Author: Climber, Golden Finance

On June 13, Beijing time, Curve founder Michael Egorov's $140 million CRV loan position has begun to be liquidated as the price of the currency fell. As of writing, Egorov's positions on 5 addresses have all fallen below the liquidation line, but only the main address has begun liquidation. However, the price of CRV has plummeted, with a short-term maximum drop of more than 30%.

In July last year, the founder of Curve also encountered a liquidation crisis, but because it was caused by an external hacker intrusion, the incident caused the crypto market to launch a plan to assist Curve. A total of dozens of institutions and many Chinese bigwigs such as Justin Sun, Du Jun and Maji Big Brother have provided financial assistance.

In the blink of an eye, a year is coming, and financial assistance and crypto bull turn seem to have failed to save Curve and its founder from being liquidated.

$140 million position liquidation is on the agenda

In the early morning of June 13, Arkham posted on X that Curve founder Michael Egorov is currently facing the liquidation risk of $140 million in CRV tokens. Egorov borrowed about $95.7 million in stablecoins, mainly crvUSD, with about $141 million in CRV tokens as collateral in five accounts on five different protocols. The annualized interest cost to maintain these loans is as high as $60 million.

Among them, $50 million of the loan came from Llamalend, with an annual interest rate of about 120%. Since there is almost no remaining crvUSD available for lending on Llamalend, Egorov's three accounts already account for more than 90% of the borrowing on the protocol. If the price of CRV drops by about 10%, these positions will be at risk of liquidation.

Unfortunately, with the decline of the crypto market and the partial influence of market FUD, the price of CRV coin fell. In less than an hour, the price of CRV plummeted by more than 30%, reaching a minimum of $0.219. This also directly triggered liquidation.

According to Lookonchain monitoring, Curve founder Michael Egorov is being liquidated. Michael currently holds 111.87 million CRV (US$33.87 million) collateral and US$20.6 million in debt on 4 platforms.

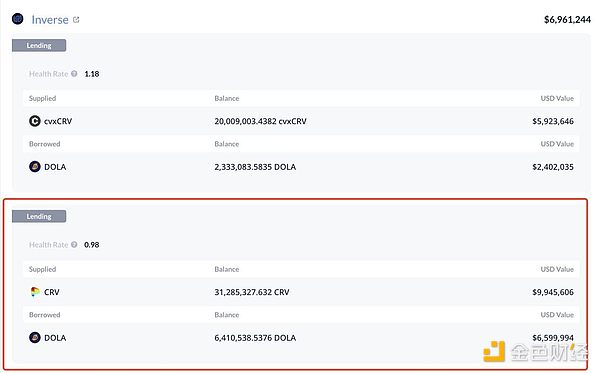

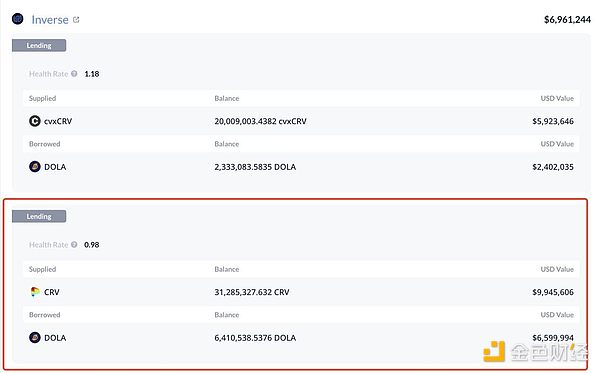

However, according to monitoring by Ember, the loan positions of the five addresses of the founder of Curve that pledged CRV have all fallen below the liquidation line. At present, the positions on the main address of Egorov (0x7a1...428) are being liquidated. Although the positions on the remaining addresses have also fallen below the liquidation line, they have not yet begun to be liquidated.

According to monitoring by on-chain data analyst @ai_9684xtpa, the founder of Curve has been liquidated 29.62 million CRV, and the address 0xF07...0f19E is one of the main liquidators. The user of this address liquidated 29.62 million CRV at an average price of $0.2549, spending a total of 7.55 million FRAX. Currently, all of these tokens have been recharged to Binance.

In addition, due to the decline in CRV prices, some investors were liquidated 10.58 million CRV (US$3.3 million) on Fraxlend.

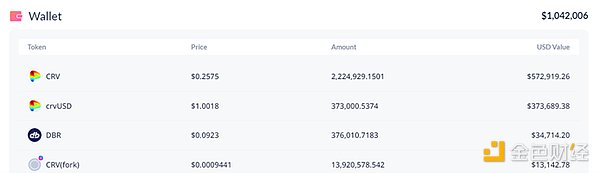

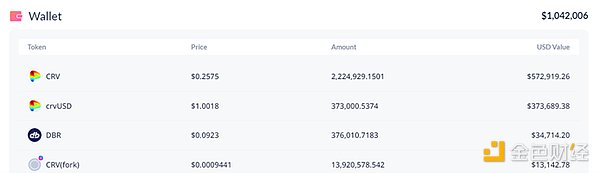

Currently, the position on the Egorov main address (0x7a1...428) shows that the number of CRV is about 2.22 million, and the total value of the wallet is about US$1.04 million.

The liquidation of the founder of Curve and the plunge of CRV also led to the emergence of concentrated selling. According to The Data Nerd, a whale deposited 10.926 million CRV (about 2.7 million US dollars) into Binance. In 1 hour, he deposited a total of 24.2 million CRV (about 6.936 million US dollars) into Binance. CryptoQuant CEO Ki Young Ju also posted that the exchange's CRV balance hit a record high, up 57% in the past two hours.

Sponsored Business Content

Institutional celebrities failed to rescue successfully

In late July 2023, due to a reentrancy vulnerability caused by the Vyper programming language, four Curve Finance mining pools were hacked, with a total loss of about 70 million US dollars. This also directly led to the huge liquidation risk faced by the founder of Curve.

However, since this was a malicious attack by hackers, many forces in the crypto market have expressed their support for Curve. In addition to Egorov selling more than 106 million CRV tokens to 19 institutions and investors to raise funds, crypto celebrities such as Justin Sun, Du Jun, and Maji Da Ge also purchased CRV.

Justin Sun bought 5 million CRV tokens, Du Jun bought 10 million CRV with a total of US$4 million, and Maji Da Ge bought 3.75 million CRV tokens with US$1.5 million, and all of them were pledged and locked for 6 months.

Regarding the Curve project, Du Jun said, "Many people asked me why I supported Curve, just like when BendDAO encountered a liquidity crisis in 2022, we immediately communicated with the project team to support it.", "These are truly innovative projects and the industry's infrastructure. The current difficulties are only temporary. Let us support each other more so that the industry will be healthier."

With financial assistance from many institutions and many Chinese bosses, Egorov's over-the-counter fundraising transactions went smoothly, and Curve's debt health on major DeFi platforms also improved. The health coefficient of Aave V2 rose to 1.87, and Fraxlend was 1.8.

According to public information, in August last year, Michael sold 159.4 million CRVs to 33 investors/institutions in an over-the-counter (OTC) transaction to avoid liquidation due to the decline in CRV prices, in exchange for 63.76 million stablecoins to repay the loan, with a selling price of US$0.4.

But in September of that year, Curve's trading volume plummeted by 97%, and its project token CRV has also been falling all the way to the present.

It is worth noting that on June 13, the lending position of Curve's founder went from warning to formal liquidation very quickly, but in fact, in April of this year, the lending position of Curve's founder on various platforms entered the dangerous range, and the lending health rate of many positions had dropped to around 1.1.

In April, the crypto market pulled back, altcoins generally fell sharply, and the price of CRV also fell to around $0.42. This also means that the lending position of Curve founder Michael Egorov has entered the red line again.

At that time, Egorov pledged a total of 371 million CRV (US$156 million) on 6 lending platforms through 5 addresses, and borrowed $92.54 million in stablecoins.

Because of the decline in CRV prices, Egorov's lending positions on various platforms have now entered the dangerous range again. The lending health rate of multiple positions has dropped to around 1.1 (i.e., if the CRV price continues to fall by 10% without replenishment or repayment, liquidation will begin).

In the two months that followed, it was clear that the founder of Curve had not made adequate preparations, which ultimately led to the rapid liquidation of his lending positions.

Conclusion

It seems that the liquidation of the lending positions of the founder of Curve was already destined. The crypto market's bear-to-bull turn, a one-year recovery period, and the influx of massive funds have not reversed the future. The price of CRV has also been getting lower and lower. This good project that was once supported by capital and stood for has ultimately hurt investors.

In response, some community members said that Curve's operations are similar to traditional finance. Equity cannot be sold on a large scale, so it chooses to pledge. When the stock price falls, the bank is forced to liquidate and close its positions, and the founder is forced to make a fortune.

JinseFinance

JinseFinance