Author: Matías Andrade & Tanay Ved Source: coinmetrics Translation: Shan Ouba, Golden Finance

Key Points:

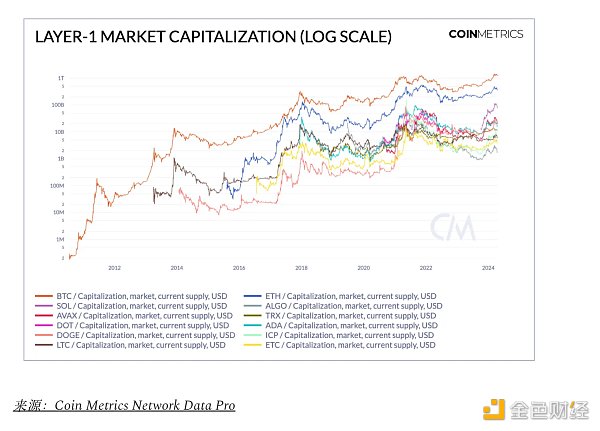

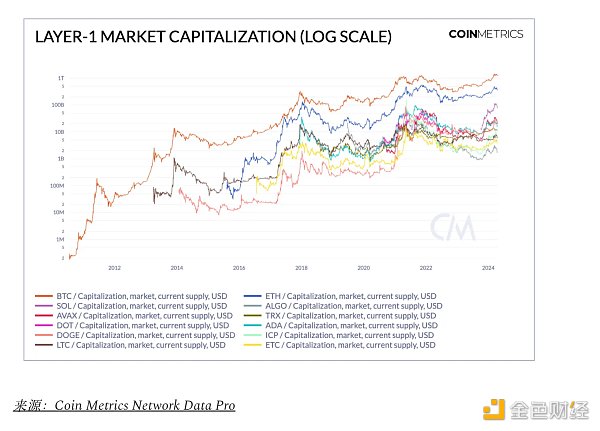

The innovation happening on Layer-1 platforms is heating up, bringing changes that require us to use data to compare and contrast the different features and trade-offs these different L1s offer.

Bitcoin is evolving from a specialized chain that primarily acts as a settlement layer to a more general platform that leverages the security of its second-layer capabilities.

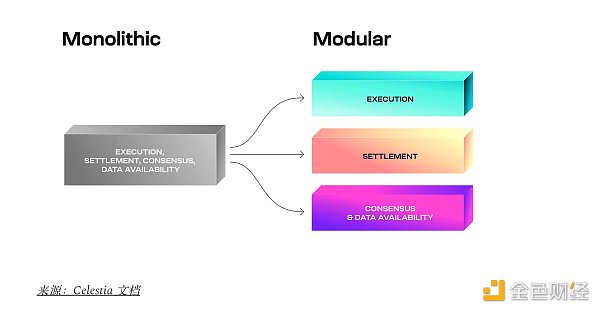

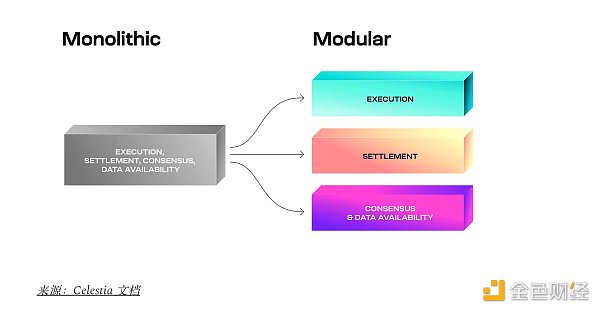

With the recent Dencun upgrade, Ethereum is moving towards a modular blockchain architecture that leverages specialized layers to implement its functions, highlighting the difference between a monolithic network and a modular network.

Introduction

Innovation in the digital asset space seems to be heating up again as old paradigms are abandoned and new horizons are realized. Bitcoin is evolving from a specialized chain whose primary purpose is to serve as a transaction settlement layer to a more general platform that leverages its extraordinary security to serve layer 2 functions. Similarly, with the recent Dencun upgrade, Ethereum is moving towards a modular blockchain architecture with specialized layers to handle its functions. We are also witnessing the birth of new layer-1 blockchains like Aptos, which utilizes different virtual machines, and others like Monad, which brings parallel execution capabilities to the EVM.

In this episode of Coin Metrics’ State of the Network, we explore the diverse landscape of layer-1 blockchain networks and understand their impact on the broader crypto ecosystem.

What constitutes a Layer–1?

In the crypto ecosystem, Layer-1 (or L1) is the base layer or foundational blockchain network on which other layers and applications are built. L1 blockchain networks are independent, decentralized ledgers that operate independently and establish their own consensus, transaction validation, and data storage rules. These networks act as infrastructure and provide the basic functionality required to develop and deploy decentralized applications (dApps) and other blockchain-based solutions. Many first layers have emerged in past cycles, each gaining varying degrees of traction and maturity.

Types of Layer 1 Blockchains

While all L1 networks have the essential characteristics of decentralization and protecting their respective ecosystems, they can be roughly divided into two types: specialized networks and general-purpose platforms.

Specialized Networks:These L1s are primarily designed to facilitate secure peer-to-peer transactions and serve as a strong settlement layer. Examples include Bitcoin, Litecoin, and Dogecoin. While they may not directly support complex smart contracts or decentralized applications, their primary purpose is to provide reliable and trustless value transfer using strong security guarantees and decentralization, even through protocols like Omni or as L2s or rollups built on top.

General-Platforms:These L1s are designed as programmable platforms that can support a wide range of decentralized applications and smart contracts. Examples include Ethereum, Tron, Solana, Avalanche, and others. These networks generally prioritize features like programmability, scalability, and interoperability to support the development and deployment of a wide range of decentralized solutions, including decentralized exchanges, lending protocols as part of DeFi, and more. Layer-1s can be further categorized based on differences in their architecture or approach to core blockchain functionality, including execution, consensus, and settlement.

Monolithic: This includes L1s such as Bitcoin and Solana, which handle the execution and settlement of transactions and the maintenance of consensus within a single layer.

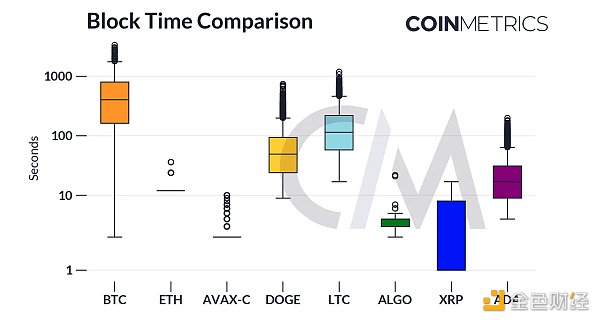

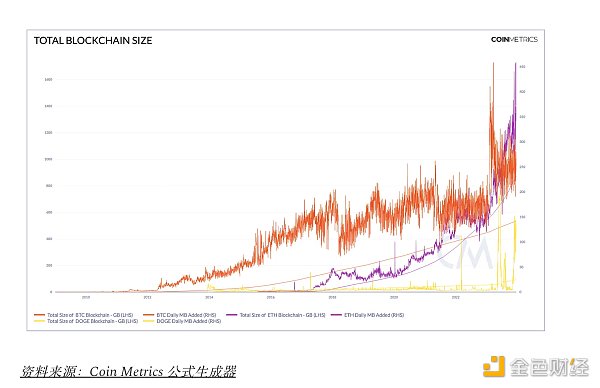

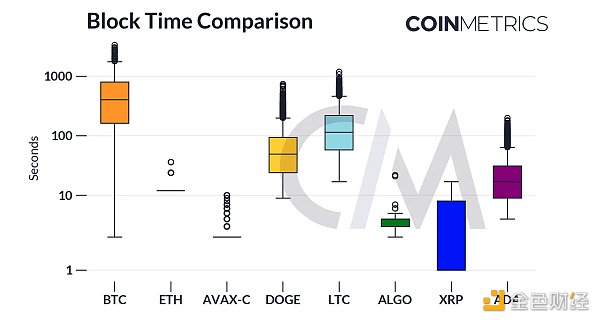

Modular: This includes L1s like Avalanche, Cosmos, and most recently Ethereum, with its rollup-centric roadmap. Modular blockchains separate these functions into different specialized layers. While these categories provide a high-level overview, understanding the nuances and trade-offs between these L1 network categories is critical to understanding the broader dynamics and potential of the decentralized ecosystem as it evolves. To gain a deeper understanding of Layer-1, we will take a data-driven look at how these networks span different approaches and provide innovative solutions to the fundamental problems that decentralized networks pose. The performance of L1 blockchains can be affected by a variety of technical factors, such as consensus mechanisms, block size (the amount of data that can fit in a block), and block time (the time it takes to add a new block to the blockchain), to name a few. These factors can directly impact the transaction speed and network throughput of an L1, which in turn impacts the blockchain’s user experience. Due to the unique design choices and architectural trade-offs of L1s, these metrics cannot be used as a direct comparison, but rather as a means to understand their technical differences.

Sponsored Business Content

As shown by Solana (around 0.4 seconds) and Avalanche C Chain (2 seconds), a shorter average block time allows incoming transactions to be executed faster. This is especially beneficial for high-frequency trading, such as financial transactions on applications such as decentralized exchanges (DEX), microtransactions, or game-related interactions where speed is critical. In addition, AVAX-C and Ethereum also have constant block times, which makes the distribution around the average very tight (some outliers come from missed blocks). On the other hand, Bitcoin and Litecoin have longer average block times (~10 minutes for Bitcoin and ~2.5 minutes for Litecoin), which prioritizes network security over transaction speed.

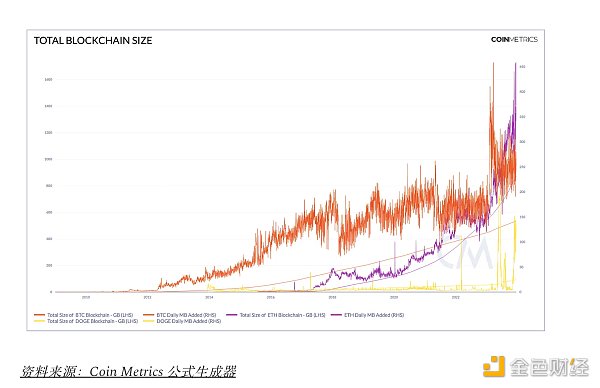

The same relationship can also be understood as a trade-off between the ease of participating in the consensus process and the performance of the underlying network. This is evident when we consider the size of a blockchain as a function of the size and creation rate of new blocks. Blockchains with longer block times and “smaller” blocks, such as Bitcoin, are easier to sync as a standalone node operator. Compared to Ethereum, the requirements are higher because the network performance requirements for faster block inclusion add up to larger download sizes and require higher-performance computers and network infrastructure to maintain comparable oversight of the network.

Fees and Economics

The primary product of a layer 1 blockchain is blockspace. Users and applications access this valuable resource by paying fees, typically in the network’s native token (i.e. ETH on Ethereum). These transaction fees serve two important purposes: first, they disincentivize network spam, and second, they serve as a subsidy or compensation for the miners/validators responsible for building blocks. However, the specific structure of the fee market can vary between different L1s. While some blockchains, such as Ethereum, employ an auction-based model where users bid for blockspace, others, such as Solana, use a more static fee structure based on the size of the data and computation required. These changes in fee structures mean that L1s react differently to changes in demand, impacting the user experience of transacting on the blockchain. Solana’s transaction fees are the lowest among the L1s shown in the above chart. Although the average fee has recently risen to about $0.059 due to increased congestion, its low fees make it one of the cheapest blockchains to trade. The Avalanche X chain, which is responsible for AVAX transfers, and the Avalanche C chain where the smart contracts are located, also have relatively low fees. Avalanche’s fee mechanism is similar to Ethereum’s EIP-1559, with dynamic base fees and priority fees that fluctuate according to the utilization of block space.

On the other hand, users on Ethereum have struggled with high transaction fees prior to the Dencun upgrade, which introduced an adjacent fee mechanism to price the use of blobspace. While average fees on Ethereum L1 remain relatively high (~$3), fees on Ethereum L2 solutions are effectively cost-free. Average fees on Bitcoin typically range from $1 to $4. However, on the day of the fourth halving, average fees spiked to $124 due to a surge in demand for newly released “Runes” of the protocol in the same block as the halving event.

Adoption and Usage Metrics

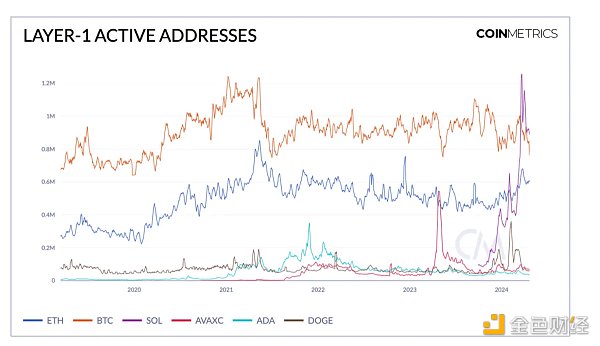

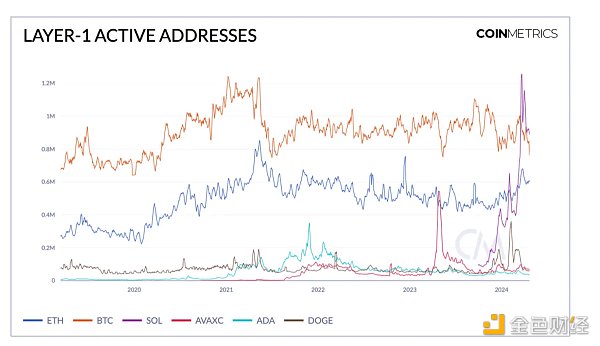

Having a high-level grasp of the technical capabilities and fee structures of the various L1s, we can dive into how they compare in terms of adoption and usage metrics. Active addresses (the number of unique addresses active in the network) for Bitcoin and Ethereum L1s have remained relatively flat at around 800K and 600K, respectively. Due to the presence of externally owned accounts (EOAs) and program-derived accounts (PDAs) on Solana, active address counts can be misleading. However, unique wallets on Solana rose to 1.2 million in March before tapering off to around 900,000. Other L1s such as Avalanche and Cardano also saw spikes but failed to sustain high levels of activity.

As stablecoins begin to proliferate across various L1s, the value transferred in each stablecoin provides an important proxy for its usage on these blockchains. Tether (USDT) maintains strong footing on Tron, with an adjusted transfer value of $14B and a median transfer value of $312 USD, thanks to its low fees and favorability for emerging markets. This is followed by USDC and USDT on Ethereum, which currently show transfer values of around $6B USD and median transfers of around $800 and $1000 USD, respectively. USDC is also gaining traction on the blockchain with the re-emergence of the Solana ecosystem, with an adjusted transfer value of $3B USD. Due to low fees, stablecoins on Solana have the lowest median transfer value, at $20 for USDC and $75 for USDT.

Adoption and usage metrics provide insight into the appeal of different L1 networks. The number of active addresses on Bitcoin and Ethereum L1s remained relatively stable, while Solana saw growth in unique wallets. Stablecoins such as Tether (USDT) and USDC have gained significant traction on various L1s, with Tron leading the way in USDT usage due to its low fees and appeal to emerging markets.

Conclusion

The landscape of layer-one blockchain networks has significant implications for the broader crypto ecosystem. As we have seen, L1 networks can be categorized based on their specialization (transaction settlement vs. general-purpose platform) and their architectural approach (monolithic vs. modular). These differences lead to variations in network performance, fee structure, and adoption metrics.

As the crypto ecosystem continues to evolve, understanding the nuances and trade-offs between different L1 networks is critical to understanding the broader dynamics and potential of the decentralized ecosystem. The emergence of new L1s and the evolution of existing networks highlight the continued innovation and competition in the space, ultimately benefiting users and driving growth in the decentralized economy.

JinseFinance

JinseFinance