Author: Coinbase Ventures Translation: Shan Ouba, Golden Finance

Abstract

With the number of assets in the crypto ecosystem As the number of +chains continues to grow, the importance of cross-chain bridges also increases.

The main use case of the bridge is still asset transfer (tokens in one chain to tokens in another chain) + exchange (Trade tokens on chain A for tokens on chain B). Bridges competes on various aspects such as distribution, product features and security profiles.

Looking ahead to future multi-chain issuance technologies (such as CCTP), listings, and overlap with oracles will enable the use of bridging and popularization.

Disclosure and Footnote:Coinbase Ventures Portfolio CompaniesSupported Items are indicated by an asterisk (*) when first cited in the article below.

Bridges have become central to protocols, service providers and users accessing cryptographic use cases infrastructure. This report aims to capture the current state of the bridging landscape and its impact on the broader crypto ecosystem.

Current Key Points/Lessons Learned

1. Classification: The types of bridges can be divided into 3 categories: native bridge, part 3 bridge and bridge aggregator.

Native Bridges: Typically the ones the user will interact with to save Standard contract for depositing/withdrawing assets. These can be run by a set of trusted participants or via decentralized consensus on a compatible chain/L2 that can also take advantage of bridge compatibility with first-party security. Examples include Optimism OP Stack*, Arbitrum Nitro*, Cosmos IBC, Superbridge.

3rd party bridge: is a network/validator that sits between chains and acts as the "middleman". Most bridges follow a variation of this design. Examples include Axelar*, Wormhole*, LayerZero (Stargate)*.

Bridge Aggregator: Integrate the first two bridges listed above and provide /Enterprise partners provide optimal routing across bridges. Examples include Socket*, Li.Fi*.

2. The main purpose of the bridge is to provide data/assets (ledger/chain/location) Services are provided incrementally to the intended execution destination of the data/asset. The main use case remains asset transfer (tokens in one chain to tokens in another chain) + swaps (trading tokens on chain A for tokens on chain B).

Asset transfer: There is an asset on "A chain" ( ETH), this asset is not natively issued on the "B chain". The bridge can provide the service of sending this asset from "Chain A" to "Chain B". For example, bridge USDC from ETH L1 to Zora L2 via Zora Native Bridge*.

Swap: There is a sum of ($ETH) on "Chain A" and ($ATOM) on "Chain B" trade. The bridge will send the token and then perform the exchange. Examples include [1] Squid Router "switches" and builds on Axelar "bridging"; [2] Matcha by 0x* takes care of "switching" and integrates Socket bridging".

Other: These may include any type of call data or contract ownership, such as governance or multisig ownership. For example, Uniswap v3 contracts are deployed on many EVM chains, but core governance The contract is located on the ETH mainnet. The Uniswap Foundation* would rather have one contract and execute messages to other chains in a "one-to-many" manner (rather than creating governance contracts on each chain).

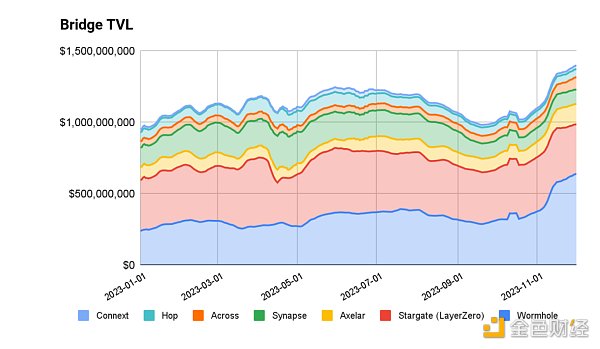

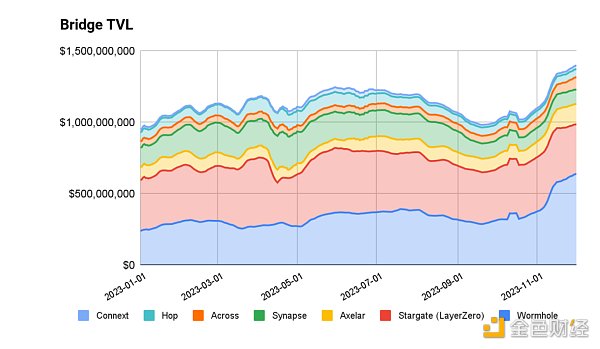

. Bridges typically use on-chain AUC (or TVL) as a proxy for liquidity/usage.

Theattractiveness of Native Bridges and the success of the underlying use of L2 itself Directly related.The bridge contract will hold the funds and serve as a way to measure the TVL of the bridge to L2. According to L2 Beat, the TVL of Rollups ranges from ~$50M all the way up to ~$8B. < /p>

The famous3rd Square BridgeThere are LayerZero and Wormhole and Axelar, which are traction based on TVL, volume and chain coverage.

LayerZero: TVL :About 304 million US dollars; Trading volume: ~$23.9B; Trading volume: 34.5M

Hole: TVL:~$850M; Volume: $30B; Volume: 1.7 million

xelar:TVL:Approximately $224 million;< strong>Volume: $7B;Transactions: 1M

Aggregatorsoften route trades, so volume metrics are more appropriate. The split between consumers and businesses (the winning flag) is the key metric. Leading providers include Socket and Li.Fi.

p>

4. Bridges compete on various aspects of differentiation, and there may be multiple winners depending on use case and distribution.

Security: The nuances of security will depend on the demand side preferences. Most consumers using bridges seem to prefer speed/latency + cost over security above the lowest viable threshold.

Smart Contracts: Most bridging attacks occur at the smart contract level. In most bridges, the user locks funds in a contract on chain A → the bridge reads the chain A contract → mints the user’s funds on the chain B contract. Misconfiguration of withdrawal access in the contract can lead to hacking attacks.

Multi-sig: Control of the contract is delegated to a group of trusted participants . These are typically operated by the project team and other trusted stakeholders.

Relayer + Oracle: Dapps/developers can set up their own Relayer + Oracle for their own setup . They can also choose from the options menu of other live relayer + oracle settings.

PoS chain: Security is achieved through consensus through proof of stake.

Distribution: Bridges will attempt to leverage existing partner channels as well as back-end infrastructure GTM.

Wallet: Bridges will attempt to be the backbone of existing wallet/portfolio aggregator bridging capabilities infrastructure/API. For example, Phantom works with Li Fi and Coinbase Wallet works with Socket. Portfolio frontends/wallets will all have some form of bridging support (e.g. Zerion* / Zapper* / Metamask*).

B2C Frontend: Bridges will typically set up a website portal where any user can connect a wallet + Bridge Funding. Examples include Stargate.Finance (LayerZero), Bungee.Exchange (Socket), Jumper.Exchange (Li Fi), and Squid Router (Axelar).

Dapps: Dapps themselves will include a "deposit" feature that uses bridging under the hood, So the user doesn't have to jump back to L1 and then back to L2 to use the application. Think of it as an abstracted version of "B2C" above, but supported natively by developers in the API. Examples include Aevo*.

Developer Platform:Many bridge companies will leverage existing releases of developer platforms to enable . Examples include Conduit RaaS, Microsoft Azure + Axelar, Google Cloud + LayerZero.

Ecosystem: While all major third-party bridges cover all the same chains, they will try to do so by devoting resources to specific Take a seat in the chain/developer ecosystem to gain first-mover advantage. The reason is that since the product feature set needs to be more advanced to achieve differentiation, it is easier to scale within the virtual machine/smart contract framework of the ecosystem.

EVM: Socket is dedicated to the EVM rollup ecosystem (OP Stack, Arbitrum*, Polygon* CDK ). L2s such as Aevo and Lyra are existing users.

Solana: Given Wormhole’s early involvement, its ecosystem coverage is broad . DeBridge has also seen an increase in traction.

Cosmos: Axelar’s ecosystem has broad reach due to their ability to provide IBC Compatible transactions. One data point is that new chains leveraging IBC, such as Celestia*, are getting day one coverage.

Most providers can provide services to other ecosystems.

Product/Feature Set: Since Bridges are in the "abstraction" business, they often need to do custom smart contract work to Support specific use cases. Therefore, bridge teams often end up carving out a niche to find dedicated verticals/domains. Examples include NFTs/payments (e.g. Decent), Gas Abstraction, and swaps.

What do we pay attention to

CCTP (Circle’s multi-chain USDC standard) will be an important data point affecting the bridge. CCTP is a standard developed by Circle* to help achieve multi-chain issuance of USDC.

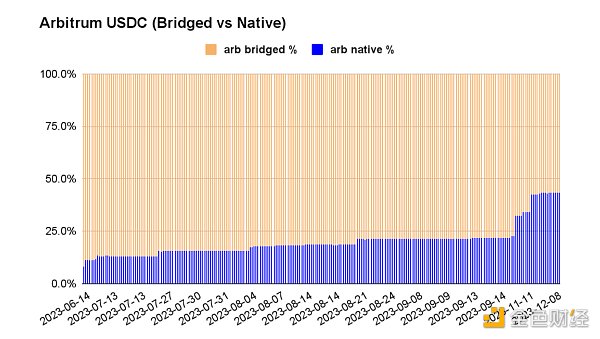

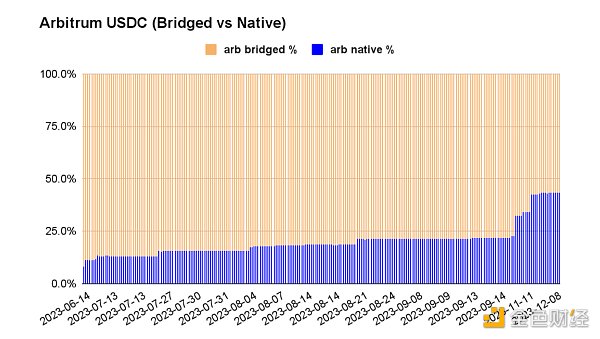

Before CCTP: When the new chain was launched, it A bridged version of USDC will be used (as Circle must approve and add support for the native version of USDC for each new chain on its roadmap). As the chain looks to gain Day-1 DeFi support, USDC will be bridged from ETH L1 and the bridged version of USDC becomes the standard on the new chain.

Example: An example might be axlUSDC on Axelar or USDC.e on Arbitrum – USDC on ETH L1, bridged via Axelar and Arbitrum respectively.

Impact:This will lead to liquidity fragmentation because chain A bridges USDC with chain B Bridging USDC creates a dependency on individual bridge operators. DeFi protocols across ecosystems will consolidate it into one asset and make it harder to release.

After CCTP: When a new chain comes online, it will deploy USDC tokens that comply with the CCTP Circle standard currency contract. When Circle is ready to go live on-chain, it can take over the implementation of CCTP support. Basically, the new USDC contract has backward compatibility to comply with subsequent standards.

Example: NewChain is a newly launched L2, which does not yet have native USDC. NewChain deploys a standards-compliant USDC contract. NewChain supports bridging USDC in the short term - but the important thing is that it can be taken over by CCTP, and bridging USDC can become native USDC.

Meaning: If you are a developer, you usually rely on bridging of USDC and is locked into any liquidity program associated with the asset and bridge. With CCTP, you can switch to enabling USDC natively, and you can hit the CCTP API to enable x-chain transfers of USDC.

Adoption of CCTP will have an impact on the long-term defensibility of bridges.

Bridged USDC (i.e. non-CCTP) is locked in the DeFi pool , and will remain in this state until it is released or becomes a minority share of the on-chain assets.

While CCTP will work with bridges (given their distribution) to help support CCTP, the adoption of CCTP will naturally result in The share of local USDC issuance increases, and the share of bridged USDC decreases. Bridging USDC as an asset locked in various DeFi pools should naturally unfreeze in the long run.

CCTP’s story will be an important lesson for bridges as they approach asset issuance and lock it into a multi-chain-first approach at the technical level. Bridges must compete in other areas of differentiation, such as latency, security, and distribution.

As long as the number of chains and the need for user experience abstraction increases, bridges will continue to find uses.

This year, changes in block space settlement trends (modularization, aggregation , data availability, etc.) will have an impact on how users perform trades + move assets, and bridges will become a popular choice for enabling this user experience.

Over time, native protocols and technology improvements should help users eliminate withdrawal periods (currently Optimistic Rollup 7 days by design) and get "Fast Track" sending/receiving.

Verified wallets and users holding on-chain proofs (such as Coinbase Verifications) may be able to interact with centrally managed liquidity in the future Bridge for on-chain interaction.

App-hosted wallets (and self-hosted wallets) will continue to work on "Bridge Plus" - where "exchange" and "Bridge" is no longer two different transactions, but merges them into one transaction for better user experience results.

Bridges and oracles will eventually compete for data distribution rights.

Bridges is working to secure first-party issuers Utilize/use its infrastructure. CCTP demonstrates that local issuers want to build compatibility to reduce dependence on any single bridge. Some projects are also trying to issue multi-chain token standards. While CCTP is centered around USDC, the way the token is natively issued can be significantly different. Example: $OP is launched natively on the Optimism chain; most ERCs are issued natively on ETH L1. Connext has a token standard called xERC (think CCTP for any ERC20)

Oracles can be thought of as "Bridge", but for off-chain data issuers. Chainlink takes off-chain data (cryptocurrency prices on CeFi) and brings it on-chain - although they don't own the data itself, it monetizes it by providing it as a third party. Conceptually, this is similar to how bridges are positioned today. Oracles + Bridges will continue to serve the delta that exists between those who need data/assets and those who can bridge the data/assets. Ultimately, they will need to become tools for first-party data publishers to maintain long-term moats/defenses. Chainlink has its own bridging product called CCIP, which is further evidence of the overlap.

In summary, bridging and interoperability will continue to be top trends, as in an environment where the number of chains continues to grow , in order for protocols and users to meet the needs of abstract user experience, bridges will become compelling service providers. In the bridging space, Coinbase Ventures is investing in new use cases emerging in bridging. If you’re building in these areas, we’d love to hear from you – Ryan Yi’s DMs are open!

JinseFinance

JinseFinance