Author: Dynamo DeFi, Compiler: 0xjs@黄金财经

Recently I have been developing a new on-chain metric to properly capture economic activity on blockchains.

As I often say, a useful framework for analyzing blockchains is to think of them as digital economies:

So, what is the best metric to measure this activity?

There are many problems with current metrics:

TVL - represents dollars, but not activity. Affected by large deposits, not all TVLs are equally productive.

TX number - represents activity, but not amount. It's easy to be fooled.

DEX volume - represents dollars and activity, but only represents specific types of economic activity. Does not capture the activity of games or even other DeFi projects.

Chain GDP - Chain GDP measures dollars and activity on the chain. Essentially, this is the sum of all fees generated by applications on the chain. Note: this does not mean only the fees of the chain itself.

Since only fees are counted (and not raw transfer volume), it is much harder to fake using wash trading or Sybil attacks. To fake a chain GDP, you would need to pay a lot of fees to various dApps in the ecosystem.

Methodology

To extract the data, I used DefiLlama’s Fees and Revenue API.

If you’re unsure about the difference between fees and revenue:

For example, fees paid to liquidity providers are not revenue, but fees used for governance token staking rewards are.

As for actually extracting this data, you can either iterate over the protocols and extract their total fees by chain, or iterate over the chains and calculate the total fees for the protocols on that chain. I chose to iterate over chains and use the /overview/fees/{chain} endpoint because when extracting fees by chain, the TotalDataChart property shows the sum of fees for all protocols on that chain — which is exactly what we want.

Two main decisions must be made at this point:

Fees or revenue?

Group L2 with L1 or keep them separate?

Fee vs. revenue is an easy decision. Revenue is heavily dependent on token economics. Take a protocol like Uniswap, for example. Even though Uniswap is one of the largest centers of economic activity in the crypto space, if we count revenue instead of fees, only Uniswap Labs’ revenue contributes to Ethereum’s GDP. Furthermore, analysis I’ve performed in the past has consistently found that fees are a better predictor of market cap than revenue.

Deciding whether to group L2 with its parent L1 is more difficult. Honestly, this is mostly about Ethereum. I chose to separate them for a few reasons:

Higher granularity. Combining Arbitrum, Base, etc. with Ethereum provides less information than separating them. Anyone who wants to count them together can easily do so; however, grouping them by default obscures the meaningful shifts happening in the on-chain economy.

Industry standards. Like it or not, most data providers (like DefiLlama and Artemis) default to comparing L2 as their own chain.

On-chain economy. Economic activity on a chain is somewhat downstream of the liquidity flowing into that chain. At least for now, liquidity flowing into and out of L2 is similar to inter-chain flows.

By popular request, I plan to publish the full scripts I use on GitHub so that others can test it themselves, but I’ve never posted there before (my background is in finance/economics, not software).

Chain GDP Data

Now let’s look at the data.

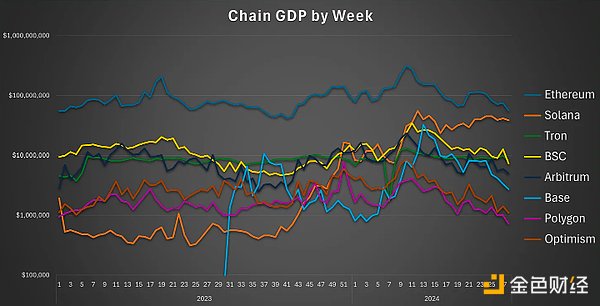

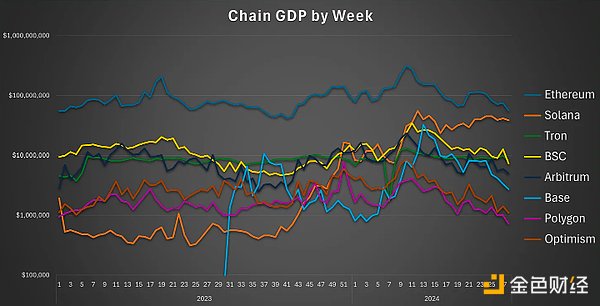

Ethereum is the clear leader in terms of chain GDP (not surprisingly). In recent days, Ethereum’s GDP has been around $10-15 million most days, while Solana, the runner-up by this metric, has a GDP of around $6-7 million.

That being said, Solana is the clear winner this year. While most major blockchains peaked in March and have suffered from a drop in economic activity since then (recession?), Solana has remained stable and even grown, distancing itself from its closest competitor and approaching the GDP of Ethereum itself.

Another notable trend is Base, which has briefly risen from 8th to 3rd place in GDP among these public chains, and is now ranked 6th, despite a downward trend in recent weeks.

For those who want to dig deeper into other chains and time periods, here are the 12 July 2024 stocks. Daily exported data excerpts

https://docs.google.com/spreadsheets/d/1JSIMYO4gTMIRbc2PIIHUtEkGcQKj3zJy6QL0SUAaBF8/edit?gid=0#gid=0.

This spreadsheet contains data for more than 50 chains since the beginning of 2024.

Aaron

Aaron