Source: XT Research Institute

In the first half of 2024, the cryptocurrency market experienced many major events. For example, the BTC spot ETF was approved, the ETH ETF is about to be approved, and now there is an expectation for the SOL ETF. At the same time, the global economy has begun to enter a cycle of interest rate cuts. Although it is not clear when the United States will cut interest rates, its inflation has been well contained, which is undoubtedly a big boon to the crypto market. In addition, changes in regulatory policies are still one of the key factors affecting the crypto market. There are differences in the positions of governments on cryptocurrencies, and the adjustment of regulatory systems will also become an important variable in determining market trends. In the last quarter, BTC fell by 16%. The continuous outflow of institutional funds and the lack of breakthrough technological innovation have brought certain difficulties to the entire cryptocurrency market. BTC is currently fluctuating between $56,000 and $70,000, and investors are generally in a wait-and-see state. In such an environment, is now the best time to buy at the bottom? Will the cryptocurrency market usher in a new round of bull market in the second half of the year? These issues deserve our in-depth discussion.

1. Timeline of important crypto events this month

Entering July, in addition to the above-mentioned important project time nodes, the crypto market still needs to pay close attention to:

MT.Gox's Bitcoin repayment plan in June caused a sharp drop in the market. We need to continue to pay attention to this dynamic in July;

Large amounts of tokens such as WLD, SOL, ALT, XAI, and ARB will be unlocked;

FTX creditors will vote to decide whether to pay in cash or cryptocurrency;

In terms of mainstream public chains, Cardano will usher in a Chang mainnet hard fork; HNT has a new sub-network proposal; Arbitrum's ARB will launch a staking function;

left;">Finally, Jupiter's JUP will reduce its total supply by 30%, Gala Games' G token will be rebranded 1:60, and Orion ORN will launch a Lumia brand upgrade.

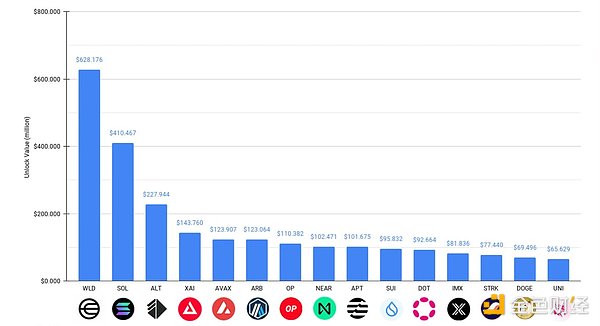

Many tokens are facing large amounts of unlocking. The following figure shows the top 15 projects in terms of unlocking volume in July according to @Token_Unlocks:

$WLD has the highest unlocking value this month, exceeding $600 million, and the unlocking scale accounts for 53.36% of the current circulating supply.

$SOL ranks second, with an unlocking value of more than $400 million. $400 million seems like a lot, but due to the high market value of $SOL, the unlocking amount only accounts for 0.5% of the current circulating supply.

$ALT has seen significant unlocking this month, with nearly 45% of the current circulating supply unlocked.

$XAI has also seen a high unlocking this month, accounting for 71.59% of its current circulating supply.

Ethereum's second-layer $ARB, $OP, and $STRK will see unlocking of 120 million, 110 million, and 70 million USD in July.

2. Macro Data Analysis

After entering July, the focus of the macroeconomy is still on when to cut interest rates. Fed Chairman Powell has long said that the timing of the interest rate cut will be determined based on two key factors (4+2 indicators) - inflation and unemployment. Against the backdrop of major changes in the current international landscape and the profound impact of Sino-US industrial adjustments on the global economy, these changes will not show results in the short term.

The annual rate of the core PCE in the United States in May, released last Friday, fell to 2.6%, the lowest in three years, providing confidence support for the September rate cut. However, how the economic data in July and August will perform remains the focus of market attention. The decline in the core PCE in May was mainly due to the decline in the prices of housing prices, automobiles and crude oil. However, after entering July, the prices of these three factors have rebounded, and the expectations for the core PCE data in June are not optimistic, so the smart money in the market did not bet in advance.

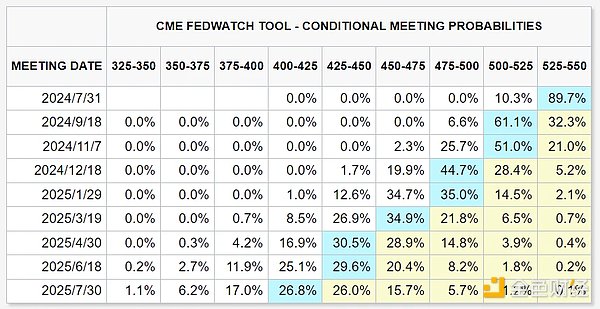

It is worth noting that after the release of the core PCE data in May, the Chicago Mercantile Exchange (CME) Federal Reserve Observation Tool showed that the market's expectation of the Federal Reserve's 25 basis point rate cut in September rose to 61%, and the possibility of another rate cut in December was 44.7%. Although expectations of rate cuts have risen, the market remains cautious, especially before the release of June data, and the market's attitude towards risky assets such as Bitcoin also reflects this cautious sentiment. Although Bitcoin faces downside risks, its downside is limited in the absence of major negative news.

In addition, changes in the international economic environment cannot be ignored. The industrial adjustment between China and the United States is having a profound impact on the global economic landscape, and this process may take a long time to fully show its results. This adjustment has an important impact on the global supply chain, trade relations and investment flows, and the market needs to keep an eye on it.

The economic data in the next few months will have a key impact on market expectations and the Fed's policy decisions. Investors need to pay close attention to the upcoming data, while considering changes in the international economic environment and market sentiment to make more informed investment decisions.

Since March, altcoins have been adjusted for more than three months, and Bitcoin has also formed an obvious M top pattern. The June 27 election debate, the June 28 PCE data, and the July 2 launch of the Ethereum spot ETF, which we had high hopes for, did not bring the expected benefits to the market. Although the PCE index is beneficial to US stocks and risk markets, the market's digestion and interpretation of these data have become more hesitant due to the impact of the US election. The rapid rise and fall in the short term further highlights the market's differences and uncertainty about the future direction.

Three, key factors in the macro market

The cryptocurrency market has been facing the influence of many key factors. The correlation between U.S. stocks and cryptocurrencies in the past cycle is self-evident. In the context of the global economy entering a cycle of interest rate cuts, the overall performance of risky assets will also be the key. At the same time, the strong U.S. dollar, which has remained near its highest level in the past 30 years, will also put some pressure on the crypto market. A strong dollar will make cryptocurrencies denominated in U.S. dollars relatively more expensive, and will also reduce investors' risk appetite to a certain extent. When faced with high interest rates, investors are more likely to choose to deposit funds in banks to earn interest, thereby affecting market liquidity.

In addition, the approval and listing of the most popular Ethereum spot ETF will inject new momentum into Ethereum and the entire crypto ecosystem. There is also the U.S. election in the second half of the year, and the impact of political factors on market sentiment is also very important. The interweaving of various factors will jointly determine the direction of the crypto market in the second half of 2024.

On Tuesday morning, Eastern Time, Federal Reserve Chairman Powell said at the Central Bank Forum held by the European Central Bank that the Federal Reserve has made considerable progress in controlling inflation, but hopes to see more progress before having the confidence to start cutting interest rates. The forum also attracted the participation of European Central Bank President Lagarde and the President of the Central Bank of Brazil.

Powell expressed satisfaction with the results of inflation control in the past year: "We have made considerable progress in reducing inflation back to the target level. The latest inflation data shows that we are back on track to cool inflation." But he stressed that too fast policy adjustments may undermine the results of inflation control, and too slow may hinder economic recovery and expansion. Powell pointed out that the Federal Reserve needs to find a delicate balance between controlling inflation and avoiding a deterioration in the labor market.

When talking about the labor market, Powell said that the U.S. unemployment rate remains at a low level of 4% and the labor market is gradually cooling down. Powell expects inflation to be in the lower-middle range of 2%-3% over the next year, but he expressed concerns about higher service sector inflation, especially wage-related.

Although market expectations for a September rate cut have risen, Powell declined to give a specific time. When asked if a September rate cut was possible, Powell said: "I won't set any specific date now." This statement shows that the Fed remains cautious on the issue of rate cuts and future policies will continue to be data-driven.

Powell also mentioned that fiscal policy is the responsibility of politicians and debt sustainability should be the focus in the future. Boosted by Powell's speech, the Nasdaq index turned higher, the S&P 500 index erased its early losses, U.S. Treasury yields extended their declines, and the U.S. dollar index fell back to an intraday low. Traders in the swaps market continue to expect the Federal Reserve to cut interest rates nearly twice this year.

Potential impact of the election on US markets

The next major factor that may trigger political and economic fluctuations in the United States is still the election. As voters' expectations of the election of Trump and Biden change, the market is also betting on the different impacts and expectations of the election of different candidates. If the market stirs up a storm of "Trump market", expecting that he will implement large-scale loose policies and inject a lot of money into the stock market after his election, capital will rush into risk markets in advance, triggering a sharp rise.

Market participants are concerned about the uncertainty brought by the election, not only because the policies of different candidates vary greatly, but also because of their potential impact on the economy. Trump's policies tend to be large-scale fiscal stimulus and tax cuts, which may be seen as positive for the stock market. In contrast, Biden focuses more on infrastructure investment and social welfare, which may also promote economic growth, but the market is cautious about his possible tax policies.

If expectations of Trump's victory rise, the market may reflect this expectation in advance, and funds will quickly flow into stocks and other risky assets, pushing up market prices. However, this situation also brings potential risks, including uncertainty in policy implementation and long-term economic impact. The market will continue to pay close attention to the development of the election and assess the possibility of each candidate's victory and the impact of their policies on the economy.

Overall, the US election is not only a political game, but also a major event that affects the global market. Investors need to remain vigilant and adjust their strategies in time to cope with possible sharp fluctuations and changes in the market.

Fourth, focus on the sector

Focus on the target: ETH, ENS, LDO, SSV, ETHFI

The ETF Store predicts that the Ethereum spot ETF may be launched in the week of July 15. Once the ETH spot ETF is approved and launched by the SEC, it will definitely have a significant repair on the market sentiment. The approval of Ethereum ETF, like Bitcoin ETF, means that more institutional investors can enter the market more conveniently, pushing up the price of the currency. At that time, the entire Ethereum ecosystem will also rise. You can focus on Ethereum's own son ENS, as well as the leading staking project LDO, and the leading re-staking project ETHFI. In the second half of the year, we can also look forward to the technological innovation brought by the parallel EVM: continue to pay attention to the new developments of Fuel, Monad, Berachain, and the application of Sei on the game chain.

Key Focus: SOL, JUP, HNT

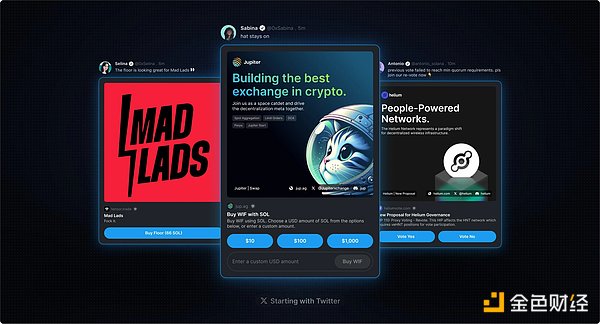

On June 28, asset management giant VanEck submitted the Solana ETF (VanEck SolanaTrust) application to the SEC. Subsequently, 21 Shares also submitted the Solana ETF's S-1 document, which attracted great attention from the market. Solana has also recently launched the powerful Blinks, which converts various interactive operations on Solana into a button on Twitter, such as Mint, Swap, etc. By linking social media accounts, you can copy trade popular assets on the chain with one click, opening up the imagination of multiple application scenarios. The high-speed information requirements of early Meme tokens may be met by Blinks, further opening up the Meme market. At present, a series of protocols such as two wallets Phantom and Backpack, DEX Jupiter, and NFT platform Tensor already support Blinks.

This month, Helium will also announce a new sub-network proposal, and you can pay attention to the trend of HNT. In addition, Solana's ecological re-staking LST liquidity aggregation protocol Sanctum is also about to airdrop. It has previously announced the token economy of its token $CLOUD, and 10% will be used for airdrops. At present, TVL exceeds 800 million US dollars, which is the fifth largest project in the Solana ecosystem TVL and is worthy of attention.

Focus on targets: RNDR, AKT

Capital continues to invest in large quantities to promote the development of AI technology and also drive the encryption sector of AI concepts. It is expected that the market's continued preference for artificial intelligence will continue to benefit the decentralized GPU market such as Render and Akash. In July, there will be new progress in the merger of AGIX, FET, and OCEAN.

Focus on targets: PEPE, BONK, WIF, TRUMP

MEME manufacturer Pump.fun has surpassed Ethereum in terms of daily revenue. In the market where the market failed and the cottage industry plummeted, investors found solace in MEME. We can choose projects that have entered the public eye and have a strong community consensus as investment targets, such as PEPE, to avoid a large and rapid withdrawal of assets. MEME is a product driven by emotions, and any exciting news will become a catalyst for the rise. A large, active and actively involved community will always be the backing of MEME. The WIF and BONK communities have done a good job in this regard. If you want to choose investment targets in the Solana ecosystem MEME, I believe WIF and BONK will be the first choice for many people. In the US election that has not yet ended in the second half of the year, TRUMP also has many opportunities for swings. In general, the risks and randomness of participating in MEME projects are too high, and investment needs to be cautious.

Key targets: TON, RON

TON has been very resilient in this round of correction, and its monthly return rate is still positive, which is a very impressive performance. In July, Telegram's mini-program games Hamster and Catizen will also issue tokens, so you can focus on their trends and performance. In addition, the game public chain Ronin will upgrade to Goda this month. After the hard fork, validators can get rewards by generating blocks every day. It also introduces the upgradeability of smart contracts. REP-0014 proposes to implement Ethereum's EIP-1559 to transfer gas fees to the Ronin treasury. You can pay attention to whether the treasury funds will be used to repurchase RON.

V. Conclusion

BTC fell below 58,000 again, and the market is very pessimistic. At present, the BTC hashrate has dropped to the lowest level since December 2022. Multiple indicators, such as miners' reserves, exchange reserves, and miners' position index (MPI), also indicate that the market may have bottomed out, miners' willingness to hold positions has increased, and cashing out has been reduced. At this stage, miners are less likely to sell BTC. All of these mean that market sentiment and expectations are improving to a certain extent. Bitcoin is looking for new upward momentum to lay the foundation for a subsequent rebound. This momentum may come from the official interest rate cut in the United States, the emergence of new breakthrough technologies in the market, or the dust has settled on the election, and crypto advocate Trump has introduced more market-friendly policies. By then, long-term wait-and-see investors will enter the market again and re-drive capital inflows.

In general, the crypto market still has strong rebound momentum in the second half of 2024. We should pay real-time attention to the multiple changes in policies, fundamentals, innovation and market sentiment. This article does not serve as any investment advice. Risk control is also the most important thing we always talk about. "If a losing position makes you feel bad, it's simple: exit quickly, because you will always have the opportunity to enter the market again (Paul Tudor Jones)". When the market is not good, it is best for us not to linger, exit and wait and see, patiently wait for the next opportunity, and avoid excessive trading caused by emotions.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Miyuki

Miyuki Coindesk

Coindesk Coindesk

Coindesk Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph