Source: Cointelegraph Research; Compiled by: Deng Tong, Golden Finance

As 2023 gradually fades from people's sight, the new year has begun, and the cryptocurrency world has also made significant developments.

On January 10, the U.S. Securities and Exchange Commission approved 11 spot Bitcoin exchange-traded funds (ETFs), marking a major milestone in the history of the cryptocurrency. After just one week of trading, these ETFs outperformed the silver exchange-traded product, making Bitcoin the second-most traded exchange-traded commodity.

The launch of a Bitcoin spot ETF has fueled speculation about the potential of other cryptocurrency spot ETFs. Coupled with the expected Bitcoin halving in April, various industries have strong confidence in potential price increases, thus increasing optimism about future value growth.

The February edition of Cointelegraph Research's "Investor Insights" monthly trends report delves into industry reaction to the launch of a spot Bitcoin ETF in the United States, covering a variety of areas, including cryptocurrency mining operations, derivatives markets , decentralized finance (DeFi) field and real-world asset tokenization, etc.

The report provides a comprehensive overview of each segment, combining in-depth analysis, future forecasts, and sentiment analysis to provide readers with a comprehensive summary of the current situation and expectations.

DeFi market saw strong growth in January, but offset by exploits

Decentralization in January The financial (DeFi) space truly reflects the broader cryptocurrency market: volatility, excitement, and unpredictability. An unexpected security breach affecting the Socket protocol resulted in the theft of $3.3 million worth of Ethereum. Shortly after the incident, the Socket Protocol team quickly identified and fixed the vulnerability. Thanks to the combined efforts of various analytics firms, approximately 70% of the stolen funds were recovered within a week, providing significant assurance to affected stakeholders.

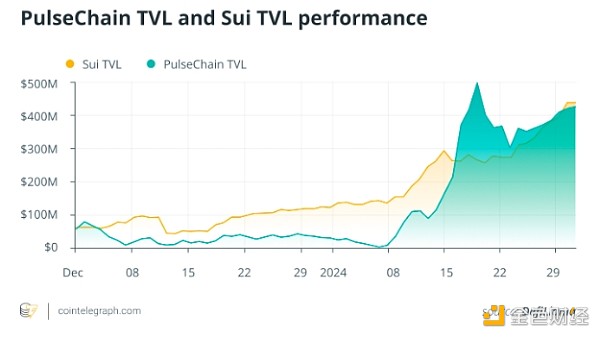

Although the total value locked (TVL) of DeFi projects and their token prices increased at the beginning of the month, they slowed down significantly in the second half of the year. However, Sui and PulseChain saw significant TVL growth, surging by 107% and 189% respectively. The significant growth in PulseChain’s value can be attributed to the expansion of its native decentralized exchange PulseX, specifically the transfer of over 20 million Dai stablecoins from Ethereum to PulseChain in less than a week.

Meanwhile, Sui’s TVL growth has been linked to the growing popularity of two lending protocols, with Navi Protocol growing 162% and Scallop growing 229%. Scallop launched the second phase of its airdrop and rewards program on January 16, doubling the protocol’s TVL.

Sponsored Business Content

PulseChain TVL and Sui TVL performance. Source DeFiLlama

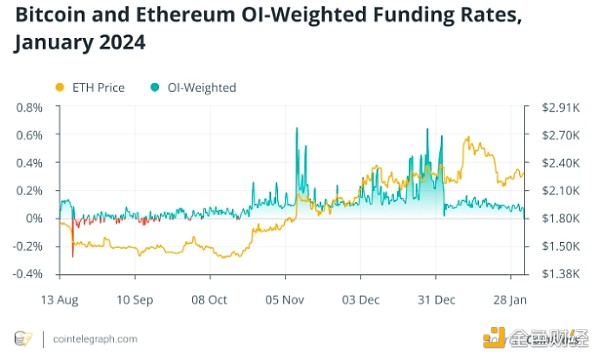

Regulatory challenges put derivatives trading at risk as bulls deleverage

< p>Throughout 2023, there are large regulatory differences in various countries and regions. Coupled with strict regulatory measures, global retail derivatives transactions are significantly restricted. Both centralized exchanges and DeFi projects have found themselves forced to cease operations entirely as it becomes increasingly difficult to obtain trading licenses for various products.

Major industry players, including Crypto.com and Binance, have been forced to cut operations, scale back service offerings, reduce leverage, limit the types of products available and limit access to certain users. Despite these challenges, derivatives markets remain an important indicator of sentiment within the industry.

Bitcoin and Ethereum open interest weighted funding rates, January 2024. Source CoinGlass

JinseFinance

JinseFinance

JinseFinance

JinseFinance Sanya

Sanya JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Kikyo

Kikyo JinseFinance

JinseFinance JinseFinance

JinseFinance Beincrypto

Beincrypto Bitcoinist

Bitcoinist