Co-founder Kevin Wang: He worked on enterprise data solutions at IBM Silicon Valley Laboratory and co-founded Launch School, an online school for software engineers. In addition, Kevin Wang is also a co-founder of Khalani, an intent-driven centralized solver infrastructure. (Khalani is a versatile "collective solver" that can be seamlessly integrated into a variety of intent-centric applications and ecosystems.) Co-founder and COO Daniel Lv: Co-founder of Ethereum wallet imToken and former CTO of crypto exchange Yunbi. In addition, Daniel Lv has organized the Ruby China community for 10 years and co-founded ruby-china.org. CEO Terry Tai: Former core developer of crypto exchange Yunbi and co-founder of technology podcast Teahour.fm. Interestingly, although the CKB founding team has close ties with the Ethereum community, they chose to inherit the Bitcoin UTXO + PoW model in the construction architecture of Layer1. This is because the team recognized the limitations of Ethereum infrastructure. They realized that Ethereum's architecture limited the radical reform of the entire system, and it was impossible to fundamentally reconstruct and innovate boldly. Therefore, the CKB team decided to take a different path from Ethereum and build a new blockchain.

On the other hand, the reason why the CKB team chose to rebuild a public chain may be inspired by the name Nervos. The word Nervos comes from "Nerve", which also draws on Charles Darwin's theory of evolution: "Only species that adapt and flexibly adjust to a changing environment can survive." It means allowing the network to self-adjust and evolve at the bottom. However, there is another saying about the origin of Nervos, because the co-founder of CKB is also a lover of e-sports and anime, and the "United Nations Direct Secret Service Agency" in the anime "Neon Genesis Evangelion" is abbreviated as "NERV".

In order to accelerate the progress of the ecosystem, CKB has focused on developing tools since the beginning of 2020, and has launched a series of tools, including Lumos, a framework based on JavaScript/TypeScript, Polyjuice, an Ethereum compatibility layer that allows the use of account models on CKB, Force Bridge, a cross-chain bridge connecting Ethereum and CKB, and Tippy, a dApp development kit. These tools have greatly lowered the threshold for developing applications. Based on these tools, the CKB ecosystem has launched 127 projects, covering different tracks such as DID, wallets and inscriptions.

Going against the mainstream: What innovations does the CKB architecture have?

In the context of the community's general concern about TPS and PoS, CKB has chosen a technical route that is completely different from the mainstream. They insist that there must be no compromise on the issues of anti-censorship and permissionlessness. Therefore, we chose to reduce L1 performance to maintain sufficient decentralization, and adopt improved PoW and simple hash functions to ensure the security and permissionlessness of the network.

Layered Concept

The reason for choosing a layered architecture is based on the team's reflection on the operation mode of the Internet. The Internet has built a relatively stable trust network through a layered and decoupled architecture, but its trust level is limited and lacks inherent support for self-protection protocols. CKB's ideal crypto-economic network infrastructure should also adopt a layered and decoupled architecture. This means defining the network through a set of protocols rather than just one protocol, while providing native support for self-protection protocols. Therefore, the team decided to build a secure and scalable layered network, in which Layer1 focuses on providing security and decentralization, and Layer2 uses the security of Layer1 to provide unlimited scalability.

As Layer1, CKB is called "Common Knowledge Base". "Common Knowledge" is defined as knowledge that is universal and widely known, that everyone or almost everyone knows and knows that others know it. In the context of blockchain, "common knowledge" refers to a state that has been verified by global consensus and accepted by everyone in the network. This property is also the reason why we can use cryptocurrencies stored on public chains as currency. Nervos CKB is designed to store all types of common knowledge, not just currency. For example, it can store user-defined crypto assets, including FT, NFT, etc.

Layer 2 protocol can use CKB to ensure security while providing unlimited scalability. The layered architecture proposed by CKB was later recognized by Ethereum. Since 2019, Ethereum has abandoned its previous research on sharding and switched to Layer 2 as the core for expansion, which continues to this day.

PoW mechanism ensures decentralization

CKB firmly believes that Layer1 is the cornerstone of the crypto economy, so it must be a permissionless network. In contrast, PoS determines the block distribution ratio according to the pledge weight, which leads to a conflict with the goals of decentralization and neutrality. In contrast, PoW is completely permissionless, and users only need to purchase mining machines and electricity to participate in block production. In addition, in terms of security, it is extremely difficult to forge or reconstruct a PoW chain because the computing power of each block needs to be recalculated. Vitalik also created the concept of "weak subjectivity" to explain that the security of PoS is not lower than that of PoW.

Therefore, the CKB team believes that although PoS is indeed better than PoW in performance, if you want Layer1 to be as decentralized and secure as possible, PoW is more suitable than PoS.

Cell model achieves scalability

With the rise of the Bitcoin ecosystem, the debate between the account model and the UTXO model has once again attracted attention. In the early days, both models were interpreted around assets, but over time, UTXO still regards assets as the core (peer-to-peer), while the account model has evolved to serve contracts, where users' assets are hosted in smart contracts and interact with them. This has led to a higher security level for assets issued on the UTXO chain than ERC-20 assets issued on Ethereum. In addition to security, the UTXO model has better privacy, with addresses changing for each transaction, and naturally supports parallel transaction processing. Most importantly, unlike the account model, which performs calculations and verifications on the chain at the same time, the UTXO model puts the calculation process off-chain and only verifies on the chain, thereby simplifying the implementation of applications, which means that there is no need to consider optimization issues on the chain.

CKB not only inherits the ideas of the Bitcoin architecture, but also abstracts the UTXO model and creates the Cell model, which has the ability to support smart contracts while retaining the consistency and simplicity of Bitcoin. Specifically, Cell abstracts the nValue field in UTXO, which represents the value of the token, into two fields: capacity and data. Data saves the state and can store any data. At the same time, the Cell data structure also contains two fields, LockScript and TypeScript. The former mainly reflects ownership, while the latter can customize many rich functions.

In summary, the Cell model is a more general UTXO model, which enables CKB to have smart contract functions similar to Ethereum. However, unlike other smart contracts, CKB adopts an economic model for common knowledge storage, rather than an economic model designed for payment for decentralized computing.

High-level "abstraction"

The concept of "abstraction" is not unfamiliar to crypto users. It refers to removing the particularity in the system, creating universality, and making the system applicable to a wider range of scenarios. The development from Bitcoin to Ethereum is actually a process of abstraction. Bitcoin lacks programmability and is difficult to build applications. Ethereum, on the other hand, introduced a virtual machine and operating environment, providing a platform for building various types of applications. Ethereum has also been constantly abstracting in its development, whether it is the "account abstraction" repeatedly mentioned by Vitalik, or the addition of pre-compiled "cryptographic abstraction".

Just as Ethereum is an abstraction of Bitcoin, CKB is also an abstraction of Ethereum to some extent, providing smart contract developers with more freedom to play.

1) Account Abstraction

CKB implements account abstraction through the Cell model. For example, Nervos ecosystem wallet UniPass has created an identity authentication system based on email and mobile phones. Users can log in with email and password, similar to traditional Internet accounts. The decentralized domain name protocol .bit developed by the decentralized identity service provider d.id team also uses the characteristics of Nervos abstract accounts, allowing Internet users, Ethereum users, and EOS users to directly operate applications, not just CKB users.

2) Cryptographic Abstraction

The core of cryptographic abstraction is an efficient virtual machine. CKB uses CKB-VM. With the characteristics of the RISC-V instruction set, CKB-VM allows developers to implement cryptographic algorithms using languages such as C and Rust. For example, the JoyID wallet built on CKB takes full advantage of Nervos CKB's custom cryptography, and creates wallets and confirms transactions directly using biometric technologies such as fingerprints without passwords and mnemonics.

3) Operational Abstraction

CKB's goal is to build higher levels of abstraction to improve performance and throughput. With the increase in the level of abstraction, the Nervos network is able to migrate more work to off-chain or Layer 2. For example, although XBOX is an abstract general platform, there are still some limitations, such as the inability to change hardware. PC allows users to replace hardware such as graphics cards, CPUs, memory, and hard disks. Therefore, PC is a more abstract system. The goal of CKB is to transform from XBOX to PC, so as to meet more needs and provide more convenience for developers.

Analysis of CKB Economic Model: Mining Rewards and Inflation Mechanism

The native token of CKB is CKB (Common Knowledge Byte), which represents the global state of the blockchain that the holder can occupy. For example, if you own 1,000 CKB, you can create a Cell with a space of 1,000 Bytes, and you can use these 1,000 Bytes to store assets, application status, or other types of data.

The economic model of CKB is very unique. In addition to halving the mining reward every 4 years (similar to Bitcoin), it also introduces an inflation design similar to mainstream PoS coins, with an additional issuance of 1.344 billion each year. As of now, according to CKBDAPPS statistics, the number of CKB issued is 44.379 billion, of which 43.69 billion are in circulation. The specific design is as follows:

1) Genesis issuance:

A total of 33.6 billion CKB were issued in the Genesis block. In order to pay tribute to Satoshi Nakamoto, 8.4 billion CKB were deposited into Satoshi Nakamoto's address at the beginning of issuance. The remaining 25.2 billion CKBs are allocated to institutional investors, ecological funds, development teams, and public investors, and have all been unlocked.

2) Primary issuance:

The total primary issuance is 33.6 billion. Similar to Bitcoin, it is halved every four years until all primary issuance is mined. Currently, CKB has undergone its first halving in November 2023, and the issuance has dropped to 2.1 billion CKB per year. The second halving is expected to take place in November 2027, and the issuance will drop to 1.05 billion CKB per year. All CKB issued at the primary level will be rewarded to miners.

Specific distribution:

21.5% is used for public token sales, and all will be unlocked when the mainnet is launched

17% is allocated to the ecosystem fund, 3% will be unlocked when the mainnet is launched, and the rest will be unlocked within 3 years

15% is allocated to the Nervos team, with a four-year vesting period, and 1/3 will be unlocked when the mainnet is launched

14% was used for private placement in 2018, locked for two years. 5% was allocated to founding partners, locked for three years, and will not be circulated on the main network. 2% was used for foundation reserves, unlocked in July 2020, and will not be circulated on the main network. 0.5% was used for testnet incentives, providing rewards to testnet participants through mining competitions and bug bounty programs. The remaining 25% has been destroyed. alt="hpOZvQSi8EfWzNn5ZOS97GPNhKmfIebpIDyIJViZ.png">

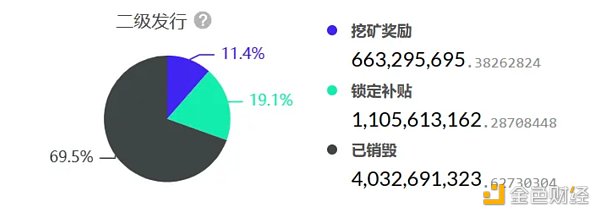

3) Secondary issuance

In order to ensure that miners' income sources are not affected by halving and on-chain transaction volume, CKB introduced the concept of "secondary issuance", with a fixed issuance of 1.344 billion CKB per year. The specific distribution method depends on how CKB is used on the network:

Miners: Proportional to the on-chain state occupation

NervosDAO: Proportional to the proportion of locked CKB in NervosDAO to the total issuance

Treasury: Proportional to the proportion of CKB in circulation to the total issuance. The governance mechanism is not yet perfect, so this part is directly destroyed

Secondary issuance can be regarded as an "inflation tax" mechanism. That is, if users need to store data or state on CKB, they need to pay a certain amount of CKB to miners as "state rent". If storage is no longer needed, CKB can be unlocked and deposited in NervosDAO. Those holders who do not have storage needs can directly deposit their CKB into NervosDAO and receive subsidies to avoid the dilution of token value by secondary issuance.

According to CKB browser data, 11.4% of the secondary issuance tokens are used for mining rewards, 19.1% are used for lock-up subsidies, and 69.5% are allocated to the treasury fund and destroyed.

Network computing power

CKB mining began on May 18, 2019, using the Eaglesong hash algorithm. After March 2020, it gradually shifted from CPU, GPU, and FPGA to ASIC mining machines. Currently, ASIC mining such as Antminer K7 and Goldshell CK6 are supported (GPU and FPGA mining machines are too low to be profitable).

Currently, the network mining power is 240.06 PH/s, and the mining difficulty is 2.31 EH. The mining pools that currently support CKB include F2Pool, Poolin, 2miners, etc.

Amidst the constant controversy, how do you view the new ideas of Bitcoin Layer2? On February 13, Cipher, a co-founder of CKB, proposed an RGB extension protocol: RGB++. This move has affected the secondary market price of CKB to a certain extent and triggered a discussion on the legitimacy of Bitcoin Layer2. Some users believe that compared with the EVM compatible faction, RGB++ inherits the legitimacy of Bitcoin UTXO, and the team has been deeply involved in the Bitcoin ecosystem. Whether it is the layered architecture, UTXO abstraction, or the recently proposed OTX protocol CoBuild Open Transaction, it is an extension and innovation of Bitcoin's thinking. However, there are also some opinions that CKB has too many positioning. From 2019 to 2020, the cooperation with Huobi, and the direction of games from 2020 to 2022, no substantial progress has been made. Therefore, this turn to Layer2 may be suspected of hype. In addition, Bitcoin native developers also expressed their disagreement with the meaning of the name RGB++, believing that it means "Better than RGB". At present, CKB has launched the RGB++ roadmap. How it will perform in the future may only be answered after the test of time.

Since the beginning of 2024, the competition among Bitcoin Layer2 solutions has intensified. However, no matter which solution is adopted, they have promoted the sustainable development and implementation of the Bitcoin ecosystem to a certain extent. This competition may inspire more creativity and solutions. Fortunately, in this process, CKB seems to have always adhered to its original intention, insisted on being isomorphic with Bitcoin, and further bridged the gap.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph