Author:0xLeoDeng,Twitter ,@leodeng08

Token swap is not just a new way to solve the liquidity problem of NFT, but is related to the entire encryption industry in terms of asset classes, protocol standards, operation promotion, infrastructure, and application ecology. A comprehensive, whole-system, all-factor turbine-like revolution.

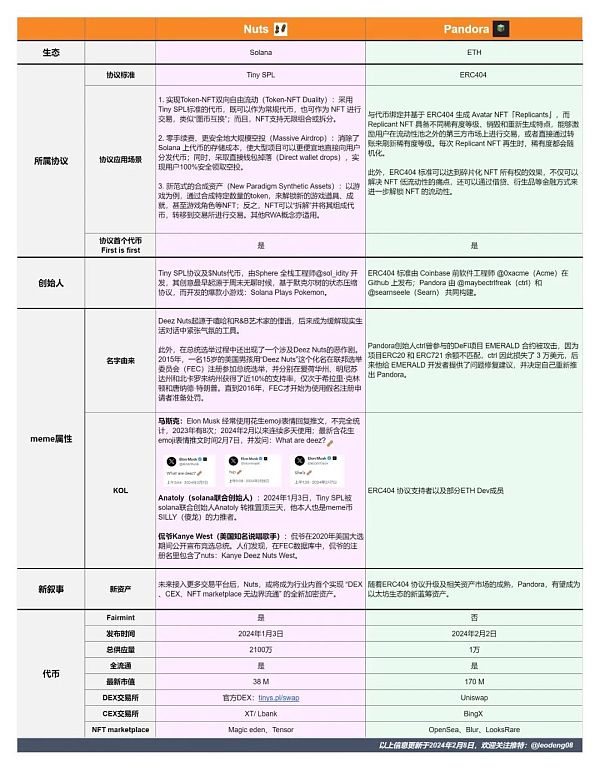

$Nuts on Solana went from 0.3u at the bottom to 2.3u at the peak in 9 days. Pandora_ERC404 on Ethereum went from the bottom to 2.3u at the peak. From 400U to the peak of 24,000U, it took 6 days. Pulling the disk is the best focus. The prices of Pandora and peanuts have skyrocketed, making the concept of “coin swap” continue to be a hot search topic. A brief summary of the project analysis of $Nuts and $Pandora is provided, with pictures attached for your reference.

The following are my five predictions on the future development trend of “coin swap/coin duality”: < /p>

1. Token swap, creating a dynamic and automatically adjustable NFT/FT hybrid new asset class

Combination The hybrid asset standard of non-fungible tokens (NFT) and fungible tokens (FT) will officially become a new asset class. BRC20 token similar to ordinarys. Many people equate it with old narratives such as NFT fragmentation and liquidity, which is actually a limitation.The most core innovation of encryption is the innovation of asset types. The duality of NFT/FT is characteristics of such assets.

How to continue to play with subsequent assets to form a wealth effect and make the new asset protocol paradigm become popular. Just like after Ordi, there must be relays for Sats and other events.

Looking forward to it, the edamame, melon seeds, and pistachios behind the peanuts? Prometheus and Sphinx after Pandora?

2. Token swap, restart NFTFi 2.0

NFTFi was once regarded as a false proposition by many people. Drawing on the M1/M2 theory of modern currency, the token swap will focus on how to regulate liquidity to ensure that the value of tokens is stable and that overheating and undercooling will not occur.

There will even be new algorithmic stablecoins (dynamic supply adjustment/anchoring strategy diversification, etc.), new market-making mechanisms (automated Liquidity provision/cross-asset liquidity pool/layered market intervention mechanism, etc.) as well as new types of lending, liquidity mining, income farming and other financial services.

3. Token swap has become the standard for launching new crypto projects

Achieve rapid market verification. With the help of token swap, new projects can quickly gain market exposure and community user feedback, accelerate the market verification process of products, and design incentives, such as early participation rewards, Trading competitions, etc., encourage users to participate in token swaps, therebypromoting the liquidity of new projects and the growth of user bases. At the same time, the new project can provide a simple and intuitive interface for currency exchange, lowering the threshold for new users to participate in cryptocurrency transactions and investments.

4. Rich extensions of the "infrastructure layer" of the token swap class

With new assets and new standards, the need for the infrastructure service layer is even more urgent. In order to support a large number of token swap transactions, a basic network with high throughput and low latency, reliable smart contracts, and interoperability solutions are required.

For example, develop a currency exchange mechanism that supports cross-chain technology, build a broad ecosystem that supports currency exchange, and enable people on different blockchains to Assets can be exchanged seamlessly, promoting the integration of the cryptocurrency ecosystem.

Just imagine, will the opensea and blur models be subverted? Will uniswap build a new V4 pool? In my opinion, actively embracing Tiny SPL and ERC404 is not good for Peanuts and Pandora, but good for the exchange trading platform itself.

5. The outbreak of "application scenarios and business models" of token swaps

This is also the most important point in my opinion. In the NFT market, the shift from PFP to the equity certificate category is unstoppable. If you just keep opening pictures, you will lose the meaning of Non-Fungible. NFT should create value, not solve liquidity, but solve liquidity. "Graphic currency swap" is not a goal, but a new tool and new method. Only by finding application scenarios and business models as soon as possible can the larger narrative of "graph currency swap" be supported.

GameFi, RWA, DePIN, etc. are all good directions for currency exchange applications (will be discussed in subsequent tweets). Although the currency swap uses some old technologies, what often really breaks out is business model innovation and scene application innovation. For example, the touch screen of the iPhone is an innovative fusion of old technologies, but because of touch games such as "Angry Birds" , gradually bringing about a revolution in human-computer interaction and mobile Internet applications.

Miyuki

Miyuki

Miyuki

Miyuki JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Miyuki

Miyuki JinseFinance

JinseFinance CaptainX

CaptainX CaptainX

CaptainX CaptainX

CaptainX JinseFinance

JinseFinance