Author: JK, Coinbase Ventures investor; Translation: Jinse Finance xiaozou

Abstract of this article:

EigenLayer is an Ethereum-based protocol that introduces a restaking mechanism - a new primitive for cryptoeconomic security that has become the main narrative of the Ethereum community.

Restaking through EigenLayer enables developers to leverage Ethereum's existing economic security infrastructure (i.e., validator sets and staked ETH) to bootstrap new active verification services (AVS).

Just as traditional cloud platforms and SaaS solutions have revolutionized web2 development, we believe that the emergence of EigenLayer and its thriving AVS ecosystem has opened up a "verifiable cloud" paradigm for web3.

As re-staking and shared security models develop further, and driven by growing demand from stakers and developers looking to unlock new opportunities on-chain, their impact on the blockchain ecosystem will become increasingly apparent.

1, What is EigenLayer?

EigenLayer is an Ethereum-based protocol that introduces a re-staking mechanism, a new primitive in cryptoeconomic security. Essentially, EigenLayer consists of a series of smart contracts that allow users to choose to "re-stake" their staked ETH or Liquid Staking Tokens (LST) to bootstrap new Proof-of-Stake (PoS) networks and services in the Ethereum ecosystem and earn additional staking income/rewards.

The core goal of EigenLayer is to usher in a new era of permissionless innovation and free market governance by reducing the complexity for developers to build and bootstrap these networks from scratch. This is achieved by leveraging Ethereum's existing trust and economic security infrastructure.

EigenLayer was released in 2023, allowing users to re-stake their staked ETH or LST. As of May 14, 2024, more than 4.9 million ETH (worth approximately $15 billion) has been re-staked into the EigenLayer protocol.

2 Why is it important?

The Ethereum network uses a Proof of Stake (PoS) consensus mechanism, under which node operators stake their ETH and run validator software to ensure network security (i.e. store data, process transactions, add new blocks to the beacon chain, etc.), earning rewards in return (i.e. a certain share of network fees). If a node operator fails to perform its verification function or behaves improperly, it may lose its staked ETH (i.e., be fined).

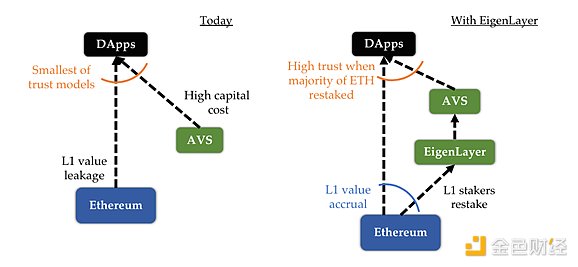

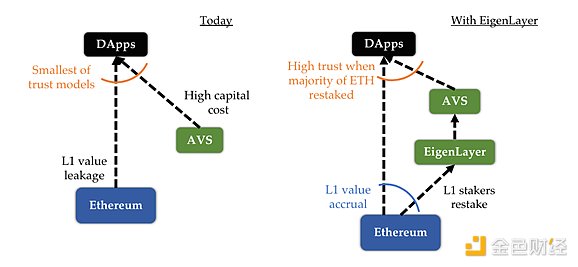

Now, developers seeking to build protocols on top of Ethereum that require external operators are generally required to bootstrap their own PoS network and ensure network security. This is a difficult task that requires developers to design/issue tokens, incentivize node operators to stake tokens and run validator software, and implement fair reward distribution and slashing mechanisms. In addition, requiring each new protocol to launch its own PoS network will undermine the security of Ethereum and siphon value (in the form of staked tokens) from the beacon chain.

3, EigenLayer operating mechanism

EigenLayer attempts to address the above challenges, allowing developers to leverage Ethereum's existing validator set and stake ETH from day one through a "shared security" approach. Shared security and re-staking mechanisms not only promise to lower the entry barrier for developers and promote rapid innovation within the Ethereum ecosystem, but also aim to create new ways for Ethereum stakers to actively participate in multiple networks that require crypto collateral and external operators, thereby maximizing return potential.

The EigenLayer protocol architecture includes four key components: restaker, operator, AVS (active verification service) and AVS consumer.

Re-stakeholder: refers to an individual or entity that re-stakes their staked ETH or LST, with the goal of expanding the security of services in the EigenLayer ecosystem, namely the Active Verification Service (AVS).

Operator: refers to an entity that runs specialized node software and performs verification tasks for AVS built on EigenLayer to earn predetermined rewards. Operators register in EigenLayer, are commissioned by re-stakeholders, and then choose to provide verification services for various AVS. It should be noted that operators must comply with the slashing conditions of each AVS.

Active Verification Service (AVS): refers to any system that requires a unique distributed verification method for verification. AVS can take many forms, including data availability layers, shared sorters, oracle networks, bridges, coprocessors, application encryption systems, and more.

AVS Consumer:The end user or application that consumes EigenLayer services.

4、Crypto's “Verifiable Cloud

EigenLayer founder Sreeram Kannan is often quoted as saying "EigenLayer is Crypto's Verifiable Cloud", but what does this sentence mean? In traditional cloud architectures, a central entity provides computing, storage, and hosting services for various web2 SaaS solutions. These SaaS solutions are generally divided into two categories: horizontal SaaS (i.e., general-purpose software solutions that are usually targeted at a broad audience of end users regardless of their industry factors) and vertical SaaS (i.e., software solutions that target specific user groups, use cases, or industry standards).

Sponsored Business Content

Compared to the transformation of web2 development by cloud platforms and SaaS solutions, we believe that the emergence of EigenLayer and AVS provides a similar paradigm shift for the blockchain ecosystem. EigenLayer aims to provide crypto-economic security services (such as "web3 SaaS") for AVS. Similar to the emergence and widespread adoption of web2 SaaS solutions, we see a similar trend in AVS, driven by the growth of protocol and dapp demand.

In short, EigenLayer's "shared security system" aims to promote rapid on-chain innovation while providing greater decentralization, trust and transparency, thereby redefining the future of "verifiable cloud" computing.

5、EigenLayer AVS Status

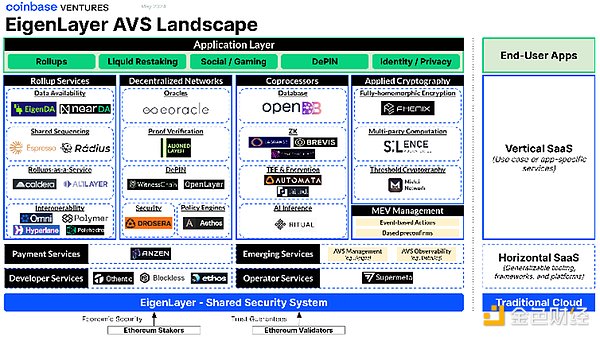

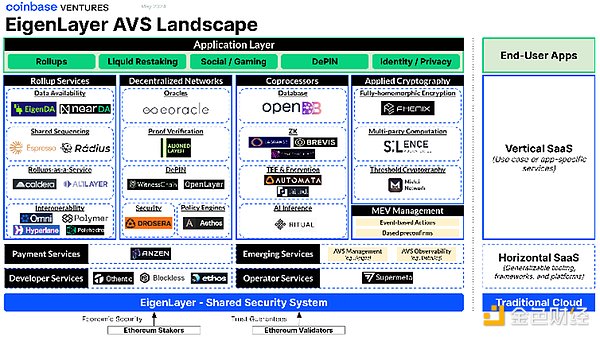

On April 9, 2024, EigenLayer launched the Operator and AVS modules on the mainnet. It is now a vibrant operator ecosystem (as of May 14, 2024, the number of operators has exceeded 200), and more and more AVS are expected to be launched in the coming months (currently 11). We hope that just like the traditional SaaS landscape, AVS can naturally form different categories (for example, horizontal AVS and vertical AVS).

Taking the above framework into consideration, we see the current status of EigenLayer AVS as follows:

“Horizontal>AVS

Developer Services: Frameworks and tools to help developers build and deploy PoS networks (e.g., AVS, L1s/L2s, etc.) that require shared security infrastructure (e.g., Othentic, Blockless, Ethos).

Operator Services: Services that help AVS operators manage their node infrastructure, validator tasks, and/or staking operations (e.g., Supermeta).

Payment Services: Services that manage the delivery of payments (e.g., AVS rewards) to resellers and operators (e.g., Anzen).

“Vertical” AVS

Rollup Services: Development of Ethereum scaling infrastructure services (e.g., Rollup) while inheriting the security of the Ethereum web of trust. For example: data availability (e.g. EigenDA, NearDA), shared ordering (e.g. Espresso, Radius), RaaS (e.g. Caldera, AltLayer), or interoperability (e.g. Omni, Polymer, Hyperlane, Polyhedra).

Decentralized Networks:Networks that require a distributed validator mechanism. Examples include Oracles (e.g. eOracle), proof verification (e.g. Aligned Layer), DePIN (e.g. WitnessChain, OpenLayer), security monitoring (e.g. Drosera), or smart contract policy engines (e.g. Aethos).

Coprocessors:Services that provide developers with cost-effective, verifiable off-chain computational power. Examples include database coprocessors (e.g. OpenDB), ZK coprocessors (e.g. Lagrange, Brevis, Space and Time), trusted execution environments and cryptographic coprocessors (e.g. Automata, Fairblock), or AI reasoning (e.g. Ritual).

Applied Cryptography:Services for creating reliable cryptographic systems. Examples include fully homomorphic encryption (e.g. Fhenix), multi-party computation (e.g. Silence Laboratories), or threshold cryptography (e.g. Mishti Network).

MEV Governance:Emerging services that allow block proposers to add additional trusted commitments to block inclusion and ordering.

Application Layer

On top of AVS, we expect new on-chain apps to emerge that seek to leverage the unique economic security properties of EigenLayer.

New examples include Rollup, Liquidity Re-staking Tokens (LRT) and related LRTFi apps (i.e., DeFi protocols that use LRT as the underlying source of collateral), social and gaming applications, decentralized physical infrastructure networks (i.e., DePIN), and identity/privacy protection applications.

6, Future Outlook

As re-staking and shared security models develop further, their impact on the blockchain ecosystem is becoming increasingly apparent. The growing demand from stakers/validators seeking to maximize their earnings potential and developers seeking to accelerate innovation at the infrastructure level is expected to unlock new on-chain opportunities. Additionally, while EigenLayer was the first to release a re-staking protocol, we are seeing similar mechanisms emerge in other ecosystems, such as Bitcoin’s Babylon Chain, Solana’s Solayer, Cambrian, and Fragmetric, IBC’s Picasso Network, Omnichain re-staking (such as Exocore), and multi-asset re-staking (such as Karak).

That said, while re-staking and shared security models open up many exciting opportunities on-chain, re-stakers need to understand the risks associated with smart contract security risks or unexpected slashing events. It should be noted that at the time of writing, EigenLayer’s slashing and payout (i.e., AVS rewards) mechanism is not yet live and is expected to be launched later this year.

JinseFinance

JinseFinance