Source: Jinshi Data

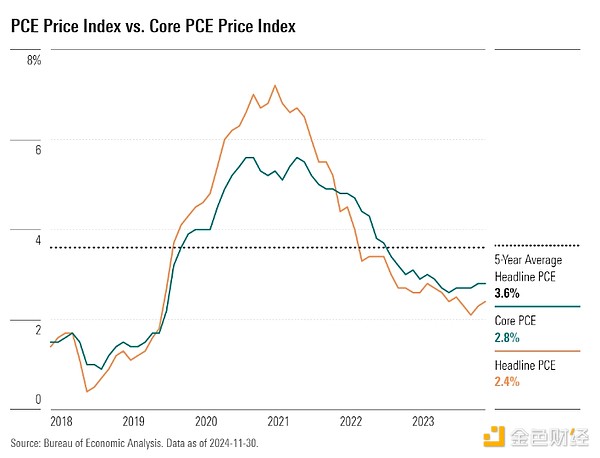

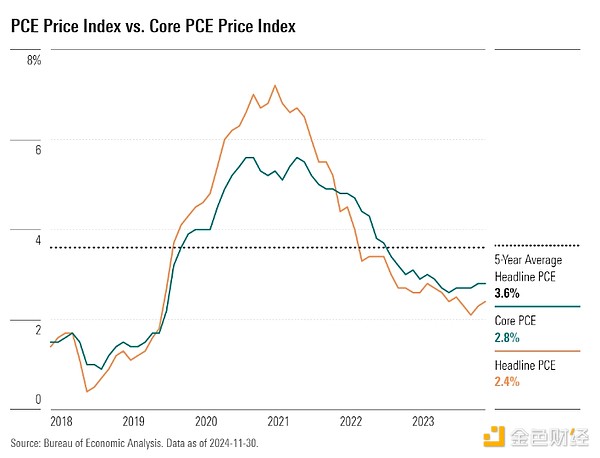

On Friday, the latest readings of the Federal Reserve's favorite inflation indicator will be released. According to market consensus, the December personal consumption expenditures price index (PCE) report will show that core inflation continues to slow, although rising gasoline prices have put upward pressure on the overall PCE.

The latest PCE report comes as the Federal Reserve is entering wait-and-see mode, and the market generally expects the Federal Reserve to keep interest rates stable in the coming months.

While price pressures in the United States have steadily eased from their peak two years ago, investors are now struggling with a series of unanswered questions. These questions involve the impact of Trump's policies and the possibility that the Federal Reserve may keep interest rates at higher levels for longer than initially expected.

According to FactSet consensus estimates, economists believe that the overall PCE in December rose 0.3% month-on-month and 2.6% year-on-year, both of which were higher than the previous value. They expect the month-on-month growth rate of core PCE inflation (excluding volatile food and energy prices) to accelerate by 0.2% and maintain the year-on-year growth rate at 2.8%.

While the overall PCE may rise in December, Russell Price, chief economist at Ameriprise Financial, said, "We continue to make progress on inflation."

He expects the overall PCE to increase by 0.3% month-on-month in December and the core PCE to increase by 0.2% month-on-month, in line with market consensus estimates. "We still expect both data to make further progress in the coming months and may approach (but not quite reach) the Fed's target of about 2% by mid-year," he said.

Many of the raw data in the PCE report are released in advance, such as the Consumer Price Index (CPI). That means economists already have a good idea of what to expect from Friday's PCE data.

The December CPI report showed that while overall inflation rose slightly due to higher energy prices, core inflation continued to slow. Markets cheered the report, which eased investor concerns that price pressures were building again.

Price doesn't expect the market to react the same way on Friday, even though the data is likely to show the same."There are already numbers that suggest inflation is easing, and the PCE should show a similar message," he said.

Economists generally expect the core PCE to continue to decline in the coming months, even though sticky service prices continue to put upward pressure on the index. "If we don't see another surge in inflation, the year-over-year core PCE growth rate will fall to a low of 2.2% in March, assuming inflation doesn't surge again, like we saw in the first quarter of 2024," predicts Preston Caldwell, senior U.S. economist at Morningstar.

When will the Fed cut rates?

The Federal Reserve held interest rates steady at its first meeting of the year earlier this week, a move that came as no surprise to markets. The policy-setting committee noted in a statement that "inflation remains somewhat elevated." With the economy still growing and the labor market showing no signs of softening, officials have room to wait for more evidence of cooling price pressures before taking another rate cut.

"Maintaining a pause is a very rational and reasonable view," Price said, citing strong consumer spending, employment and economic growth data. He expects the Fed to cut rates by a quarter point at its June meeting.

Some strategists are even suggesting the Fed is done with its rate-cutting cycle after cutting rates by a full percentage point last fall. "The labor market is stabilizing and inflation is running just above target," economists at Bank of America wrote in a note to clients earlier this month.

After this week's Fed meeting, Nomura now expects the Fed to remain on hold through 2025, compared with its previous forecast for one rate cut. Meanwhile, Goldman Sachs reiterated that they still believe the Fed will cut rates twice, but it is a reduction from the three cuts earlier this year. Earlier this month, Barclays also lowered its expectations, predicting that the Fed will only cut once this year.

Gold bulls are in full swing

On Thursday, spot gold soared to a record high, approaching the $2,800 mark after US economic data showed that economic growth slowed less than expected. In addition, Trump's reaffirmation of the 25% tariff on Mexican and Canadian imports also boosted gold's safe-haven demand. Investors are now turning to PCE data for further clues on the trajectory of interest rates.

"Repeated tariff threats have fueled safe-haven flows into gold... Any unexpected downside in inflation data could indicate greater policy flexibility from the Fed, which could bring forward expectations of rate cuts and provide further support for gold."

KCM Trade chief market analyst Tim Waterer said that gold could rise further if the tariff threat turns from a bargaining chip into an economic reality.

With the resumption of the upward trend in gold, the path to $2,800 is clear. Fxstreet analysts said that bulls may then challenge key psychological levels such as $2,850, $2,900 and $3,000. On the other hand, bears must pull gold prices below $2,750 to have a hope of testing $2,700. A break below this level will open up more downside space. The next key support level is $2,663, which is the confluence of the 50-day and 100-day moving averages.

Alex

Alex