Author: pedro Source: Modular Media Translation: Shan Ouba, Golden Finance

Over the past few weeks, we have gradually explored the various components of the chain abstraction layer, focusing on the permission layer and the solution layer. The permission layer is the interface that users interact with, and users can express specific intents (i.e., the results they want) through a unified balance. The solution layer consists of high-level actors outside the chain, whose responsibility is to execute these user intents as efficiently as possible.

We need to remember that solvers will be the entities that conduct transactions on the blockchain on behalf of end users. Because the goal of chain abstraction is to make the user experience no different from using traditional Web2 applications, in other words, users should not be aware that they are interacting with the blockchain.

In the previous article, we explained that solvers often use their own liquidity to advance users to speed up execution. Now let's review this process through an example:

Suppose Alice wants to bridge 100 USDC from the Polygon chain to the Base chain.

In order to complete Alice's intention as efficiently as possible, the solver Bob competes with other solvers to perform the task.

Bob uses his funds on the Base chain to directly advance 100 USDC to Alice because he holds liquid funds on multiple chains.

At this point, Alice has obtained 100 USDC on the Base chain and can use it immediately, but Bob's 100 USDC remains on the Polygon chain. This creates the so-called "fund rebalancing problem".

Rebalancing Problem

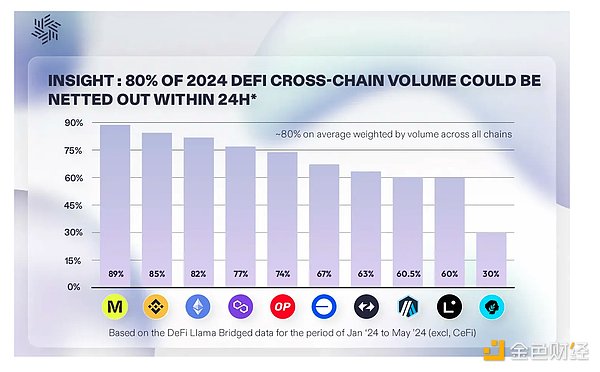

After completing an order, solvers are challenged with rebalancing their funds to the chain required for their operations. Currently, they rely on centralized exchanges (CEX) and cross-chain bridges to complete this process. However, Everclear has found that about 80% of rebalancing activities can offset each other, reducing unnecessary transactions.

Back to our example: Ideally, Bob would like to transfer his 100 USDC on Polygon back to the Base chain, as he expects more order flow and revenue to come from the Base chain. However, in the current environment, Bob needs to manually bridge these funds from Polygon back to the Base chain, which will incur bridge fees and cause additional time delays. These operational costs cut into Bob's profits and may ultimately result in higher fees for end users.

However, the competition between solvers is about speed and cost: who can complete the user's intention the fastest and with the lowest fee. This means that solvers can only charge a certain fee because there will always be other larger companies or entities that can afford these ongoing bridge fees (their trading volume is enough to offset these fees). Not only that, large companies may even have their own teams (depending on trading volume) to manually handle the rebalancing of these funds (i.e., perform the actual bridge operation).

Ultimately, this problem leads to an increasing centralization of solvers, and only solvers with sufficient resources can bear the high costs of rebalancing.

To deal with this growing centralization problem, the chain abstraction stack needs a new component: the clearance layer.

Clearing Layer

The clearing layer is a decentralized network responsible for coordinating the net settlement of inter-chain liquidity. By helping solvers, decentralized applications (dApps), market makers, and other participants handle liquidity rebalancing, the clearing layer eliminates the need for manual rebalancing and significantly reduces overall costs.

Back to our previous example: Bob no longer needs to manually bridge his 100 USDC from Polygon back to Base, the clearing layer will automatically perform liquidity net settlement for him, eliminating expensive and time-consuming manual operations.

In fact, the concept of "clearing" is not new, it is very common in the traditional Web2 financial industry.

Clearing in Payments: VISA

When Visa nets a transaction, it is actually calculating the final balance between all the parties involved (banks, merchants, and customers) over a specific period of time (such as a day). Rather than transferring funds one by one for each transaction, Visa batches these transactions and calculates the net amount owed or due by each party.

Let's look at an example:

Customer A (Alice) uses Visa to buy $100 of goods from Merchant 1.

Customer B (Bob) uses Visa to buy $50 of goods from Merchant 2.

Customer C (Charlie) uses Visa to buy $75 of goods from Merchant 1.

These are separate transactions, but instead of processing each one separately, Visa combines them into one batch.

After a period of time, Visa aggregates all the transactions that occurred.

Instead of transferring $100 and $75 to Merchant 1 separately, Visa can simply say, “Merchant 1 is due $175 in total.”

This process of combining the amounts and processing the net amount is called netting.

After netting, Visa settles these net amounts between the parties involved (and merchants receive funds deposited into their bank accounts).

Introducing Everclear

Everclear is the first clearing layer in Web3, allowing any solver, market maker, or intent protocol to connect to the network and take advantage of its clearing and rebalancing capabilities.

Although Everclear was first launched at the beginning of this year, the team behind it has been around for years, and Everclear’s predecessor was the cross-chain bridging protocol Connext - it was the first project to propose the concept of "chain abstraction".

While Connext has achieved some success in its field, the team realized that there is an underexplored but critical link in the field of chain abstraction - clearing. By June 2024, Connext was rebranded as Everclear and became the first Web3 clearing layer.

Everclear’s clearing layer directly addresses the cost and complexity issues solvers face in liquidity rebalancing. By orchestrating the netting, rebalancing, and settlement of liquidity across chains, Everclear is purportedly able to reduce operational costs by up to 10x, making the solving business more economically viable and affordable to more participants.

Going back to our original example, this means that solvers like Bob will no longer have to manually bridge funds back to their preferred chain. Instead, Everclear will automatically handle this process, not just for Bob, but for all solvers leveraging the clearing layer.

In a nutshell, Everclear is responsible for the following:

Netting: Netting is the aggregation and offsetting of multiple trades to minimize the actual movement of funds. For example, if $100 flows from chain A to chain B, and $80 flows from chain B to chain A, then only $20 actually needs to be transferred from chain A to chain B after net settlement.

Rebalancing & Settlement: Ideally, solvers' balances should be constantly adjusted across chains. When solvers' funds on one chain are used to execute intent on another chain, rebalancing and settlement must be performed to restore their original balance and settle any unsettled amounts between the relevant chains.

How Everclear Works

Everclear uses a Hub-and-Spoke model. In this model, individual blockchain networks (such as Ethereum, Arbitrum, or Optimism) act as "spokes" and a centralized "hub" serves as the core clearing chain - in Everclear's case, the clearing chain is its Rollup.

At the heart of Everclear's architecture is the intention matching (netting) mechanism, which is designed to optimize the flow of assets between chains by reducing unnecessary asset transfers. This system works by matching mutually satisfying intentions on the hub.

Netting example:

Everclear’s system matches these intentions and processes the transaction through netting, meaning that only 30 USDC needs to be transferred from Ethereum to Arbitrum (100 - 70). By netting, Everclear reduces the need for multiple large token transfers, reducing costs and delays.

At the end of each cycle, Everclear will finally settle. That is, the 30 USDC that actually needs to be transferred across chains will be settled to repay the solver who pre-paid liquidity. Ultimately, Everclear returns the 30 USDC to the solver’s account on Ethereum after netting.

This process allows solvers to focus on liquidity management and opportunities rather than manually transferring funds or bridging across chains.

Everclear’s Architecture:

Rollup Framework: Arbitrum Orbit.

Rollup as a Service (RaaS) Provider: Gelato.

Messaging: Hyperlane AVS (via EigenLayer) — Everclear will rely on Hyperlane’s validator cluster until AVS is fully live.

Data Availability: EigenDA — Everclear will initially use Gelato’s Data Availability Committee (DAC) and gradually transition to EigenDA.

By centralizing the rebalancing and settlement of cross-chain liquidity, Everclear reduces the operational burden on solvers and makes the solving process more efficient. Last week, Everclear officially launched on the mainnet, becoming the first clearing layer in the Web3 market.

Summary

In the broader field of chain abstraction, Everclear is incorporated into Frontier's CAKE framework as part of the Clearing and Settlement Layer, helping to complete the entire abstraction process.

Permissions Layer allows users like Alice to express cross-chain operation intentions through unified balances, providing a Web2-like user experience.

The Solving Layer executes these user intentions by interacting with different blockchains.

Finally, the Clearing & Settlement Layer optimizes the solving process by managing liquidity rebalancing and capital settlement between solvers' chains.

Chain abstraction is not a single product or protocol, but a collaboration between multiple teams and layers to provide users with a seamless experience. The goal is for users to interact with blockchain applications without even realizing they are using blockchain technology - bringing the simplicity of Web2 to the decentralized applications of Web3.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coindesk

Coindesk