Author: Nicholas Boey, Coingecko; Compiler: Deng Tong, Golden Finance

1. When is the best time to sell airdrops?

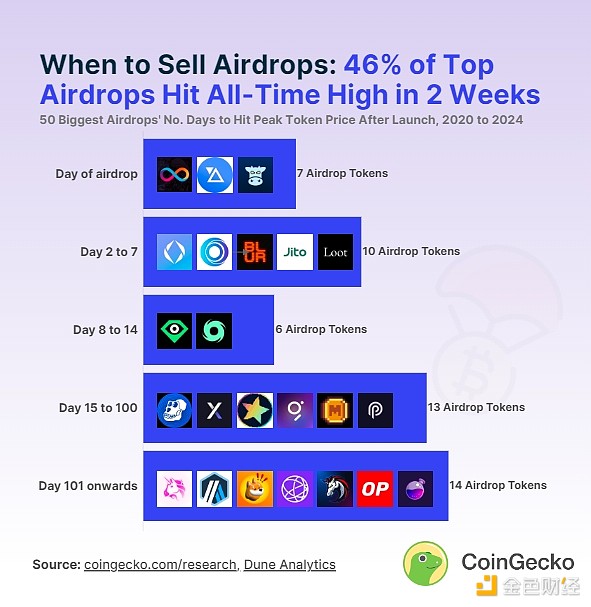

Of the 50 largest airdrops, 23 (46%) recorded token price peaks within two weeks of the airdrop date. This suggests that the best time to sell airdrop tokens may be within 14 days of receiving airdrop tokens for maximum profit.

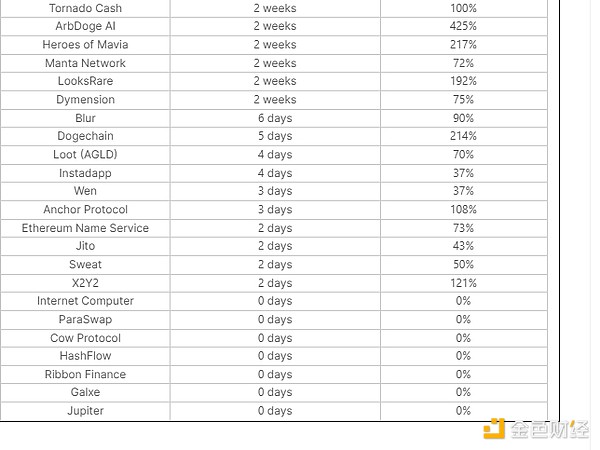

Airdrop tokens that achieved the highest price returns in the short term include Ethereum Name Service (+73% on day 2 of trading), X2Y2 (+121% on day 2), Blur (+90% on Day 6), LooksRare (+192) % (Day 10) and ArbDoge AI (425% on Day 14).

In recent airdrops, Jito (increased by 43% on day 2), Wen (increased by 37% on day 3), Dymension (increased by 75% on day 10), Manta (increased by 72 on day 12 %) and Heroes of Mavia (217% increase on day 13), it is also most profitable for investors who received the airdrop if sold shortly after the airdrop. Still, these airdrops have only been trading for a few weeks, and it remains to be seen whether their token prices will rise to new highs.

Of the 23 airdrop tokens, 16 airdrops reached peak returns between the 2nd and 14th day after the airdrop date. In other words, once a token is airdropped and traded, interest tends to spike. This confirms that token airdrops are an effective marketing or growth strategy, but also shows that as more people talk about airdrops, interest in a specific token tends to grow, peaking shortly thereafter and reflected in the token price. coin price.

The price of the remaining 7 airdrops peaked on the day of the airdrop, and the token price was unable to recover thereafter. For example, Solana aggregator Jupiter’s airdrop token began trading at around $0.66, but has since fallen 28% and remains below its initial price. This happens when airdrop recipients are eager to cash in on their “free funds,” causing the airdrop to be immediately sold off. As recipients decide to exit airdrops over time, token prices from these airdrops continue to face selling pressure and reach new lows.

On the other hand, 27 of the top 50 largest airdrops were more than two weeks after the airdrop date The time range for reaching peak earnings ranges from 15 days to 581 days. Price spikes over longer time frames of this kind generally coincide with favorable market conditions and growth of individual projects, which pushes airdrop token valuations beyond initial levels.

2. Market conditions drive airdrop price returns

38% of airdrop tokens peaked in the 2021 bull market

Amid the crypto bull run, 19 of the 50 largest airdrops hit all-time highs (ATH) in 2021. All of these were launched before or in 2021, suggesting market conditions are driving higher valuations in the price of these airdrop tokens.

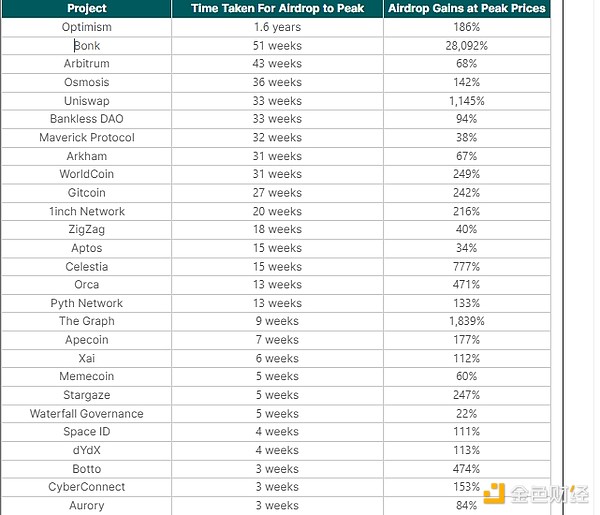

Four of these 19 tokens reached ATH more than 100 days after the airdrop. These airdrop tokens are Uniswap (1.145%), 1inch (216%), Gitcoin (242%), and Bank (94%).

These tokens have seen significantly higher returns on their ATH prices compared to their short-term peaks. For example, Uniswap’s ATH price return is 1.145%, which is 10 times the highest price return of 106% in the 14 days prior to trading.

This suggests that For some airdrops, recipients may consider retaining their airdrop allocation for a longer period of time Internally add value in order to achieve higher profits under favorable market conditions.

2022: A good year for NFT airdrops, but not others

In 2022, market conditions were relatively pessimistic, with 11 out of 50 airdrop tokens reaching ATH.

However, in early 2022, there was a bull run in non-fungible tokens (NFTs), which helped 3 of these 11 airdrop tokens (ApeCoin, LooksRare and X2Y2) pushed valuations to new ATH. On the other hand, other airdrop tokens that reached ATH in 2022 were launched in the same year and reached ATH shortly after the airdrop date. The exception is Osmosis, which launched in June 2021 but reached ATH in 2022.

This shows that during a bear market, after an airdrop is the best time to sell airdrop tokens to achieve Profit maximization.

2023 and 2024: A return to bullish sentiment?

The remaining 21 of the 50 airdrop tokens reached ATH in 2023 and 2024, due to U.S. Spot Bitcoin ETF Approved, Bullish Sentiment Returns.

8 of the 21 airdropped tokens reached ATH more than 100 days after the airdrop. These airdrop tokens are Arbitrum (68%), Bonk (28,091%), Celestia (777%), Optimism (186%), Aptos (34%), WorldCoin (249%), Arkham (67%), and Maverick (38 ) %).

Another 5 airdrops took 15 to 100 days to reach the token price peak, while the remaining 8 airdrop tokens reached ATH within 14 days of the airdrop date. (Note that of the 8 coins that peaked within 14 days, 5 were recently airdropped: Manta, Jupiter, Dymension, Heroes of Mavia, and Wen).

This suggests a shift in market sentiment in 2024, so when airdropped tokens reach the expected bull run It may be more profitable to hold airdropped tokens at new valuations.

3. When to sell airdrops

As of February 20, 2024, the number of days required for the 50 largest airdrops to reach the highest token price in history , weeks or years, and the corresponding peak price return percentage:

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Davin

Davin decrypt

decrypt Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Nulltx

Nulltx Nulltx

Nulltx