Author: coinbase Source: coinbase official website Translation: Shan Ouba, Golden Finance

Summary

The various classifications of ETH's role raise some questions about its position in the portfolio. We clarify some narratives and point out the potential drivers that the asset may have in the coming months.

Main conclusion

Despite Ethereum's poor performance year-to-date, we believe its long-term positioning remains strong. We believe it has the potential to surprise to the upside in the late cycle.

We also believe that Ethereum has some of the strongest sustained demand drivers among cryptocurrencies and maintains a unique advantage in its expansion roadmap.

ETH's historical trading pattern shows that it benefits from a mix of "store of value" and "technical token" narratives.

The approval of a spot Bitcoin ETF in the U.S. reinforces Bitcoin’s store of value narrative and its position as a macro asset. On the other hand, open questions remain about ETH’s fundamental positioning in the cryptocurrency space. Competing layer-one (L1) blockchains such as Solana have weakened Ethereum’s position as the “go-to” network for decentralized application (dApp) deployment. The growth of Ethereum’s second layer (L2) and the reduction in ETH burn also appear to be affecting the asset’s value accumulation mechanism at a high level.

Nevertheless, we continue to believe that Ethereum’s long-term positioning remains strong and that it has important advantages that significantly differentiate it from other smart contract networks. These advantages include the maturity of the Solidity developer ecosystem, the popularity of the EVM platform, ETH’s utility as DeFi collateral, and the decentralization and security of its mainnet. In addition, we believe that advances in tokenization may more positively impact ETH in the near term relative to other L1 blockchains.

We find that ETH’s ability to capture both the store of value and tech token narratives is demonstrated in its historical trading patterns. ETH is highly correlated with BTC, exhibiting behavior consistent with BTC’s store of value model. At the same time, it has decoupled from BTC during periods of long-term BTC price increases (like other altcoins), behaving like a tech-oriented cryptocurrency. We believe ETH will continue to juggle these roles and has the opportunity to outperform in the second half of 2024, given its year-to-date underperformance.

Countering opposing narratives

ETH has been categorized into multiple roles, ranging from “ultrasonic currency” for its supply-burning mechanism to “internet bond” for its non-inflationary staking yield. As L2s expand and re-staking occurs, narratives such as “settlement layer asset” or the more esoteric “universal objective work token” have also surfaced. Ultimately, however, we believe these categorizations fail to fully capture ETH’s dynamics. In fact, we believe the complexity of ETH’s use cases increases the difficulty of defining a single value-capture metric. Conversely, the confluence of these narratives may even appear negative as they could undermine each other – distracting market participants from the positive drivers of the token.

Spot ETH ETF

Spot ETFs are critical for BTC as they provide regulatory clarity and new avenues for capital inflows. These ETFs structurally change the industry and, in our view, challenge the past cyclical pattern of capital rotating from Bitcoin to Ethereum to higher beta altcoins. There is a barrier between ETFs and centralized exchanges (CEXs), with only the latter having access to the broader universe of crypto assets. The potential approval of a spot ETH ETF removes this barrier for ETH, giving ETH access to a pool of capital currently only enjoyed by BTC. In our view, this is the biggest unanswered question for ETH in the near term, especially in the current challenging regulatory environment.

While timely approval is uncertain given the SEC’s apparent silence on issuers, we believe that the existence of a U.S. spot ETH ETF is simply a matter of when, not if. Indeed, the primary rationale used to approve a spot BTC ETF applies equally to a spot ETH ETF. Namely, the correlation between the CME futures product and the spot rate is high enough that “CME’s oversight could reasonably be expected to detect…inappropriate behavior in the spot market.” The time period for the correlation study in the spot BTC approval notice begins in March 2021, one month after the launch of CME ETH futures. We believe that this evaluation period was deliberately chosen so that similar reasoning could be applied to the ETH market. Indeed, correlation analysis previously presented by Coinbase and Grayscale suggests that the spot and futures correlations in the ETH market are similar to those in the BTC market.

Assuming the correlation analysis holds, we believe the remaining possible rationales for rejection may stem from the qualitative differences between Ethereum and Bitcoin. In the past, we have discussed some of the differences in the size and depth of the ETH vs. BTC futures markets as likely a factor in the SEC’s decision. But among the other fundamental differences between ETH and BTC, the one we believe is most relevant to the question of approval is Ethereum’s proof-of-stake (PoS) mechanism.

Since regulatory guidance on staking of the asset has not yet been clearly defined, we believe a spot ETH ETF that allows for staking is unlikely to be approved in the near term. It differs significantly from Bitcoin due to the complexity of head-cutting conditions, differences between validating clients, potentially opaque fee structures for third-party staking providers, and liquidity risks (and exit queue congestion) of unstaking. (It is worth noting that there are ETH ETFs in Europe that include staking, but in general, exchange-traded products in Europe are different from those offered in the United States.) Nonetheless, we believe this should not impact the status of unstaking ETH.

We think there is room for upside surprises in this decision. Polymarket predicts a 16% probability of approval on May 31, 2024, while Grayscale Ethereum Trust (ETHE) trades at a 24% discount to NAV. We believe the probability of approval is closer to 30-40%. As crypto begins to become an election issue, we believe it is less certain that the SEC will be willing to expend the necessary political capital to support a rejection. Even if the first deadline of May 23, 2024 is rejected, we believe litigation could overturn the decision. Additionally, it is worth noting that not all spot ETH ETF applications need to be approved at the same time. In fact, Commissioner Uyeda’s statement on the spot BTC ETF approval criticized the hidden “motivation to accelerate application approvals, namely to prevent first-mover advantage.”

Alternative L1 Challenges

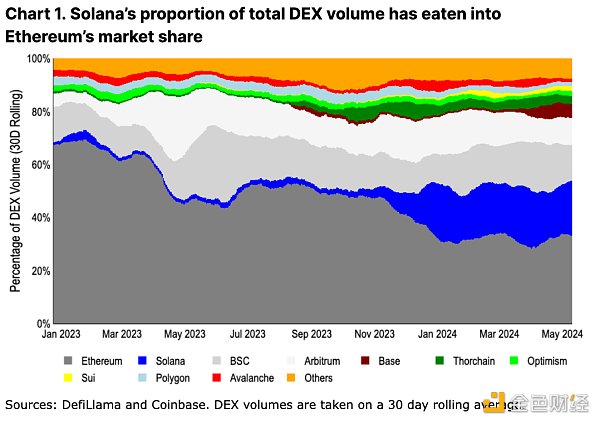

At the adoption level, the rise of highly scalable integrated chains, especially Solana, appears to be eating into Ethereum’s market share. High throughput and low-fee transactions shift the center of transaction activity away from the Ethereum mainnet. Notably, Solana’s ecosystem has grown over the past year from just 2% of decentralized exchange (DEX) volume to now 21%.

In our view, alternative layer-one (L1) blockchains now offer more meaningful differentiation with respect to Ethereum than in previous bull cycles. Moving to non-Ethereum Virtual Machines (EVM) and redesigning decentralized applications (dApps) from scratch results in unique user experiences (UX) across different ecosystems. Additionally, an integrated/monolithic approach to scaling enables more composability across applications and avoids the issues of poor bridging UX and liquidity fragmentation.

While these value propositions are important, we believe it is premature to extrapolate incentivized activity metrics as confirmation of success. For example, the number of transacting users on some Ethereum L2s has dropped by more than 80% from the peak of the airdrop. Meanwhile, Solana’s share of total decentralized exchange (DEX) volume grew from 6% to 17% between the time Jupiter’s airdrop was announced on November 16, 2023, and the first claim date on January 31, 2024. (Jupiter is the leading DEX aggregator on Solana). Jupiter still has three of four airdrops to complete, so we expect Solana DEX activity to remain high for some time. Meanwhile, assumptions about long-term activity retention remain speculative.

Nevertheless, the leading Ethereum L2s (Arbitrum, Optimism, and Base) now have 17% of total DEX volume in terms of transacting activity (combined with Ethereum’s 33%). This may provide a more appropriate comparison for ETH demand drivers to alternative L1 solutions, as ETH is used as the native gas token on all three L2s. MEV and other additional demand drivers in these networks are untapped, which also provides room for future demand catalysts. We view this as a more equivalent comparison of integrated vs. modular scaling approaches in terms of DEX activity.

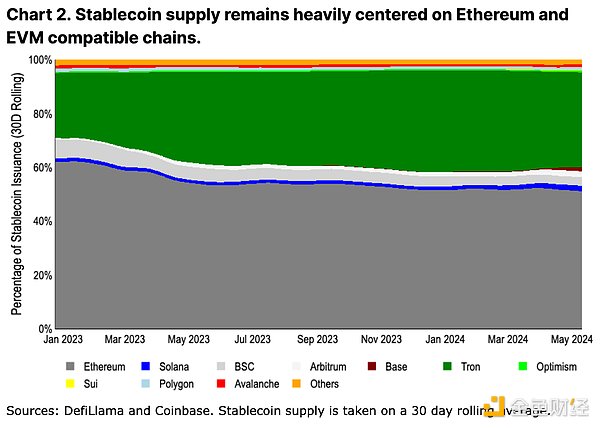

Another, more “sticky” adoption metric is stablecoin supply. Stablecoin distribution changes more slowly due to bridging and issuance/redemption frictions. (See Figure 2. The color scheme and sorting are the same as Figure 1, with Thorchain replaced by Tron). Activity by stablecoin issuance is still dominated by Ethereum. We believe this is because the trust assumptions and reliability of many new chains are still insufficient to support large amounts of capital, especially capital locked in smart contracts. Large capital holders are generally indifferent to Ethereum’s higher transaction costs (on a pro rata basis) and prefer to reduce risk by reducing liquidity downtime and minimizing bridge trust assumptions.

Even so, among high-throughput chains, stablecoin supply is growing faster on Ethereum L2 than Solana. Arbitrum surpasses Solana’s stablecoin supply in early 2024 ($3.6 billion vs. $3.2 billion, respectively), while Base’s stablecoin supply has grown from $1.6 billion to $2.4 billion year-to-date. While the ultimate conclusion of the scaling debate is unclear, early signs of stablecoin growth may actually favor Ethereum L2 over L1 alternatives.

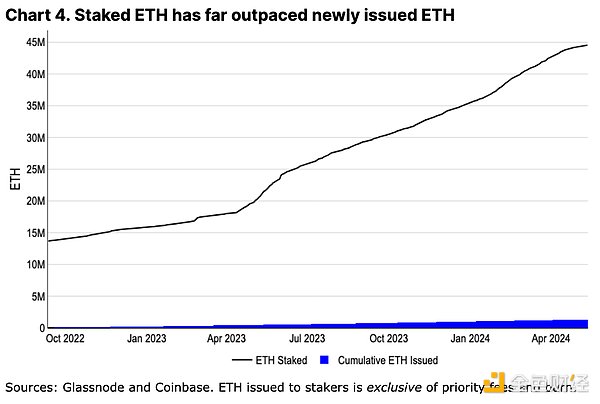

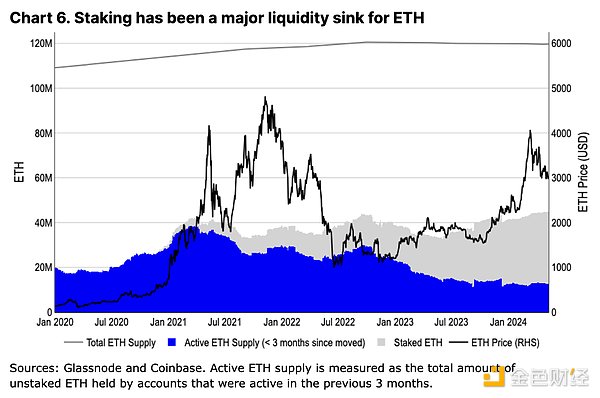

The growing adoption of L2s has raised concerns that they are actually cannibalizing ETH - they reduce L1 block space requirements (thus reducing transaction fee burn) and may support non-ETH gas tokens in their ecosystem (further reducing ETH burn). In fact, ETH's annualized inflation rate has reached its highest level since its transition to Proof of Stake (PoS) in 2022. While inflation is often understood as a structurally important component of BTC, we do not believe this applies to ETH. The entirety of ETH issuance is accumulated in the hands of stakers, and the collective balance of stakers far exceeds the cumulative ETH issuance since the merger (see Figure 4). This is in direct contrast to Bitcoin’s proof-of-work (PoW) miner economics, where miners need to sell large amounts of newly issued BTC to fund operations in a highly competitive hashrate environment. While miners’ BTC holdings are tracked in cycles to account for their inevitable sales, the minimal operating cost of staking ETH means that stakers can continue to accumulate their positions. In fact, staking has become a sediment of ETH liquidity - the growth rate of staked ETH is 20 times higher than the rate of ETH issuance (even excluding burns).

Sponsored Business Content

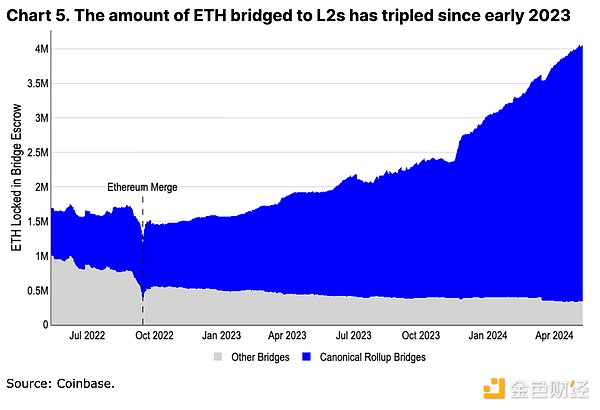

L2 itself is also an important demand driver for ETH. Over 3.5 million ETH has been bridged to the L2 ecosystem, becoming another liquidity sediment for ETH. In addition, even if the ETH bridged to L2 is not directly burned, the native token balances held by new wallets to pay transaction fees, their reserves, also constitute a soft lock-in of more and more ETH tokens.

In addition, we believe that even if L2 expands, some core activities will remain permanently on the Ethereum mainnet. Heavy staking activities like EigenLayer or governance actions of major protocols such as Aave, Maker, and Uniswap remain firmly rooted in L1. Users with the highest security needs (usually holding the largest capital) may also keep funds on L1 until fully decentralized sorters and permissionless fraud proofs are deployed and tested - a process that may take several years. Even if L2 innovates in different directions, ETH will always be a component of its treasury reserve (used to pay L1 "rent") and the native unit of account. We firmly believe that the growth of L2 is not only good for the Ethereum ecosystem, but also for the ETH asset.

Ethereum’s Advantages

Beyond the common metric-driven narratives, we believe Ethereum has several advantages that are harder to quantify but equally important. These may not be short-term tradable narratives, but rather represent a core set of long-term advantages that could sustain its current dominance.

High-Quality Collateral and Unit of Account

One of ETH’s most important use cases is its role in DeFi. ETH is able to be leveraged with minimal counterparty risk across the Ethereum and its L2 ecosystem. It serves as collateral in money markets such as Maker and Aave, and is also the base unit of trade for many on-chain DEX pairs. The expansion of DeFi on Ethereum and its L2 will result in additional liquidity sedimentation in ETH.

While BTC remains the dominant store of value asset more broadly, the use of wrapped BTC on Ethereum introduces bridging and trust assumptions. We do not believe WBTC will replace ETH’s use in Ethereum-based DeFi — WBTC supply has remained flat for over a year and is over 40% below its previous high. Instead, ETH can benefit from its utility in various L2 ecosystems.

Continued Innovation in Decentralization

An often overlooked component of the Ethereum community is its ability to continue to innovate while being decentralized. Ethereum has been criticized for its long release timeline and development delays, but few acknowledge the complexity in balancing the goals and objectives of various stakeholders to achieve technological progress. Developers of more than five execution clients and four consensus clients need to coordinate design, testing, and deployment of changes without impacting mainnet execution.

Since Bitcoin’s November 2021 Taproot upgrade, Ethereum has implemented dynamic transaction burning (August 2021), moved to PoS (September 2022), enabled staking withdrawals (March 2023), and created blob storage for L2 scaling (March 2024) in similar timeframes — along with many other Ethereum Improvement Proposals (EIPs) included in these upgrades. While many alternative L1s appear to be able to develop more rapidly, their single client makes them more fragile and centralized. The path to decentralization inevitably leads to some degree of rigidity, and it’s unclear if other ecosystems would be able to create a similarly efficient development process when they begin this journey.

Rapid L2 Innovation

This isn’t to say that Ethereum is innovating slower than other ecosystems. On the contrary, we believe that innovation around execution environments and developer tooling is actually outpacing its competitors. Ethereum benefits from the rapid centralized development of L2s, all of which is paid in ETH settlement fees to L1s. The ability to create a variety of platforms with different execution environments (e.g. Web Assembly, Move, or the Solana virtual machine) or other features (e.g. privacy or increased staking rewards) means that the slower development timeline for L1 does not hinder ETH's adoption for more technically comprehensive use cases.

At the same time, the Ethereum community's efforts to define different trust assumptions and definitions around sidechains, validiums, rollups, etc. have increased transparency in the field. For example, similar efforts in the Bitcoin L2 ecosystem (such as L2Beat) have not yet emerged, where their L2 trust assumptions vary widely and are often not well communicated or understood by the wider community.

EVM Proliferation

While innovation around new execution environments does not mean that Solidity and the Ethereum Virtual Machine (EVM) will become obsolete in the near future, on the contrary, the EVM has spread widely to other chains. For example, research on Ethereum L2 has been adopted by many Bitcoin L2s. A large part of Solidity's shortcomings (e.g., prone to reentrancy vulnerabilities) now have static tool checkers to prevent basic vulnerabilities. Additionally, the popularity of the language has created a mature audit sector, a large number of open source code examples, and detailed best practice guides. These are important for building a large developer talent pool.

While EVM usage does not directly lead to ETH demand, changes to the EVM are rooted in Ethereum's development process. These changes are subsequently adopted by other chains to maintain EVM compatibility. In our view, the core innovations of the EVM are likely to remain rooted in Ethereum - or soon adopted by L2 - which will focus developer attention and new protocols within the Ethereum ecosystem.

Tokenization and the Lindy Effect

We believe that the push for tokenized projects and increased global regulatory clarity may also benefit Ethereum (among public blockchains) first. Financial products often focus on technical risk mitigation rather than optimization and feature richness, and Ethereum has an advantage as the longest-running smart contract platform. We believe that slightly higher transaction fees (in dollars, not cents) and longer confirmation times (in seconds, not milliseconds) are secondary issues for many large tokenized projects.

In addition, for traditional companies looking to scale on-chain operations, recruiting a sufficient number of developers becomes a key factor. Here, Solidity becomes the obvious choice as it constitutes the largest subset of smart contract developers, echoing the above-mentioned point about EVM propagation. Blackrock’s BUIDL fund operating on Ethereum and JPM’s proposed ERC-20 compatible Onyx Digital Assets Fungible Asset Contract (ODA-FACT) token standard are early signs of the importance of this talent pool.

Structural Supply Mechanism

The evolution of ETH’s active supply is significantly different from BTC. Despite the price increase since Q4 2023, ETH’s 3-month circulating supply has not increased significantly. In contrast, in the same time frame, we observe an increase of nearly 75% in the active BTC supply. Instead of increasing the circulating supply as it did when Ethereum was still operating on PoW in the 2021/22 cycle, long-term ETH holders are staking a growing portion of the ETH supply. This reaffirms our view that staking is an important liquidity sink for ETH and minimizes structural selling pressure on the asset.

Evolving Trading Regime

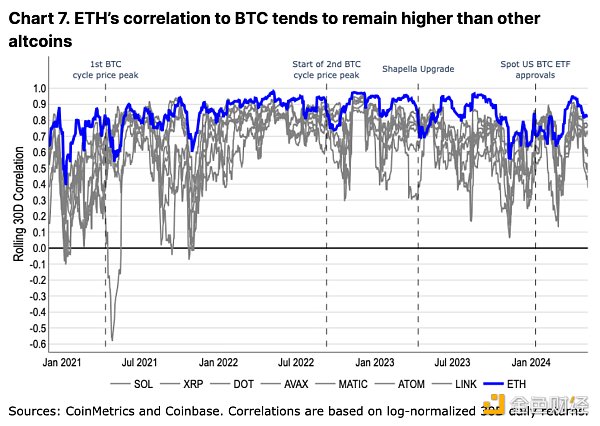

ETH's historical trading pattern is closer to BTC than any other altcoin. At the same time, it also decouples from BTC during bull market peaks or specific ecosystem events - a pattern also observed in other altcoins, but to a lesser extent (see Figure 7). We believe this trading behavior reflects the market's relative valuation of ETH, both as a store of value token and as a technical utility token.

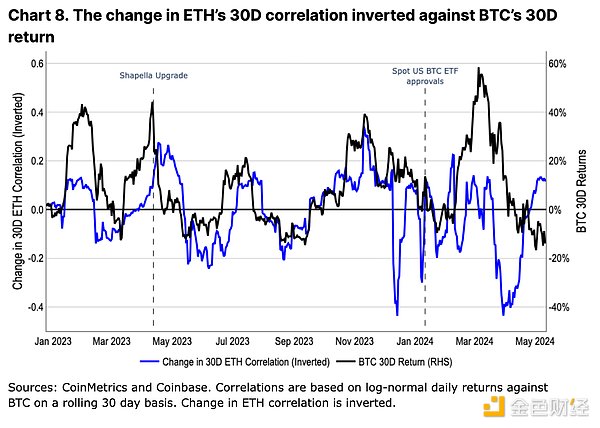

In 2023, the change in ETH's correlation with BTC has an inverse relationship with the change in BTC price (see Figure 8). That is, when BTC appreciates, ETH's correlation with BTC decreases, and vice versa. In fact, changes in BTC price appear to be a leading indicator of changes in ETH's correlation. We believe this is an indicator of market excitement about altcoins, led by BTC price, which in turn boosts their speculative performance (i.e. altcoins trade differently in bull markets, but perform in line with BTC in bear markets).

However, this trend has weakened after the approval of the spot US BTC ETF. In our view, this highlights the structural impact of ETF-based inflows, with a completely new capital base only able to access BTC. Emerging registered investment advisors (RIAs), wealth managers, and financial institutions view BTC differently in their portfolios than many crypto natives or retail traders. In pure crypto portfolios, BTC is the least volatile asset, while in more traditional fixed income and equity portfolios it is often viewed as a small diversification asset. We believe this shift in BTC’s utility has had an impact on its trading patterns versus ETH, and that ETH could also see a similar shift (and a recalibration of trading patterns) if a spot US ETH ETF emerges.

Conclusion

We believe ETH still has potential to surprise to the upside in the coming months. ETH does not appear to have major sources of supply-side pressure, such as token unlocking or miner selling pressure. Instead, staking and L2 growth have proven to be important and growing sediments of ETH liquidity. We believe that ETH’s position as the hub of DeFi is also unlikely to be displaced due to widespread adoption of the EVM and its L2 innovations.

Nevertheless, the importance of a potential spot US ETH ETF cannot be overstated. We believe the market may be underestimating the timing and probability of potential approvals, leaving room for upside surprises. In the interim, we believe ETH’s structural demand drivers and technological innovation within its ecosystem will enable it to continue to span multiple narratives.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cointime

Cointime Beincrypto

Beincrypto Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Ftftx

Ftftx