Source: Gryphsis Academy

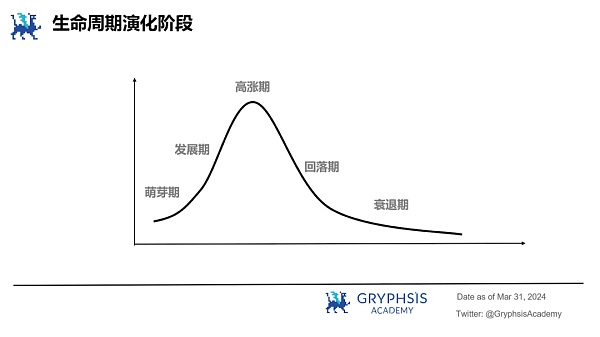

Memes spread through imitation. Any information that can be copied through imitation can be called a meme; the information in the form of words that spread is a variety of memes; its expression forms are numerous, such as music, ideas or styles, etc. The meme propagation process conforms to the life cycle theory, and the propagation method is applicable to the infectious disease model, but its strong meme standard is still difficult to quantify.

MEMEs are presented in different forms in each cycle, and their characteristics and mechanisms are different as the cycle changes. MEMEs can reflect the mentality of investors and market hotspots in different periods to a certain extent, including the outlook for current new technologies and the direction of narrative.

The MEMEs wave in this round of bull market is jointly influenced by society, psychology, economy and technology. At this stage, MEMEs types can be roughly classified from the aspects of mechanism innovation, market narrative, market sentiment, meme culture, celebrity effect, hot imitation disk, etc. Its gameplay mechanism is diverse, and it is necessary to establish a reasonable strategy to make a profit.

The future of MEMEs is highly controversial, and institutional retail KOLs have different views. MEMEs must be interesting and meaningful, and cannot be reduced to a speculative tool.

Introduction

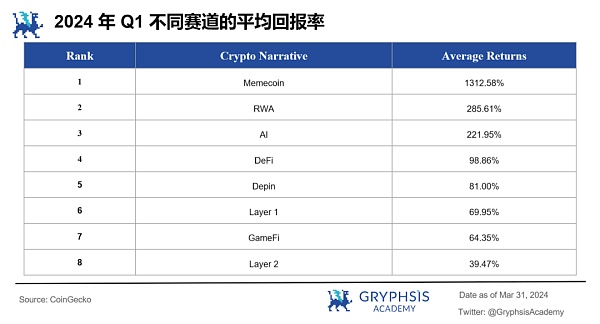

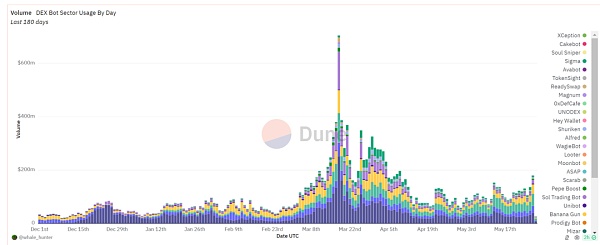

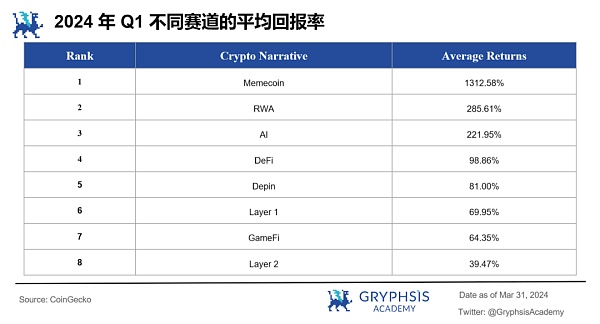

From Ethereum to Solana, MEMEs have never lacked myths of benefit. According to the CoinGecko report, MEMEs are the most profitable cryptocurrency in the first quarter of 2024, and its top tokens have the highest average return rate of 1312.6%.

PANews once interpreted the investment returns of MEMEs from the perspective of the Kelly formula. By calculating the number of coins issued daily and the winning rate on Ethereum and Solana chains, it is found that their winning rates are extremely low, with Ethereum's winning rate of 3.28% and Solana's even lower rate of only 1.6%. They will eventually become slaughterhouses where players lose forever.

MEMEs is a high-risk, high-return investment game. How does it attract the public to participate and how is it spread? Value coins vs MEMEs, where is the future of MEMEs?

1. How do memes spread?

1.1 What are memes?

"When we leave this world, only two things remain, one is genes and the other is MEME."

——Richard Dawkins

MEME, also known as meme, meme, meme, meme, meme or meme, is an abbreviation of the word mimeme (derived from the ancient Greek word μíμημα), and its original meaning is to imitate or copy. The concept of MEMEs originated from the book The Selfish Gene by Richard Dawkins, a British evolutionary biologist. He described memes as "units of cultural inheritance that reproduce themselves in the meme pool through... (in a broader sense) imitation."

The concept of meme has been colored by biological analogies since its birth. This analogy equates memes with genes (they can both replicate, inherit, mutate and respond to selection pressures), and thus gave rise to a new discipline - memetics.

The classification dimensions of memes are diverse. From the perspective of pros and cons, they can be divided into beneficial memes and harmful memes, according to the form of expression, they can be divided into composite memes and simple memes, from the perspective of evolution, they can be divided into symbiotic memes and parasitic memes, and according to the ability to replicate, they can be divided into strong memes and weak memes.

Currently, there are various interpretations of the concept of memes. The most widely accepted definition is mainly based on the synthesis of Dawkins and Blackmore, that is, memes spread through imitation; any information that can be copied through imitation can be called a meme; the information in the form of words that spread is a variety of memes; memes have many forms of expression, such as music, ideas or styles, etc.

The definition of MEMEs is even more different. There is a big gap between MEMEs in the eyes of different people. In the eyes of Web2, BTC may be the biggest MEMEs. In the eyes of mainstream currency players, altcoins may all belong to MEMEs. But summarizing their common points, it can be found that MEMEs refer to those Tokens that have no practical use in the eyes of investors, only speculation, and are dependent on market sentiment pricing.

1.2 Meme propagation mechanism

The meaning of "being imitated and spread" of memes means their own iteration. Without propagation behavior, they cannot constitute memes.

It can be seen that the successful replication of MEMEs is inseparable from propagation. How do MEMEs spread?

A MEME is expressed (E), propagated (T), assimilated by the recipient (A), and finally saved (R) in the memory system of the brain. After completing these four steps, MEMEs find a new host, and the life cycle of MEMEs propagation is completed.

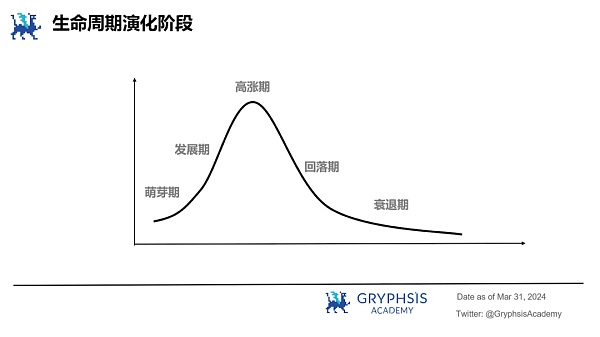

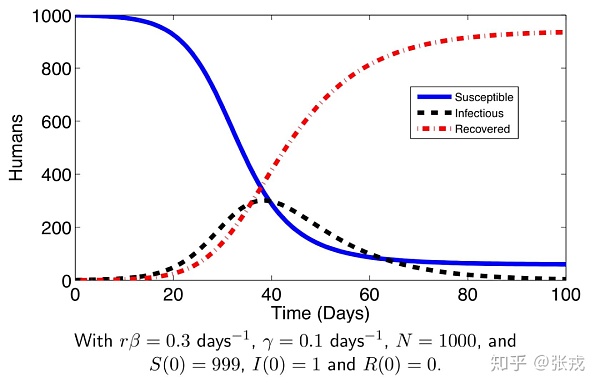

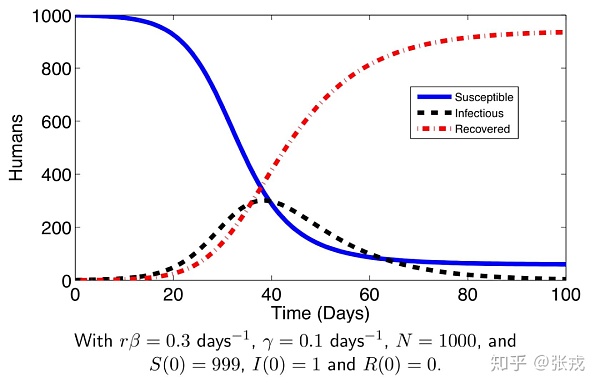

Its propagation mode is similar to that of viruses, and the propagation path can be well revealed from the infectious disease model. The infectious disease model divides the population into susceptible (Susceptible), exposed (Exposed), infected (Infectious) and recovered (Recovered) to simulate the propagation mechanism. Due to the short incubation period of MEMEs propagation, it is usually deconstructed from the SIR model. The number of susceptible people decreases, the number of recovered people increases, and the number of infected people increases first and then decreases, and there is a peak. This peak is the vertex of MEMEs. Polarization, opinion leaders, and emotional contagion will all have different effects during the dissemination process.

In addition, the dissemination mechanism of online memes is also related to the social identity theory of psychology. Spears and Lea (1992) found that due to the anonymity of the Internet, members of virtual communities cannot effectively display their personal characteristics and identities. People must rely on society's definition of certain decisions and organizations to help define themselves and their interactions with others. Therefore, in the process of dissemination, memes are also shaping a sense of identity with community organizations. The stronger the community consensus and identity recognition, the stronger the meme dissemination.

An interesting phenomenon worth mentioning is that in the Solana chain Pump gameplay, MEMEs holders are worried that the serious project party will not be able to withstand the decline and Rug, and will also encourage and support Dev in the community. It reflects that a good community atmosphere will promote both parties, thereby strengthening community identity, and MEMEs are more likely to go viral.

Source:https://zhuanlan.zhihu.com/p/103974270

1.3 Strong Meme Indicators

Strong meme indicators have a strong guiding significance. They can not only help individual traders determine whether a meme can be successfully spread and at what stage of its life cycle? They can also help project parties create more popular MEMEs.

From the perspective of biological evolution, Dawkins (1998) proposed three indicators to measure successful memes:

Copying-fidelity: The more faithful the copy is to the template, the more likely it is to maintain its intrinsic characteristics after several rounds of replication.

Fecundity: The faster the replication speed, the wider the copies spread.

Longevity: The longer the replica template of the entity survives, the more copies it makes.

A successful meme needs all three. The reason why strong memes can spread widely is largely because they are easy to remember, not important or useful. Therefore, effective memes should be those that can cause highly realistic and long-term memory.

From the perspective of communication, Heylighen described 10 selection criteria such as coherence, novelty, and simplicity in more detail. Thus, a simple formula for the fitness of meme was designed.

F(m)=A(m)xR(m)xE(m)xT(m)

F(m) represents the ratio of the average number of MEMEs in a certain time unit t to the average number of MEMEs in the previous time unit t-1.

A(m) represents the ratio of assimilation rates before and after;

R(m) represents the ratio of the maximum storage time of assimilated MEMEs before and after;

E(m) represents the ratio of the number of expressions of a MEME saved by the host before and after;

T(m) represents the ratio of the number of copies of the expression propagated to the host before and after.

For a certain moment, A ≤ 1, R ≤ 1, and E has no upper limit. A MEME can be expressed 10, 20 or even hundreds of times; T also has no upper limit. If it is broadcasted, assuming there are 10,000 listeners, it is equivalent to copying 10,000 copies of MEMEs each time. In the above formula, as long as any factor is zero, its product must be zero. To make the fitness F>1, one of the strategies is to make E>1 or T>1.

By observing the propagation trends and rough statistics of most memes, Heiligen found that if a model meets certain criteria in the above table, it is possible to successfully realize the life cycle of the meme, so that it can be copied and spread to become a strong meme.

However, whether from the perspective of communication or biological evolution, it is difficult to accurately determine to what extent a meme that meets which criteria is a strong meme. Combining finance and mathematics-related disciplines, the winning rate of secondary trading indicators on MEMEs is about 30%, and there will be a certain error. Liquidity, the proportion of the top ten holdings, the number of project Rugs, etc. will have an impact on the measurement of MEMEs, but the actual indicators are difficult to quantify accurately, and combined with AI large model analysis may be helpful.

2. Current status and development of MEMEs

Since the birth of Bitcoin, MEMEs have existed in every cycle and have performed well. From Litecoin to Dogecoin, to NFT and Zoo MEMEs. MEMEs are presented in many ways, and their characteristics and mechanisms vary with the changes in the cycle. Sorting out its development and current status will help to better discover the version answer.

2.1 Early Development of MEMEs

Source: https://dogecoin.com

The concept of MEMEs did not cause a market boom at the beginning. It was not until Dogecoin (DOGE) in 2013 that MEMEs entered the public eye.

Doge is a MEME with Japanese Shiba Inu as the protagonist. The meme originated from the picture of Japanese Shiba Inu Kabosu that appeared in 2010. After Billy and Jackson launched Dogecoin (DOGE), it received widespread attention on sites such as Reddit and was used as a currency for tipping. Two weeks after its birth, the daily transaction volume exceeded that of Bitcoin.

In 2014, doge was selected as Time Magazine's best MEMEs of the year and appeared in mainstream culture. In 2021, with Elon Musk's repeated promotions, the price of Dogecoin soared. The success of Dogecoin (DOGE) created the foundation for the prosperity of MEMEs and brought new currencies. These new currencies were initially launched in the "Alternative Cryptocurrency" sub-forum of Bitcointalk as proof of work (PoW).

Subsequently, different MEMEs emerged in each period. Looking back at the ICO boom in 2017, most projects provided detailed white papers to attract investment with technological innovation as potential. Most of the MEMEs during this period were more serious, and their vision hoped to make practical innovations beyond MEMEs.

In the Defi boom, projects are more focused on explaining economic and liquidity advantages to attract participants. At that time, MEMEs were mainly animals, food, etc. In addition, NFT projects were also considered to belong to MEMEs in the early days. Some of the most representative NFTs include: CryptoPunks, Bored Apes, Pudgy Penguins, etc.

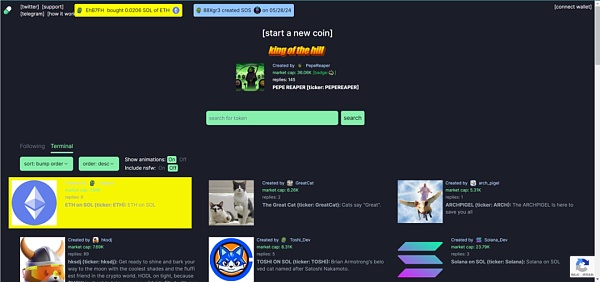

The current MEMEs boom is more dependent on emotional promotion. Projects no longer pursue technological innovation, but pay more attention to narrative direction and market hotspots. This phenomenon may reflect the fatigue of the market to a certain extent, that is, investors have gradually begun to seek more IQ50 ways to participate in the market after experiencing a long period of technology orientation. In this mode, Pump has emerged, and the immediate low-cost method has attracted a large number of players to participate.

Tracing the development of MEMEs, the characteristics of MEMEs can reflect the mentality of investors in different periods and the current market hotspots. MEMEs include the outlook for current new technologies and the capture of hot spots.

2.2 Analysis of MEMEs on major public chains

Source: https://www.MEMEsrace.xyz/

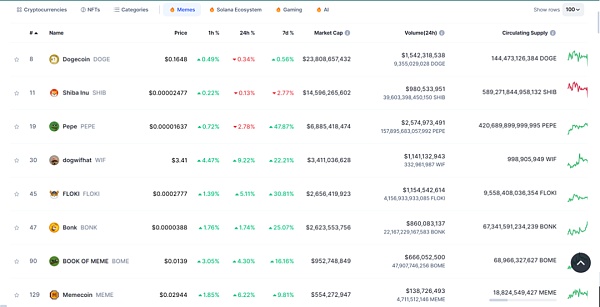

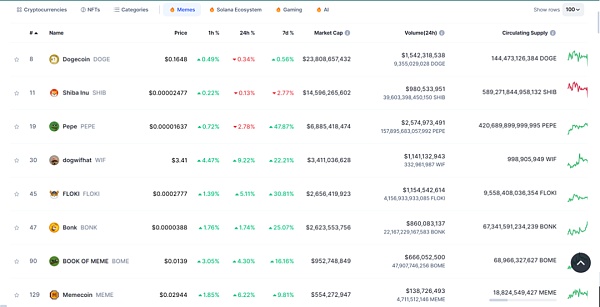

MEMEs can bring prosperity to public chains. From Doge to Bome, MEMEs have become a unique cultural symbol and communication method of Web3. MEMEs have a place in all major public chains.

Some MEMEs with higher market capitalization are mainly deployed on Ethereum, Solana, Base, Bitcoin (BRC20, etc.) and other chains.

Among the top 500 MEMEs in terms of market capitalization, most are deployed on Ethereum and Solana chains. This reflects the prosperity of the MEMEs ecosystem on the Solana chain in this round of bull market. From the perspective of the types of MEMEs that have emerged, the rise of the top MEMEs on the Ethereum chain is still based on early narrative logic, as most of them are early MEMEs, such as PEPE and SHIB.

In addition to DOGE, the types of animal MEMEs on the Solana chain are more diverse, and their gameplay is more susceptible to market sentiment due to the emergence of BOME. The MEMEs that have emerged on the Base chain are more inclined to capture technological trends and revolve around social ecology.

Sponsored Business Content

Source: Coinmarketcap

(1)Innovative advantages of gameplay mechanism

Representative cases include PEOPLE and SLERF. Web3 consensus is king, while MEMEs pay more attention to consensus. PEOPLE gathered nearly 20,000 people from all over the world through ConstitutionDAO at that time, which was an in-depth experiment of MEMEs on DAO.

It was planned by innovators Graham Novak and Austin Cain, with the goal of auctioning off a printed copy of the 1787 U.S. Constitution. This became the first project to use crowdfunding to protect world historical documents, and it also achieved a hundredfold return at the time. SLERF was due to the project owner's operational error, and the founder was forced to repay the loan, achieving a completely fair sale and triggering a craze.

(2) Capturing the direction of market narratives

There is a certain time difference between the primary market and the secondary market. And MEMEs themselves can reflect the pursuit of new technologies. When the secondary market's current narrative is AI, it can be found that AI MEMEs also soared rapidly, and AIDOGE, AIBB and other AIs have soared one after another.

In addition, festivals such as Women's Day and the Spring Festival will also cause the increase of related tokens such as LADYS; Nvidia conferences and CZ court hearings will also trigger the issuance and fluctuation of tokens such as NVEDUA and FREECZ, but most of these MEMEs quickly return to zero after the event.

(3) Elusive market sentiment

This type is difficult to judge, but most of them trigger people's consensus and ignite market enthusiasm. For example: the operation of the founder of BOME adding a pool quickly detonated the market.

(4) Strong meme culture

DOGE was popular before the token was sold, and PEPE's emoticons were widely circulated before the token was sold. These are examples of strong memes first and then tokens. In addition, MEMEs with artistic characteristics are often stronger, probably because artworks are inherently more unique in the assimilation stage.

(5) The influence of celebrity effect

Musk called for Dogecoin, triggering "DOGE to the moom". Anatoly Yakovenko, the founder of Solanaana, launched SILLY during Halloween, which also performed extremely well. Within two weeks of going online, the market value reached 70 million US dollars, with more than 8,600 addresses holding coins and a pool of 1.2 million US dollars on the chain. Due to the Summer Olympics, national tokens have also emerged one after another on the chain. Musk only mentioned Argentina in a tweet, and smart money immediately discovered and bought it on the chain to make huge profits.

(6) Related hot imitations

Most of these types are trying to take advantage of the popularity of the god disk. It is difficult to run a real god disk, but there is room for speculation in the short term.

Only when the above conditions are met can it become a strong MEME. Although MEMEs seem to be a dog game, they still require a very high market sense.

2.3 Why MEMEs are attracting much attention at this stage

The emergence and existence of MEMEs are jointly influenced by society, psychology, economy and technology. The mentality of speculation and getting rich quickly, powerful marketing methods, professional financial teams, and barbaric growth environment are all reasons for the growth of MEMEs.

The reasons why MEMEs have attracted much attention in this round of bull market can be briefly interpreted from the following points.

(1) The need for mainstream narrative. Analyzing this round of bull market, it can be seen that the market lacks a mainstream narrative that can take over the popularity of Bitcoin ETF. The rise of value coins is not satisfactory, and BOME was listed on Binance in three days. MEMEs can continue the enthusiasm of crypto players to a certain extent and become a potential melody.

(2) Improvement of infrastructure. The development of decentralized exchanges and the continuous upgrading of public chain performance have greatly reduced the cost of token issuance and player participation.

(3) Official support of public chains. Public chains use the wealth-making effect of MEMEs to further attract a large number of active users to participate, increase their own popularity and expand the ecosystem. But at the same time, it will also bring many bad impressions caused by wild growth. Solana chain cools down MEMEs, while BASE chain chooses to support it. Behind this, we can see the difference in the development stages and strategies of the two public chains.

(4) The fit of consensus concept. The rise of MEMEs is closely related to Fair Launch. This fair sale method is more in line with the value concept of Web3.

(5) Market FOMO sentiment. Social media hype and highly contagious pictures attract users to participate. This FOMO sentiment is also accompanied by retail investors’ venting of dissatisfaction with institutions.

(6) The impact of the wealth creation effect. The legend of getting rich overnight is widely circulated in MEMEs, attracting countless players to participate. Moreover, MEMEs are simple and easy to understand, without the need to understand complex technical principles, which further lowers the threshold for players to participate.

(7) A bull market where no one takes over. This round of bull market is a bull market where no one takes over, while MEMEs is a mismatch of funds on a time scale, which is more in line with this round of narrative and retail investor psychology.

MEMEs restore the wild nature of the unregulated financial primeval forest and face many problems. However, as a cultural phenomenon and a popular investment, MEMEs have become an indispensable part of the crypto market. In the face of a complex market environment, it is important to know that profit is a reward for good risk management, and bets that rely on luck will eventually be returned to the market.

3.MEME is an exploration of the gameplay mechanism

MEMEs have developed to this day, and their gameplay mechanisms have become more and more diverse. Some people have made a lot of money in it, but most players end up with zero. MEMEs are not just a game of luck. Only by mastering a good strategy can you make a profit in the cruel financial market.

3.1 A preliminary exploration of MEMEs

On-chain transactions are mainly security-oriented. When interacting on the chain, it is most important to pay attention to the security of wallets and contracts. There are currently many tools that support contract security detection, and some basic viewing applications have integrated these functions. In addition, it is also necessary to prevent project Rugs, false illusions of burning pools, Pixiu disks, etc.

The initial MEMEs gameplay is mainly to discover early Alpha. The project issuance and user participation costs are still relatively high, and players mainly focus on improving their winning rate. Basic judgments can be made by observing the pool size, market value, liquidity, and the proportion of the top 10 holdings. Combined with the number of Twitter followers, community popularity, and website completion for comprehensive analysis.

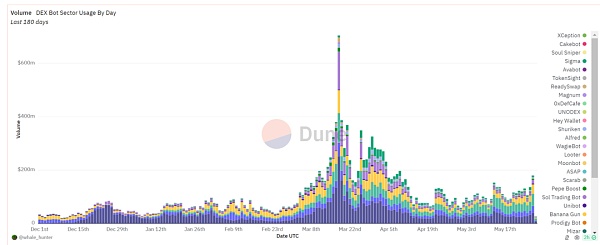

With the rise of Solana chain MEMEs, its gameplay is more diverse, and the number of Twitter followers, community popularity, etc. cannot be used as a single evaluation indicator. In addition, MEMEs have a faster trading rhythm and a very high frequency of issuance. The trading robot market has become hot again because of MEMEs.

With the continued popularity of Pump, hot spots such as national currency, fruit currency, vegetable currency, and TRUMP have continued, and the conversion speed is also very fast. The rise of MEMEs has also had a certain impact on the activity of Tg Bot.

Source: Dune (@whale_hunter)

3.2 Analysis of Pump Mechanism

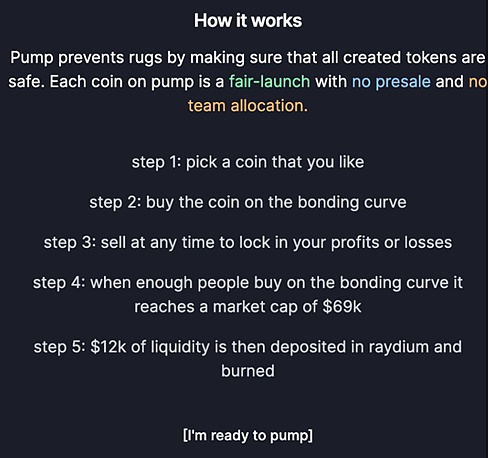

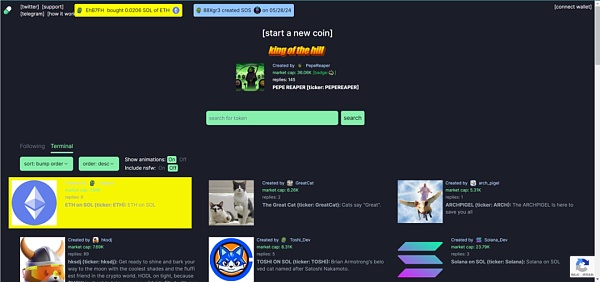

Pump, as a platform focusing on creating and trading MEMEs on Solana and Blast, continues to gain popularity. The popularity of Pump gameplay, to a certain extent, reflects the project's demand for quick coin issuance and the players' demand for social interaction.

Source: Pump

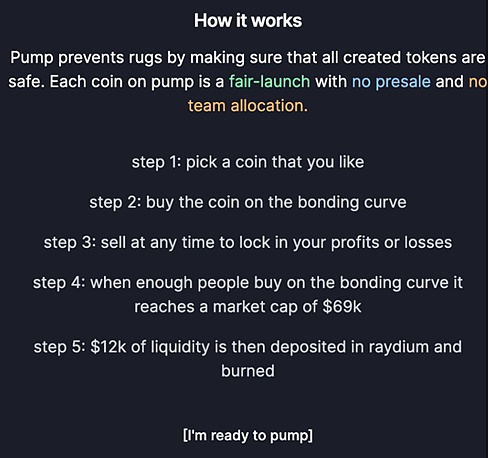

Pump, as a Dex, currently uses a bonding curve mechanism. Compared with AMM, it is more suitable for the issuance and trading of new tokens, directly linking the token price to the supply through a mathematical function without relying on the two assets in the liquidity pool.

Pump is very simple to issue or trade. When the market value of MEMEs reaches 69K, the platform will automatically deposit 12K of liquidity to decentralized exchanges (such as Raydium) and execute a burning mechanism to stabilize the coin price and increase scarcity.

Pump's extremely low participation cost has attracted a large number of players to join, and its profits are very considerable, with daily income exceeding US$400,000. However, the platform lacks technical barriers and currently only makes profits by scarcity.

Source: Pump

The Pump interface is simple but very magical, and the hot spots on it change extremely quickly. Michi (michi), USA (American Coin), SC (Shark Cat), etc. are all MEMEs that appeared on Pump. The wealth effect on them attracted many players to participate.

3.3MEME is a strategy analysis

MEMEs can be traded through a variety of indicators, but there is no golden indicator. Indicators that strongly follow the framework may increase the winning rate, but may also lead to missing the golden dog.

(1) Trading strategies driven by public opinion heat. Judge from the degree of FOMO in each link of the communication chain. In the actual operation, you need to have extremely high sensitivity, as well as a high-quality community and KOL list.

(2) Technology-based trading strategy. Signal trading and on-chain data analysis are carried out in parallel with robot tools. These include several strategies: Smart money tracking, which is suitable for large market transactions. However, you can form your own investment strategy through the trading style of smart money. Scientist sniping requires the establishment of screening criteria for the target and the use of robots to assist in trading. The strict implementation of the strategy by the robot can significantly increase the winning rate, but may result in missing the golden dog.

(3) Financial mathematics-based trading strategy. Mainly judged by K-line, chip distribution, etc. Different pool sizes and capital volumes have different playing methods. Common ones include: day-line players, who usually participate in medium-sized pools to ensure that the project party will not Rug overnight. Long-term holding or swing trading. Ultra-short-term players, who mainly observe K-line, the quality of the target, etc. to participate. With the popularity of Pump, there are also players who ambush hot targets early and trade through the inner plate Pump.

Risk warning: MEMEs are extremely risky to participate in, and you may lose all your principal.

4. MEME is the future

4.1 What do major institutions think?

MEMEs have attracted much attention for their outstanding performance in this round of bull market. Major institutions have different views, and MEMEs VS value coins have become a hot topic in this round of discussion.

Source: https://x.com/eddylazzarin/status/1783149288471617661

A16Z CTO has explicitly criticized MEMEs, believing that "MEMEs undermine the long-term vision of keeping many people in the crypto space, and are technically unattractive; they are not attractive to builders." Looking at its positions, there may be further interpretation. According to the on-chain address data counted by Scopechat and Rootdata, the largest position of A16Z's public address is Uni, followed by COMP and ETH.

But there are many institutions and KOLs who have a positive attitude towards MEMEs.Pantera partners believe that MEMEs, as an interesting social activity, can attract more people to join Web3 with a low threshold, and as the introducer of the early ecology of the public chain, it is the easiest way for the next generation to experience the latest DeFi applications and introduce them to Web3. And for applications, MEMEs can add NFT projects, social protocols, etc. for further development.

V God also has a vision for the future of MEMEs, believing that MEMEs must be interesting and meaningful, and cannot be reduced to a speculative tool. It is believed that MEMEs can be further developed in charity and Robin Hood games. In fact, as the largest MEMEs, Dogecoin has always been committed to charity, supporting the Jamaican bobsled team to participate in the Sochi Winter Olympics, building clean water wells in Kenya, and planning to remove 30 million pounds of garbage from the ocean.

4.2MEME is a reflection of the wave

MEMEs have been controversial in this round, and the reason is the impact of the real value of MEMEs and the current market value gap. However, how to define a high-quality MEME and what kind of projects are considered high-quality MEMEs are still difficult to reach a consensus at this stage.

As the largest meme coin in Web2, the people who were willing to pay for Bitcoin at the beginning were gamblers who pursued quick wealth or investors with blockchain consensus? It is worth looking forward to whether the wild land of the unregulated financial primeval forest will eventually give birth to MEMEs under capital consensus or meme coins that track equality and freedom.

Finally, before learning to construct, don't take the deconstructed things as the final answer to the problem.

JinseFinance

JinseFinance