Author: Paul Veradittakit, Partner at Pantera Capital; Translator: Jinse Finance xiaozou

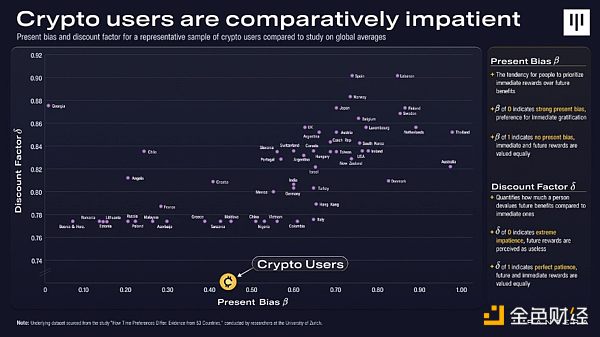

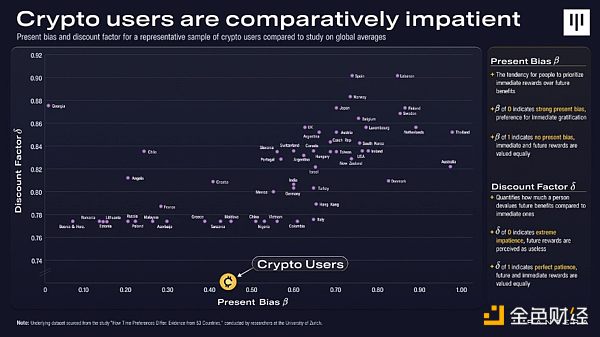

A study by Pantera Research Lab found that crypto users exhibited high present bias and low discount factor, indicating a strong preference for instant gratification.

The quasi-hyperbolic discount model, characterized by parameters such as present bias (ꞵ) and discount factor (?), helps understand individuals’ tendency to prefer immediate returns over future gains, a behavior that is particularly evident in volatile and speculative crypto markets.

This research can be applied to optimizing token distribution, such as airdrops used to reward early users, decentralized governance, and market new products.

1, Introduction

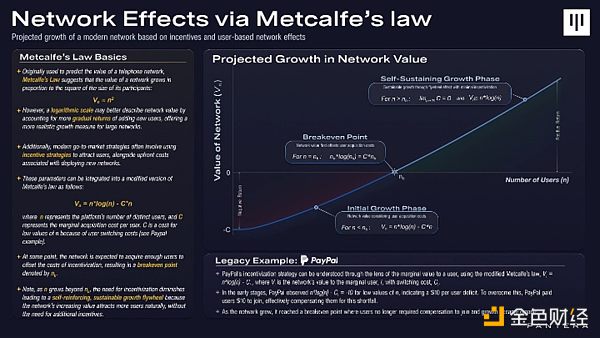

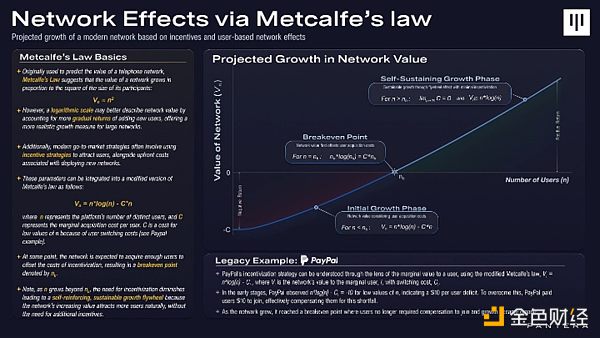

A classic story of Silicon Valley startups is Paypal’s decision to pay users $10 for using its product. The reasoning is that if you can pay people to use your product, eventually when the network value is high enough, new people will join for free and you can stop paying. This tactic seems to have worked, as PayPal was able to continue to grow after it stopped paying, successfully bootstrapping the network effect.

In crypto, we have adopted and expanded this approach through airdrops, not only getting people involved, but often keeping them using our products for a period of time.

2, Quasi-Hyperbolic Discounting Model

Airdrops have become an all-rounder that can be used to reward early users, decentralize protocol governance, and frankly, market new products. Formalizing token distribution criteria has become an art, especially when deciding who should be rewarded and how much value to reward them. In this context, both the number of tokens distributed and the timing of distribution (usually distributed according to a distribution schedule or gradually) play an important role. These decisions should be based on systematic analysis rather than guesswork, whim, or precedent. Using a more quantitative framework ensures fairness and strategic alignment with long-term goals.

The quasi-hyperbolic discounting model provides a mathematical framework to explore how individuals make trade-offs between rewards at different times. The application of this model is particularly important in fields where impulsive emotions and inconsistency will significantly affect decisions over time (such as financial decisions and health-related behaviors).

The model is driven by two parameters for different populations: present bias (ꞵ) and discount factor (?).

Present bias (ꞵ):

This parameter measures the tendency of individuals to prioritize immediate rewards over disproportionate rewards in the long term. It ranges between 0 and 1, with a value of 1 indicating no present bias, reflecting a balanced time-consistent assessment of future rewards. As values get closer to 0, they indicate an increasingly strong present bias, indicating a high preference for immediate rewards.

For example, if the choice is between $50 today and $100 a year from now, someone with a high "present bias" (values close to 0) would choose to get the $50 immediately rather than wait to get more money.

And the discount factor (?)

This parameter describes the rate at which the value of a future reward decreases as the time until it is redeemed increases, indicating that the perceived value of future rewards will naturally decrease with delay. Over longer time intervals of many years, the discount factor can be more accurately quantified. When evaluating two options over short periods of time (less than a year), this parameter exhibits high variability because the immediate environment may disproportionately affect perceptions.

Research shows that for the general population, the discount factor is typically around 0.9. However, in groups with a tendency to gamble, this value is often much lower. Research shows that habitual gamblers typically have an average discount factor of just under 0.8, while problem gamblers tend to have a discount factor closer to 0.5.

Using the above conditions, we can express the utility U of receiving reward x at time t as:

U(t) = tU(x)

This model captures how the value of rewards changes over time: immediate rewards are evaluated at full utility, while the value of future rewards is adjusted downward, taking into account both present bias and exponential decay.

3Exploration Experiment

Last year, Pantera Research Lab conducted a study to quantify the behavioral tendencies of crypto users. We surveyed participants with two simple and direct questions to measure whether they prefer immediate rewards or prefer to obtain a certain future value.

This approach helped us determine representative values for ꞵ and ?. Our results show that a representative sample of crypto users shows a present bias slightly above 0.4 and a significantly lower discount factor.

The study shows that crypto users have above-average present bias and low discount factors, indicating that they tend to act impulsively and prefer immediate gratification over future gains.

This can be attributed to several interrelated factors in the cryptocurrency space:

Cyclic market behavior:Crypto markets are known for their volatility and cyclicality, with tokens often experiencing rapid value fluctuations. This cyclicality affects user behavior as many are accustomed to speculating during these cycles rather than adopting long-term investment strategies more common in traditional finance. Frequent ups and downs may cause users to discount future value more significantly, fearing that a price drop could wipe out their profits.

Characteristics of Tokens:The survey specifically asked about tokens and their perceived future value, which may reveal a deep-rooted characteristic of token trading. This characteristic is related to the cyclical and speculative nature of token valuations, highlighting a cautious attitude towards long-term investment in the cryptocurrency space. Furthermore, let us assume that the survey used fiat currency or other forms of rewards to measure preferences. In this case, the discount rate of crypto users may be closer to the global average, suggesting that the nature of the reward itself may significantly affect the observed discounting behavior.

Speculative Nature of Crypto Applications:Today's crypto ecosystem is deeply rooted in speculation and trading, and these characteristics are prevalent in its most successful applications. This tendency highlights the current users' overwhelming preference for speculative platforms, which can be seen in the survey results, which show a strong preference for immediate financial gains.

While the results of this study may differ from typical human behavioral norms, they reflect the characteristics and trends of the current crypto user population. This distinction is particularly applicable to projects designing airdrops and token distributions, as understanding these unique behaviors can lead to better strategic planning and reward system structure design.

Take the example of Drift, a decentralized perpetual swap exchange on Solana, which recently launched its native token, DRIFT. The Drift team built a time delay into their token distribution strategy, offering double rewards to users who waited six hours after the token was released to claim their airdrop. The added time delay was intended to alleviate network congestion caused by bots at the start of the airdrop and potentially help stabilize token performance by reducing the initial surge of sellers.

In fact, only 7,500 (15% of total airdrop claimants at the time of writing) potential claimants were unable to wait six hours to receive their doubled rewards. Based on the research we present, Drift could have delayed the doubling of rewards by several months and, statistically, should have been able to appease the majority of end users.

Weatherly

Weatherly