Written by: Evan, Joy, Aaron J, Waterdrip Capital

1. Now is the time to prioritize Mass Adoption

Mass Adoption has always been the core challenge of Web3. However, the market tends to focus on short-term wealth effects and ignore the sustainability of projects and the key factors for achieving Mass Adoption. Since the launch of BTC in 2009, looking at many tracks, only centralized exchanges such as Binance have exceeded the 200 million mark with their number of users, becoming the first typical product in the Web3 field to achieve Mass Adoption.

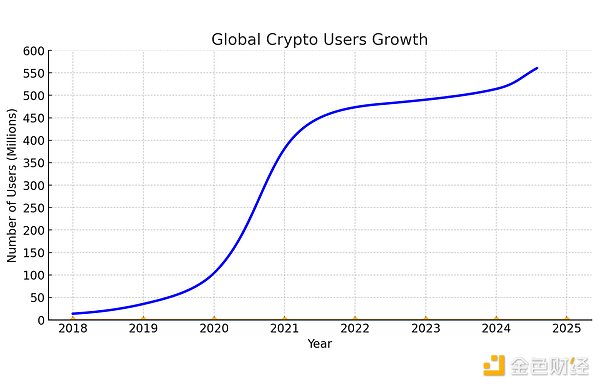

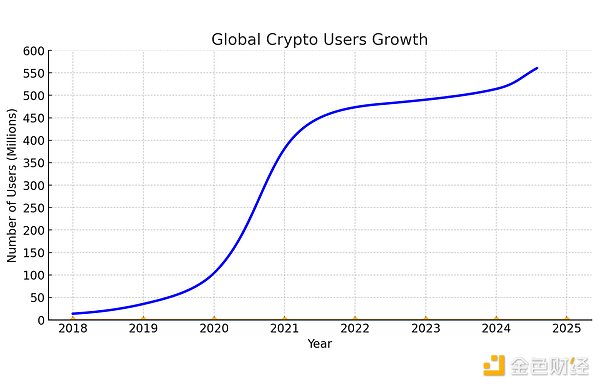

With the passage of BTC ETF, the market ushered in a bull market that belongs exclusively to BTC OGs and believers. In contrast, due to insufficient liquidity, the performance of new coins is unsatisfactory, and altcoins are far from showing the phenomenon of flourishing in the last bull market. Most Web3 users have not enjoyed the prosperity of the bull market. In the last bull market, the number of crypto users grew rapidly from less than 50 million in 2019 to 420 million in 2022, an increase of about 10 times. However, from the beginning of 2024 to date, the number of global crypto users has only increased by 30 million users, a much lower growth rate than the last bull market.

Global Web3 user growth chart, data source: Triple-A, https://www.triple-a.io/cryptocurrency-ownership-data

From the perspective of first principles, the fundamental reason for the gap lies in this, and because of this, now is the critical moment to put Mass Adoption into explicit construction.

2. Obstacles to Web3 achieving Mass Adoption

A16Z emphasized in its "big-ideas-in-tech-2024" report that simplifying the user experience is the basis for Web3 to achieve Mass Adoption.

Binance pointed out in its "Road to One Billion On-chain Users" report that achieving Mass Adoption requires two core conditions: one is that there are on-chain applications that users want to use; the other is that these applications must be easy to understand and access. Many products that have achieved product-market fit (PMF) and successfully crossed the cycle have confirmed these two core conditions. At the same time, the crypto industry also needs to build the necessary infrastructure, tools, and public awareness to make the concept of "digital ownership" understandable and accessible to the global community.

Mark Suster, managing partner of Upfront Ventures, a long-established venture capital firm in Los Angeles, mentioned that if you want to build a Mass Adoption product, in addition to PMF, you also need to make the product profitable and have a large enough target market.

Mass Adoption is not only about acquiring users, but also about capturing the liquidity in the hands of users.

IOBC Capital believes that solving the problem of compliance channels for traditional institutions to enter Web3 is also the key to Web3's realization of Mass Adoption. Compliance issues are regarded as soft infrastructure. With the approval of BTC/ETH ETF, the establishment of BlackRock RWA Fund, and the candidates in the US presidential election adding the construction of Web3 to their campaign promises, the development of relevant policies and compliance channels has shown a steady and irreversible trend.

To summarize, Web3 needs to meet the following conditions to achieve Mass Adoption:

1. Satisfy a real demand (i.e. PMF);

2. The target market has at least billions of people or tens of billions of US dollars;

3. Low user adoption threshold and high product usability;

4. Mature upstream and downstream supply and infrastructure to support the core value and experience of the product;

5. Ability to acquire users on a large scale and accurately;

6. Possess a long-term sustainable business model.

We can see that for conditions 1-4, there are many projects in the Web3 field that have been focusing on investment and are constantly improving. Telegram and TON have brought dividends to condition 5. But there has been little progress in condition 6. But the core logic lies in this:

PMF ≠ business model, a good product does not mean that you can make money

Without sustainable profitability, it is difficult to acquire customers on a large scale and accurately in the long term. After all, airdrops can only bring low-cost bursts to projects in the early stages. If they cannot make sustained profits, who will pay for the airdropped chips in the long term?

Looking back at the last cycle, DeFi, GameFi, NFT and Metaverse have all provided sufficient power for Mass Adoption, and all of them match the above requirements: Axie Infinity and YGG solved the income problem of a large number of unemployed people in the Philippines during the epidemic, and STEPN matched users' fitness needs and lowered the user threshold through the built-in wallet. However, so many projects that have achieved remarkable results, but due to the lack of sustainability of the business model, the value of non-financial return products cannot impress users to pay, resulting in their inability to continue the mission of Mass Adoption. This provides us with valuable experience and lessons.

3. Advantages and challenges of TON ecosystem in achieving Mass Adoption

3.1 Advantages

Social fission network based on 1 billion users - able to acquire users on a large scale

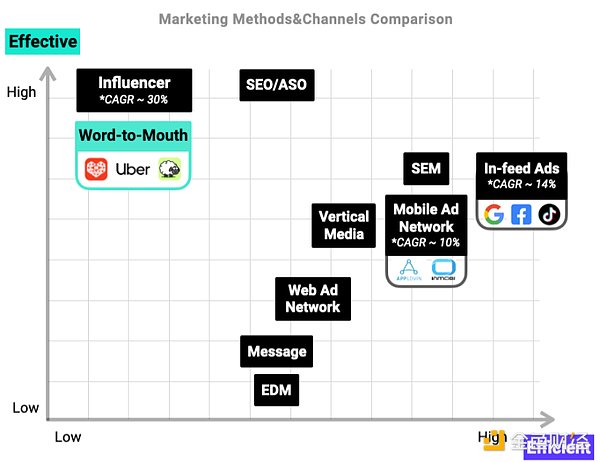

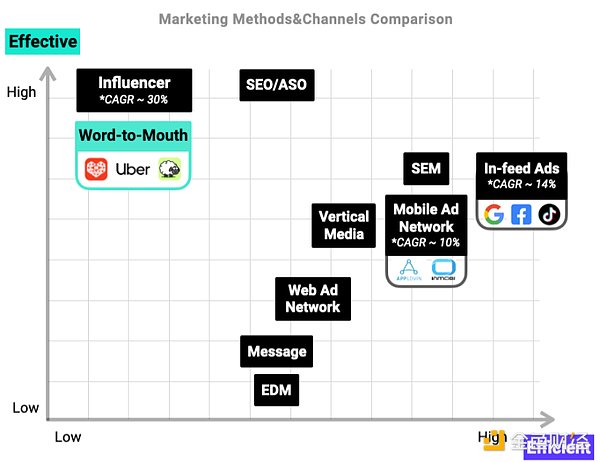

As of now, Telegram has 950 million monthly active users, and its social network provides a broad space for the implementation of social fission marketing for projects. Social fission (Word-to-Mouth) marketing is one of the most efficient ways to acquire customers on a large scale, and large-scale and efficient acquisition of users is an important prerequisite for achieving Mass Adoption.

Comparison of marketing methods and channel effects in the Web2 era, data source: Miniton

Relying on this advantage of the TON ecosystem, the TON ecosystem has successfully nurtured multiple ecological projects with tens of millions of users, of which 60% of the active projects belong to the game category. Among them, Notcoin was the first to achieve this goal, and has attracted more than 35 million encrypted users since its launch. Its token $NOT took less than a month from launch to release on the exchange, and achieved a 400% increase within two weeks of launch, becoming one of the few Alt Coins with outstanding performance in this bull market.

Further attract developers through the mini-program framework - maximize coverage of end-user needs (PMF)

For ecology and infrastructure, the PMF of products is a probabilistic problem. Ecology can solve the PMF problem by increasing the number of products - there will eventually be a product that can meet user needs. Obviously, the combination of Telegram mini-programs + TON ecology has attracted a large number of developers to develop a large number of mini-programs to infinitely meet the various needs of users.

Developers are entering Telegram and TON for clear reasons: there are a large number of users here, and the conversion rate from exposure to opening the application is very high: Mini Programs provide users with the shortest access path, no need to enter the URL, no need to download, just click and use - this not only lowers the user threshold, but also improves the conversion rate of product acquisition users.

Banana Gun is a Telegram robot that will be launched on Binance on July 18, 2024. It not only facilitates automated and manual transactions on the Ethereum network, but also supports users to manually buy and sell tokens on the Solana network. Undoubtedly, the success of Banana Gun is due to the support of robots and mini-programs provided by Telegram, as well as the advantage of reaching users on Telegram.

Highly integrated MPC wallet - low threshold, high ease of use

TON currently provides users with two wallet tools: Telegram Wallet and TON Space. Except for users in the United States, other users can open Telegram Wallet by adding the wallet robot and start TON Space in the Telegram Wallet mini-program. When conducting transactions within the Telegram app, from account registration to transfers, and then to every payment, the Telegram wallet provides the most convenient user experience at present, with an experience close to that of WeChat Pay.

With the low-threshold wallet provided by the TON ecosystem, Catizen in the TON ecosystem has achieved a 10% on-chain user conversion rate, with 25 million players, about 1.5 million on-chain game players and more than 500,000 paying users worldwide, and in-game revenue of more than 16 million US dollars.

On July 23, Binance Labs announced an investment in Pluto Studio, Catizen's issuance platform. He Yi, co-founder of Binance and head of Binance Labs, said: "Binance Labs has always been keen to support projects like Pluto Studio that have the potential to attract billions of users to Web3. We look forward to supporting more visionary builders who aim to build products designed for mass adoption."

3.2 Challenges

Single reliance on Telegram

The biggest advantage of the TON ecosystem is that it has the official and exclusive support of Telegram: it is the only Web3 infrastructure integrated with and promoted within Telegram. This is both an advantage and the biggest risk. Any changes in Telegram may have a systemic impact on TON. For example, on the day when Telegram founder Pavel Durov was arrested, the TVL of the TON ecosystem fell by more than 60% in a single day, highlighting the systemic risks behind the single reliance on centralized organizations.

DeFi track is underdeveloped

Although users are the basis of funds, not all products and teams have the ability to monetize traffic. We believe that the current widespread phenomenon of insufficient payment ability of Telegram users is not an ecological problem, but a product form and team problem. For example: Catizen and a considerable number of Trading Bot/applets have captured the liquidity behind Telegram traffic very well. At the same time, in the high-income Web2 WeChat mini-games, about 60% of the traffic comes from decentralized product fission. Despite this, the TVL scale of the TON ecosystem is still unreasonable, which is mainly related to the lack of DeFi projects. Currently, STON.fi and DeDust account for 80% of the total TVL of the TON ecosystem.

Imperfect Commercial Services

Developers usually focus on four aspects of the ecosystem:

1. Platform scale

2. Infrastructure integrity

3. Efficiency in reaching users

4. Support for traffic monetization

Among these four aspects, the third and fourth points are commercial services/infrastructure. In these two aspects, TON has only achieved 50% of each point.

In terms of reaching users, TON has achieved large-scale and efficient reach: the current customer acquisition model of the TON ecosystem, excluding the sharing fission model, is mainly based on the non-performance marketing CPM method of Telegram Ads and the point wall diversion between mini programs. However, due to data privacy protection, accurate reach and performance marketing cannot be achieved unless Telegram violates its product principles and collects a lot of user privacy data.

In terms of traffic monetization, TON provides excellent payment tools, such as Web3 payment tools Telegram Wallet and TON Space, and Web2 payment tool Telegram Star. However, most of the products that best match user needs are not suitable for paid monetization methods, such as free tools and light games. These free products that are not suitable for paid monetization often establish a stable and reliable business model, which is an indispensable prerequisite for products to achieve Mass Adoption. The lack of commercial services/infrastructure in the TON ecosystem seems to have become the last unclear obstacle to building Mass Adoption products.

There are also many participants in the issue of business model sustainability. MiniTon is a commercial monetization service provider funded by the TON Foundation. It provides TaaS (Tournaments as a Service) profit solutions for casual game and competitive game developers to help them get rid of the dilemma of relying solely on advertising monetization. Based on the Friend Tech protocol, it reconstructs the social operation model of the game to establish a sustainable and stable Web3 business model.

The profit model of competitive games (EF & RK) is listed as one of the three major game monetization models along with the profit models based on advertising (IAA) and in-game purchases (IAP). This model has been widely used in PvP games such as chess and card games. The annual market size of such games in the Web2 market exceeds 30 billion US dollars, and it has always been the best-selling category in social programs. It is known as the driving force of Mass Adoption in the Web2 field. MiniTon uses encryption technology to not only seamlessly combine the profit model of competitive games with Telegram. At the same time, it uses encrypted social protocols to optimize the operation model of PvP games with a market size of more than 30 billion US dollars.

MiniTon received key investment and incubation from Waterdrip Capital in the early stages of development. At present, MiniTon has provided players with a social competition platform. Through game battle contracts, players can also get the experience of e-sports in stand-alone casual games and establish new social connections. Developers can access the monetization solution provided by MiniTon in just 1.5 days of development time by accessing the SDK.

So far, MiniTon has completed the closed beta of Alpha I, with the number of users participating in the internal beta reaching 30,000, and achieved a 1% payment conversion rate. It is expected that the Alpha II test version will be launched at the end of September, and the test scale will be expanded to hundreds of thousands of users.

It is worth noting that MiniTon's game contract is a multi-chain protocol that does not rely entirely on a single ecosystem, so it has a strong ability to resist system risks.

4. How much success and failure experience can the TON ecosystem learn from WeChat?

4.1 Is WeChat worth learning from?

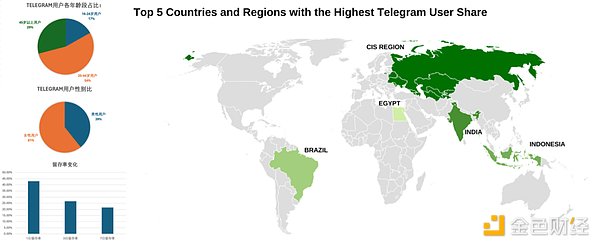

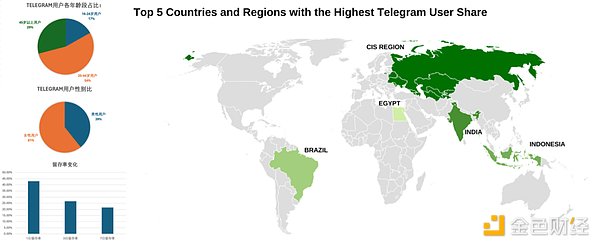

Like Telegram, WeChat is a social product with communication and social relationships as its core. However, there is a huge difference between Telegram users and WeChat users. The following is the user data of Telegram in the past week based on third-party monitoring:

Telegram user data overview, data source: Waterdrip Capital

4.2 The user profiles of Telegram and WeChat users are different:

Excluding the differences in the geographical distribution of the population, the most significant difference between Telegram and WeChat lies in the user's usage habits:

WeChat is a typical acquaintance social and strong social relationship application. Telegram is a pan-social relationship application, more similar to QQ.

The average daily usage time of WeChat is 1.5 hours. The average daily usage time of Telegram is 0.5 hours.

As of the end of June 2024, the monthly active user scale of WeChat Mini Programs has reached an astonishing 930 million, with a penetration rate of over 90%. The customer acquisition advantage, plus WeChat's mature commercial service infrastructure, is the core reason why developers succeed in the WeChat Mini Program ecosystem:

1. Ultra-lightweight user access path: no need to download or enter a URL, just click and use

2. Effective customer acquisition based on social relationships: about 60% of traffic comes from user sharing

3. New incremental market: According to data, in February 2024, the monthly active users of WeChat Mini Games will be 755 million, even exceeding the 650 million users of mobile game apps

But it is undeniable that Telegram is still the product with the highest penetration rate in the crypto track. Cutting into the existing high-net-worth crypto track users can offset the current shortcomings of Telegram mini-programs. Therefore, the successful model of WeChat mini-programs is completely worthy of reference.

4.3 Project construction paths that can be referenced from the WeChat mini-program/mini-game ecosystem

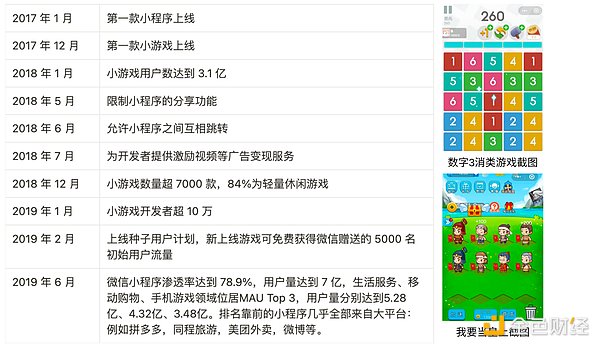

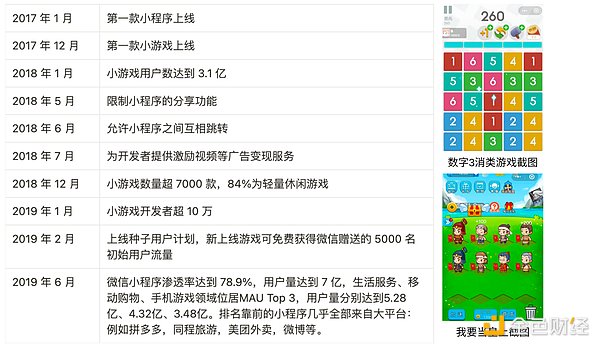

By combing through the development history of the WeChat mini-game ecosystem, we found that the survival of WeChat mini-game developers is highly dependent on the level of developer services provided by WeChat officials.

WeChat Mini Program Development Timeline and Project Examples, Source: Waterdrip Capital

WeChat Mini Program Wild Growth Timeline

During this stage, WeChat operations lagged behind, and the ecosystem developed wildly: Since a large number of users can be easily obtained through fission sharing, there are a large number of "skin-changing" games that take 5 days to develop + 3 days to complete cost recovery after going online, resulting in relatively rough game quality.

During this stage, the distribution of mini games adopts a decentralized approach, and the main source of customer acquisition depends on other mini programs and WeChat advertising.

During this period, the income of mini-games and free mini-programs mainly came from advertising (IAA) monetization, that is, importing users to other mini-games or mini-programs, and connecting to WeChat advertising monetization plug-ins.

It is worth referring to Web3 developers: By comparison, Telegram is also in the current stage. Excluding the phenomenal game "Pirates Are Coming" during this period, 98% of the top 50 games during this period were casual and casual competitive games. For example, "Happy Landlord", "Digital Match 3", "Brain Fight", "Geometry Escape", "I Want to Be the Emperor", etc. Among them, the gameplay of "I Want to Be the Emperor" belongs to the same type of gameplay as Catizen today.

2020-2022, ecological adjustment

During the epidemic, this period had certain macro-specificities, such as the health code applet had 800 million users in 2020.

As of October 2022, the monthly active users of WeChat applet reached 1 billion. On the one hand, the WeChat applet ecosystem focuses on increasing the scale of traditional industries, such as education, medical care, and catering. On the other hand, it guides the game industry to improve product quality, provides developers with more than 100 functions and interfaces, and continuously improves its own commercialization (IAA and IAP) services.

During this period, the only phenomenal product of WeChat mini games was "Sheep". Due to WeChat's continuous improvement of the requirements for the quality of game content and the restrictions on sharing fission behavior, WeChat mini games have shown a smile curve. But judging from the results, WeChat's operation strategy is successful. Among the selected games, 50 games have revenues exceeding 50 million, and 7 games have revenues exceeding 100 million.

WeChat mini-game user "smile curve", source: Waterdrip Capital

It is worth referring to Web3 developers: The best-selling games during this period are still casual competitive products, such as chess and cards. From the perspective of gameplay: card, MMORPG, management, and placement games have the highest revenue.

2023 to date, stable and explosive

Thanks to WeChat Mini Games' continuous guidance of developers to develop high-quality content, and the continuous optimization of technical underlying support for mini games, a large number of medium-heavy and high-income games have emerged.

According to Tencent's Q1 2024 financial report, the total user usage time of WeChat Mini Programs increased by more than 20% year-on-year. The revenue of WeChat Mini Games in 2023 increased by 3 times compared with 2022, and more than 240 games had quarterly turnover of more than 10 million in one year.

Reasons for the explosion of WeChat Mini Programs/Mini Games during this period:

WeChat Mini Games and Mini Programs are allowed to advertise on external WeChat platforms (such as TikTok), further improving the efficiency of advertising;

Live streaming has been added as a new customer acquisition channel;

The top best-selling game categories have gradually changed from chess and card games to MMORPG, placement, card and management;

Commercial monetization has shifted from a single IAA or IAP to a mixed monetization (both IAA + IAP).

4.4 Lessons TON can learn from the growth of WeChat Mini Programs

Continuously work to solve the problems that developers are concerned about (PMF), such as improving compatibility with game engines, improving customer acquisition efficiency, opening external performance marketing channels outside Telegram to Telegram Mini Programs, increasing wallet penetration, and increasing support for commercial solutions;

Have a fast response speed to adjust to the market like WeChat (there will be multiple adjustments to WeChat's ecological operation policies every month in the early days);

Provide support for each start-up product as much as possible, such as providing a special, free traffic support policy for each mini program (compared with the preferred policy of WeChat mini programs);

Encourage the ecosystem to produce high-quality content.

JinseFinance

JinseFinance