Author: Lim Yu Qian, Coingecko; Compiler: Deng Tong, Golden Finance

Which countries have spot Bitcoin ETFs?

Spot Bitcoin exchange-traded funds (ETFs) are registered in 11 countries around the world and trade in only 6 regional markets.

The countries registered for spot Bitcoin ETFs are: G20 countries the United States, Canada, Germany, Brazil and Australia, tax havens Bermuda, Jersey, Switzerland, Liechtenstein and Guernsey, and the only Asian country Malaysia . Hong Kong could be the next country to launch a spot Bitcoin ETF, with regulators there ready to accept applications.

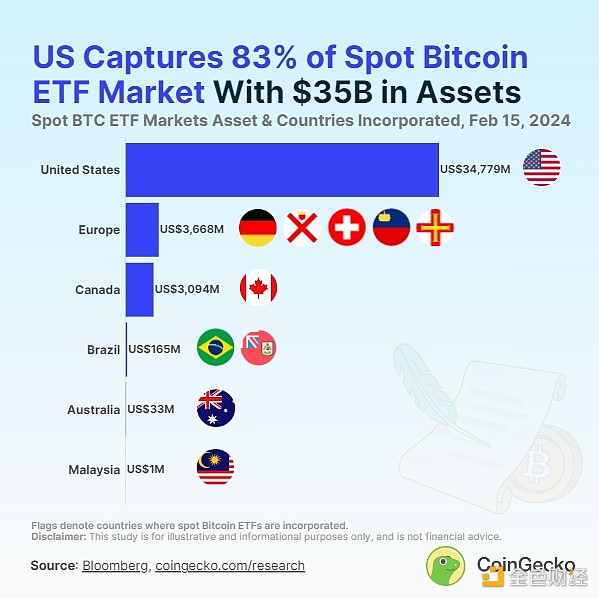

The main markets for spot Bitcoin ETFs are the United States, Europe and Canada, while the smaller spot Bitcoin ETF markets are present in Brazil, Australia and Malaysia.

The United States has become the largest country for spot Bitcoin ETFs. The total assets of the 10 spot Bitcoin ETFs approved at the beginning of this year reached $34.78 billion. The United States currently holds an overwhelming 83.3% of the $41.74 billion global spot Bitcoin ETF market, surpassing Canada, which previously led the market with 46.3%.

Despite this, Canada remains a major player in the global spot Bitcoin ETF market, ranking second with a market share of 7.4%. Canada’s six spot Bitcoin ETFs remain resilient, with total assets at $3.09 billion, compared with $2.79 billion on December 18, 2023. This suggests that net outflows from the country’s spot Bitcoin ETFs were modest after taking BTC prices into account, but also did not significantly increase share.

Europe also remains an important spot market for Bitcoin ETFs, with assets totaling $3.67 billion and accounting for 8.8% of the global market share. Europe has the largest number of spot Bitcoin ETFs, with 13 ETFs based in Jersey, Guernsey, Germany, Switzerland and Liechtenstein.

How many spot Bitcoin ETFs are there?

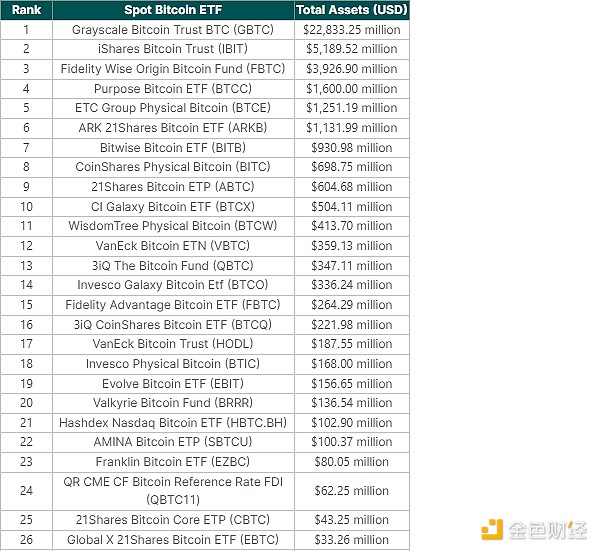

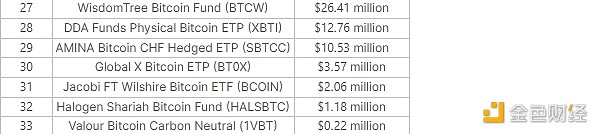

There are currently 33 spot Bitcoin ETFs in the world, with total assets of US$41.74 billion. This means that the Bitcoin ETF spot currently holds approximately 839,323 BTC, which is 4% of the maximum supply of Bitcoin.

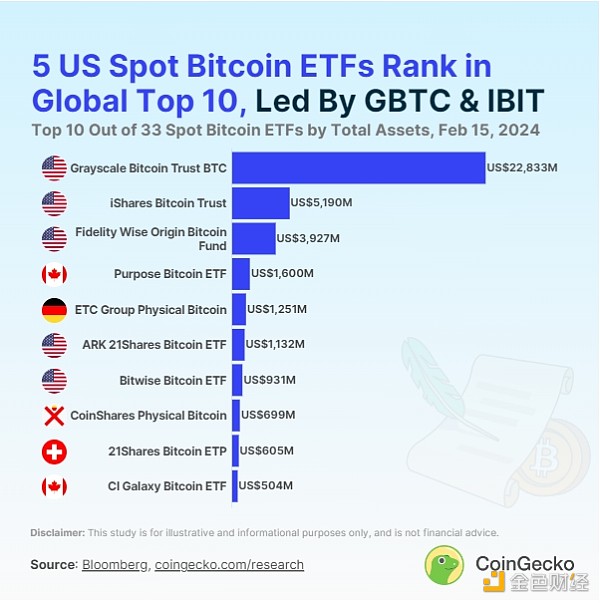

Grayscale Bitcoin Trust (GBTC) is the largest spot Bitcoin ETF, with total assets of $22.83 billion. GBTC alone accounts for more than half of the global spot Bitcoin ETF market, with a market share of 54.7%. However, GBTC’s dominance may be challenged as net outflows continue, including Genesis’ impending sale of 35 million GBTC shares.

Overall, the top 10 spot Bitcoin ETFs account for 92.7% of the global market share. In addition to GBTC, other spot Bitcoin ETFs with total assets of billions of dollars include: iShares Bitcoin Trust (IBIT) $5.19 billion, Fidelity Wise Origin Bitcoin Fund (FBTC) $3.93 billion, Purpose Bitcoin ETF (BTCC) 16 billion, ETC Group Physical Bitcoin (BTCE) is $1.25 billion, and ARK 21Shares Bitcoin ETF (ARKB) is $1.13 billion.

Of the top 10 spot Bitcoin ETFs, 5 are from the United States, 3 are from Europe, and 2 are from Canada.

The first spot When will the Bitcoin ETF be launched?

The first three spot Bitcoin ETF products were launched in 2020, at a time when Bitcoin was at its peak early stages of the bull market. German ETC Group Physical Bitcoin was the first spot Bitcoin ETF product to begin trading in June 2020, followed closely by the 3iQ Bitcoin Fund and the VanEck Bitcoin ETN.

While the Grayscale Bitcoin Trust launched back in 2013 and is the longest-running active spot Bitcoin ETF, it did not switch from a unit trust to an ETF structure until 2024.

Fourteen spot Bitcoin ETFs launched in 2021, making it the most popular year for spot Bitcoin ETFs yet. In particular, six of these ETFs launched in the second quarter after the Bitcoin craze first peaked in 2021.

A further three spot Bitcoin ETFs will be launched each year in 2022 and 2023, bringing the mainstream cryptocurrency into new markets in Australia and Malaysia. However, spot Bitcoin ETFs in 2022 and 2023 have yet to see significant inflows and are among the smallest by asset size.

The highly anticipated US approval will launch 9 new spot Bitcoin ETFs to global markets in 2024. It remains to be seen whether more spot Bitcoin ETFs will be launched in other markets this year.

Spot Bitcoin ETF Countries

As of February 15, 2023, the number of active spot Bitcoin ETFs registered in each country and the total assets in USD are as follows:

Global Spot Bitcoin ETF Ranking

As of February 15, 2023, the ranking of globally active spot Bitcoin ETFs by total assets in US dollars is as follows:

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex JinseFinance

JinseFinance Sanya

Sanya Catherine

Catherine Kikyo

Kikyo Olive

Olive