Author: Kyle Source: @0xKyle's Research Translation: Shan Ouba, Golden Finance

While it is difficult to predict the future, as traders and investors, we need to have a plan. This plan, like all plans, is adjusted as market fundamentals change - the market is an evolving "organism". This memo is just my vision of where the market will be in 2025, based on where we are today. This is an entry point for my thinking about 2025 and should not be considered financial advice.

Let's first review my 2024 plan.

2024 Plan Review

Gosh, I made a lot of mistakes in the 2024 plan; let's look at the predictions one by one:

1. The Bitcoin halving is an insignificant event

I remember a lot of people discussing this issue - is the halving "good news realized and bad news exhausted"? Although it is usually "buy the news" in history, the final result is just a normal event marking the beginning of a bull market.

2. Rate cuts are bad news

This is obviously wrong, but I have to defend myself - I had changed this position in public before the rate cut. The initial assumption was that "inflation is stubborn and rate cuts will occur after economic data has deteriorated significantly, so it is a reactive response rather than a preventive measure."

But it turns out that the Fed has broken this assumption. The right attitude for 2024 is: act directly on the Fed's statement.

3. Scenario Planning

The core of my 2024 plan is: "risk control a certain proportion of the portfolio before the rate cut, and then buy back when the price is lower, while retaining the remaining position."

I have no idea what I'm talking about because I haven't done any of these operations.

Ultimately, the market in 2024 is a completely different monster - the market experienced an initial sell-off after the ETF launch, then a rally in the first quarter, followed by a summer lull, interest rate cuts stimulated the stock market, but the crypto market still hovered in the $50,000-60,000 range until the final election became a real flashpoint.

My biggest mistake was not emphasizing that 2024 is the year of Bitcoin's gradual penetration into traditional institutions. What was I thinking? This may be the most important thing in 2024 - Bitcoin's gradual and steady acceptance into the traditional financial field.

4. Market narratives I mentioned:

I also mentioned tokens like STX and TRAC, but they didn’t perform well. COIN is a great choice though. It was around $120 when I wrote the article.

The short-term narratives for BRC-20 and LST didn’t last long, but they are indeed great trading opportunities in Q1 2024.

At time of writing, SOL is at $60! OMG, this is one of my proudest trades - I originally wrote this prediction at $20. The title was even a little funny: "SOL will hit triple digits in the next cycle." It completely came true.

But the TIA / Aptos / Layer 2 narrative has underperformed for most of 2024.

The narrative is in the right direction, but the tokens are all wrong. My thought process was: "DeFi projects that can pass the regulatory test, but have not yet demonstrated clear market fit."

What was I thinking? I chose MMX and dYdX.

I also mentioned HYPERLIQUID. I really wish I had listened to my own advice and participated in mining more. Although I was one of the early users of HYPERLIQUID, I didn't realize its importance until it was too late.

This one is really complicated. I was very bullish on this track, but turned extremely bearish at the market top in Q1 2024 because I found that the actual products were nothing like what I imagined. Projects like Render and Akash have almost no actual use cases and look more like empty projects. Although I am very interested in AI narrative now, I did feel empty at the time.

TAO was $300 when I wrote the article. Has it doubled now? Forget about OLAS. I don't want to mention it.

This direction is good. This is a profitable transaction I made in 2024. There was a small window in the first quarter of 2024, when the price of BEAM rose sharply, and many GameFi-related assets performed well (such as Pirate NFT). Prime is also a good choice.

Of course, you have to sell at the top, otherwise you have lost a lot now. I didn't sell too much, but overall, the transaction is still profitable.

Popular choices: Overworld / Treeverse / Prime / L3E7 - Overworld tokens increased from 5ETH to 15ETH, Treeverse plots increased from 0.2ETH to 1ETH, and L3E7 increased from 3ETH to 14ETH (but I lost it back later).

BLUR related narratives performed generally.

• dePIN / RWAs

• deSci

• Meme Coin (BONK / DOGE / PEPE / HPOS10INU)

• RUNE / CACAO

• GambleFi

• Airdrop (LayerZero / Starknet / ZKSync)

5. Cycle Top

I wrote at the end of the article: "One thing I haven’t talked about is how I think this cycle will end - recently, I have become more and more in agreement with GCR’s view: ‘The peak of the last cycle was the entry of funds, and the peak of the next cycle is the beginning of national buying. ’"

Looking back now, with hindsight — gosh, I think I should write this view directly into the 2025 plan. This is definitely an important part of my inclusion of “Signals of the Top of This Cycle”, and it really makes a lot of sense.

2025 Plan

Now that the 2024 review is done, let's get straight to the point. As usual, I'll talk about the macro and scenario planning first, and then talk about the theme narrative.

Scenario Planning

The 2024-?? cycle has already begun. I think the cycle starts at the end of 2023, but that's just a matter of details. The cycle so far is:

• January 10 - Bitcoin ETF launched

• Bitcoin then hits a new all-time high, triggering the altcoin season (altszn)

• Market volatility in the second and third quarters of 2024, with Bitcoin fluctuating between $50,000 and $60,000

• Breaking the all-time high on election day, soaring all the way to $100,000, but failing to break through, and then fluctuating around $90,000

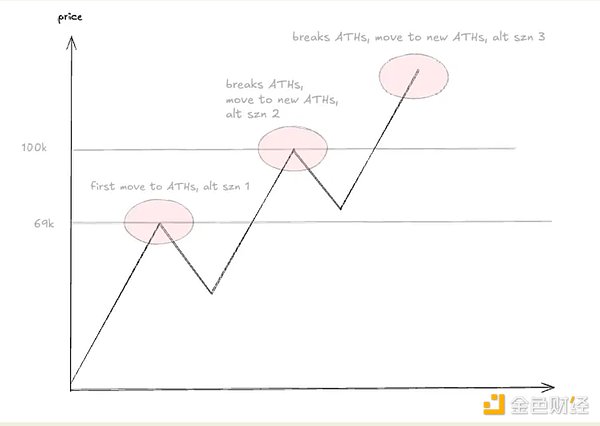

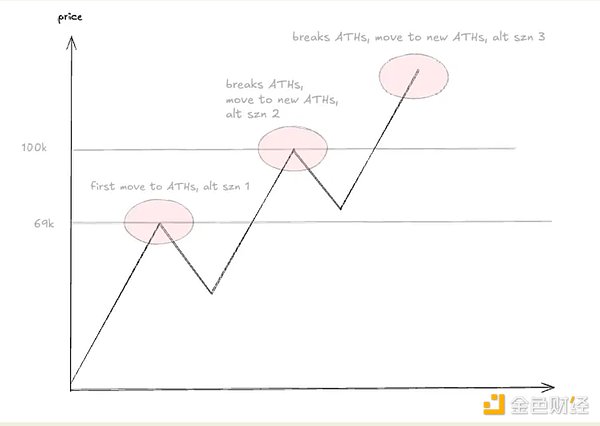

It is important to note that the altcoin season or "good times" all began with the rise of Bitcoin, the first phase was Bitcoin's rise to $69,000 but failed to break through, and the second phase was the rush to $100,000.

The next altcoin cycle may begin when Bitcoin firmly breaks through $100,000. I don’t have a crystal ball, and while I hope this is what happens in Q1 2025, the reality is that the next few months will repeat the turbulent period of Q2/Q3 2024 - I have to be prepared. So I’ve laid out the following scenarios:

Scenario 1: Bitcoin and altcoins both rise

2025 continues to rise, we have another round of altcoin season, Bitcoin continues to rise, all tokens perform well, and the market recreates the grand occasion of “millions of coins rising together” in the past two months.

Probability: 30-40%

Coping strategy: Buy on dips (BTFD), focus on strong altcoins.

Scenario 2: Bitcoin rises, altcoins rise slightly

The market repeats 2024, with altcoins fluctuating in the next few months; but the overall market is more optimistic than in 2024 (because Bitcoin continues to rise), and some areas perform well.

Probability: 50-60%

Coping strategy: Buy selected altcoins on dips, avoid overly concerned areas, and look for the next hot spot in the market.

Scenario 3: Bitcoin rises, altcoins fall

Bitcoin continues to strengthen, but altcoins generally fall, and the market ushered in the top of altcoins.

Probability: 20-30%

Coping strategy: Sell all altcoins. If altcoins no longer rise, you may need to liquidate all positions, even if it means taking some losses.

Scenario 4: Bitcoin and altcoins both fall

The overall market has peaked, and everything is falling.

Probability: 10-20%

I believe that Bitcoin will not break through the all-time high in 2025 as slowly as in 2024, because the macro backdrop is in place. In the summer of 2024, Bitcoin ETFs were just launched, and traditional financial institutions (TradFi) were still promoting Bitcoin to their clients. More importantly, the world had not yet fully recognized the importance of Bitcoin.

But now the situation is different. With Trump back in power and even the news of the establishment of a Strategic Bitcoin Reserve (SBR), the market narrative has shifted. I will not speculate on the actual probability of SBR - I have no experience in the field where politics and finance are intertwined.

I focus on the narrative. The fact is that the current new administration is driving more attention to the digital asset field, and now the US President frequently talks about Bitcoin, which makes it easier for people to buy Bitcoin than in the past.

This regime change is an extremely important market signal. Therefore, I believe Bitcoin will continue to benefit from macro tailwinds in 2025. For altcoins, the situation is similar but slightly different.

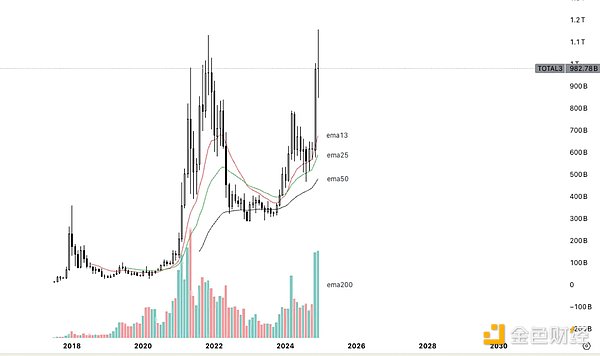

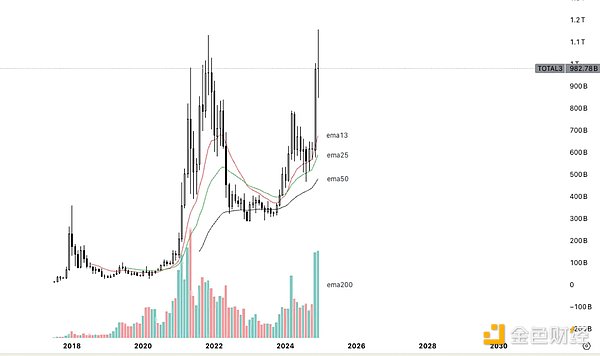

In Q1 2024, the total market capitalization (Total3) hits the 2021 all-time high and reaches the cycle high again in Q4 2024. The market basically follows a similar pattern, so I don't think the difference between Scenario 1 and Scenario 2 is big.

The key is position management and timing. I am optimistic about 2025, but not sure about the specific rise time. I think the "up and down" phase of the market will arrive earlier than 2024, but altcoins could still fall without a catalyst.

As long as the cycle has not peaked, I will remain net long, both in Bitcoin and other assets. I don't think 2025 will repeat the summer of 2024, but the market could still experience a similar downturn - prices remain stable but the market lacks a clear catalyst.

On-chain assets are different from mainstream markets, and on-chain assets tend to fall 70% when the market retreats. Therefore, the goal is always to sell when the on-chain attention is the highest, return to the mainstream altcoins (top 20), and then gradually re-invest.

I don't think altcoins will peak at this time, because I can't imagine Bitcoin continuing to rise while altcoins fall sharply. It is also unlikely that Bitcoin will peak at this time.

Summary

• Bitcoin continues to rise, and the increase will exceed 2024

• Altcoins - Stay on the offensive, know when to switch to a defensive state, but the defense is less than 2024

Risks

1. Cycle Top Risk

Cycle tops are often a self-fulfilling prophecy. While I don't think we are close to the top of the cycle now, this requires continuous evaluation on a weekly basis. The top of the cycle is not necessarily a clear "event", more like a process that gradually approaches over time.

2. Strategic Bitcoin Reserve (SBR) Risk

With the new president in office, all eyes will be on his movements. Despite the bullish factors facing Bitcoin, it would certainly be a bearish signal if the President completely ignored Bitcoin. Personally, the biggest risk to me is that the SBR could be forgotten, or more likely, never implemented at all in favor of other measures.

If the latter happens (i.e. a different policy replaces the SBR), it could be bearish in the short term, but ultimately still a bullish signal as long as the new policy is Bitcoin-friendly.

In short:

• Buy signal = Cycle continues

• Bearish signal = Revised plan needed, the cycle could continue, but the probability is low.

3. Supply risk

In the summer of 2024, we experienced an extreme macro environment with stocks hitting new highs. However, we have not enjoyed a similar rally in crypto markets, instead we have been weighed down by massive sell-offs from the likes of Mt. Gox, the German government, and Grayscale GBTC.

Supply risk is unavoidable. There are always institutions or governments holding large amounts of Bitcoin - the UK government, Silk Road, FTX claims distributions, etc. These events require ongoing monitoring, but are often good bargain hunting opportunities if all goes well in the market.

4. Macro Risks

Although a rate cut is smaller, a rate cut is still a rate cut. Although the stimulus is lower, as long as rates continue to fall, liquidity will improve.

• Positive signal = cycle continues

• As long as there is no rate hike or a halt to rate cuts, the macro environment is bullish for digital assets.

The real bearish signal is the return of inflation, and the Fed is forced to raise interest rates to curb inflation.

Themes and Tokens

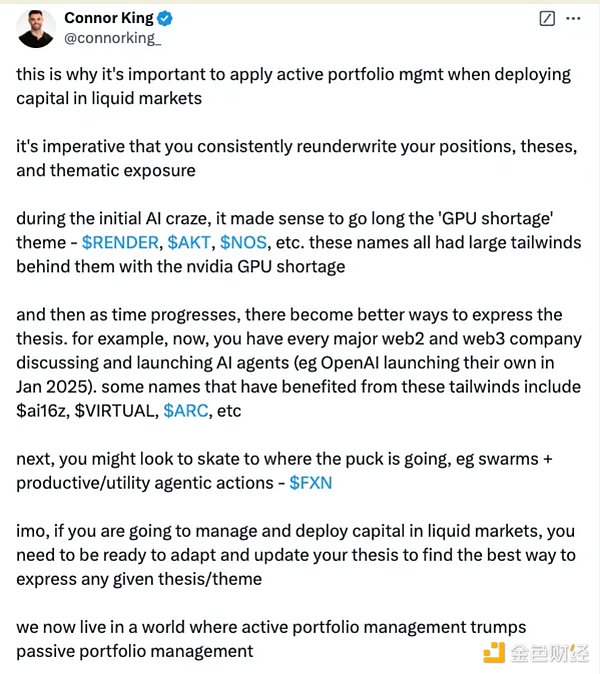

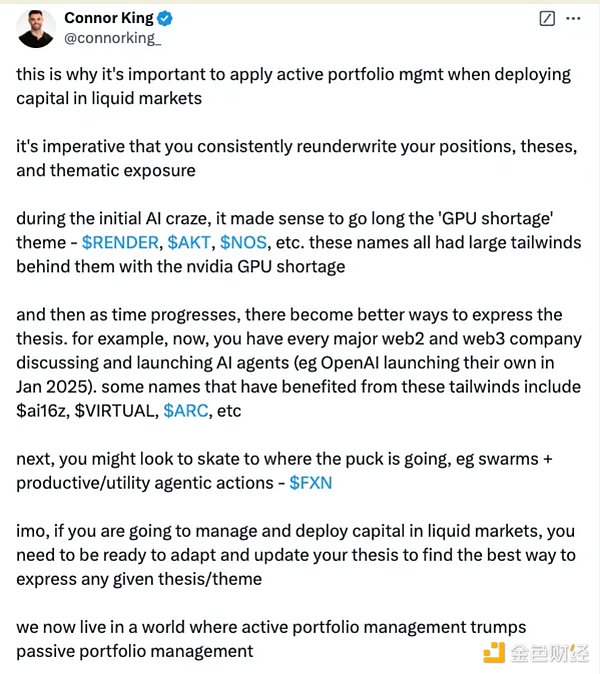

Now we come to the part that everyone is most interested in. But before I introduce it, I want to emphasize again-"Stay on the offense, but know when to switch to defense." In this cycle, actively managed portfolios will perform far better than passive holdings.

The era of "buy and hold will always rise" is over.

In 2024, Solana's performance for the whole year is on par with Bitcoin, despite a 10-fold surge in 2023. Popular tokens such as TAO have not enjoyed the dividends of the recent AI wave. The memecoin craze is also fading - Dogecoin (DOGE) lost its cap, Chill Guy is no longer cool, and Hippo (PEPE) looks to be out of its depth.

It’s likely that none of the coins on this list will make you a “buy and hold”.

It’s important to consider who the potential buyers are. There are three main types of marginal buyers in the crypto market:

1. Institutional investors (TradFi)

2. Funds (crypto native or liquid funds)

3. Speculators (perpetual contract traders, on-chain players, etc.)

For a narrative to become a hot topic in the market, it must attract at least one of these types of buyers.

1. Artificial Intelligence (AI)

Yes, this track is still there. But as the tweet shows, we have experienced several waves of AI craze. If you have read my analysis on AI tokens, I believe a new wave of craze is coming.

• Macro Path: Hype → Infrastructure → Actual Application

• Micro Path: Retail investors follow suit → Basic Layer (infra) → Applications and Virtual Humans

Holding on will not bring good results. The leading AI token Goat has already pulled back 60% from its high and is likely to continue to underperform the market.

Recommended tokens:

• Application layer technology / swarm intelligence / games / consumer-oriented AI projects

• ALCH (game development), Griffain (smart wallet agent), Digimon, Ai16z are all projects I am optimistic about. There are many more tokens worth paying attention to, but these are the key points.

2. DeFi

This one needs no further explanation. DeFi is still a good track, but the investment difficulty is extremely high, and there are very few tokens that can really benefit. Even if they can benefit, they may not rise (look at the LST track).

The risk-return ratio is not high, but I think the DeFi track will continue to grow in 2025.

Recommended tokens: AAVE / ENA / Morpho / Euler / USUAL

Sub-line: Stablecoin / Payment token

3. Layer 1 public chain track

I know this may be controversial, but I believe that L1 public chain transactions will return significantly again. Sui has risen from $1 to $2 and now to $4, despite the market's negative attitude towards it. But this is exactly where the market ignores, and often contains huge opportunities (Hype has already increased 10 times).

Recommended tokens: SUI / Hype

Sub-line: Abstract

I am not very interested in Monad and Berachain, but I am very much looking forward to Abstract, which may be a hit.

4. NFT tokens & game coins (second round)

I like this track very much. I recently bought some game projects, and I think the NFT token track is worth paying attention to. Pengu is rising again, Azuki launched the $ANIME token, and Doodles is also doing something. I don’t think NFT itself will return, but NFT tokens will perform.

Game tokens are also interesting, and Off-The-Grid proves that it is possible to develop an interesting game. Since the market attitude towards game coins is very negative, this is a good time to dig deeper and find truly interesting game projects and their tokens.

Recommended tokens: Pengu / ANIME (Azuki) / Spellborne / Treeverse

Subplots: Prime / Off-The-Grid (if a token is launched) / Overworld

5. Other narratives

These tracks are on my watch list. Although they are not my favorites, they are interesting:

• Data tokens: Kaito / Arkm

• Meme coins: I only like PEPE, and the others feel cold

• DePIN: PEAQ / HNT

• Ordinals

• Old Leaders: XRP, etc.

• Old DeFi: CRV / CVX

2025 Predictions

This section is just for fun, and they are all ideas that sound a bit outrageous but not completely impossible.

• DePIN (Decentralized Physical Infrastructure Network) is officially implemented by a legitimate large company, and may even be achieved through acquisition.

• Binance loses its position as the leading exchange, not because it is surpassed by Hyperliquid, but because Bybit or OKX takes over.

• Metaverse tokens are reborn as VR technology breaks through.

• ICOs are back and popular again.

• ETH on-chain season (On-Chain Szn) will not happen.

• Sui breaks double digits (at least $10).

• Ethereum staking yield is approved for inclusion in ETFs, triggering more staking yield products for other tokens, and yield aggregators will become popular again, just like in 2021.

• A top artist uses NFTs and tokens to interact with fans, track and reward fan bases.

• Bitcoin rises to $200,000.

• CEOs/founders of multiple L1 public chain projects have resigned one after another, similar to the Aptos phenomenon.

• Base loses its competitive advantage on the chain, another L1 public chain takes its place, while Solana continues to lead.

Conclusion

This article roughly summarizes my market layout for 2025. Just like the plan for 2024, I expect that many of these views and strategies may be significantly adjusted.

The most important advice here is: stay flexible, like water, and enjoy the market journey. The market will continue to change, and this is part of the game. As the famous saying goes:

"One can never step into the same river twice, for the river is not the same river as it was yesterday, and neither is the man yesterday."

Good luck and safe journey. Hope to see you in the next cycle. If you make a life-changing profit along the way, remember - let it truly change your life.

Brian

Brian