Written by: Zixi.eth, 321 DAO member Source: X, @Zixi41620514

< p style="text-align: left;">Continuing the article I wrote in December last year, we will open another article to summarize what happened in 2023 and look forward to the future in 2024. 2023 is a process of starting from low and moving high, with the secondary market continuing to rise. However, at the same time, the primary market continues to be deserted. It gives me the feeling that the primary market may be even more deserted than in 2022. This may come from:

1. The primary market lags behind the secondary market by about half a year, and new entrepreneurs have not yet entered the market;

2. Old entrepreneurs continue to pass away (they go to AI);

3. There is an extreme lack of new stories. Most of the stories currently on the market are old stories that are cooked to perfection.

The entire article is the same as last year, divided into three parts. It mainly explains what was optimistic about this year but was disappointed, what is optimistic about next year, and what needs to be observed next year.

1. What was promising this year but was beaten in the face?

1.1 Developer Tools - Everything in the world is beneficial

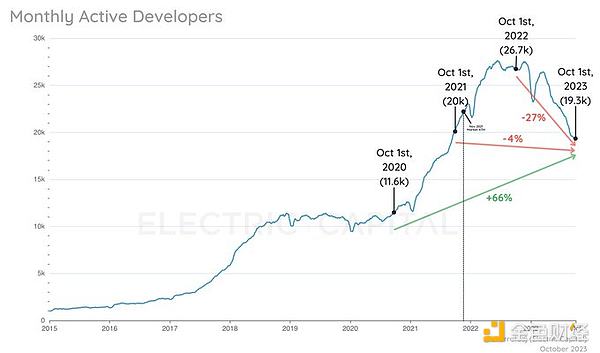

Compared to 2022 During the same period, crypto MAD fell by 27% year-on-year, but thankfully, there was still a 66% increase compared to two years ago. Due to the decrease in new developers and the loss of old projects, the size of the developer tools market has declined to a certain extent this year. In addition, because the primary market for AI is so good in North America and China, many engineers have chosen to join the AI Nuggets.

So overall, the scale of the developer tools market has declined to a certain extent this year. This is reflected in Alchemy's primary and semi-market valuation - compared with the last round valuation of US$10.5 billion, the current valuation is only about US$3 billion. Consensys’s valuation of US$7 billion is now only around US$3 billion. But we are still confident in this market in 2024-2025.

We have also seen the growth of domestic developer tool data. For example, the number of developers on the Chainbase platform was 800 last year and increased to 6,000 in December this year. As the most directly beneficial track for developers to enter, if 24-25 is the next bull market, then the increase in the developer tools track will be very significant in 24-25. And I also believe that there will be a series of MA opportunities for developer tools in 24-25 years.

1.2 NFT—besides PFP, what else can it be?

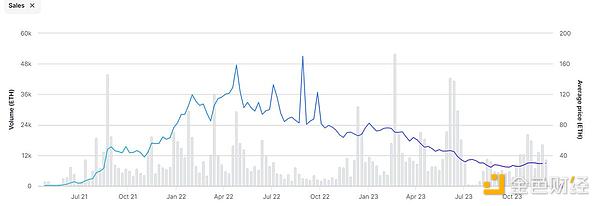

The traditional PFP story has made it difficult for people to pay for it. The picture below shows the price trend of BAYC in the past one or two years. In 2022, Yugalabs also launched a combination of APE + Monkey Land, which made the market fomo for a while. However, this year's NFT market is very deserted, and it is difficult for large investors to pay tens of thousands or hundreds of thousands of dollars for NFT. In addition, Azuki has also given the market another chill. The AZuki Elemental launched this year is equivalent to directly copying and pasting one-click generation to start printing money. It is difficult to feel the team's dedication.

But it is worth noting that there are still some interesting projects appearing in this year's NFT market. For example, Little Penguin took the NFT + offline toy route and indeed gained North American popularity. The market's unanimous praise has allowed us to see the new route of pfp NFT.

Although NFT is on a declining trend this year, we have also seen the uses of NFT besides PFP, such as the commercial value of entities + NFT (Li Ning/adidas+ Monkey), brand pass card (Starbucks), opera/concert ticketing, etc. NFT may gradually evolve into a "technology" in traditional industries next year.

2. What are you optimistic about next year?

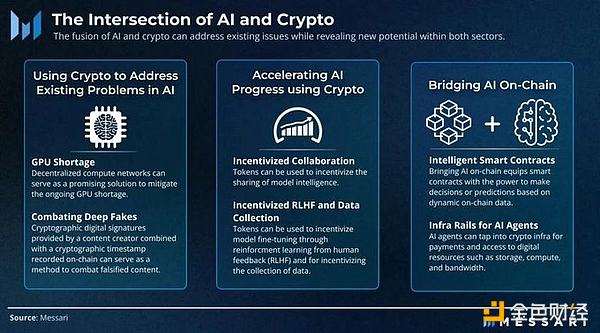

2.1 AI+Crypto——2B or 2C?

Let me make an interesting point first. If there is a bull market in 2024-2025, we will see a certain amount of 2C games/social/C. AI/Chatbot-like web2 AI projects have embarked on the path of web3 currency issuance. This view comes from the fact that many 2C AI projects we have seen this year have relatively high homogeneity and relatively low income ceilings. Moreover, due to the increasing cost of computing power, it is difficult to even out the profit statement. After investing investors’ funds, exit channels should also be considered.

When income/game play/growth stagnates, issuing Utility tokens to increase game play is actually an idea that can be considered - on the one hand, issuing tokens is a very A good mkt strategy can also bring web2 users into the market (now the technology of wallet and account abstraction has developed well), so it may be a win-win for web2/3. In addition, this group of AI 2C entrepreneurs are also very young and have a high degree of acceptance of new things, which may also contribute to this.

Getting back to the topic, I simply divide crypto+AI into two categories: 2C and 2B. The 2C ones are similar to Myshell, NFprompt, Worldcoin, etc., and the 2B ones are more, such as Modulus Labs, ChainML, EZKL, Questlab, http://Flock.ai, Gensyn, etc. I won’t go into details about 2C’s AI products. Whether they are games or http://C.AI products, they have been verified successfully in web2, and we have also seen it in web3.

Myshell-like voice robot communities are booming. Because Crypto+AI is still in its early stages, it is still mainly 2B, such as serving project parties and providing them with on-chain agents; serving project parties and companies to do ZKML verification; serving LLM/Text to Video models or AI related companies, crowdsourcing data annotation, etc.

There is another interesting point about 2B AI companies, especially the data and computing power sides, both of which are platform businesses - the upstream is computing power/data annotation On the demand side (such as various model companies), the midstream is the distribution platform for computing power/data annotation, and the downstream is various large, medium and small C. The blockchain schedules long-tail retail investors downstream through a reward mechanism, but currently, data annotation scheduling is easier to implement, and the team has also obtained annotation orders from many large model companies. Scheduling computing power is difficult, especially when it comes to scheduling large-scale heterogeneous GPUs.

We have seen the vigorous growth of projects in many directions of 2B, and we are also looking forward to the performance of AI+Crypto in business and currency issuance next year.

2.2 Regulatory compliance - institutions have entered the market

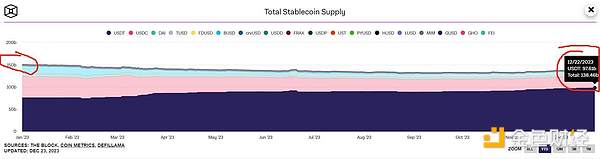

Regulatory compliance is an eternal theme. In fact, the growth rate at the end of this year is very high. Most of it comes from everyone's pricein for Blackrock BTC ETF. The increase in the past month or so has been a good proof - "Just imagine that some traditional funds can enter the market, and there will be great growth."

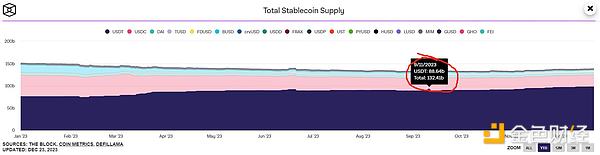

At the beginning of 2023, the market value of stablecoins was US$150 billion. September 23 was the lowest time for stablecoins in the past one or two years, with a market value of US$132.4 billion, and the market was outflowing. Nearly 18 billion US dollars. However, BTC has risen from US$17,000 to US$26,000, which means that mainstream funds have withdrawn, and the liquidity in the market has sucked blood from copycats to Bitcoin. However, from September to December this year, stablecoins only had an inflow of 4 billion US dollars in 3 months, and BTC rose from 26,000 to 44,000.

We assume that not many traditional funds enter the market (after all, traditional funds think that the blockchain is a scam, and there is not much investment in the primary market), then This part of the money may be old people in the currency circle + traditional funds who know ETFs. So once the BTC ETF is passed, the market will flow into the mainstream institutions with another 10 billion US dollars and 20 billion US dollars in one or two years. So how high can crypto rise? The analysis here will wait until the year-end summary in 2024 before reviewing it.

There are several topics that I think are good regulatory compliance related:

1 .Stable currency 2. Exchange (Onchain/Offchain, especially for Perpetual) 3. Asset management. This part will not be described again.

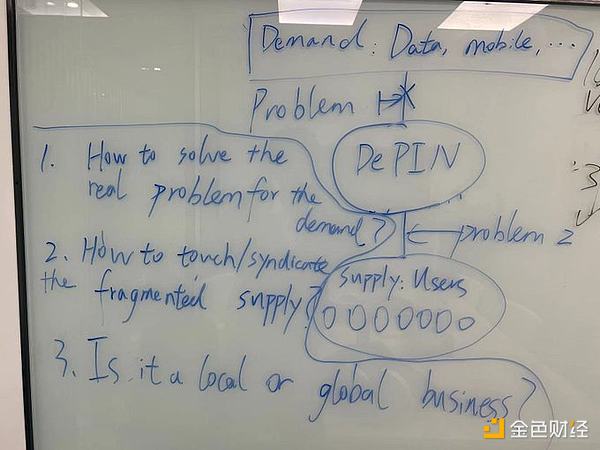

2.3 DePIN - How to use Crypto Distribution

I have seen many interesting projects recently, among which DePIN is the most interesting. It can be summarized as, XX+Crypto. XX is the main business, and Crypto is the distribution method. For example, Helium's main business is Wifi, and Crypto/token is the distribution method; Hivemapper's main business is that users feed map data to suppliers who need data, but uses Crypto for distribution; Questlab's main business is to help people obtain data The AI companies that are in demand do data annotation, but they just use Crypto to distribute it. Why use Crypto for distribution? I think this is the same as the logic of trading/coin speculation. Instead of directly telling users that they can make 100 yuan a year, it is better to give users a hope that they can make money. Moreover, using Token as a settlement method is more convenient than cash, especially in cross-border settlement for a wider range of users.

To complete a DePIN project, I divided it into three major questions.

The first big question is, what are the problems with the real demand of the upstream? For example, the real demand in Helium and Helium mobile is that communication data is expensive and the signal is not good. It costs a lot of money to lay out 4G and 5G base stations. There is no large centralized company in the United States that can do similar things, so we need decentralization. spread; data annotation is a real need of AI companies, and someone needs to help solve the problem of data annotation; rendering is a real need, so idle GPUs are needed for offline rendering; inference and training are also real AI needs, so it is needed Idle computing power serves AI companies.

The second big question is how to access and syndicate these fragmented resources and connect them to the DePIN platform to serve the B-side. Quickly promoting the C-side was actually a difficult problem before. In traditional web2 businesses, such as e-commerce, community group buying, taxi-hailing, etc., the essence is to burn VC money to promote growth. But in Web3, it becomes ponzi to promote growth. The community relies on ponzi (actually burning the money of the people behind it) instead of burning VC money to grow. This has been done in Axie/YGG/Stepn/Helium, etc. It is already a mature model in many cases.

In addition, for downstream contacts, the simpler the product, the easier it is to access it, such as playing online games GameFi, running Stepn, data annotation, and installing a Smart sockets are very simple things; but if you want to promote something that is not available in your life, such as installing a signal box at home, it will be relatively difficult.

As for how to syndicate downstream to connect upstream needs, some are relatively simple to solve using scheduling methods, such as offline rendering, data annotation, bandwidth crawler, etc.; but there are some Complex upstream requirements, such as heterogeneous GPU scheduling inference/training, etc., are difficult to achieve.

The third big question is, is this a local or global business? There won’t be much explanation on this aspect. Global’s business will reach B and C faster, while Local’s business will reach slower. This is reflected in how many users and needs there will be in the end, as well as what the final project can achieve. How big.

3. What to observe next year

3.1 GameFi√/SocialFi?

First of all, you must understand Crypto and token market value, which is a good emotional amplifier and a good Mkt tool.

In 2022/2023, we have seen that there are very good teams in the East and the West playing games. For example, there are Funplus/Xterio, Matr1x, etc. in the East, and there are also teams in the West. bigtime. Coupled with the sudden online game opinion draft on December 22, I believe this will (force) help Eastern game entrepreneurs to go overseas. This is a very big plus for Web3 Game. We are looking forward to seeing Axie/Stepn-like Eastern phenomenon-level game products again in 2024.

We have discussed before that social products may not be suitable for web3, because social networks have been very solidified in web2, and we do not need to reshape social relationships. But this year http://Friend.tech has provided a very good way to play. Trading friends' keys is actually no different from issuing inscriptions and assets in IEO (both are plates). We still hold a relatively conservative attitude when it comes to web3 social networking.

3.2 L2 - Internal and external troubles

The Infra theme narrative in 2022 is Modular blockchain, and everyone is optimistic about execution, consensys, settlement Compatible with DA. And from 2020 to 2022, the technical barriers to L2 are indeed very high, so the valuations of Arbitrum, Op and several major ZK projects are very high. I still remember that when analyzing L2 in 2021, we felt that the first-mover advantage of the ecosystem was very important with reference to the development of L1. Therefore, we will first be optimistic about OP L2 in 3-5 years, but we will still be optimistic about ZK L2 in the next few years due to technology iteration.

But the iteration of technology seems to be far beyond our expectations. OP Stack can issue OP L2 with one click; now Rollup as a service company can even issue it with one click ZK L2 has very high composability, so the barriers to L2 development are currently very low. In 2022, only 4 ZK L2s could be named. Now in 2023, there are at least more than 10 ZK L2s on the market, and there are at least 5 more RAAS companies. The battle for L2 will be very fierce in 2024. Blur/Blast even told VCs and retail investors that NFT Mktplace can not only vampire attack Opensea, but also other L2s.

In addition, the EVM Competitors that are still alive now all have special skills, such as Tron for payments, BSC for games, and Solana for DePIN. In the future, how L2 will win the internal battle and how it will compete with EVM Competitor externally will be a very, very cruel battle. It may not be weaker than the Hundred Regiment War, the E-commerce War, and the Large Model War.

It is no longer 2020/2021, and the technical barriers to public chains have been much lower. In 2024, it is no longer an environment dominated by public chains. Head DApps can choose top public chains at will, but it is difficult for top public chains to choose top DAPPs (unless they spend money). The current ecological path for public chain verification is: use your own strengths and take a path that others have never walked before. You cannot copycat. Only by leveraging your strengths can you win in differentiated competition.

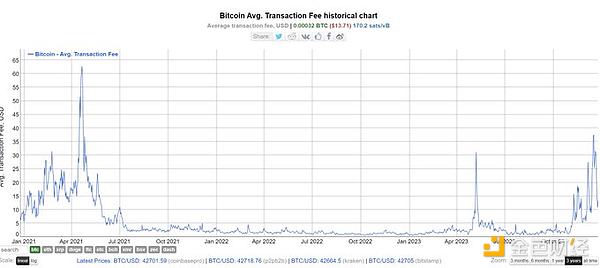

3.3 Bitcoin Ecology - Is it a return to value or a bubble?

First of all, I very much agree with the view of a senior in Singapore: an overflow of 1% of Bitcoin funds will create a huge ecosystem, and due to the If the currency network is stuck, the speed and effect of capital overflow will be greater.

In 2023, we will see the carnival of the Bitcoin ecosystem. The Bitcoin ecosystem has indeed gone through the four-year old path of the Ethereum ecosystem in one year. But can we really create a unique ecosystem instead of replicating the old path of Ethereum (DeFi three-piece set + oracle + meme generation)? Institutions still need to be observed, but individuals can be shuttled.

The market this year is focused on bottoming out. When token2049 ended in September this year, I felt that the industry was almost over. Especially after investing in ai+crypto, it was difficult to see meaningful new stories. However, the market picked up after October, and the increase convinced people and brought confidence back to everyone.

In fact, if you think about it carefully, this market has already undergone too many iterations in 2022-2023. In the DeFi market, dex has gradually transitioned from spot to derivatives, and institutions DeFi is increasingly accepted; developers from major web2 companies in the game market have basically completed research and development, and will start publishing in 2024; L2 has overcome many technical difficulties, and we can already issue OP and ZK L2 with one click; AI+Crypto also has There are many markets that can be used, such as data and computing power; Friend.tech has also appeared in social networking; many developers have poured into the Bitcoin ecosystem; Solana has been reborn, and depin has developed rapidly.

2024 may be more exciting than the 2020/2021 bull market. I will continue to update next year’s article.

Beincrypto

Beincrypto

Beincrypto

Beincrypto CryptoSlate

CryptoSlate Others

Others Finbold

Finbold Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph