Author: Matías Andrade Cabieses Source: Coin Metrics Translation: Shan Ouba, Golden Finance

Introduction

Since its birth in 2009, the world's first and most famous cryptocurrency has experienced countless ups and downs, achieved major milestones, and fundamentally changed the financial and technological landscape.

In this article, we look back at Bitcoin's extraordinary journey on its 16th anniversary.As we reflect on Bitcoin's transformative impact and look forward to its potential future, we will explore key developments, challenges overcome, and the evolving story surrounding this groundbreaking digital asset. From its humble beginnings as an obscure white paper to its current status as a globally recognized store of value and a potential means of hedging against economic uncertainty, Bitcoin's story continues to fascinate investors, technologists, and policymakers. Join us as we dive into the legacy of Satoshi Nakamoto's creation and its implications for the future of money and decentralized systems.

The Beginning of a Revolution

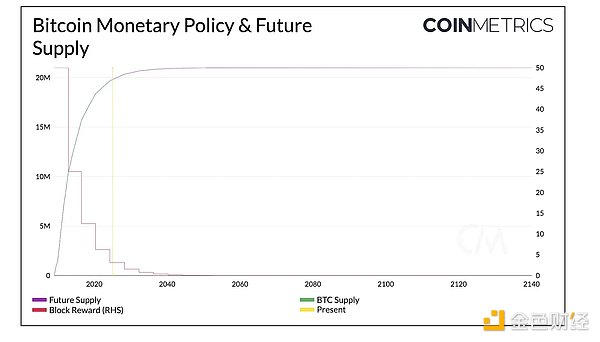

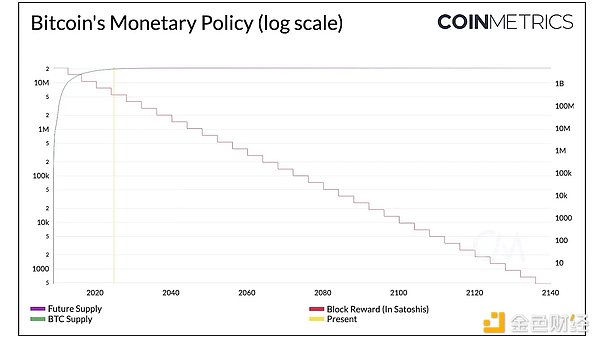

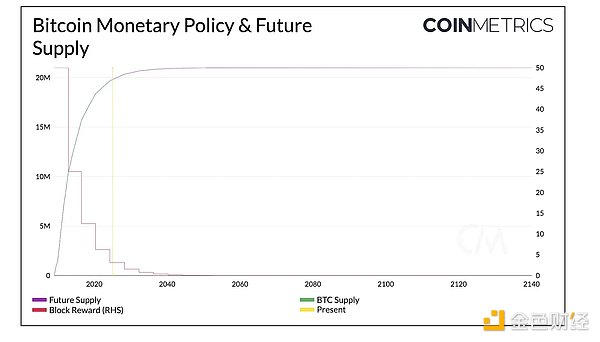

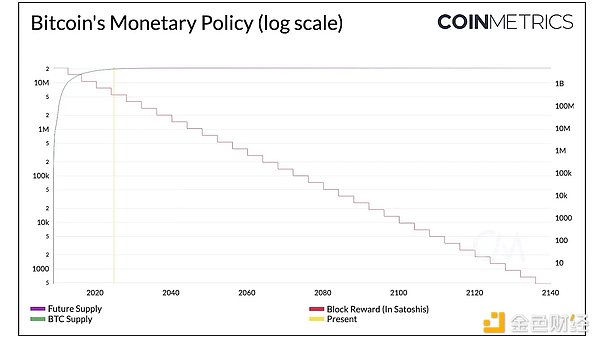

One of the most revolutionary aspects of Bitcoin is that it is a form of money that is free from state intervention and has a clear monetary policy. Unlike traditional fiat currencies, which are subject to central bank and government policies, Bitcoin's supply and issuance are determined by algorithms encoded in its underlying blockchain technology. This decentralized and transparent approach to monetary policy is a fundamental driver of Bitcoin's appeal, as it provides a reliable and predictable framework for the creation and distribution of this digital asset.

Bitcoin’s monetary policy lacks state control and directly challenges the long-dominant centralized financial system. By providing an alternative to government-issued currency, Bitcoin gives individuals and communities greater power to control their own financial affairs. This paradigm shift has far-reaching implications as it opens the door to a more equitable and accessible financial environment, free from the constraints and potential abuses of centralized authority.

In addition, Bitcoin’s scheduled issuance schedule (with a fixed maximum supply of 21 million coins) has been widely praised for its ability to resist the inflationary pressures that often plague traditional fiat currencies. This scarcity, combined with the decentralized nature of the network, has led to Bitcoin’s growing recognition as a store of value and a potential hedge against economic uncertainty.

As the world grapples with the ongoing impact of fiat currency debasement and declining purchasing power, Bitcoin’s monetary policy has become an increasingly attractive option for those seeking a more stable and predictable financial future. This revolutionary feature of Bitcoin is a key driver of its widespread adoption and growing attention from policymakers, investors, and the public.

Striving for Stability and Credibility

As Bitcoin matures as a digital asset, two important economic concepts come to the fore: stability and credibility. These factors are often considered in the context of dollarization, the process by which a country or region adopts a foreign currency as its primary medium of exchange.

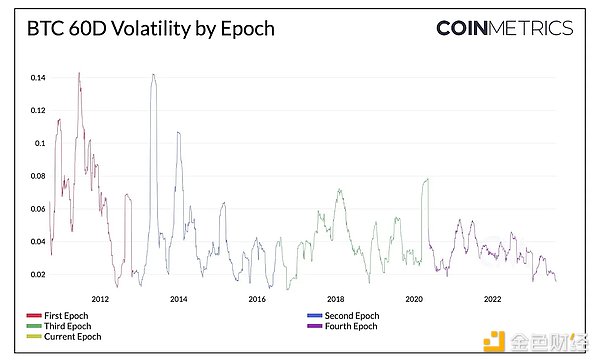

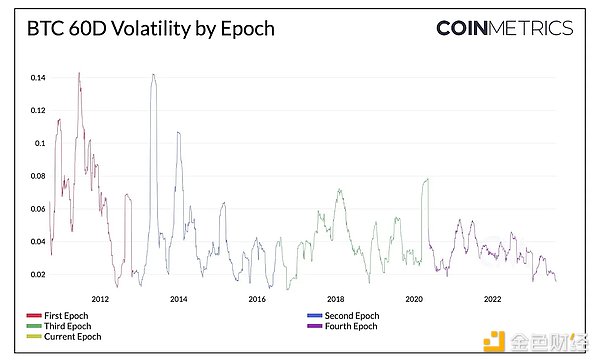

One of Bitcoin’s main disadvantages relative to the world’s major fiat currencies is its volatility. Data analysis shows that Bitcoin’s price volatility has steadily declined, especially compared to its early days. This increased stability has been driven by factors such as the growth of institutional investment, the development of sophisticated trading instruments and derivatives, and the overall maturity of the cryptocurrency market. Bitcoin currently has a daily volatility of about 2.6%—still well below the world’s best fiat currencies, but surprisingly competitive compared to some other emerging market currencies.

As this stability continues to grow, the rise of stablecoins has further strengthened the credibility of the cryptocurrency ecosystem. Stablecoins are digital assets designed to maintain a stable value and are usually pegged to a fiat currency such as the US dollar. The total market value of stablecoins has grown to more than $200 billion, reflecting the growing demand for these more stable digital currencies.

In addition, the emergence of Bitcoin exchange-traded funds (ETFs) in the United States has also contributed to the growing credibility of the asset. With over $115 billion in assets under management, these financial instruments provide institutional investors with a regulated and accessible way to invest in Bitcoin, further establishing cryptocurrencies as a viable investment option.

These developments in stability and trustworthiness have important implications for the potential role of Bitcoin and other cryptocurrencies in the global financial system. As the ecosystem continues to mature and demonstrates its ability to withstand market volatility, the prospect of dollarization or widespread adoption of digital assets as an alternative to traditional fiat currencies becomes increasingly credible.

Conclusion

As Bitcoin approaches its 16th anniversary, it is clear that this revolutionary digital asset has had a profound impact on the global financial landscape. From its humble beginnings as a white paper, Bitcoin has evolved into a globally recognized store of value and a potential hedge against economic uncertainty.

One of the most transformative aspects of Bitcoin is its decentralized monetary policy, which is free from state interference and defined by a transparent algorithm-driven framework. This contrasts with the centralized control of traditional fiat currencies, which is a key driver of Bitcoin’s appeal, giving individuals and communities greater control over their financial futures.

The stability and credibility that Bitcoin has demonstrated through reduced volatility, as well as the growing popularity of stablecoins and Bitcoin ETFs, further solidifies its position as a viable alternative to the traditional financial system. These developments have significant implications for the potential role of Bitcoin and other cryptocurrencies in the global economy, as the prospect of dollarization or widespread adoption of digital assets as an alternative to fiat currencies becomes increasingly credible.

Looking forward, Satoshi Nakamoto’s legacy of creation will undoubtedly continue to influence the evolution of finance, technology, and money itself. Bitcoin’s 16th anniversary is a testament to the resilience, innovation, and transformative power of this groundbreaking digital asset, signaling an exciting and unpredictable road ahead.

Brian

Brian