Original title: Aave - the core pillar of decentralized finance and on-chain economy

Author: 0xArthur, founder of DeFiance Capital; compiled by 0xxz@Golden Finance

Aave is the largest and most proven lending protocol

As the undisputed leader in the on-chain lending category, Aave has an extremely solid and sticky moat. We believe that As a category leader in one of the most important areas of cryptocurrency, Aave is severely underestimated and has huge room for growth in the future that the market has not yet caught up with.

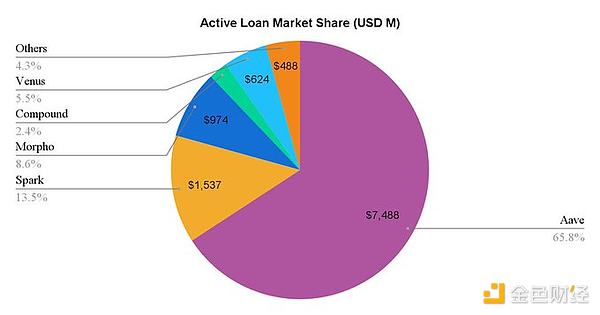

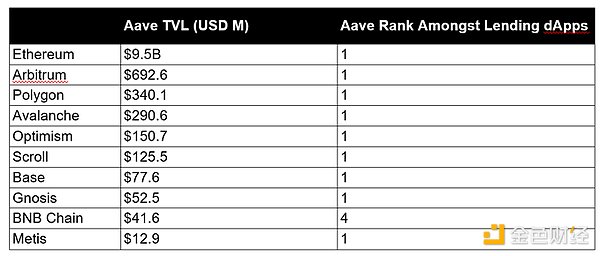

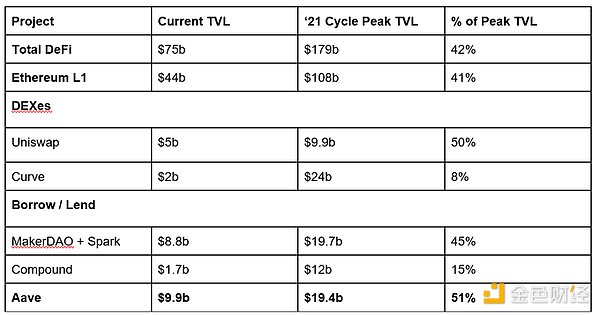

Aave was launched on the Ethereum mainnet in January 2020, and this year marks its fifth year of operation. Since then, it has become one of the most proven protocols in the DeFi and lending fields. Aave is currently the largest lending protocol with an active loan amount of US$7.5 billion, 5 times that of the second largest protocol Spark, which fully demonstrates this.

Data as of August 5, 2024

The protocol indicators continue to grow and have exceeded the highest value of the previous cycle

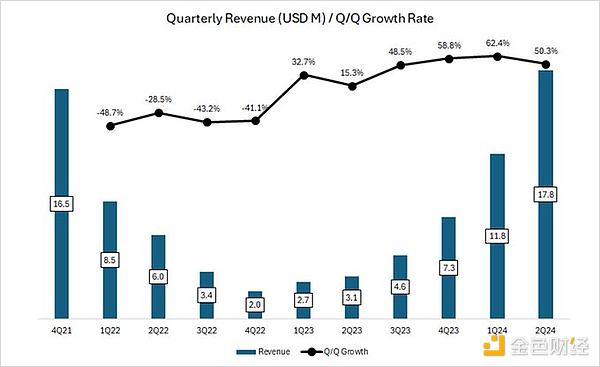

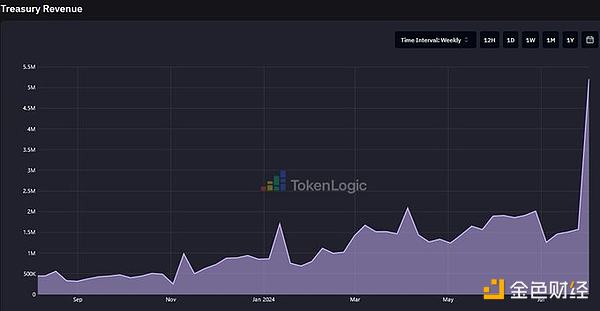

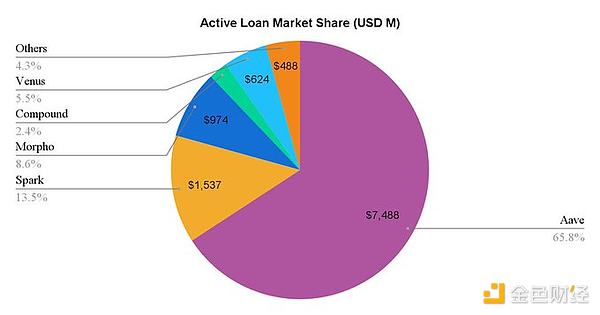

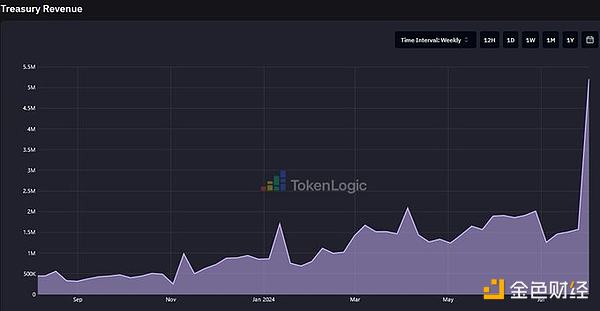

Aave is also one of the few DeFi protocols that has exceeded the 2021 bull market indicators. For example, its quarterly revenue has exceeded the revenue in the fourth quarter of 2021 at the peak of the bull market. It is worth noting that despite the sideways market from November 22 to October 23, revenue growth continued to accelerate. As the market picks up in Q1 and Q2 2024, growth continues to be strong, increasing by 50-60% month-on-month.

Source: Token Terminal

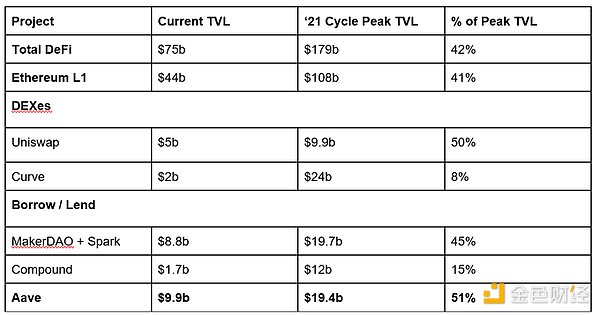

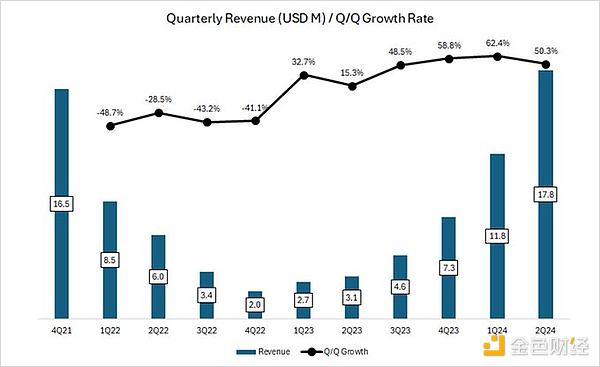

Year-to-date, Aave TVL has almost doubled, driven by increased deposits and rising token prices for underlying collateral assets such as WBTC and ETH. As a result, TVL has recovered to 51% of its 21-cycle peak level, which is more resilient than other top DeFi protocols.

Data as of August 5, 2024

Excellent profitability quality indicates product-market fit

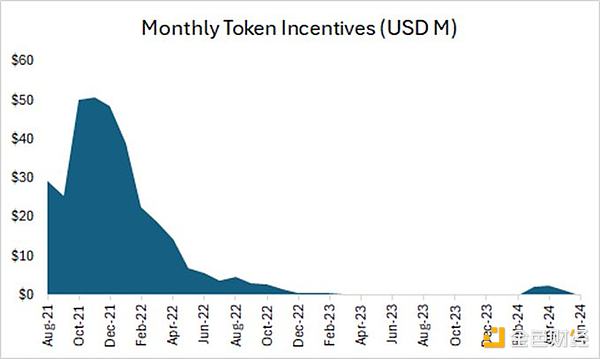

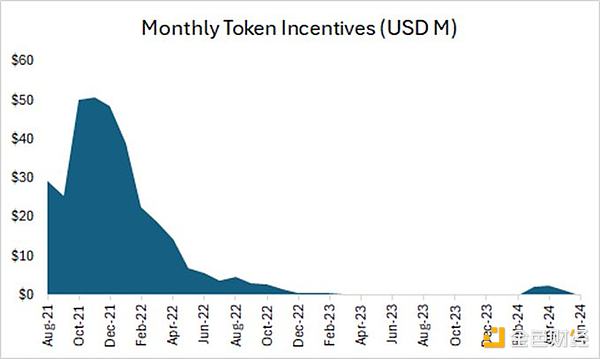

Aave's revenue peaked in the last cycle, when multiple smart contract platforms such as Polygon, Avalanche, and Fantom invested heavily in token incentives to attract users and liquidity. This led to unsustainable levels of employed capital and leverage, which supported the revenue data of most protocols during the period.

Fast forward to today, token incentives from major public chains have dried up, and Aave's own token incentives have fallen to negligible levels.

Source: Token Terminal

Source: Token Terminal

This suggests that the growth of the indicator over the past few months has been organic and sustainable, driven primarily by the return of speculative activity in the market, which has pushed up active lending and borrowing rates.

In addition, Aave has demonstrated its ability to grow fundamentals even during periods of reduced speculative activity. During the global risk asset market crash in early August, Aave's revenue remained resilient as it successfully earned liquidation fees when repaying loans. This also proved its ability to withstand market fluctuations on different collateral bases and on-chain.

Data as of August 5, 2024 Source: TokenLogic

Data as of August 5, 2024 Source: TokenLogic

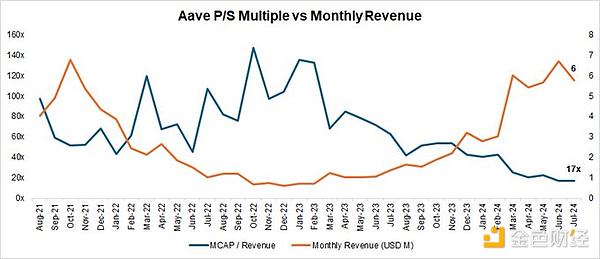

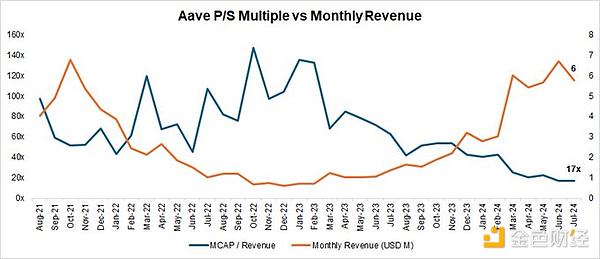

Despite the strong recovery in fundamentals, Aave's trading P/S ratio is still at a three-year low

Despite the strong recovery in indicators in the past few months, Aave's price-to-sales (P/S) ratio is still as low as 17 times, falling to the lowest level in 3 years and well below the 3-year median of 62 times.

Source: Coingecko, Token Terminal

Aave is expected to expand its dominance in the decentralized lending field

Aave's moat is mainly composed of the following 4 points:

1. Record of protocol security management: Most new lending protocols will encounter security incidents in the first year of operation. Aave has not had a major smart contract-level security incident so far. The platform's robust risk management is often the primary consideration for DeFi users to choose a lending platform, especially large users with strong funds.

2. Bilateral network effect: DeFi lending is a typical bilateral market. Depositors and borrowers constitute both the supply and demand sides. The growth of one side will stimulate the growth of the other side, making it increasingly difficult for later competitors to catch up. In addition, the more sufficient the overall liquidity of the platform, the smoother the liquidity in and out of depositors and borrowers, the more attractive it is to large capital users, and thus stimulate further growth of the platform business.

3. Excellent DAO management: The Aave protocol fully implements DAO management. Compared with the centralized team management model, DAO management information disclosure is more comprehensive and major decision-making community discussions are more in-depth. In addition, Aave's DAO community has a group of professional institutions with high governance levels, including top risk control service providers, market makers, third-party development teams, financial advisory teams, etc., with diversified sources of participants and higher governance participation.

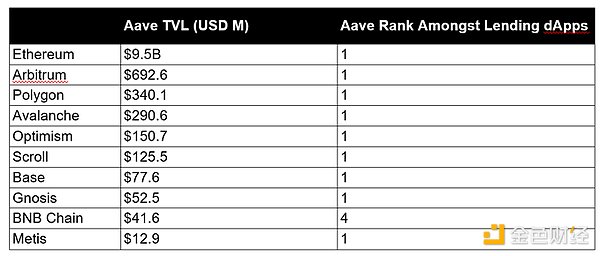

4. Multi-chain ecological positioning: Aave is deployed on almost all mainstream EVM L1/L2 chains, and its TVL (total locked value) is in a leading position on all deployment chains except BNB Chain. In the upcoming Aave V4 version, cross-chain liquidity will be linked to make the advantages of cross-chain liquidity more prominent. See the figure below for details:

Data as of August 5, 2024 Source: DeFiLlama

Improving token economics to drive value accumulation and eliminate slashing

The Aave Chan Initiative has just launched a proposal to completely reform AAVE’s token economics and enhance the utility of the token by introducing a revenue sharing mechanism

The first major shift is to eliminate the risk of AAVE being slashed when mobilizing the security module.

● Currently, $AAVE (stkAAVE - $228M TVL) and Balancer LP tokens in the $AAVE/$ETH security module (stkABPT - $99M TVL) are at risk of having tokens slashed to cover shortfall events.

● However, stkAAVE and stkABPT are not good coverage assets due to the lack of correlation with the collateral assets that generate bad debts. $AAVE will also cycle through reduced coverage in such events.

● Under the new Umbrella security module, stkAAVE and stkABPT will be replaced by stk aTokens starting with aUSDC and awETH. aUSDC and awETH providers can choose to stake their assets to earn additional fees (in $AAVE, $GHO (protocol revenue) plus interest earned by borrowers. In the event of a shortfall event, these staked assets may be slashed and burned.

● This arrangement is beneficial to platform users and $AAVE token holders.

In addition, there are more demand drivers for bringing $AAVE into the fold via a revenue sharing mechanism.

● Introducing Anti-GHO

Currently, stkAAVE users receive a 3% discount on both minting and borrowing GHO.

This will be replaced by a new “Anti-GHO” token generated by stkAAVE holders who mint GHO. Anti-GHO generation is linear and proportional to the interest accumulated by all GHO borrowers.

Users can claim Anti-GHO and use it in two ways: Burn Anti-GHO to mint GHO, which can be used to pay down debt for free, deposit stkGHO’s GHO security module

This increases the alignment of AAVE stakers with GHO borrowers and will be the first step in a broader revenue sharing strategy.

● Burn and Distribution Program

○ Aave will allow redistribution of net excess protocol revenue to token stakers, subject to the following conditions:

■ Aave Collector net holdings are 2 annualized service provider recurring costs over the last 30 days.

■ Aave Protocol 90-day annualized revenue is 150% of all protocol spend YTD, including AAVE acquisition budget and aWETH and aUSDC umbrella budgets.

From there, we will begin to observe consistent 8-digit buybacks on the Aave Protocol, and further growth as the Aave Protocol continues to grow.

Also,AAVE is almost fully diluted with no significant future supply unlocks, which is in stark contrast to recently launched tokens that are losing money at the time of their Token Generation Events (TGEs) due to the low circulation high fully diluted valuation (FDV) dynamic.

Aave is poised for significant growth

Aave has multiple growth drivers in the future, and it is also well positioned to benefit from the long-term growth of crypto as an asset class. Fundamentally, Aave's revenue can grow in a number of ways:

Aave v4

Aave V4 will further enhance its capabilities and put the protocol on track to attract the next billion users to DeFi. First, Aave will focus on revolutionizing the experience of users interacting with DeFi by building a unified liquidity layer. By enabling seamless access to liquidity across multiple networks (EVM and eventually non-EVM), Aave will eliminate the complexity of borrowing and lending cross-chain conversions. The unified liquidity layer will also rely heavily on account abstraction and smart accounts to allow users to manage multiple positions across segregated assets.

Secondly, Aave will increase the accessibility of its platform by expanding to other chains and introducing new asset classes. In June, the Aave community endorsed the deployment of the protocol on zkSync. The move marked Aave's entry into its 13th blockchain network. Soon after, in July, the Aptos Foundation drafted a proposal to deploy Aave on Aptos. If approved, the Aptos deployment would be Aave's first foray into a non-EVM network and would further solidify its position as a true multi-chain DeFi powerhouse. In addition, Aave will also explore integrating RWA-based products that will be built around GHO. This move has the potential to connect traditional finance with DeFi, attract institutional investors and bring a large amount of new capital to the Aave ecosystem.

These developments ultimately led to the creation of the Aave Network, which will serve as a central hub for stakeholders to interact with the protocol. GHO will be used to collect fees, while AAVE will become the primary staking asset for decentralized validators. Given that the Aave Network will be developed as either an L1 or L2 network, we expect the market to reprice its token accordingly to reflect the additional infrastructure layer being built.

Growth is positively correlated to the growth of BTC and ETH as an asset class

The launch of Bitcoin and Ethereum ETFs this year was a watershed moment for cryptocurrency adoption, providing investors with a regulated and familiar vehicle to invest in digital assets without directly owning them. By lowering the barrier to entry, these ETFs are expected to attract significant capital from both institutional and retail participants, further facilitating the inclusion of digital assets into mainstream portfolios.

Given that over 75% of Aave’s asset base consists of non-stablecoin assets (primarily BTC and ETH derivatives), growth in the broader cryptocurrency market is a boon to Aave. As a result, Aave’s TVL and revenue growth is directly correlated to the growth of these assets.

Growth is tied to stablecoin supply

We can also expect Aave to benefit from the growth of the stablecoin market. As global central banks signal a shift to a rate cut cycle, this will reduce the opportunity cost for investors seeking sources of yield. This could catalyze a shift in capital from traditional financial yield instruments to stablecoin farming in DeFi for more attractive yields. Additionally, we can expect higher risk-seeking behavior in a bull market, which helps to increase the borrowing utilization of stablecoins on platforms such as Aave.

Final Thoughts

To reiterate, we are bullish on Aave’s prospects as a leading project in the large and growing decentralized lending market. We further outline the key drivers that support future growth and detail how each driver can scale further.

We also believe that Aave will continue to dominate market share as it has established a strong network effect, which is driven by the liquidity and composability of the token. The upcoming token economics upgrades can help further improve the security of the protocol and further enhance its value capture aspects.

Over the past few years, the market has lumped all DeFi protocols into one category and priced them as protocols with little room for future growth. This is well illustrated by the fact that Aave's TVL and revenue run rate are trending upwards while its valuation multiples are compressing. We believe that this misalignment between valuation and fundamentals will not last long and that AAVE now offers some of the best risk-adjusted investment opportunities in the crypto space.

Original link: https://x.com/Arthur_0x/status/1825595598609023039

JinseFinance

JinseFinance

Data as of August 5, 2024 Source: TokenLogic

Data as of August 5, 2024 Source: TokenLogic