Source: Mankiw Blockchain Legal Services

On January 22, 2024, Premier Li Qiang chaired an executive meeting of the State Council to discuss the Anti-Money Laundering Law of the People's Republic of China (Revised Draft)". According to the legislative plan, the revised draft is expected to be passed in 2025.

According to Wang Xin, a professor at Peking University Law School and an expert who participated in the discussion of the revised draft of the Anti-Money Laundering Law, China’s understanding of the importance of anti-money laundering has been a “triple jump”: from the initial focus on maintaining the stability of financial institutions The narrowest understanding of reputation and money laundering extends to the connection between money laundering and predicate crimes that generate economic benefits, and then extends to the maintenance of financial security, and finally to the strategic level of maintaining overall national security.

To catch the thief first, catch the king first. As for China’s anti-money laundering cause that has risen to the level of national security, the most urgent thing at present and the most necessary to be solved at the legal level is the money laundering problem involving virtual assets. .

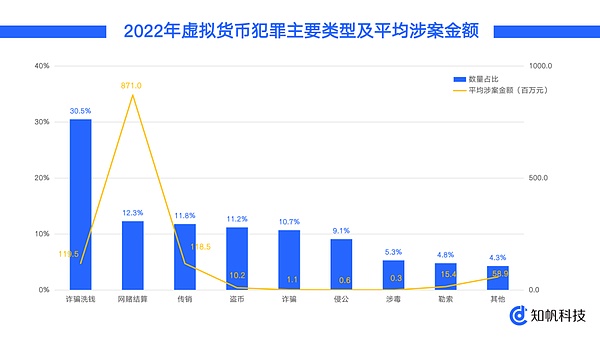

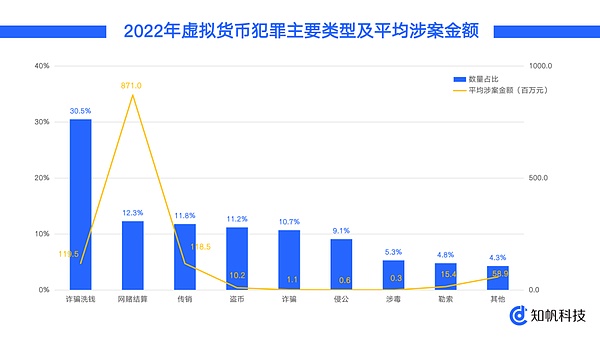

A slightly ironic statement is that if an international criminal gang does not use virtual currency when laundering money, it is really out of step with the times. According to the "Research Report on Blockchain and Virtual Currency Crime Trends in 2022" released by Zhifan Technology, in terms of the number of cases, the number of money laundering cases using virtual currency fraud ranked first in 2022, accounting for 30.5% of the total number, far behind Higher than other types;In terms of the amount involved, fraud and money laundering cases ranked second, accounting for 22.5%; it can be seen that, both in terms of quantity and amount involved, in currency-related cases Fraud and money laundering account for the majority of criminal cases.

However, in terms of preventing virtual currency money laundering and combating crime, there are many problems that are a headache for friends in China’s regulatory and judicial enforcement levels. I call it China’s Virtual Currency Judicial Practice Three major difficulties:

01 The first difficulty is to prevent in advance

In recent years, the trend of using traditional money laundering models to "bleach" funds obtained from various illegal crimes has been effectively curbed. In order to evade crackdowns, criminals turn to the more concealed and convenient "virtual currency" as a carrier to "launder" illegally obtained funds.

The virtual currency generated based on the background of blockchain technology has the characteristics of decentralization, anonymity, global liquidity and algorithm encryption that is difficult to supervise. It has been used in various fields such as online gambling, e-mail fraud, and online pyramid schemes. It serves as the main payment and settlement channel in various forms of crime.

Criminals use virtual currency to launder money, which is a process of completing the process of buying legal currency to converting virtual currency, and then selling the virtual currency to exchange for legal currency. During this process, it goes through three stages: "placement, cleaning, and collection". First, illegal funds are injected into the channels to be cleaned, and then mixed technical means such as currency mixers, cross-chains, and anonymous coins are used to create complex transaction trajectories. Finally, the laundered virtual currencies are gathered to a certain address for withdrawal, which is professional and intelligent. ization, concealment, chaining and other characteristics.

(1) Specialization. With the popularization of technology and the "get rich" effect of a large number of virtual currencies, various wallet APPs, exchange APPs, and browser wallet plug-ins continue to emerge and become popular, using virtual currencies for gambling, electronic fraud, drug trafficking, etc. Criminal money laundering has formed a type of criminal industry, and corresponding professional teams can be found in every link such as rule design, currency issuance, platform setup, system operation, transaction circulation, and product promotion.

(2) Intelligent aspects. With the increasing scale of money laundering using virtual currency, the manual exchange of legal currency and virtual currency is far from meeting the large-volume, large-amount, and high-frequency money laundering needs of criminals. Many criminals combine virtual currency money laundering business with blockchain smart contracts, using smart contracts to automatically match, exchange and transfer legal currency and virtual currency, which not only increases money laundering efficiency but also increases money laundering security.

(3) Concealment. The use of virtual currency for transactions can escape the sight of existing financial supervision and is extremely concealable. In order to evade attacks by the public security organs, criminals abandon exchanges and instead use OTC market services such as Tether acceptance and guarantee on overseas communication software to complete more covert offline same-stage transactions or anonymous guarantee acceptance. At the same time, cross-chain and currency mixing applications are becoming more and more popular, using methods similar to capital pools to cut off the capital chain between payers and payees.

(4) Chain aspect. As an important link in virtual currency transactions, virtual currency wallets have gradually shown the characteristics of industrialization of criminal chains, specialization of criminal functions, and corporatization of criminal gangs. Some criminal gangs have developed and operated virtual currency wallets for publicity and promotion. Special gangs collude with each other to add virtual currency wallets to APPs involved in online gambling, pyramid schemes, telecommunications fraud and other related cases. Users can directly enter the APPs involved in the case through the virtual currency wallet, or directly use the embedded virtual currency wallet to purchase virtual currency. Transactions and cash withdrawals form a huge industrial chain with a clear structure, detailed division of labor, and interlocking links.

In July 2022, the Joint Logistics Center of the Economic Investigation Corps of the Public Security Department of the Inner Mongolia Autonomous Region issued an early warning to the Hohhot Branch of the People's Bank of China to the Kormi Branch of the Tongliao Municipal Public Security Bureau: It was discovered that the criminal suspect Shi Mouyuan's bank card funds were flowing. Abnormal, suspected of money laundering crimes. After investigation, since May 2021, the criminal gang has used the overseas chat software "Telegram" to develop offline personnel in series, and pass funds suspected of online pyramid schemes, fraud, gambling and other crimes through Tron Chain (USDT-TRC20) and Ethereum Chain (USDT-TRC20) are converted into the virtual digital currency Tether (USDT), using the numerous criminals they recruit to register for anonymous blockchains Account address, Exchange RMB to pay to the upstream criminal group’s sponsor, and obtain illegal profits from it. It is reported that the criminal group used virtual currency transactions to launder as much as 12 billion yuan.

02 ;The second difficulty is that it is difficult to investigate during the incident

Currently, China does not have clear regulations on the legality of individuals holding, trading and producing virtual currencies. Criminals use There is no difference between the flow of funds in the virtual currency wallets of individuals or groups in the domestic currency circle and the normal purchase and sale of virtual currencies. It is difficult to determine the criminal intent of the relevant virtual currency traders.

First of all, it is difficult to verify the identity. The anonymity of virtual currency makes it very difficult to associate a personal virtual currency wallet address with a user's identity. For exchanges, the same registration information can generate a variety of wallet addresses. And just by sharing the private key, the wallet address can be transferred to others for use. In the transaction process of virtual currency, some wallet addresses belong to the "fund pool" and are used by multiple criminal suspects. It is necessary to link them to the specific user. more difficult. In addition, as the public security organs have intensified their crackdowns in recent years, criminal suspects have become more and more aware of anti-reconnaissance. They not only use niche software such as Telegram and WhatsApp or overseas chat software to communicate, but also rent overseas servers to further intensify their efforts. This makes it more difficult for the public security organs to investigate and investigate.

Secondly, it is difficult to conduct retrospective verification. The virtual currency trading environment is complex and can be mixed and matched with various transaction forms such as currency-to-crypto, currency mixing, cross-chain, and decentralized transactions. After on-chain transactions are confused and transferred multiple times, the work of fund traceability and verification will become complicated. Extremely difficult. Since the "9.24" announcement by ten ministries and commissions in 2021, domestic virtual currency exchanges have withdrawn from domestic market operations. Therefore, the currently targeted virtual currency exchanges and virtual wallet operators need to register through email or use a dedicated website to obtain relevant evidence. Since the exchange is outside the country and is not subject to the supervision and restrictions of mainland China's laws, there are difficulties such as excessive scrutiny by the law enforcement departments of the public security organs when obtaining evidence from relevant virtual currency exchanges, long verification periods, and unblocked verification channels.

Not only is it difficult to investigate criminal suspects, but the process of investigating cases is also often accompanied by accidental injuries to people related to the funds involved.

In reality, it is not uncommon for judicial authorities to "block" or "freeze" bank accounts suspected of illegal crimes such as money laundering. Those whose accounts have been mistakenly blocked and frozen have no way to appeal. Cases are not uncommon, and relevant subjects lack the necessary right to know, complaint channels, correction and relief mechanisms. For example, in the "card freezing" operation in 2020, the bank accounts of tens of thousands of merchants in a certain place were frozen, which had a great negative impact on the reputation of the local government. In order to deal with the crisis, the local government took the lead in temporarily setting up a "Bank Account Freezing Assistance Center" to sort out information on frozen accounts of registered merchants, and sent more than 40 working groups to various parts of the country to communicate and coordinate bank card unfreezing matters.

03 The third difficulty is to deal with it afterwards

Although The revised draft of the Anti-Money Laundering Law has included the prevention of virtual asset money laundering. However, there is a lack of operational specifications for the subsequent seizure, freezing, deduction, and confiscation of virtual asset money laundering crimes, making it easy for chaos to arise. < strong>Procedures are illegal, regulations are not specific, and implementation methods are inconsistentand other issues.

There are three common ways to dispose of virtual currencies:

Method 1: After obtaining authorization from the criminal suspect or judicial trial, the public security agency will entrust a specialized technology company on the market to To carry out disposal, the disposal company opened an account on the virtual currency exchange and sold it directly to OTC merchants on the virtual currency exchange in an over-the-counter transaction without going through the judicial evaluation process. The OTC merchant paid the agent in RMB. The company, on behalf of the disposal company, after deducting the service fee (the price is negotiable, the price range is very exaggerated), pays it to the account of the local financial department designated by the judicial authority. Of course, considering that large-amount transactions on the market can easily drive down the price, this is suitable Judicial disposals of small amounts or cases where the judicial authorities do not have high requirements for the number of days for disposal.

Method 2: After the public security agency and the disposal company sign a contract, the public security will pay a small amount of virtual currency for wallet verification, and then the disposal company will find some people with large amounts of cash in Yiwu, Shenzhen and other places. The buyer and the disposal company will hand over or deposit the cash to the local financial department designated by the judicial authority after deducting the service fee. After the funds are received by the police, they will then transfer the money to the currency collection address provided by the disposal company. And these companies that can withdraw large amounts of cash in the short term are often more related to underground banks.

Method 3: After the public security agency and the disposal company sign a contract, the disposal company cooperates with the domestic foreign trade company to create a fictitious export trade model. The overseas company remits money in accordance with the contract and settles the foreign exchange through the Foreign Exchange Administration of the People's Bank of China. Convert it into RMB and hand it over to the disposal company. After deducting the service fee, the disposal company pays it to the account of the local financial department designated by the judicial authority. After each payment is confirmed, the judicial authority will pay the corresponding amount of virtual currency to the wallet account designated by the disposal company.

In order to reduce the judicial authorities’ concerns about compliance and legality, currently virtual currency disposal companies will generally intervene from the beginning of case investigation to help the public security organs conduct research and judgment through transaction analysis on the virtual currency chain, but in order to ensure their interests Usually, a virtual currency disposal fee contract will be signed with the entrusted public security agency. This provides a one-stop service from investigation and judgment to post-processing, helping the public security organs save a large amount of investigation resources and energy.

With the fierce competition in this business, more and more disposal companies have begun to focus on compliance. However, our Mankiw team’s feeling after looking at the current standards and levels of compliance in the industry is:< strong>Yes, there is, but not enough.

At present, the more common compliance efforts in the industry to deal with companies include the following aspects:

1. Obtain written authorization from the public security

After reaching an intention to cooperate with the judicial authority for disposal, the disposal company will require the public security to issue a relevant explanation letter or authorization letter to authorize it to dispose of the assets of the relevant virtual currency involved; if it is during the investigation stage of the case, at the same time There will also be a signed authorization form from the suspect. When obtaining the authorization letter, the disposal company will sign a cooperation agreement with the public security department to agree on necessary matters such as the transaction quantity, pricing basis, disposal completion period, etc. Generally speaking, the text of the contract and authorization are relatively concise, and the relevant Legal risks are usually agreed to be borne by the resolution company, which is very considerate of relevant colleagues in the judicial department.

2. Provide proof of legality of funds

In order to prove its source of funds and disposal capabilities, the disposal company will proactively provide deposits from multiple banks of its own. The certificate emphasizes the legality and cleanliness of its funds, and can match funds from different channels according to different disposal and recovery ratio requirements of the judicial department. Generally speaking, the higher the legality certificate of funds, the higher the disposal cost.

3. Replace the shell company with one shot

In order to improve its compliance level, the disposal company usually establishes or controls multiple companies in advance. A shell company with only one natural person shareholder. The company is often registered as a technology company. Its legal representative and shareholders will arrange for an "octogenarian", "cancer patient", etc. to be responsible for completing the asset disposal of a single virtual currency. , then a company should be deregistered to avoid subsequent legal liability.

4. Find partners to cooperate with the bidding

In order to meet the procedural requirements of the judicial authorities, the disposal company will take the initiative to propose through "auction" and other forms. Judicial disposal of virtual currency, and arrange other third-party cooperative companies to participate in the bidding, and then sign a formal agreement after winning the bid. Due to the sensitivity of the matters involved, the relevant auction information will not be announced through normal government websites.

At present, the disposal companies in the industry are often only general limited liability companies registered with the industrial and commercial registration. They are often technology companies in nature. Their business scope may include blockchain-related technology development and consulting, but they usually do not There will be no written description of the judicial evaluation or judicial disposition of virtual currencies. Moreover, the company will not have a specific financial license or related business qualifications, and it will not have any substantive business under its name. In short, this company was born for the judicial disposal of virtual currencies.

Based on our understanding of China’s 924 policy, ordinary private companies registered in mainland China carry out exchange and matching between virtual currencies and RMB in China without special business qualifications. Services are obviously illegal; this illegal behavior will not be changed by the authorization of the grassroots police and other judicial departments and the written contract agreement between the two parties. Therefore, if a large number of judicial disposal companies on the market sort out their entire transaction methods, they have essentially opened up circulation and transaction channels between virtual currencies and RMB, which obviously violates the provisions of the 924 policy and is suspected of illegal operations.

More importantly, for disposal companies, the virtual currency they receive must always be exported. After the disposal company obtains the virtual currency, based on security considerations, it often uses technical means to clean the virtual currency address involved, such as erasing the address of the virtual currency on the chain through a currency mixer, and then dismantles it in pieces. Other domestic foreign trade merchants or high-net-worth buyers; either use gray channels to liquidate virtual currencies overseas, then liquidate them through "underground banks" or "fake trade", apply for foreign exchange settlement at the State Administration of Foreign Exchange, and then return them to the country. These operations are often suspected of violating national anti-money laundering laws and foreign exchange management-related laws and regulations, and pose great criminal legal risks.

Virtual currency is still unfamiliar to the vast majority of judicial personnel. The vast majority of grassroots judicial staff are often unaware of its market price and transaction model. In the judicial disposal process, how much can a coin be sold for? Where should I trade? These questions are often unclear. As a national judicial staff member, it is a bit too magical to be led into a trap by a third-party disposal company under the guise of compliance because he does not understand industry operations. He will be investigated by the Commission for Discipline Inspection and Supervision in the future.

04 Conclusion

With the development of the blockchain industry With the continuous rise and development, the means of money laundering through virtual currency are constantly being renovated, but no matter how the means or methods are updated, they are illegal and criminal acts. With this revision of the case, the anti-money laundering system related to virtual currency will also become more and more perfect. , which can be said to be a big step forward for the improvement of China’s virtual assets legal system. For Web3.0 entrepreneurs in China, especially those who are engaged in digital asset financial business, it is important to understand the legislative situation and work progress, and make relevant preparations in advance. After all, only in compliance with regulations can you start a business. long!

Kikyo

Kikyo