Original author: Shane Neagle, Coingecko, original source: coingecko

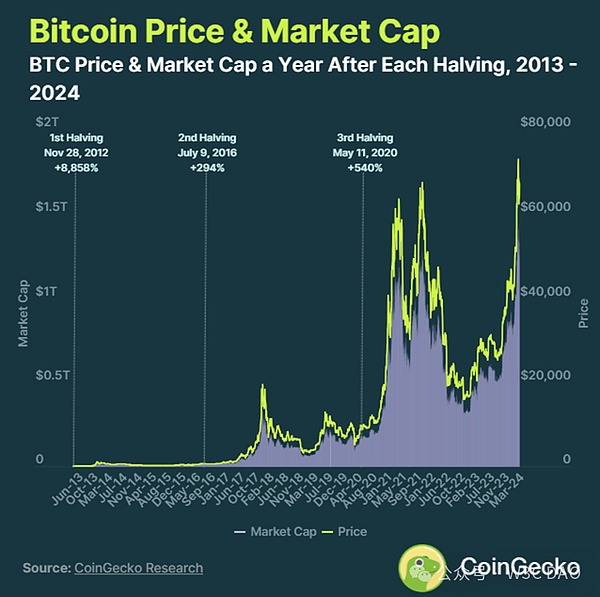

How does the price of Bitcoin perform after each halving?

After each halving, the price of Bitcoin has risen by an average of 3230% in one year. However, given Bitcoin's novelty in its early days, lack of market maturity, and diminishing returns.

Before further studying the diminishing returns of halving, how did the price of Bitcoin perform in the first three halvings?

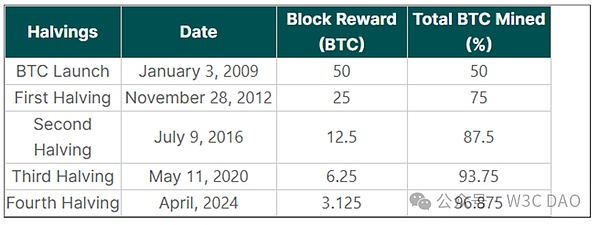

When the Bitcoin mainnet went online on January 3, 2009, the block reward was a generous 50 BTC.

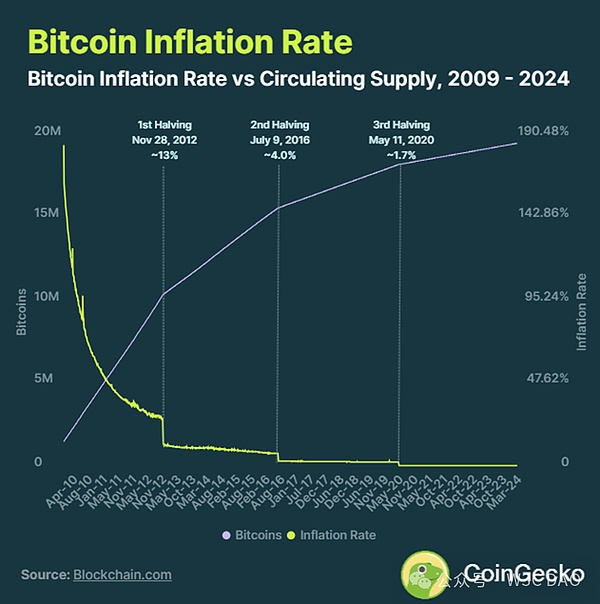

First halving: On November 28, 2012, it dropped from 50 BTC to 25 BTC. Within 12 months (as of November 28, 2013), the price of BTC rose from approximately $12 to $1,075, resulting in an 8,858% increase in valuation. By January 2022, Bitcoin's inflation rate had risen from 25.75% to 12%.

Second halving: On July 9, 2016, it dropped from 25 BTC to 12.5 BTC. Within 12 months (as of July 9, 2017), the price of Bitcoin rose from approximately $650 to $2,560, resulting in a 294% increase in valuation. By August 2016, Bitcoin's inflation rate had risen from 8.7% to 4.1%.

Third halving: On May 11, 2020, it dropped from 12.5 BTC to 6.25 BTC. In 12 months (as of May 11, 2021), the price of BTC rose from approximately $8,727 to $55,847, resulting in a 540% increase in valuation. By June 2020, Bitcoin's inflation rate had risen from 3.7% to 1.8%.

From this pattern, it is clear that Bitcoin halvings tend to bring diminishing returns.

Although the increase after the third halving was greater than the increase after the second halving, this was overshadowed by the increase in the Fed’s money supply. By increasing the M2 money supply, the Fed effectively repriced Bitcoin.

This became apparent after the Fed began suppressing asset prices through a new round of rate hikes in March 2022, reversing the trend.

Bitcoin Market Cap Before and After Halving

A week before Bitcoin’s first halving on November 28, 2012, the market cap of Bitcoin was only $123.3 million. One day after the halving, it rose to $130.3 million. Within three months, by the end of February 2013, Bitcoin’s market cap reached $335.2 million. Just one month later, Bitcoin approached the $1 billion milestone with a market cap of $947.4 million.

The second halving on July 9, 2016, was a different story. In anticipation of the halving, Bitcoin’s market cap rose to a yearly high of $11.9 billion a month earlier. A week earlier, Bitcoin’s market cap was $10.2 billion. Three months later, the market cap actually fell to $9.6 billion. After the market correction, it wasn’t until January 2017 that Bitcoin reached its all-time high of $16.4 billion.

Finally, Bitcoin’s third halving in May 2020 began at $182.5 billion. Within three months, Bitcoin’s market cap increased to $217.3 billion.

Market events and maturity play a bigger role than halvings, although they are jumping points. In August 2016, Bitfinex was hacked, which wiped out 3 months of gains. However, this only delayed until a new ATH market cap in January 2017.

Why is the Bitcoin halving important?

In practice, Bitcoin halving is a mechanism to curb inflation. Unlike fiat currencies, which have unpredictable inflation rates based on central bank actions, Bitcoin’s inflation rate is predictable, immutable, and decreases with each halving.

At the halving event, which happens every four years, the reward for miners to secure and process Bitcoin transactions is cut in half. As the supply inflow of new Bitcoins decreases, the price of existing Bitcoins becomes more attractive.

Bitcoin Halving Diminishing Returns

Since the supply of Bitcoin is finite, at approximately 21 million Bitcoins, the new inflow of Bitcoins slows. As more Bitcoins enter the circulating supply, the market becomes more saturated and Bitcoin is more efficiently priced.

Currently, 93.3% of Bitcoin has been mined, or 19.6 million Bitcoins out of 21 million Bitcoins, with an inflation rate of about 1.74%.

This means that if demand exceeds the current inflation rate of 1.74%, Bitcoin prices will rise. In turn, demand for Bitcoin's fourth halving, around April 20, 2024, only needs to exceed inflation by less than 1%.

Market Dynamics After Halving

The Bitcoin halving is just a baseline for Bitcoin's price prediction after the halving. Given that Bitcoin's inflation rate will drop below 1% after the fourth halving, demand will more easily exceed it.

Whether this demand will materialize, however, depends on a variety of factors:

Selling pressure

Bitcoin’s perception

Global market liquidity

Crypto regulation

Macroeconomic conditions

Crypto market events

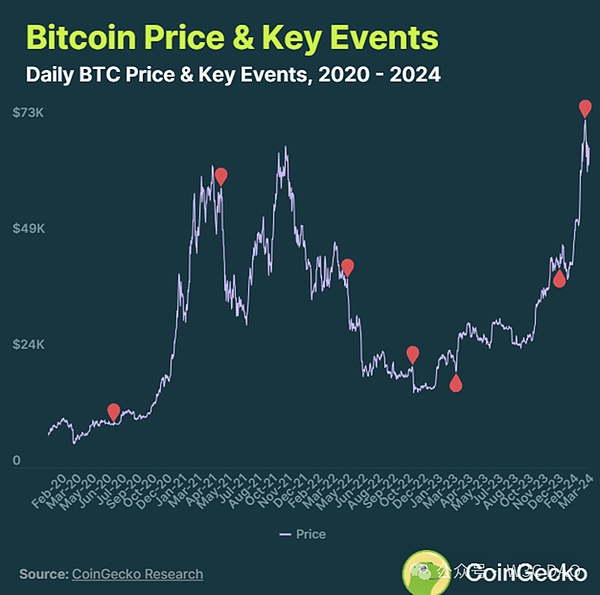

All of these factors come into play after the third halving between 2020 and 2024. Some more than others. For example, when Elon Musk tweeted “You can now buy a Tesla with Bitcoin,” Bitcoin reached a price of nearly $65,000 a month later.

Similarly, when Musk portrayed Bitcoin as not environmentally friendly enough, the price of Bitcoin plummeted. In addition, the collapse of multiple centralized cryptocurrency exchanges throughout 2022 will only amplify the tightening of market liquidity and the Fed's rate hike cycle.

The dynamics between regulatory uncertainty, rising interest rates, cryptocurrency crashes, and inflation have triggered capital outflows from Bitcoin. As these FUD supplies were finally exhausted, Bitcoin rose again after the US regional banking crisis.

Without these burdens, the market for Bitcoin is more mature than ever. We can use Bitcoin's market capitalization to represent this maturity.

Selling Pressure Before and After Bitcoin Halving

Ahead of Bitcoin's fourth halving in April 2024, Bitcoin had a strong start to the year. Since then, Bitcoin has surpassed its previous all-time high of $69,044.77 set in 2021 to hit a new high of $73,737.94.

This is due to a surge in optimism about crypto assets. Among them, the successful launch of approved Bitcoin ETFs stands out. This milestone helps to elevate Bitcoin's legitimacy to a new level and contributes to the positive sentiment in the market.

Both retail and institutional investors can now participate in Bitcoin price exposure through stocks without directly custodying Bitcoin. As of March 25, the nine approved Bitcoin ETFs have accumulated more than 4.736 million Bitcoins, while Grayscale's Bitcoin outflow was 2.694 million. In total, spot Bitcoin ETFs in the U.S. hold 8.239 million Bitcoins, or 4.2% of all Bitcoin mined.

While Bitcoin ETFs have seen inflows since their inception, it is uncertain whether they can keep up with Grayscale’s selling pressure due to uncompetitive fees. On top of that, Bitcoin miners may take profits as mining costs are expected to increase as hash rate and difficulty increase.

While analysts predict a bullish outcome for Bitcoin prices after the halving, such predictions may be thwarted or delayed as another selling pressure comes from Mt. Gox’s planned distribution of 200,000 BTC (about $13.9 billion) to repay creditors.

Before these headwinds, the Bitcoin price will encounter two hype events:

The fourth halving will occur in April 2024

The first rate cut by the Federal Reserve, expected in May or June 2024

Overall, Bitcoin's market positioning has never been more solid than it is now. A Bitcoin ETF will bring in a new generation of investors and a new marketing offensive. Meanwhile, fiat currencies will continue to depreciate wildly under a debt-based monetary system.

This makes Bitcoin a unique option for investors because its supply is predetermined and independent of demand. With Bitcoin inflation below 1%, the lower demand threshold may outweigh future selling pressure.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Bitcoinist

Bitcoinist Others

Others Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph