Author: Casey Wagner, David Canellis Source: blockworks Translation: Shan Ouba, Golden Finance

Where is digital gold going?

Halving week is off to a chaotic start.

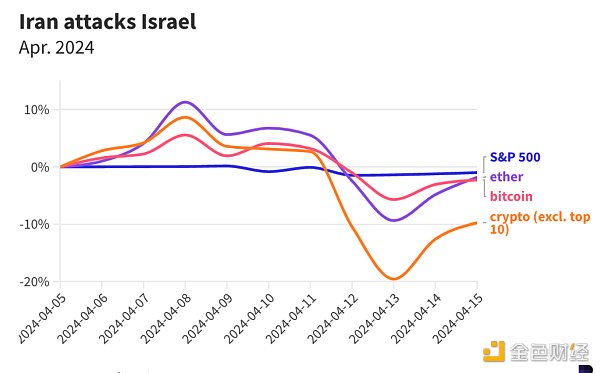

Cryptocurrencies fluctuated sharply over the weekend amid growing geopolitical concerns following Iran's drone attack on Israel on Saturday.

Bitcoin (BTC) plunged below $62,000 on Saturday night, further extending the sell-off that began on Friday, when BTC fell from $70,000 to $66,000 in a few hours. However, by early this morning, the situation had stabilized relatively. As of 11 a.m. ET, Bitcoin was down more than 2% in the past 24 hours, trading at $64,500.

Ethereum (ETH) and Solana (SOL) have rebounded more strongly. Earlier, ETH was up 7% on the day, while SOL was up 9%. Both have since retreated slightly. It is worth noting that traders are limited by stock market closures over the weekend when the threat of a wider regional war looms.

Friday began with a rush to traditional financial safe havens, gold, which rose 17%. Oil prices hit their highest level since October last week.

As of the morning of the 15th, oil prices have retreated, but gold is still rising, with spot futures rising another 0.3%.

Cryptocurrency-related stocks fell along with Bitcoin on Friday. COIN shares closed down nearly 7% last week but were up 0.6% in pre-market trading this morning. MicroStrategy similarly fell 5% on Friday and was down 0.6% before the open today.

Looking ahead, in addition to the halving, analysts are also watching oil prices, which have historically been a leading indicator of recessions. The 1973, 1980, and 1990 oil shocks all caused gas prices to surge +35%, and each time led to a recession for the U.S. economy.

“If oil prices spike enough to get U.S. gasoline to $5.40 a gallon this summer, then there is a real chance of a recession later in the year,” said Nicholas Colas, co-founder of DataTrek Research.

The one exception to the recession rule was a spike in oil and gas prices during the second Gulf War in 2023, but the Fed was already two years into its rate-cutting cycle then. A stark difference from where we are now.

A little over two weeks later, central bankers met again and expectations for rate cuts continued to fade. CME futures data put the probability of a decline at just 4.5%.

Data

Tokenized hedge fund Ethena saw its first daily net outflow over the weekend, with a total loss of $31.58 million.

Net flows to second-layer Arbitrum and Optimism reached $278 million in the past week. Ethereum fund outflows reached $289 million in the same period.

Uniswap trading volume has not slowed down after the SEC issued a Wells notice: it is still about $3 billion per day, compared with about $1 billion in February.

In the past month, week, and day, Bitcoin has remained the number one blockchain for NFT trading volume, currently more than twice that of second-place Ethereum.

Solana’s active addresses fell to 1 million after hitting a 30-month high of 2.4 million in mid-March.

Hedge status still up in the air

Cryptocurrencies appear to have overreacted to Iran’s weekend attack on Israel, with most markets selling off by as much as 20%.

Stocks didn’t fall before the close on Monday. Still, anything could happen, but it seems that whatever crypto investors are worried about, stock market folks aren’t paying too much attention.

At times like this, it would be nice if Bitcoin truly wasn’t correlated with the stock market. When the world is teetering on the edge of its seat, people can buy Bitcoin. Hedge against dystopias, which has long been the pillar of value for gold.

Bitcoin does serve as a useful hedge in certain circumstances. It moves inversely to its benchmark during periods of high geopolitical tension and market uncertainty.

As then-President Donald Trump stepped up his trade war with China in May 2019 with plans to increase tariffs on Chinese imports from 10% to 25%, Bitcoin and Ethereum rallied more than 50%. The S&P 500 fell more than 2.2% during the same period.

Around the Jan. 6, 2021 Capitol riot, Bitcoin surged 40% while the S&P fell. Ethereum and the rest of the cryptocurrency market rose even more than Bitcoin.

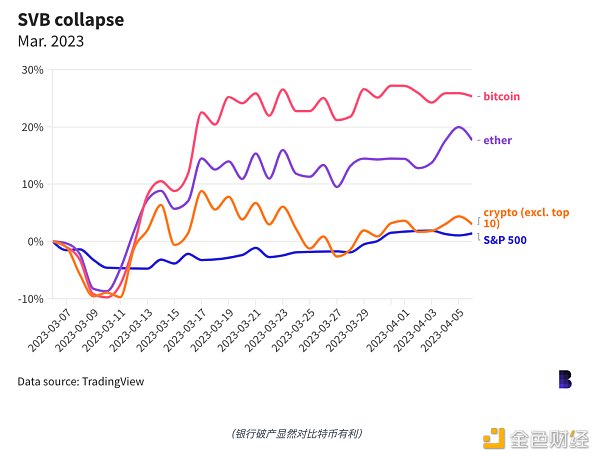

Cryptocurrencies initially fell along with the S&P last March as Silicon Valley Bank collapsed, but Bitcoin and Ethereum rose more than 20% as the U.S. government stepped in to clean up depositors. Meanwhile, the S&P has only really pared its losses.

Bitcoin even surged by more than a quarter after the Hamas attack on Israel on October 7. The S&P 500 fell about 5%.

However, in other times of stress, cryptocurrencies have traded in the opposite way to hedgers' hopes. After the assassination of Jamal Khashoggi in Saudi Arabia in October 2018, the Bitcoin, Ethereum and other digital asset markets collapsed along with the S&P 500.

Sometimes, cryptocurrencies can even trade like everything else. When the U.S. made a major troop withdrawal from Afghanistan in September 2021, Bitcoin and Ethereum fell more than 10%, and the S&P fell 6%.

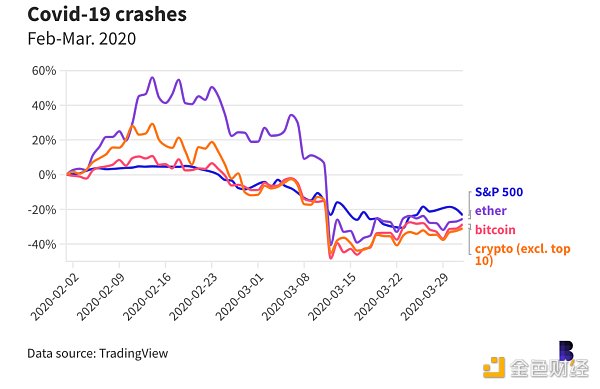

Then, during the Covid-19 crash in the first quarter of 2020, Bitcoin plunged 50%, in sync with global markets.Still, perhaps we are heading toward an era where Bitcoin and cryptocurrencies act as safe-haven assets.

Big News

Hong Kong may have just joined the ranks of Europe and the United States in potentially allowing some companies to launch spot Bitcoin ETFs. Hong Kong regulator the Securities and Futures Commission also appears to have beaten the U.S. Securities and Exchange Commission to the punch in approving a number of issuers to launch spot Ethereum ETFs.

China Asset Management said in a statement that it is working with OSL Digital Securities and BOC International Prudential. A translated version of the company's statement said the asset manager "plans to issue ETF products that invest in spot Bitcoin and spot Ethereum."

OSL confirmed in a separate statement that it has "approved in principle to launch the first spot Bitcoin/Ethereum ETF in Hong Kong."

HashKey said it also received approval along with Bosera International. The two companies plan to join forces to "co-facilitate the issuance of spot Bitcoin and Ethereum ETFs, providing investors with a secure, compliant, and convenient way to directly participate in these markets."

The news on Monday was enough to boost Bitcoin and Ethereum after a volatile weekend, thanks to reports late last week. Ethereum rose about 7%.

This is a moment for Hong Kong to solidify its position as a major player in the cryptocurrency space. The special administrative region has been working on new regulations and attracting cryptocurrency companies over the last year. Among other things, this could open the door for institutional demand in Asia.

In the United States, the launch of a spot Bitcoin ETF has led to Bitcoin hitting all-time highs, with a large number of institutional and retail investors buying into the new ETF as companies look to secure investment opportunities for themselves and their clients. Specifically, the launch of an Ethereum ETF (if executed in Hong Kong before the U.S.) could give the entire market a glimpse into what would happen if or when an ETF is launched in the U.S., depending on who you ask.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Weiliang

Weiliang Weiliang

Weiliang JinseFinance

JinseFinance Jixu

Jixu Jixu

Jixu Ftftx

Ftftx Cointelegraph

Cointelegraph