What is DeSci / Pump Science? What do the popular tokens mean?

You who hype memes are like civets in a melon field, wandering back and forth between the zoo/AI/DeSci.

JinseFinance

JinseFinance

Author: ZetaChain; Translation: Golden Finance xiaozou

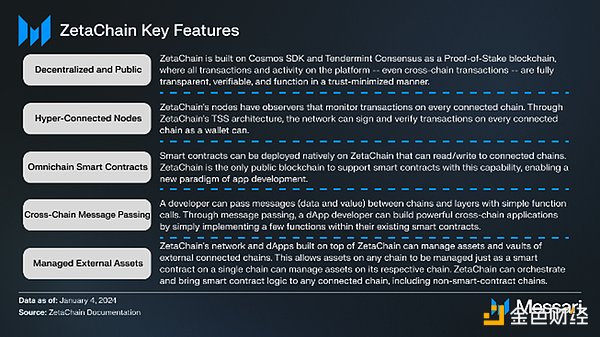

ZetaChain is a Layer-1 (L1) blockchain that provides chain-agnostic interoperability through its full-chain contract services. It allows applications developed on ZetaChain to connect with any other application or blockchain.

ZetaChain leverages the Cosmos SDK and Tendermint consensus mechanism to enable developers to custom build scalable interoperable blockchains.

The network also has an execution layer compatible with the Ethereum Virtual Machine (EVM), called zEVM. Developers can choose between full-chain contracts, which bridge different blockchains, and cross-chain messaging (CCM, which transfers data and value information across blockchains).

ZetaChain’s full-chain application introduces far-reaching chain abstraction capabilities. Recent initiatives, such as Sushi’s native Bitcoin support, highlight that the Bitcoin market within DeFi is far from untapped.

ZETA is the native token of ZetaChain and will be used to pay gas fees, call smart contracts and ensure network security through staking. Once ZETA is released, holders can earn rewards by staking tokens.

ZetaChain was launched on December 15, 2021 by an anonymous team whose members Have working experience in Coinbase and Basic Attention Token (BAT). Several former Coinbase employees serve as project advisors to ZetaChain, including Nathalie McGrath, Coinbase’s original head of people, and Juan Suarez, who served as an internal consultant at Coinbase for 10 years. On March 9, 2022, the team released the ZetaChain white paper and DevNet, and completed the initial seed round of financing for an unknown amount. Investors in this round include Dan Romero, Sam Rosenblum, John Yi, JD Kanani and HwiSang Kim. ZetaChain completed its second round of financing in August 2023, raising 27 million from investors including Blockchain.com, Human Capital, Vy Capital, Sky9 Capital, Jane Street Capital, VistaLabs, CMT Digital, Foundation Capital, LingFeng Capital, GSR and other investors Dollar.

The ZetaChain test network was released in August 2022 and quickly attracted a large number of users to participate. In the first month after its release, the number of users reached 150,000. By March 2023, the million user milestone will be reached, coinciding with the launch of validator incentives. ZetaChain continues to operate in the testnet phase. As of December 19, 2023, the official release date of the mainnet has not yet been announced.

ZetaChain is an L1 blockchain that enables interoperability between unrelated chains. The network features block times of only about 5 seconds and finality, without the ability to confirm or restructure transactions. Applications developed on ZetaChain will be able to connect with any other application or blockchain, providing new and existing crypto users with a single access point to Web3. This is achieved by leveraging full-chain smart contracts that can read and write to any other blockchain, even those that do not natively use smart contracts. Developers can also use ZetaChain’s Connector to send data and value messages to any chain with simple function calls.

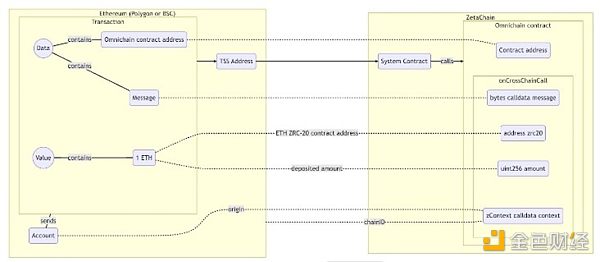

The full-chain contract must implement cross-chain call execution, and only needs to be deployed once on ZetaChain, and then can be connected to the external chain. Linked Chain can also transfer digital assets to contract addresses on ZetaChain. Assets transferred to ZetaChain adopt the ZRC-20 token standard. Full-chain contracts support efficient deployment of existing popular protocols on Ethereum, such as Uniswap and Aave. They can also be integrated with networks that are not smart contract compatible, such as Bitcoin. The gas fees generated by the full-chain contract are settled using the native gas token of the target chain.

In short, the full-chain contract on ZetaChain provides a future-oriented way of cross-chain functionality, with one-time deployment and immediate access across all integrated networks. This model leverages a synchronous execution environment and is instantly compatible with any new chain supported by ZetaChain, thus avoiding the hassle of redeploying or recoding for different blockchains. Therefore, the full-chain contract is the link for cross-chain interaction and improves user experience by minimizing cross-chain gas fees.

The main advantage of full-chain contracts is their ability to achieve unified status and execution. In CCM and other similar systems such as LayerZero and Axelar, applications with non-uniform states often require complex solutions. However, full-chain contracts support a unified single state, ensuring smooth operation for most use cases. Full-chain contracts can serve as a natively accessible complement to CCM by minimizing inbound and target transaction gas fees while not relying on multiple messages.

Cross-chain messaging (CCM) is an alternative to full-chain contracts. CCM is used to transfer data and value messages between blockchains, while ZetaChain is the middleman. Developers deploy full-chain contracts on ZetaChain, while CCM-enabled contracts are deployed on external chains. The contract then calls the ZetaChain Connector API, and ZetaChain forwards the message to the target chain, where the CCM-enabled contract on the target chain receives the message. The state is stored in a set of CCM-enabled contracts on different chains.

CCM is useful for applications that only require one-way and asynchronous logic/effects, but do not require (or do not benefit from) unified state. The main purpose of CCM is to enhance existing applications on external chains through cross-chain functionality. The gas fees generated by CCM-enabled contracts are denominated in ZETA tokens and must be sent to the Connector contract on the source chain.

ZetaChain also uses a burn/mint (destroy/mint) mechanism to protect the security of digital assets transferred using CCM contracts. The assets are burned on the source chain and minted on the target chain. This mechanism is more secure than bridging or wrapping because these methods hold the transferred assets.

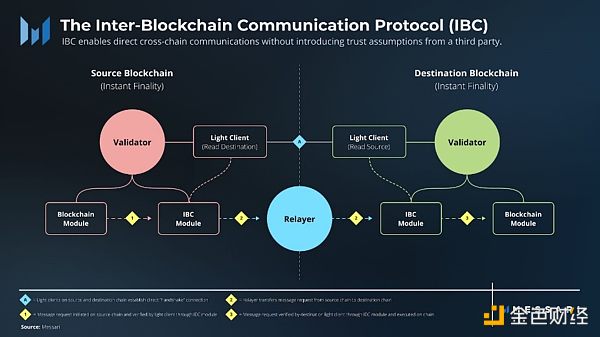

ZetaChain is an open source framework developed and built using the Cosmos Software Development Kit (SDK), which is used to build permissionless public rights and interests. Proof-of-Stake (PoS) blockchains and permissioned Proof-of-Authority (PoA) blockchains. The Cosmos SDK helps developers build new blockchains and launch, test and integrate the network after creation.

The Cosmos SDK provides a modular framework that can customize new blockchains for specific user needs. It also supports parallel chain operations to accommodate increased throughput needs as user demand grows. Since the Cosmos SDK ensures interoperability, it allows digital assets and their value to be transferred between different blockchains built using the framework. It also supports a proof-of-stake consensus module and decentralized governance through community proposals and voting. In addition to these features, the SDK also includes security measures such as firewalls to safeguard blockchain applications. Due to its numerous features, the Cosmos SDK has been used to build some famous applications and blockchains, such as BNB Chain, dYdX, Osmosis, and Celestia.

The Tendermint consensus mechanism is An asynchronous Byzantine Fault Tolerant (BFT) state machine operated by a validator. Validators take turns proposing and voting on transaction blocks. A block is proposed at each height of the chain, and if the proposed block is not approved by other validators, then a new validator will propose a block for that height. To gain approval, two stages of voting must pass. These two stages are called "pre-voting" and "pre-commit". When more than two-thirds of the validator voting weight approves a block in the same round of voting, the block is finally confirmed.

Voting weight is determined based on the asset pledge weight denominated in each specific blockchain. In the case of ZetaChain, validator node operators must stake ZETA tokens. Since ZetaChain is a delegated proof-of-stake blockchain, ZETA token holders who do not operate a validator node can delegate ZETA tokens to existing validators. The ratio of tokens controlled by a single validator (delegated and self-staking) to the total number of tokens controlled by all validators determines the staking weight and thus the voting weight.

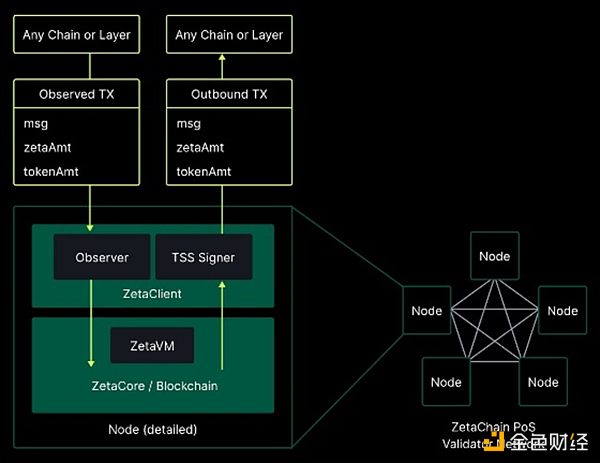

The specific architecture is as follows:

ZetaChain’s architecture mainly consists of a decentralized validator network that reaches consensus on external states and events and is responsible for updating external chain status through distributed key signatures. Each validator node contains a ZetaCore and ZetaClient, which are bundled together and run by the same operator. ZetaCore generates blocks in the blockchain and maintains a replicated state machine, while ZetaClient observes events on external chains and signs transactions destined to those chains.

ZetaChain’s verifier can be a Basic Validator, an Observer or a Signer of the Threshold Signature Scheme (TSS).

The basic validator has a specific consensus key and is responsible for Block proposals are voted on, and voting rights are obtained by staking ZETA. Basic validators need to be online at all times and able to participate in block production. In addition, running the two verification nodes of observer and TSS signer also requires running the basic verification node. In comparison, running Basic Validator has much less overhead in terms of software and hardware requirements.

The observer is responsible for reaching a consensus on the events and status of the external chain. Observers monitor transactions, events, and status on these external chains at specific addresses operated by the full nodes of each external chain.

This type of verifier can be further divided into Sequencer (sequencing) and Verifier (verification) roles. Sequencer observes relevant external behavior and reports the information to Verifier, which then verifies and votes on ZetaChain to achieve a simple majority consensus on external behavior. For this process to be effective, many validators need to be involved; however, only one Sequencer is required to report to the validator.

TSS signers on ZetaChain hold part of ECDSA /EdDSA key. Threshold Signature Scheme (TSS) is a digital signature verification method used in multi-party computation (MPC) cryptography. In MPC, private keys are generated from "key fragments", each key fragment is held by a separate party or node. TSS allows the use of a private key when a set key fragment threshold is reached, without requiring all key fragments. For example, if there are 9 people holding key fragments and the set threshold is 5, then as long as 5 of the 9 key fragment holders provide the key fragments they hold, the private key can be used.

Keys used for authentication interactions with external chains are stored throughout ZetaChain and distributed to multiple signers according to the TSS method described above. ZetaChain uses tokens staked by validators as collateral against malicious validators to ensure that TSS signers will not sign messages on external chains on behalf of ZetaChain.

There are some risks inherent in modular system architecture. These systems can increase complexity, security challenges, and composability dilemmas, while also creating greater complexity for developers. ZetaChain’s full-chain approach appears to solve many of these problems, but deep-rooted underlying issues in a multi-chain world may limit demand for ZetaChain and its solutions.

Similarly, ZetaChain may face similar risks that Bridge has faced repeatedly over the years. Keen analysis of the risks associated with bridging and interoperability will help better protect the platform as it bets its offerings on a connected blockchain future.

While ZetaChain’s PoS mechanism provides a strong security model, it also risks creating a network that is overly dependent on a small group of validators. That said, ZetaChain’s cycle selection system may be a trade-off, even if its efficacy has not yet been fully evaluated. ZetaChain is not alone in facing the dilemma of bootstrapping a reliable active validator set, as evidenced by its overall relatively low Satoshi coefficient.

ZETA is Zetachain’s native token and will be released together with the Zetachain mainnet. At the time of writing, a specific release date has yet to be announced. Once ZETA and the mainnet are released, the token will be mainly used to pay gas fees, call smart contracts, and be used for staking to ensure network security.

Validators and token holders will be able to stake ZETA and receive rewards. ZETA will also become the primary value transfer on ZetaChain, supporting transfers between connected blockchains using a one-way peg mechanism. Under this mechanism, the number of ZETA tokens being transferred will be burned on the source chain and minted on the target chain. Staking parameters have not been specified yet, but the project has listed the hardware requirements for running a validator node. No information has been released regarding the total supply or specific allocation of ZETA. The project team claims that ZETA will be one of the first multi-chain tokens issued across multiple chains and layers.

In today’s multi-chain world, users increasingly need to be able to interact seamlessly across various networks. Multi-chain users may find themselves drawn to the full-chain approach advocated by ZetaChain, rather than shuttling between bridges, chains, wallets, and other requirements. This paradigm shift reduces transaction friction and enhances security while giving developers the freedom to deploy applications on the chain that best suits them.

ZetaChain’s emerging full-chain application field reflects this potential by introducing chain abstraction functions. Initiatives like Sushi’s native Bitcoin support highlight how far untapped the Bitcoin market is within DeFi, especially given the recent discussion surrounding Bitcoin ETFs. Additionally, it makes sense to suggest that supporting smart contracts through ZetaChain’s ZRC-20 standard could stimulate the development of Web3, DeFi, and SocialFi applications. As of October, the ZetaChain ecosystem has 150 applications. As shown in the infrastructure diagram below, the ZetaChain ecosystem has expanded to include a variety of participants in different fields.

As mentioned before , the ZetaChain testnet had 150,000 users in the first month after its release in August 2022. In less than a year, user base grew to 1 million, a milestone that coincided with the launch of validator incentives. As of this writing, the testnet has processed 37.6 million zEVM transactions and 14 million cross-chain transactions from more than 2.5 million zEVM unique addresses.

As ZetaChain carves out its niche in blockchain interoperability, it will have to contend with both forms competition. First, ZetaChain’s relevance may be affected by the outcome of the monolithic vs. modular blockchain debate. Compared to cross-chain ecosystems, Ethereum’s rollup-centric approach has significant advantages in terms of users, developers, and liquidity. But beyond that, ZetaChain also faces inherent competition from various players.

Axelar is created from the same underlying Cosmos SDK as the underlying technology of ZetaChain. Axelar is committed to full-stack interoperability, a holistic approach that includes not only asset bridging but also permissionless cross-chain smart contract execution and dApp support. The Axelar community has adopted a three-part strategy to expand its connected network (currently 55). The expansion of network connectivity is driven by economic restructuring, Axelar virtual machine deployments for frictionless connectivity, and the pursuit of leaner solutions such as light clients. Compared with Axelar's comprehensive but potentially complex system, the unified execution environment provided by ZetaChain allows users to enjoy a simpler experience, lower gas fees, and better meet messaging needs.

Unlike Axelar, LayerZero stands out from ZetaChain because of its infrastructure. It is not a blockchain and thus provides developers with greater flexibility in terms of protocol implementation. Nonetheless, LayerZero relies on centralized oracles and relayers, which require a higher degree of trust, especially since it runs on a dual-chain entity multi-signature system. Therefore, LayerZero may experience complications with its CCM-type interoperability, just like Axelar and other similar chains. In contrast, ZetaChain promises to position itself as a potential trust-minimized alternative due to its on-chain operations.

THORChain is another direct competitor of ZetaChain that is natively integrated with the Cosmos ecosystem Integrate and adopt similar blockchain development toolkits. Like ZetaChain, THORChain is committed to interoperability and facilitating the flow of assets between different blockchains; however, it uses a unique mechanism to focus on liquidity and security, creating a unique niche.

THORChain is an automated market maker (AMM)-based protocol, similar to Uniswap, but different. All assets in the THORChain system are paired with their native asset RUNE. In doing so, THORChain creates a DEX that prevents liquidity fragmentation across pools and ensures that any asset on THORChain is interchangeable with any other asset. In contrast, ZetaChain can take advantage of its more decentralized validator mechanism, wider compatible chain, or relatively relaxed requirements for node operations. Furthermore, THORChain is application-specific, while ZetaChain is a general smart contract platform. This enables ZetaChain users to not only directly compete with THORChain, but also build other applications and use cases beyond DEX applications.

In summary, ZetaChain aims to provide seamless connectivity and accessibility for Web3 applications. To achieve this, it leverages its L1 blockchain infrastructure, Cosmos SDK, and Tendermint consensus algorithm. With its full-chain smart contracts and cross-chain messaging capabilities, ZetaChain enables developers to connect and interact with any blockchain, including those that do not support smart contracts.

As a delegated proof-of-stake chain, ZetaChain will achieve further decentralization through its token ZETA. In addition to protecting network security, ZETA will also be used to pay gas fees and is the main value transfer. As ZetaChain gets closer to its mainnet launch, it has the potential to promote interoperability and enhance the capabilities of the broader blockchain ecosystem.

Despite ZetaChain’s potential, its path to success is not without challenges. At the time of writing, ZetaChain is still a relatively new L1 and has not yet launched on mainnet. As with almost all blockchains, achieving mainstream adoption is a difficult task, especially when existing competitors are strong.

According to the near-term roadmap, the ZetaChain team plans to focus on increasing user and developer adoption. The roadmap emphasizes enabling more chain integrations, greater interoperability between different dapps and different asset types (especially support for Bitcoin NFTs), and providing SDKs for full-chain dapp developers. At the same time, the team will study how to improve ZetaChain’s security and efficiency by upgrading some of the network’s features.

Ultimately, compared to the focus areas of Axelar, LayerZero and THORChain, ZetaChain should highlight its unique selling points - such as its architecture, verification mechanism or transaction efficiency - in the competition. In this way, ZetaChain can effectively "enclose" the market and occupy a position in the competition by leveraging areas where it can bring greater value to users.

You who hype memes are like civets in a melon field, wandering back and forth between the zoo/AI/DeSci.

JinseFinance

JinseFinanceThe difference between Based Rollup and traditional Rollup.

JinseFinance

JinseFinanceBy using Ethereum for sorting, Taiko aims to be more decentralized than Rollups that use centralized sorters, which describes the situation for most L2s today.

JinseFinance

JinseFinanceETC, the full name of which is “Ethereum Classic”, can be translated into Chinese as “Ethereum Classic”. It is an open source blockchain platform that can be used to write decentralized applications (DApp) run and driven by smart contracts.

JinseFinance

JinseFinanceAOVM is an AI layer protocol built on top of @aoTheComputer, combining AO's hyper-parallelism with AI large models.

JinseFinance

JinseFinanceRecently, the airdrop released by the cross-chain interoperability L1 public chain @zetablockchain has attracted market attention on the "chain abstraction" track. What is chain abstraction, what are the difficulties in full-chain interoperability, and what are the core features of ZetaChain?

JinseFinance

JinseFinanceDencun includes 9 EIPs that enhance everything from security to the staking experience.

JinseFinance

JinseFinanceAs a product of its times, Dogecoin has its own set of problems. DogeLayer is here to fix just that.

Max Ng

Max NgZetaChain is teaming up with Galxe to let users explore the power of omnichain functionality. Check out the guide for instructions to claim these OATs!

Nell

Nell Cointelegraph

Cointelegraph

Please enter the verification code sent to