Source: coingecko Translation: Shan Ouba, Golden Finance

Third quarter of 2024, The cryptocurrency market closed flat with a market capitalization of $2.3 trillion, but still saw significant volatility during the period. Geopolitical and economic events have a significant impact on the crypto market. The U.S. Federal Reserve's decision to keep interest rates on hold in July and then cut rates by 50 basis points in September changed the course of the market this quarter. The Bank of Japan's surprise interest rate hike in July triggered unexpected market volatility, while China's new stimulus measures hinted at the possibility of more structural liquidity.

Our Crypto Industry Report Q3 2024 provides comprehensive coverage of the crypto market landscape, in-depth analysis of Bitcoin and Ethereum, and discussion of decentralization decentralized finance (DeFi) and non-fungible token (NFT) ecosystems, and reviews the performance of centralized exchanges (CEX) and decentralized exchanges (DEX).

7 Highlights from CoinGecko’s Q3 2024 Crypto Industry Report:

The total market value of the crypto market fell by 1.0% in the third quarter of 2024, ending the quarter at $2.33 trillion.

Bitcoin’s dominance has increased, now accounting for 53.6% of the total crypto market capitalization.

Major asset classes outperformed Bitcoin, with gold rising 13.8%.

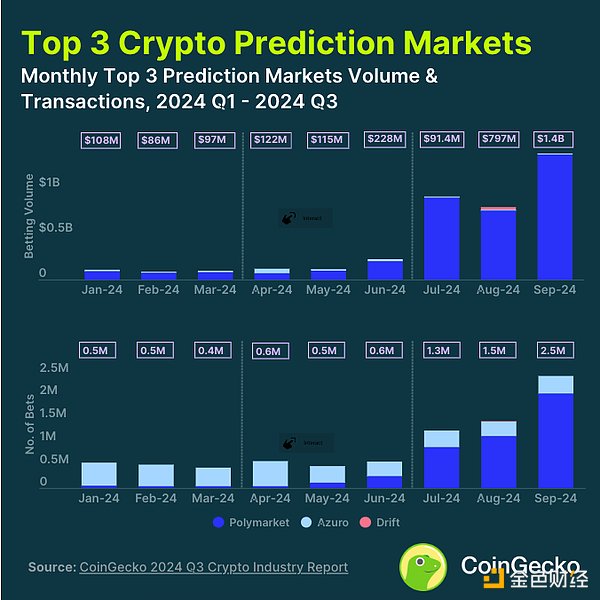

The forecast market grew by 565.4% in Q3 2024, with Polymarket holding 99% of the market share.

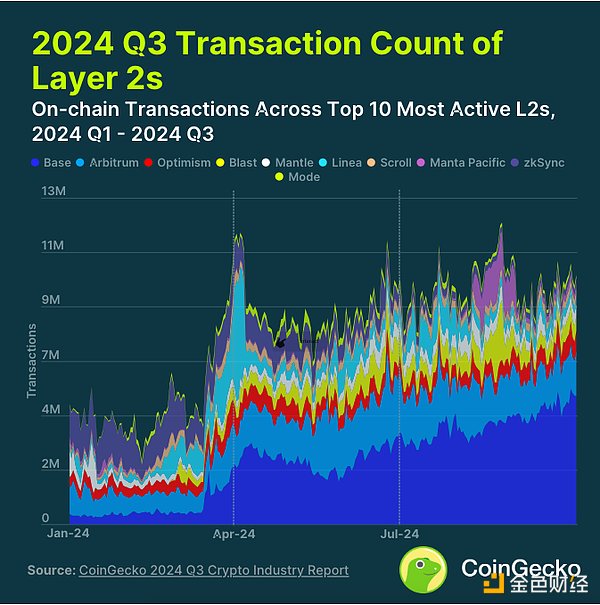

Ethereum Layer 2 transaction volume increased by 17.2% in the third quarter of 2024, with Base performing prominently.

Spot trading volume on centralized exchanges fell to $3.05 trillion, a 14.8% month-on-month decrease.

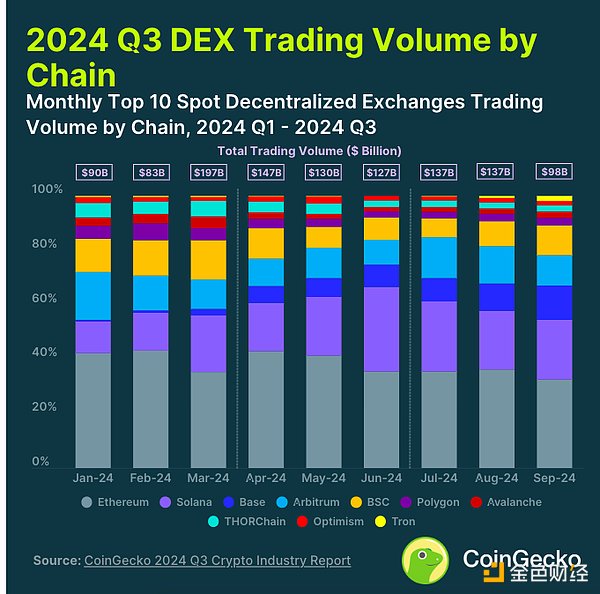

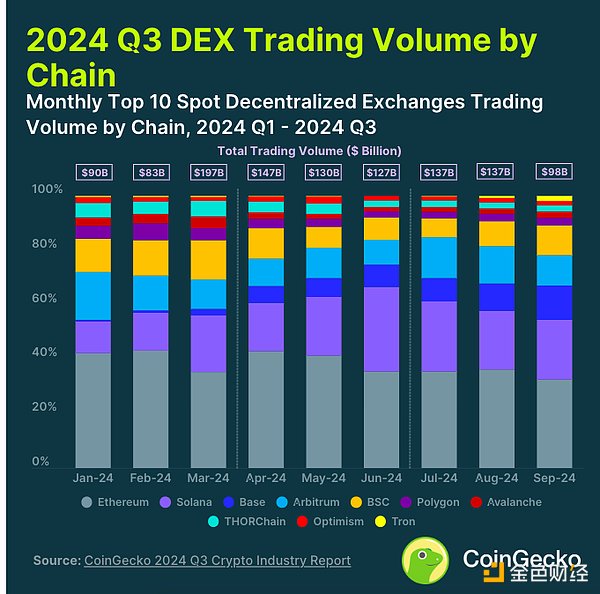

Ethereum is still the dominant chain for decentralized exchanges, but is rapidly losing market share to Solana and Base.

1. The total market value of cryptocurrency fell by -1.0% in the third quarter of 2024, and the market value at the end of the quarter was US$2.33 trillion< /h2>

At the end of the third quarter of 2024, the total market value of cryptocurrencies fell -1.0% ($95.8 billion) to $2.33 trillion. The market briefly rose to $2.61 trillion on July 22, but fell sharply on August 6 due to a weakening global economy. The Federal Reserve kept interest rates unchanged, while the Bank of Japan raised rates.

The global cryptocurrency market capitalization subsequently fluctuated between $2.00 trillion and $2.20 trillion, followed by the announcement of a massive 50 basis point interest rate cut in the United States and China Driven by stimulus measures, it recovered slightly to the current level of US$2.33 trillion.

Meanwhile, the average transaction volume in the third quarter of 2024 was $88 billion, which was also a slight decrease of -3.6% from the previous quarter.

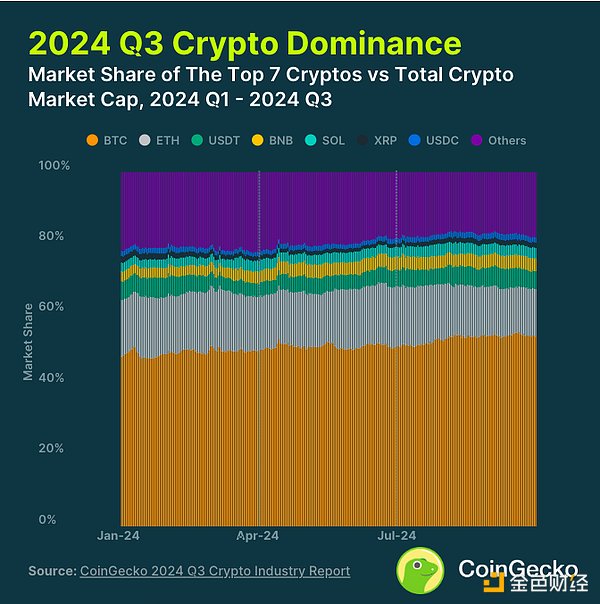

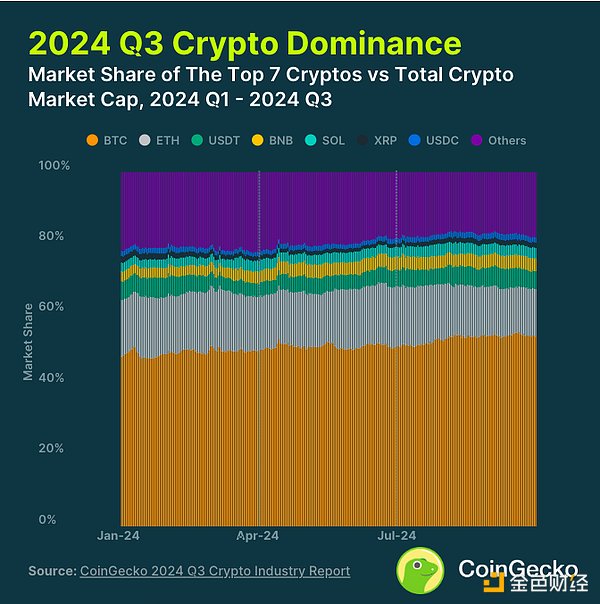

2. Bitcoin’s market dominance has further strengthened, currently accounting for 53.6% of the total cryptocurrency market

Despite a slight decline in global cryptocurrency market capitalization in the third quarter of 2024, Bitcoin ( BTC ) managed to increase its dominance to 53.6%, a quarter-on-quarter increase of 2.7%. It recorded only modest gains of 0.8%, but its dominance has declined as altcoins such as Ethereum ( ETH ) and BNB have suffered larger declines during the quarter. The last time BTC was able to achieve such dominance was in April 2021.

Meanwhile, Ethereum’s dominance among the top seven cryptocurrencies has declined the most, down 3.6% in Q3, ending the quarter The market share is 13.4%. This decline may be attributed to reduced interest in the Ethereum ecosystem, despite the launch of an Ethereum ETF in July.

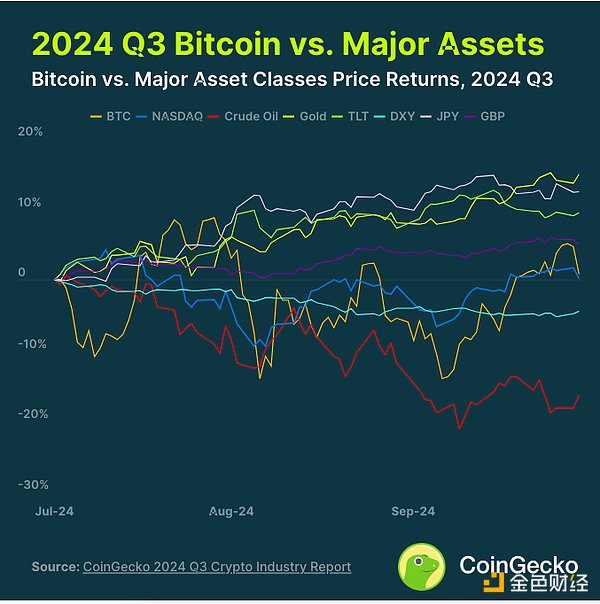

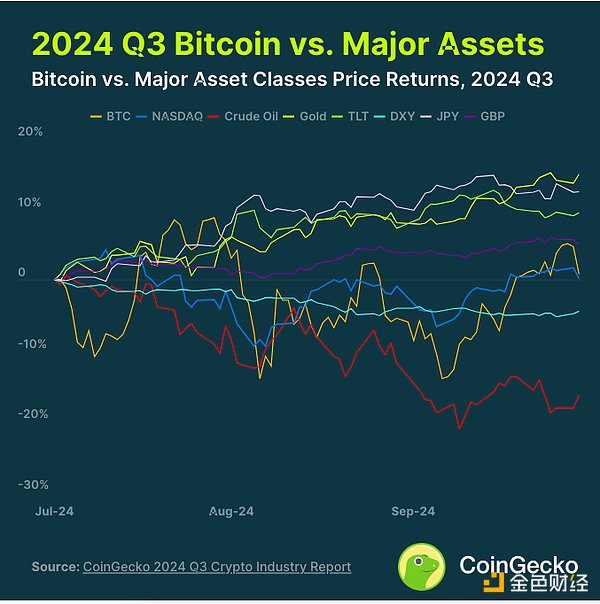

3. Major asset classes performed better than Bitcoin, with gold leading the gains, up 13.8%

Bitcoin (BTC) prices edged up 0.8% in the third quarter of 2024, handily outperforming most other major asset classes. Gold was the biggest gainer, up 13.8% for the quarter. This comes amid concerns about a slowing U.S. economy and escalating tensions in the Middle East.

The yen also performed well during the quarter, rising after the Bank of Japan (BOJ) unexpectedly raised interest rates in August and the Federal Reserve subsequently cut rates. 12.0%. Crude oil and the U.S. Dollar Index (DXY) were the only major asset classes to outperform BTC on concerns about weakening demand and interest rate cuts. All major fiat currencies advanced against the US dollar.

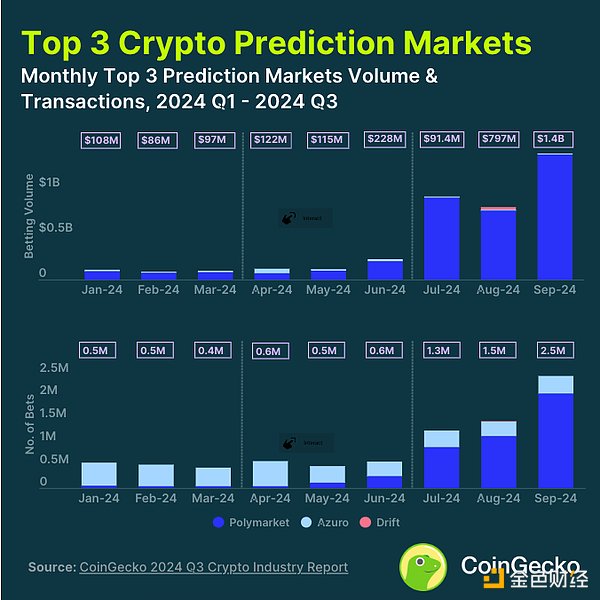

4. The market is forecast to grow by 565.4% in the third quarter of 2024, with Polymarket leading with a market share of 99%

The prediction market gained momentum in the third quarter of 2024, growing by 565.4% as experts placed bets on the upcoming US election. This increased trading volume in the top three forecast markets from $466.3 million in the second quarter to $3.1 billion in the third quarter.

However, most of the volume comes from Polymarket, which had a market share of 99% in September. Its betting volume increased by 713.2% and transaction volume by 848.5% during the same period. Since the start of 2024, $1.7 billion has been bet on the “winner of the US presidential election,” accounting for approximately 46% of Polymarket’s annual trading volume.

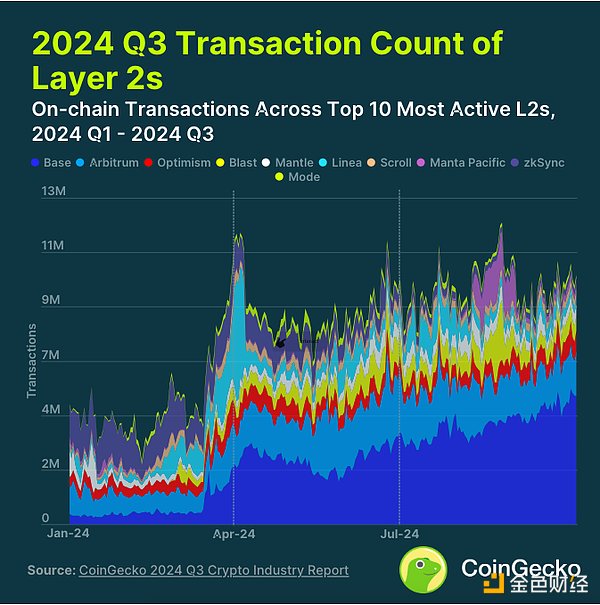

5. In the third quarter of 2024, Ethereum Layer 2 transaction volume increased by 17.2%, with Base leading the increase

In the third quarter of 2024, the total transaction volume of the top ten Ethereum layer 2 (L2) has steadily increased, and by the end of September, the daily transaction volume was close to 10 million. By comparison, the Ethereum mainnet handles around 1 million transactions per day.

Base has seen a significant increase in network activity since the start of the year and is by far the most active L2, accounting for 42.5% of all transactions in Q3. This was followed by Arbitrum, which accounted for 18.9% of transactions, followed by Blast, which accounted for 8.1% during the same period. Manta Pacific saw a surge in transaction volume in August, with most transactions attributed to a fully on-chain Telegram applet called Taman. However, once the initial launch campaign ended, activity on the network tapered off.

6. In the third quarter of 2024, the spot trading volume of centralized exchanges fell to US$3.05 trillion, a decrease of -14.8% from the previous quarter

In the third quarter of 2024, the spot trading volume of the top ten centralized exchanges (CEX) was US$3.05 trillion. A month-on-month decrease of -14.8%.

Binance remains the largest CEX, with a market share of 38% as of September 2024. However, this is the first time since January 2022 that Binance’s market share fell below 40%. Meanwhile, Crypto.com came from behind to become the second-largest CEX in September, jumping from ninth place in the second quarter. It is also the fastest growing CEX among the top 10, with 160.8% month-on-month growth. In September, its market share was 14.4%.

OKX and Gate.io both experienced a decline in trading volume in the third quarter, with a drop of more than 30%. Coinbase also saw a -23.8% drop in trading volume, falling from sixth to 10th place in the third quarter.

7. Ethereum was once the dominant chain in DEX trading, but its market share is rapidly being taken away by Solana and Base

In the third quarter of 2024, Ethereum was the dominant chain in DEX transactions, although its market share is currently below 40%. Between July and September 2024, Ethereum’s transaction volume showed a downward trend, with cumulative transaction volume falling 19.6% month-on-month to $130.5 billion.

DEX trading activity on Solana continues to flourish, driven by numerous meme coins. As of the end of September, its market share was 22%, with transaction volume of $21.5 billion. Meanwhile, Base’s market share continues to grow despite a slow third quarter for the cryptocurrency market. Base's trading volume increased by 31.4%, allowing it to surpass Arbitrum with 13% dominance and $12.3 billion in trading volume in September.

Tron is a new entry into the top ten, replacing Blast, which saw a significant drop in trading volume after TGE. With the release of memecoin generator SunPump on Tron, transaction volume surged. In September, the network managed to capture 2% of the market with $1.7 billion in transaction volume.

Joy

Joy