Author: Nancy Lubale, CoinTelegraph; Compiled by: Deng Tong, Golden Finance

In the past 48 hours, the price of Bitcoin fell 13% from a record high of $73,835, once falling to near $60,000. The correction is due to overheating in the market, which analysts refer to as a "pre-halving retracement," and comes about 30 days before Bitcoin's halving event.

BTC/USD daily chart. Source: TradingView

However, a report from CryptoQuant shows that given that investment flows from new investors are relatively low and price valuation indicators remain below levels seen at past market tops, Bitcoin The bull market cycle is not over yet.

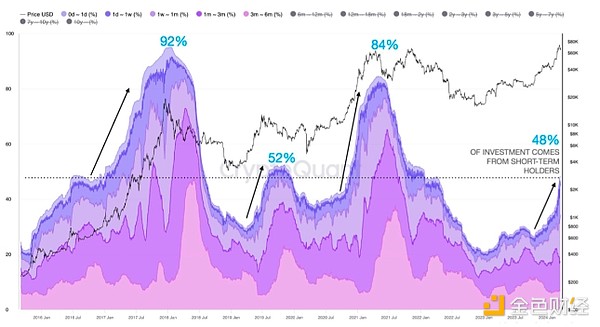

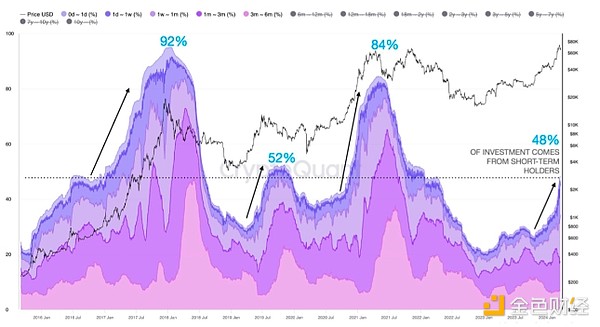

The on-chain data analytics company’s Cryptocurrency Weekly Report shows that 48% of Bitcoin investments come from short-term holders. According to analysts at CryptoQuant, “bull cycles typically end with 84%-92% of investment from these new investors.”

“The Bitcoin bull cycle is far from over, as evidenced by relatively low levels of new investment flows.”

Bitcoin implementation upper limit - OTXO age range percentage. Source: CryptoQuant

The chart above also shows that the indicator "reached similar levels to mid-2019 (52%), when Bitcoin also experienced a meaningful correction," which This is something short-term traders should be wary of.

The CryptoQuant report also shows that valuation metrics remain below levels seen at past market highs.

"The CryptoQuant Profit and Loss Index remains outside the market top zone (red zone) and above the index's 1-year moving average."

Bitcoin: CryptoQuant Profit and Loss (PnL) Index. Source: CryptoQuant

CryptoQuant’s PnL Index consists of three on-chain indicators that show Bitcoin’s profitability. The index has previously suggested that the cryptocurrency market will enter a bull cycle in 2024. However, the chart above shows that current levels are slightly lower than those observed when the market peaked during the bull markets of 2013, 2017, and 2021.

There is only one month left until the Bitcoin halving event

In addition to the indicators discussed above, The upcoming Bitcoin halving event is expected to be a major driver of Bitcoin price, ushering in a parabolic uptrend.

According to CoinMarketCap’s halving countdown, there are less than 31 days until Bitcoin’s next halving event.

Countdown to Bitcoin halving. Source: CoinMarketcap

With approximately 4,450 blocks left, Bitcoin’s fourth halving is expected to occur on April 20, with miner block rewards reduced by 50% from 6.25 BTC Reduced to 3.125 BTC.

Historically,Bitcoin supply halvings have been associated with rising Bitcoin prices. Halvings always occur before a major bull run in the Bitcoin market.

Standard Chartered Bankmade a bold prediction,raising its 2024 BTC price forecast from $100,000 to $150,000.

Standard Chartered analysts wrote in an investment note to clients on Monday, March 18:

“For 2024, given the year-to-date price gains Exceeding expectations, we now believe prices are likely to reach $150,000 by the end of the year, up from our previous estimate of $100,000."

The bank also predicts that the price of BTC will reach $250,000 in 2025 The U.S. dollar reached a cycle top and then stabilized around $200,000.

While the bank’s analysis is not entirely based on the halving event, it draws on the impressive performance of spot Bitcoin exchange-traded funds since they began trading on January 11, as well as their The different dynamics this halving cycle brings to the market.

Huang Bo

Huang Bo