Author: Mario Eats Coins

Cross-chain, also known as chain abstraction, full chain, and chain interoperability, has three giants in this field, namely Wormhole, Axelar, and LayerZero. Among them, Wormhole and Axelar have been launched, and LayerZero has not yet issued coins. Today we analyze the three giants from a data perspective to see who has the most potential?

1 Supported public chains

As a chain interoperability protocol, the supported public chains are a very important indicator. According to the official data of the three companies

Axelar supports a total of 66 public chains,

Wormhole supports more than 30 public chains,

LayerZero supports more than 50 public chains.

From the perspective of the number of public chains supported, Axelar is bullish. And the specific public chains supported show their own characteristics. The core of Axelar is the EVM series and the Cosmos series. Because it is developed based on the Cosmos framework, it supports a large number of Cosmos series public chains, such as Celestia, Dymension, Fetch.AI, etc.

Among the public chains supported by Wormhole, in addition to the EVM series and the Cosmos series, it also includes Aptos/Sui of the Move framework, Polkadot and Solana.

LayerZero is mainly in the EVM series, and has begun to try other series, such as the Aptos cross-chain bridge, and the Merlin cross-chain bridge with the BTC ecosystem.

2 Cross-chain information transmission

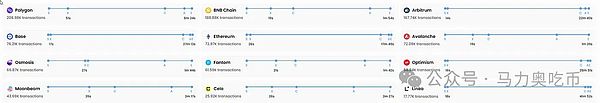

The top 3 public chains for Axelar information transmission are Polygon, BNB Chain, and Arbitrum

The top 3 for Wormhole are Arbitrum, Solana, and BNB Chain

The top 3 for LayerZero are Polygon, BNB Chain, and Arbitrum

In terms of cross-chain information, we found that the top 3 public chains of Axelar and LayerZero all overlap, and the biggest feature of Wormhole is Solana.

From the perspective of the number of cross-chain information

Wormhole has an average of 4,000 cross-chain information per day, while Axelar provides monthly information, which is 5,600 per day. LayerZero has 270,000 cross-chain information per day.

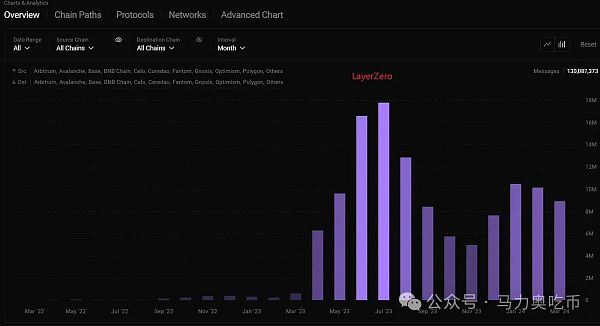

Although LayerZero's cross-chain information is dozens of times that of the other two, I think the main contribution comes from the interaction of the Mao Party. LayerZero is the only one that has not issued a coin, and it is a project that the Mao Party must participate in. Once it goes online, its real users are still unknown. From the trend of change, the number of cross-chain information of LayerZero this year is lower than that of last year. The monthly data in March this year is less than 50% of the peak last year.

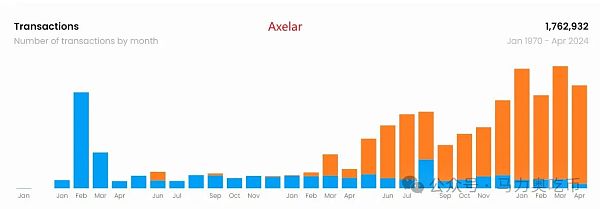

However, Axelar can be seen that its data is steadily increasing, because Axelar has been online for a year and there is no airdrop.

Axelar has increased from 59,000/month information in September last year to 170,000/month in March. This data reflects the more real data of Axelar, and also reflects that when the market is hot, the demand for cross-chain will also increase synchronously.

3 Financing and market value

From the perspective of financing, the three giants are all backed by top investment institutions. LayerZero is led by A16Z, and there are also first-tier VCs such as Sequoia and Coinbase. Axelar has investments from Dragonfly, Polychain, and Binance Labs. Wormhole has investments from Coinbase, Multicoin Capital, etc.

From the valuation at the time of financing, LayerZero has the highest valuation, reaching 3 billion US dollars. Wormhole's valuation is also very high, reaching 2.5 billion US dollars. Its current FDV is 10.7 billion US dollars, and it has a profit of 4 times. In comparison, Axelar's valuation is the lowest, and its current FDV is basically equivalent to the financing valuation.

4 Summary

From the perspective of the number of public chains involved, Axelar has the highest number of 66, while Wormhole has the least number of more than 30. The public chain development of the three giants has its own advantages and development directions. Axelar's advantage lies in the Cosmos series. Now most modular public chains will be developed based on Cosmos, including infrastructure Celestia and Dymension, which may bring great growth in the future. Wormhole focuses on Solana and also supports Aptos/Sui and Polkadot of the Move framework. LayerZero focuses on layer2 and is now actively trying Aptos and BTC layer2.

From the perspective of cross-chain information, the number of LayerZero is dozens of times that of the other two, but the actual retention after removing the wool party is still unknown. The remaining Axelar's data is higher than wormhole. From the previous data, only Axelar has been growing steadily since the past year.

From the perspective of coin price potential, I think Axelar is more worthy of attention. Wormhole's data is worse than Axelar's, but its FDV is about 10 times that of Axelar. The real data of LayerZero is still unknown, but its financing valuation has reached 3B, and it may reach 10B after listing, which is also 10 times that of Axelar.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Anais

Anais Brian

Brian Sanya

Sanya Cheng Yuan

Cheng Yuan Xu Lin

Xu Lin Alex

Alex Cointelegraph

Cointelegraph