Original title: Upcoming Demand for Bitcoin Block Space and Its Impact on Mining Revenue, author: Matthew Kimmell

Translator's Note: Perhaps what is different from all previous halving cycles is the change in the income structure of absenteeism, which is determined by the future price space of BTC and the current development status of the Bitcoin ecosystem. caused by a combination of factors.

Image source: generated using DALL-E 3

Key Key Points

Bitcoin halving will reduce the main source of income for miners. This leads miners to invest in more efficient machines and prepare for production losses.

Transaction fees are also expected to increase significantly due to atypical use of Bitcoin block space. These fees are becoming a more important part of mining revenue and may even offset the revenue reduction caused by the block reward halving.

Transaction demand has surged recently due to the resurgence of projects based on the Bitcoin network such as non-monetary use cases, such as on-chain marketplaces, collectibles, and multi-layer platforms.

These projects are also paving the way for other new revenue strategies, such as miner extractable value (MEV) and transaction accelerators, that leverage Bitcoin transactions Major changes in the market.

In the next halving period, transaction fees are likely to become the main source of miners' income.

It is also very likely and reasonable that the upcoming increase in transaction demand may make up for nearly half (~43%) of the halving's impact on fee revenue.

Introduction

Everyone is waiting for Bitcoin Zone The block reward halving is coming. While many in the community are celebrating, miners are even more concerned as they face a significant reduction in mining revenue. So, as the story usually goes, miners have been actively preparing for a drop in production. Install more efficient machines, reduce debt, and optimistically hope (beg?) that Bitcoin’s market price skyrockets.

But what if I told you that other factors in mining revenue may significantly or even completely offset the impact of the halving this time? The historically negligible transaction fees are likely to increase. And coincidentally, it started increasing at the exact moment, at the exact block, when the halving took effect.

My prediction of a significant increase in fees is based on the motivations behind many Bitcoin transaction changes. With new ways to use the Bitcoin block space, a whole new realm of users, developers, and businesses is forming, and their non-monetary use cases are bringing higher differentiation to the fee market. As we know it, simple peer-to-peer electronic cash systems are taking on more complex settlement forms. This isn’t the first time, but it’s happening at an unprecedented rate, to the point where these ancillary use cases are becoming real players in the fee market.

Users are choosing to use external software that allows them to view Bitcoin from a different perspective. One is like putting on kaleidoscope glasses, allowing users to see the Bitcoin supply dispersed in unique fragments rather than the flowing ocean of homogeneous units they actually are. Another example is reading data files that can be attached to transactions, allowing users to claim ownership of various media tied to the coins they receive (think NFTs to get the idea). As well, some interpret certain standardized messages across many transactions as the issuance or spending of an external asset, observe any such transactions on the chain, and create an ownership trail for a completely independent system of record (think sidechain or mainchain-based L2, L3...).

This is unconventional. This is also quite controversial. But that’s not what this article is about. We are not going to discuss whether Bitcoin is right or wrong, good or bad. This article will focus on a less discussed part of mining revenue: transaction fees, and how unusual demand vectors for Bitcoin transactions may offset revenue losses before and after the halving.

Unusual vector of Bitcoin transaction demand

< strong>Fungible Token Standard

Initial efforts to introduce new assets into Bitcoin were creative but crude. The early experiments actually laid the foundation for popular Ethereum applications (and Ethereum itself) while highlighting some of the challenges that ultimately killed Bitcoin adoption.

Projects such as Counterparty, Colored Coins and Mastercoin (later renamed Omni) were major innovations in the wider cryptocurrency space and led to initial coin offerings (ICO) and decentralized exchanges (DEX), as well as the birth and popularity of several other pioneer technologies. However, they have failed to gain widespread adoption and acceptance within the Bitcoin community. A combination of cultural unpopularity, scalability and other technical issues, plus the competitive environment created by the rapid growth of these use cases outside of Bitcoin, have limited their success. Adoption of these programs never really took off and even faded into obscurity.

However, demand for external assets is rising again. New attempts don't solve the challenges that have held back projects in the past, but today's market timing makes that different. Nowadays, awareness of Bitcoin has greatly increased, venture capital investment has increased, and, as silly as it sounds, the meme coin speculation craze is undoubtedly a significant contributor to this trend.

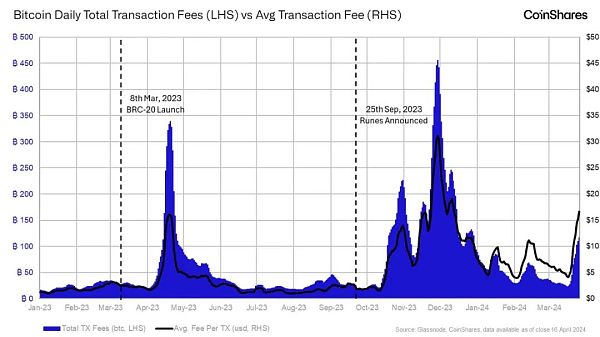

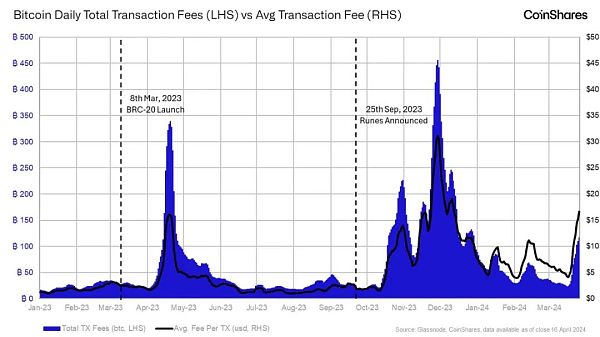

Whatever the reason, or whether it is sustainable or not, we are seeing significant growth in transaction demand from some new Bitcoin token projects . The BRC-20 asset, for example, has spent over $180 million (4.8k btc) in fees for issuance and transfers since its launch in March 2023. These transactions account for nearly a third (30%) of all Bitcoin transactions and have generated 17% of the total fees on the Bitcoin network since launch.

This is particularly relevant to the fee market at the time of the halving, as a new standard called Runes is being launched with significant upfront demand and growing focus on.

Demand for future Runes tokens has a market cap of over $1.2 billion, already half of all BRC-20 assets, and the market has only been open since around November. Note that the issuance of Runes tokens must be traded using Bitcoin, and when the BRC-20 asset was first released, fee levels soared to over $16 per transaction and over 300 BTC per day.

The potential impact is that when the Runes token is released, there will be massive transaction demand on Bitcoin for the issuance of external assets, which happens to be at the same block height as the halving. Meanwhile, other standards aren't giving up on Runes, with updates for BRC-20, Taproot Assets, and RGB still in the works.

If these transaction requirements are similar to when BRC-20 was first released, then the fee will likely reach 150 Bitcoins per day, thus offsetting the impact of the halving Mining revenue shrunk by a full third.

Runes won't be the only catalyst building trade demand, however.

Collectibles

Ordinals protocol announces a method , allows users to voluntarily agree to a tracking system for tracking the smallest unit of Bitcoin, called a satoshi (equal to 0.00000001 or 10^-8 btc). According to the Ordinals protocol, each unit is assigned an ordinal number. By adopting such a standard, each subdivision of Bitcoin would be labeled and identified along a continuous numerical line, from the first satoshi minted all the way to the last satoshi minted. In other words, when looking at Bitcoin units this way, each Satoshi becomes an individual non-fungible unit.

By opting in, users can also choose to embed additional uniqueness for their identifiable satoshis by attaching an arbitrary data file to any cell. These documents are called inscriptions. Users can mix Inscriptions with any Satoshis they own while retaining the ability to transfer and store such modified Satoshis on the Bitcoin network, similar to regular BTC.

As a result, many tiny units of Bitcoin have now been designated as images, text, and even complete video game files, making them unique from each other distinction and provides investors with a reason to value otherwise fungible units of Bitcoin differently.

The collectible value of certain satoshis has been verified by the open market due to numerical meanings or related inscriptions.

As far as we know, the highest auction price of a satoshi so far is US$240,000. Its inscription is called "Genesis Cat" and is known as "Genesis Cat". A 1/1 artwork of cultural and political significance, it is part of a series of similar inscriptions intended to symbolize and support the restoration of previously removed functionality from the Bitcoin protocol. Another Satoshi with no attached inscription sold for $165,100 and was advertised as a rare supply unit due to its provenance dating back to Bitcoin’s first difficulty period.

The evidence of these sales is encouraging for those looking for expensive satoshis. The purpose of Bitcoin units changing hands on the secondary market at prices well above their usual market price is to change the propensity of certain users to pay transaction fees. It’s safe to say that the purchasing power of collecting a satoshi can run into hundreds of thousands of dollars, making fee bids much higher than most peer-to-peer transactions.

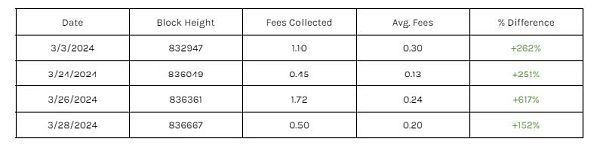

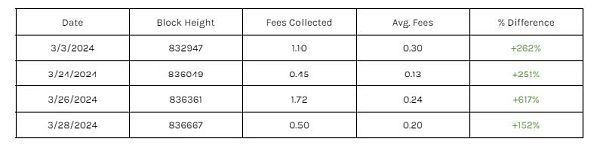

Given that the halving was a completely predictable and scarce event in Bitcoin's history, there was a certain inevitability in collecting satoshis and inscribing the first block. There will be competition. Demand for the first minted satoshis after the halving is expected to be so valuable that the Foundry USA mining pool even plans to share its proceeds with miners if they are lucky enough to win a block. It may be short-lived, but this intense competition will almost certainly cause fees to skyrocket.

Privacy Transaction

Another alternative to typical needs Possibilities are deal accelerators. Marathon launched a product called Slipstream in late February, creating a way to circumvent Bitcoin's mempool (native transaction waiting room) by giving users the option to communicate and pay for transactions directly with the MARA Pool. The product does not offer a sustainable advantage in terms of earning fees compared to other mining pools, but there are several successful examples.

Although accelerators such as Slipstream are not widely popular, as long as With enough demand, they may raise fees indirectly. If a transaction is submitted directly to a mining pool, it will not be known to any other Bitcoin users in advance. As a result, users may find that their transaction, the next one to be processed, actually has to continue waiting because those transactions submitted directly to the pool are covertly included. This can leave consumers confused as to how much precise processing fee should be attached to encourage prompt processing of transactions. As enough transactions flow to these accelerators, a multi-sided market for fees emerges, one public as part of the Bitcoin protocol and one private.

In cases of extreme emergency, users may choose to pay far more than what is actually expected in the open market. This confused fee market can lead to increased fees. We don't see this really happening on any meaningful scale, but it's certainly worth watching.

Miner Extractable Value (MEV)

MEV is Another emerging dimension of Bitcoin’s block space requirements. MEV refers to a situation where miners have the opportunity to earn additional profits by manipulating the order of transactions within a block. Previously, MEV was primarily a potential feature of Bitcoin that was often limited due to its more rigid nature and simpler transaction model. However, due to changes in the Bitcoin software, and changes in the way some users conduct Bitcoin transactions, the possible vectors of MEV will become more apparent, as we alluded to in this article. Here is a brief description:

Collection: Certain inscriptions The high value tags of satoshis, and the inefficiencies of market technology, lead to additional fees being earned through buying or "sniping" and reselling mispriced market items, and sacrificing fees in pursuit of higher value satoshis

**Tokenized assets (Runes, BRC-20, RBG, Taproot Assets, and possibly other assets)**: The above agreement Providing a homogeneous asset opens the door for miners to engage in front-loading and arbitrage trading to earn additional rewards.

Bitcoin Plugin: With the increasing number of external platforms, or so-called "Layer2" With the rise of Bitcoin and the use of Bitcoin to settle value, miners may be able to exploit vulnerabilities in early designs and additional incentives to achieve higher revenues.

Another halving means another reduction in block rewards and a relative increase in the importance of transaction fees to miners. This may provide additional incentives for miners to drive interest related to trading options and seek to diversify their income methods. As mercenaries in a highly competitive industry, we believe that the MEV strategy will at least be tried.

The relationship between the transaction fee market and miners is getting closer and closer

The diversification of Bitcoin transaction demand may play a redemptive role in the mining economy. Since the halving event reduces block rewards, these new uses of Bitcoin block space could significantly increase transaction fees. This is crucial for miners as these fees offset the loss of block rewards and maintain their profitability.

As mentioned previously, near-term fee increases will be driven by increased competition in new market segments, including issuance of outside assets and the search for unique collectibles. Not only do these applications incur additional transaction fees, but they may also encourage a more strategic approach to transaction processing.

Ultimately, the shift to a more complex and transaction fee-reliant economic model highlights the importance of understanding and leveraging new demand vectors to remain competitive.

Looking forward, current transaction fee levels are expected to account for about 14% of mining revenue after the halving, which is already several times higher than in the past few years. . However, I expect this percentage to get much higher, well over 50% in some blocks. Looking back at the two-month period towards the end of 2023, this was largely driven by high demand for Inscription, with average fee levels accounting for 30% of mining revenue post-halving. If we just repeated this average (193 BTC per day), we would cover 43% of the impact of the halving.

Given the current development trajectory, it makes perfect sense that transaction fees may become the main source of income for miners during this halving period. However, the sustainability of these non-monetary demand drivers remains an open question. Are they leading a long-term shift in the Bitcoin trading market, or are they just a temporary symptom of a bull market? Can only wait for time to verify.

Wilfred

Wilfred