Author: Thor Hartvigsen, crypto analyst; Translation: Golden Finance xiaozou

This article covers some major crypto events/catalysts in June and several DeFi/airdrop strategies worth paying attention to.

June’s Crypto Events/Catalysts List

L1/L2

•Peercoin Hard Fork - June 3rd

•Sagaxyz “Vault 2” Airdrop Snapshot

•LayerZero Rumored to Airdrop in June

•zkSync Airdrop on June 13th

•Blast L2 Airdrop will take place on June 26th

• Lisk L2 blockchain launch and token migration

• zkEVM L2 Taiko airdrop (5% of supply) will take place sometime in June

• Fluent announces Blend - L2 combining WASM, EVM and SVM

DeFi

• Fractal (Frax finance) hackathon to stimulate the ecosystem

• Ether.fi S2 Airdrop scheduled to end June 30 (5% of supply)

• Maker begins Phase 1 of “Endgame” (subDAO possible? )

•Platypus Finance has been acquired by Stable Jack - Token Swap

•Stake RabbitX’s native RBX token to get new BFX tokens - June 1st snapshot

•Swell TGE will happen in a few weeks alongside “Voyage” airdrop (8% of supply)

•“Ether.fi Cash” is coming soon, offering native savings accounts and Visa credit cards

Crypto x AI/DePIN

• Apple Worldwide Developers Conference - June 10

• Tesla AGM - June 13

• NVIDIA AGM - June 26

• Aethir TGE rumored to be in June

• Ionet TGE rumored to be in June

">GameFi/SocialFi

• DeGameFi Conference

•BeeCasinoGames airdrop runs until June 30th

Important token unlocks

•$SUI 7.29% of total supply enters circulation on June 1st

•$ENA 3.63% of total supply enters circulation on June 1st

•$DYDX 11.9% of total supply enters circulation on June 1st

• June 1st $1INCH 8.5% of total supply entered circulation

• June 12th $APT 2.6% of total supply entered circulation

• June 14th $IMX 1.72% of total supply entered circulation

• June 15th $STRK 5.61% of total supply entered circulation

• June 16th $ARB 3.49% of total supply entered circulation

• June 17th $APT 2.6% of total supply entered circulation

• June 14th $IMX 1.72% of total supply entered circulation

June 25th $ALT 6.9% of total supply entered circulation

Macroeconomics

• June 7th: Unemployment Rate = Anything above 4% would likely be seen as a huge risk-off signal.

•June 12: Core CPI

•June 12: Federal Funds Rate and Press Conference

•June 13: PPI

•June 18: Retail Sales

•June 21: Services and Manufacturing PMI Preview

•June 27: Final GDP Quarterly Rate

• The EU MiCA (Markets in Crypto-Assets) Act will partially take effect on June 30

2024 Crypto project financing in May 2019

•NodeOps raised US$5 million

•StripChain raised US$10 million

•Zeta Markets raised US$5 million

•Farcaster raised US$150 million in Series A financing

•Blockless raised US$8 million in seed round financing

•Babylon raised US$70 million • Paramlabs, the Gamefi project, raised $7 million, led by Paradigm. • Orbiter Finance Fork Owlto Finance raised $8 million. • Mitosis, the ecosystem’s liquidity pioneer, raised $7 million. • Lagrange, a blockchain service platform, raised $13.2 million in a seed round. • Gamic, a social gaming project based on Linea, received $18 million from Binance Labs. • Lava Network, a data service platform based on Cosmos, raised $11 million, with participation from Coingecko, Gate.io and Animoca. • Web3 publishing platforms Paragraph and Mirror merged into Paragraph, raising $5 million. • Fantom Foundation raised $10 million and announced the launch of Sonic Foundation $S and Sonic Labs, as well as its upcoming blockchain. DeFi strategies worth watching style="text-align: left;">1、Blackwing

Blackwing is a modular rollup DEX layer built on Initia. Blackwing is unique in its "infinite pool" design - abstracting the bridge to allow liquidation-free leveraged trading of long-tail assets. Blackwing has received $4.5 million in strategic financing led by Hashed and Gumi Cryptos.

Blackwing is currently running its Tomcat-1 testnet, where users can deposit liquidity to earn "BXP" (Blackwing native points). Supported assets include: · ETH, USDC, PEPE, SHIB · LRT (eETH, ezETH, rsETH, rswETH, etc.) · Pendle PT tokens (PT-ENA, PT-sUSDe, PT-rsETH, etc.) I have deposited some Pendle PT-sUSDe and have earned 46% APY. Therefore, Blackwing is a very good DeFi strategy for me, which allows me to earn more income. Let's take a look at the potential return rate in the figure below. I created a calculator that allows you to input points and the percentage of your expected airdrop/total supply. Based on this, along with the FDV of the Blackwing token and the total BXP supply, you can see how much your expected airdrop will be. How many BXP will be distributed in total? That depends on the TVL and when the campaign ends. I speculated that the campaign end time might be in September, which leads me to the following: At a 100% growth rate, that's a total of about 40 million BXP. Note that this number can easily deviate up or down. As for how many points you can earn, it depends on when you deposit. As more liquidity comes in, the APR will decrease over time. In my personal case, I deposited $160,000 a few days ago, which is about 3,200 BXP (if you don't count the referral points).

In short, putting aside the smart contract risks, if you are earning fixed income ETH or stablecoins by depositing Pendle, then depositing it in Blackwing seems to be a wise choice, and it seems that you can earn two to three times the current amount. But remember, risks are everywhere!

2、Ethena S2

So far, the Ethena S2 "sats airdrop event" has been going on for almost 2 months and will end in September. There are still 3 months left. If you want to participate, there is enough time. The beauty of the Ethena <> Pendle strategy is that leverage increases over time. Therefore, there is no obvious difference between 4 months and 3 months of yield farming.

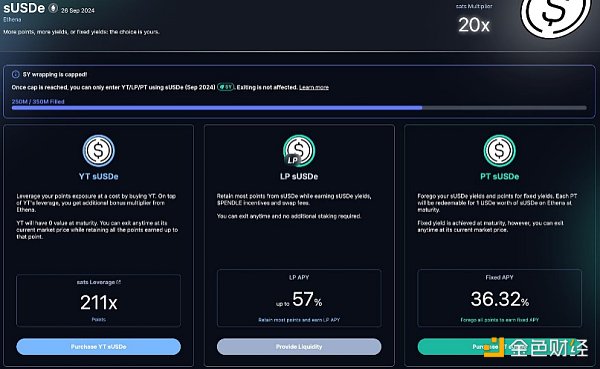

Point Leverage (YT-sUSDe)

If you are bullish on ENA and want to maximize your S2 airdrop, the Pendle sUSDe market is by far the best strategy, not only can you gain leverage through the points you earn, but you can also earn a high yield (currently 36% APY) paid to sUSDe holders. Please note that the sUSDe market on Pendle has limits on the amount that can be deposited, so you may have to act quickly.

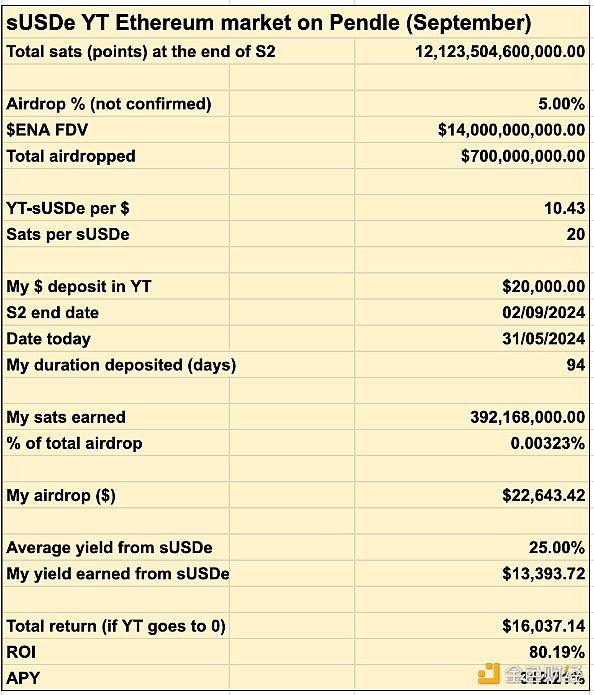

The chart below shows the estimated return on buying $20,000 worth of YT-sUSDe tokens today.

Based on previous analysis, I estimate that a total of approximately 10 trillion sats will be distributed. However, given recent growth, the 12 trillion figure seems more realistic. Based on some additional assumptions above, purchasing $20,000 worth of YT-sUSDe will net:

· $22,643 in ENA airdrop

· If the average sUSDe yield from now to September 2nd is 25%, the sUSDe yield will be $13,393.

Note that the $20,000 spent on YT-sUSDe will become 0 at maturity, so the actual return is $16,037, which is an 80% ROI (not too bad). As you can see, about 40% of the return comes from sUSDe earnings. If you assume that funding rates will be high in the coming months and sUSDe yields will remain around 35% instead of the estimated 25%, then sUSDe earnings will give you $21,394 instead of $13,393. But if Ethena earnings decrease due to low funding rates, the return of this strategy will be lower.

What's a more risk-averse approach? You can also lock in a fixed yield of 36% per year for the next 3 months by purchasing PT-sUSDe tokens. This is an amazing yield, and it's a fixed yield. If you are looking for stablecoin-related passive income, it's hard to fail. You can also deposit PT-sUSDe tokens into Blackwing to reap airdrops in addition to passive income.

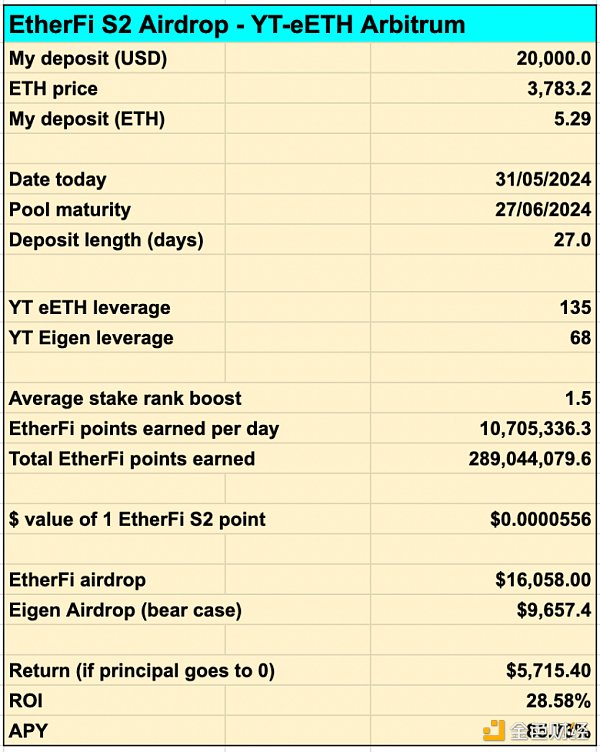

3、Ether.fi S2

Ether.fi is the largest liquidity re-staking protocol with a TVL of over $6 billion. Ether.fi's second quarter points plan will end with a 5% airdrop at the end of June. So in reality you have almost no time to participate. However, due to the high leverage of the Pendle YT-eETH Arbitrum market, it still seems to be a profitable strategy when the EIGEN airdrop income is taken into account. The pool currently offers 135x leverage on Ether.fi points and 68x leverage on EIGEN points. If your Ether.fi StakRank has reached the highest level L8, then the expected return rate brought to you by Ether.fi and EIGEN is 55%. If you have not yet reached L8, the expected return rate is 28.58%, as shown in the figure below.

Please note that while there is a lot of information about Ether.fi's S2 airdrop that has been confirmed by its team, it is still unclear how EigenLayer will allocate points for the S2 airdrop. So, please take these estimates with a grain of salt.

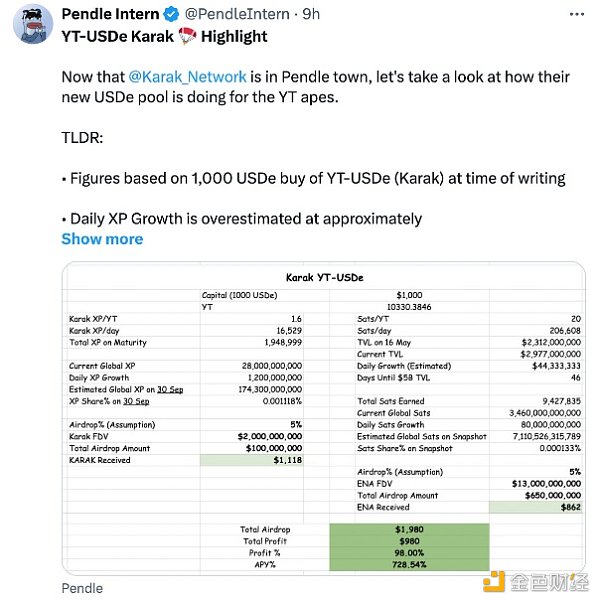

4, Karak

Karak is a competitor to EigenLayer with nearly $800 million in TVL. There are several interesting strategies about Karak, including depositing LRT that has earned LRT points and EIGEN points, and now you can also get Karak XP.

In addition, Pendle recently launched three Karak markets, for Karak USDe, Karak sUSDe, and Karak eETH. This allows users to either lock in fixed returns on these assets or gain leveraged exposure to all credits. Pendle Intern was able to obtain information from the Pendle team about the total supply of XP and published details on the expected returns of this strategy:

In summary, there are several great strategies to expand your portfolio in June. All of these strategies are personally in my portfolio, but remember that many returns are based on speculative assumptions.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Coindesk

Coindesk Coindesk

Coindesk Coindesk

Coindesk Coindesk

Coindesk Ledgerinsights

Ledgerinsights Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph