-2024 is a great challenge for investors. How can investors survive the bear market smoothly and accumulate capital to welcome the bull market after Trump's election?

On the one hand, it depends on the listing strategy of the exchange chosen by investors in the cyclical rhythm, and some measures taken by them to protect the interests of investors.

This year, Binance, which has smoothly survived a series of storms, still occupies the first place in the exchange track. At present, the number of Binance users has exceeded 225 million, of which the number of new users this year has exceeded 40 million.

Newcomers have chosen Binance as always. The success in the highly volatile market relies on Binance's listing strategy and the launch of a series of high-return financial products, which guarantees the investment returns of users. This is the "art" of Binance's success.

And the "Tao" of Binance's success is to always stand with users.

A listing strategy that focuses on quality rather than quantity

In 2024, unlike some second- and third-tier exchanges that have very aggressive listing strategies, Binance's listing is still selective, adhering to the principle of focusing on quality rather than quantity.

According to a research report by Animoca Digital Research, in the first three quarters of this year, Binance launched 44 tokens. In contrast, KuCoin and Bybit both launched more than 150 tokens, and Bitget launched 339 tokens. It is precisely thanks to this selective listing model that Binance has achieved the highest rate of return in the bear market in the middle of this year.

As of September 2024, the average returns of these exchanges were Binance-27.00%, Bybit-50.20%, KuCoin-48.30%, and Bitget-46.50%. This also shows that Binance has implemented a more effective selective listing strategy. In the challenging altcoin market environment, the token price performance is relatively better.

Specifically, Binance has its own consistent principles in the selection of listed coins. Sister He Yi said that the principles are divided into three points. The first is to list projects that users need, projects with users and traffic; the second is to list projects that have a long life; and the third is to list projects with solid business logic.

Under the bear market in the middle of this year, the market liquidity was insufficient, low-market-cap Memes were fully circulated, there was no large-scale selling pressure from VCs, and the resistance to pull-up was small, which became the only way out for retail investors at the time. Binance also listed some popular Meme tokens.

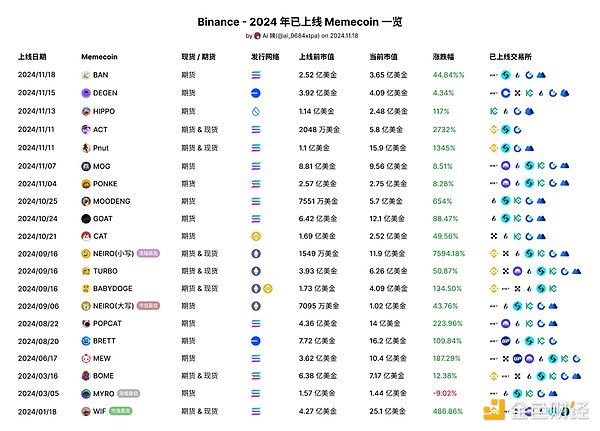

According to the data summarized by X user Aunt Ai, as of November 18, Binance has launched a total of 20 Memecoin projects (including contracts and spot) since 2024. Among all the launched projects, spot transactions account for 35%. Only one project fell after its launch, and the lowercase $NEIRO even rose by as much as 7594%.

PNUT and ACT were launched on Binance on November 11. After listing on Binance, the price of ACT soared 16 times in half an hour, and the initial market value rose from 20 million US dollars to 350 million US dollars. After listing, there was still a 72.60% increase, ranking among the MCAP top 200. PNUT was not to be outdone, and tripled in just one hour. Catering to the market hotspots and the election narrative, it ushered in a 4-fold increase after listing, and the market value soared to 400 million US dollars.

As one of the important narratives of this cycle, the Meme token is undoubtedly something that Binance cannot and should not miss.

He Yi said that Binance also reflected on Meme coins. In the dispute between big and small Neiro, due to the criticism of the community, Binance reflected more on what is a good MEME, so it chose MEME projects with relatively decentralized tokens and low market value.

From the choice of Meme, we can also see that Binance always considers the problem from the user's standpoint. Meme with concentrated chips has a greater probability of cutting leeks, while Meme projects with decentralized tokens and low market value give ordinary people more opportunities to make money.

The other two principles of Binance listing coins are-long-lived projects and projects with solid business logic. Following these two principles, Binance has launched projects with solid business logic such as TON, Arkham, a concept coin similar to AI, and Pendle, which has been re-noticed by the market due to the craze of restaking.

The above projects are sustainable in themselves, and their value has been verified after experiencing the deep baptism of the bear market.

Sponsored Business Content

Binance's listing behavior has also brought more exposure and liquidity to the project. This is a win-win situation for users and projects. The data also shows that the strict control of Binance has helped users reduce losses, at least in the bear market in the middle of this year.

Rich financial products guarantee users to make money

Data shows that the average ROI return of Binance Launchpool projects this year is 2.13 times. The average valuation of the project is 326 million US dollars, and the total financing in Launchpool is 929 million US dollars.

The data is very impressive. Under normal circumstances, traditional trading platforms have no way to guarantee that users can make money. But on Binance, users holding BNB or FUSD can get some new project airdrops. This ensures that users can "make money".

In this round of bull market, Binance launched Launchpool more frequently, and users holding BNB or FUSD on the platform can participate in Launchpool to get new coin airdrops.

Especially for users who hold BNB, not only can they obtain the steady increase of BNB, but also Launchpool and other wealth management products can bring objective "passive income".

The airdrop of new coins is not limited to Launchpool, but also includes Hodler Airdrop, Megadrop and other channels. In addition, BNB in Binance Web3 wallet can also participate in the airdrop of new coins.

For conservative investors, they can hold a large amount of BNB, so that they can enjoy the profits of BNB's unstable rise and get the airdrop of new coins, thus achieving one fish and two kills.

On the other hand, holding BNB and obtaining stable wealth management income on the platform can hedge the risk of token decline in the bear market. In the bull market, users can obtain the most popular tokens at no cost through Launchpool and other wealth management methods. While obtaining rich returns, they can also participate in the hottest narratives in the industry without risk, help popular projects to raise funds and promote, and participate in the construction of the industry.

In addition to the popular Launchpool, Binance also has other rich financial products. Currently, Binance Financial Management has financial products such as earning coins, ETH staking, Binance mining pool, BNB income pool, DeFi mining, and dual-currency investment. These products can be divided into principal protection and high-yield types to meet the various investment needs of users.

Stand with users

He Yi once said that Binance's success is because it hit the pulse of the times and stood with users.

Discovering the needs of users in the industry and meeting their needs is the core reason for Binance's success.

The evolution of Launchpool can prove this point. At first, users participated in Binance's Launchpool by investing BNB or a specific stablecoin into the Launchpool pool, and when the time came, they had to "claim" the income themselves. However, this year, users can accumulate interest and automatically obtain the rewards of Launchpool, Megadrop and HODLer airdrops after using BNB to purchase products that guarantee principal and earn coins. There is no need to automatically invest and confirm, and BNB in Binance Web3 wallets can also participate in the airdrop of new coins. Binance's move undoubtedly simplifies the participation process and benefits users.

Binance not only meets the needs of users in transactions. Binance started with transactions, but it is not limited to transactions. The emergence of Earn, Square, Pay, and Web3 wallets are enough to prove that Binance is using a variety of products to meet the various needs of users in the industry.

Binance Square allows users to understand the information in the industry and find the code of wealth. Binance Pay makes it possible to truly apply cryptocurrency to real-world scenarios.

As He Yi said, Binance has been trying to explore how to cross the gap and truly popularize blockchain technology, so that ordinary people can use blockchain instead of just speculating on it. Ordinary users can benefit from blockchain without knowing what blockchain technology is.

Binance has great ambitions to support the development of the industry, and the realization of these ambitions relies on seeing and meeting the needs of the industry and users.

Aaron

Aaron

Aaron

Aaron Davin

Davin Kikyo

Kikyo Clement

Clement Hui Xin

Hui Xin Jasper

Jasper Catherine

Catherine Kikyo

Kikyo Clement

Clement Jasper

Jasper