Author: Alex O’Donnell, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

Multiple industry executives pointed out that Decentralized Finance (DeFi) will reach a turning point in 2025 as Bitcoin staking, real-world asset (RWA) tokenization, and agent artificial intelligence catalyze applications.

In 2024, the price of Bitcoin exceeded $100,000 for the first time as investors poured more than $100 billion into spot BTC exchange-traded funds (ETFs).

"Bitcoin's all-time high will trigger new interest in cryptocurrencies from institutions and regulators, and will revitalize the entire cryptocurrency industry in 2025," said Dean Tribble, CEO of the first-layer network Agoric Systems.

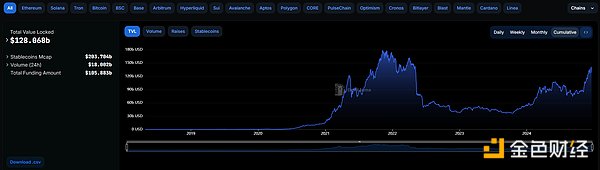

In December, the total value locked (TVL) in DeFi protocols reached $130 billion, according to DefiLlama, close to the ecosystem's all-time high of about $175 billion in 2021. Industry executives expect this upward trend to continue next year.

"By 2025, DeFi infrastructure and blue-chip protocols like Aave, Maple, Maker, etc. will have been operating at scale for more than four years," noted Jacob Phillips, co-founder and head of strategy at Bitcoin staking protocol Lombard.

"These platforms will become a trusted place for institutions and new users to use Bitcoin," said Phillips.

Source: DefiLlama

Bitcoin Staking

Bitcoin’s emerging second-layer (L2) expansion network and DeFi protocol ecosystem are creating unprecedented opportunities for investors to earn returns on Bitcoin.

“Bitcoin DeFi currently accounts for 0.1% of its total asset value. This is a 300x opportunity to grow DeFi on Bitcoin,” noted Alexei Zamyatin, co-founder and CEO of Build on Bitcoin, adding:

“We have spoken to dozens of large Bitcoin DeFi users and funds who are keen to earn yield on their Bitcoin assets.”

Bitcoin L2s like Babylon and CoreChain pay stakers to secure their networks by locking BTC as collateral.

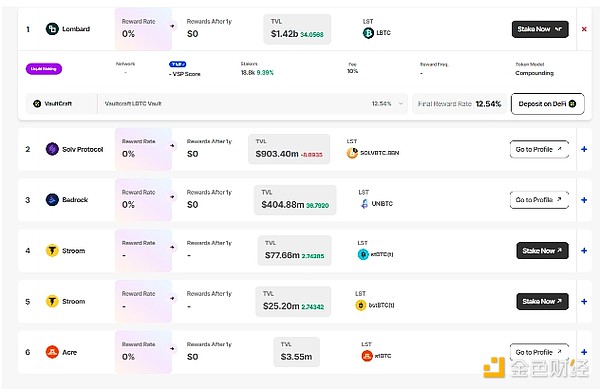

Currently, Liquid Staking Tokens (LSTs), which represent claims on staked BTC, are surging. According to stakingrewards.com, as of December 19, the total locked value (TVL) of Bitcoin LSTs reached $2.5 billion.

Matt Hougan, head of research at asset manager Bitwise, believes that Bitcoin-collateralized ETFs may also gain traction by 2025.

“There’s a lot of demand for the yield on bitcoin. Whether it’s going to be structured as an ETF in the U.S., I’m not sure, but in Europe, definitely,” Hougan said.

Source: Stakingrewards.com

RWA Tokenization

Polygon’s global head of institutional capital, Colin Butler, noted in August that tokenized real-world assets (RWAs) — digital tokens that represent claims on anything from U.S. Treasuries to art — are a $30 trillion market opportunity globally.

They have garnered around $14 billion in TVL, according to RWA.xyz. Tokenized U.S. Treasuries with yields are particularly popular, with a TVL of over $3 billion.

“Tokenizing real-world assets like real estate and carbon credits will unlock unprecedented liquidity, while advances in payments will further simplify cross-border transfers,” noted Raj Brahmbhatt, CEO of Web3 settlement platform Zeebu.

Even the U.S. Treasury Department has praised tokenization’s potential to improve liquidity and reduce “operational and settlement friction.”

“In the U.S., with (President-elect Donald) Trump’s victory, I’m very bullish on the U.S. becoming a global leader in this space by the end of the year,” Brahmbhatt said.

Source: RWA.xyz

Agent AI

According to CoinGecko, by 2024 In 2019, the market capitalization of tokens associated with agent AI (machines that autonomously pursue complex goals) reached a total of nearly $10 billion. Analysts expect the convergence of AI and blockchain technology to transform Web3, creating a future in which autonomous AI builds decentralized applications and transacts with human users. J.D. Seraphine, CEO of AI protocol Raiinmaker, noted that agent AI “has proven to be core to the future of the industry.” Seraphine said that in 2025, “AI agents are expected to play a more significant role in decentralized communities.” Hougan said the potential areas for AI agents are nearly limitless, adding: “It’s OK if you don’t know exactly what’s going to happen, as long as you know that what’s happening is really potentially important and you want to get involved in it.”

Hui Xin

Hui Xin

Hui Xin

Hui Xin Alex

Alex Clement

Clement Brian

Brian Catherine

Catherine Hui Xin

Hui Xin Kikyo

Kikyo Aaron

Aaron Alex

Alex Clement

Clement