Are cryptocurrencies securities products? The protracted legal battle over cryptocurrency regulation in the United States continues. But judging from the latest situation, the balance of victory seems to be tilting towards the exchange.

A federal judge on Wednesday expressed doubts about the U.S. Securities and Exchange Commission's (SEC) claims, noting that if it upholds the SEC's claims, it could inadvertently The definition extends to areas such as collectibles, which are not within the scope of SEC regulation.

Judge questions SEC’s definition of securities as too broad

On Wednesday local time, U.S. District Judge Katherine Polk Failla presided over a hearing on Coinbase’s request to dismiss the SEC’s civil lawsuit.

SEC sued Coinbase in June last year, claiming that it was an unregistered securities broker. Coinbase submitted a motion to dismiss (MTD) in August, claiming that the SEC had no supervision. Legal powers of cryptocurrency exchanges.

During the five-hour hearing, Failla seemed unconvinced by the SEC’s views. She told the SEC’s lawyer in court:

“I would like to understand how your criteria do not address the collectibles market or commodities. I am concerned that your arguments are too broad.”

Failla did not make a ruling at the end of Wednesday's hearing, but a decision is expected in the coming months. If she allows all or part of the case to proceed, the lawsuit could begin next year.

Coinbase: Speculating in currencies is like buying baseball cards or Beanie Babies, it is two different things from securities

The impact of this case is quite significant. The legal confrontation between Coinbase and the SEC is a critical moment in cryptocurrency regulation and compliance. The outcome of the case could set a precedent that affects how digital assets are regulated in the United States and around the world.

Furthermore, the outcome of the case will also greatly affect Coinbase's operations. Industry observers believe that if Coinbase is recognized as a securities broker, it will be forced to reorganize a number of services, such as trading, marking, and custody. The company may face significant operational and financial challenges and lose up to 30% of its revenue.

Sponsored Business Content

When prosecuting large cryptocurrency exchanges such as Binance and Coinbase, the SEC cited the 1946 Supreme Court case of SEC v. W. J. Howey Co., The case provides a definition for investment contracts, which are a type of securities product distinct from stocks and bonds.

The SEC believes that most cryptocurrencies meet the definition of an investment contract. This meansCoinbase cannot trade cryptocurrencies without following the same rules as the New York Stock Exchange or Wall Street brokerages.

One of Coinbase’s defenses against the SEC’s accusations is the so-called “major questions doctrine”, which requires restrictions U.S. federal agencies enact regulations of economic and political significance without explicit direction from Congress.

At Wednesday's hearing, a lawyer for Coinbase said that Congress did not give the SEC the power to regulate cryptocurrencies, but the SEC did its own thing. If the court accepts the SEC’s assertions in the Coinbase case, it would have “legislative implications” that would “ripple throughout the industry.”

In addition, regarding the SEC’s assertion that cryptocurrency is an investment contract, Coinbase argued thatcryptoassets do not come with rights such as dividends, nor do they other contractual commitments and therefore are outside the jurisdiction of the SEC. Transactions in the secondary market are only between individuals, and there is no explicit investment contract specific to the securities. Most cryptocurrencies are commodities, not securities, and investors may hope that a cryptocurrency will appreciate in value, much like collecting baseball cards or Beanie Babies, but that is not enough to make it a security.

After the hearing, Citigroup raised the Coinbase target price from $90 to $151.

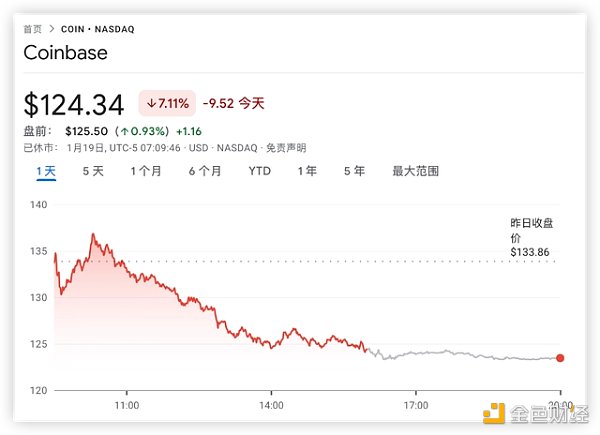

As of press time, Coinbase was up about 1% before the market opened.

Yahoo Finance

Yahoo Finance

Yahoo Finance

Yahoo Finance cryptopotato

cryptopotato Beincrypto

Beincrypto CryptoSlate

CryptoSlate dailyhodl

dailyhodl Bitcoinist

Bitcoinist Others

Others Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph