Author: Ye Kai; Source: Ye Kaiwen

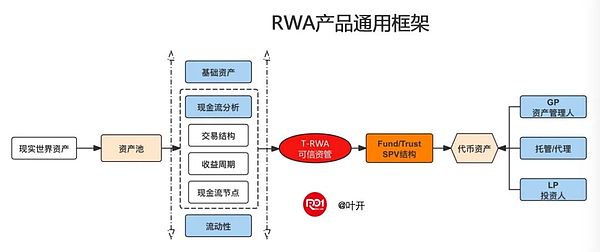

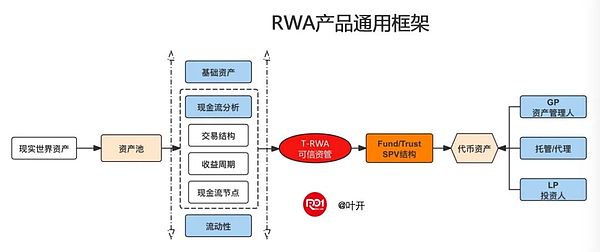

Around the core of RWA: "controllable assets, trusted asset management", we have designed a general framework for RWA trusted asset management products, which serves as a reference for the design of Hong Kong compliant RWA products and is also applicable to offshore RWA tokenization design.

The general framework of the entire product is shown in the figure, which is divided into six links: asset pool, structuring, asset tokenization and mezzanine, tokenized assets, and management.

(Figure 1) General framework of RWA products

Among them, the mezzanine structure is generally the SPV of Fund or Trust, which is the core of RWA trusted asset management. Whether it is the requirement for Hong Kong compliant RWA in the form of Fund, or the trusted SPV coded with smart contracts and protocols in offshore tokenization.

This mezzanine is O2O, offchain2onchain, which is both isolation and link. The significance of the mezzanine is to isolate assets. When the direct tokenization of physical assets cannot solve the problem that physical assets and virtual assets cannot be 100% mapped, the existence of the mezzanine is very meaningful. RWA is to financialize this mezzanine, while the direct tokenization of Web3.0 is to code and contract the mezzanine. The trustee of the mezzanine, under licensed supervision and industry norms, manages and operates assets through traditional methods, and uses the credit and regulatory constraints of financial institutions to achieve asset O2O management.

The multiple core elements of this RWA product framework: basic asset pool, cash flow analysis, programmable SPV (cash flow, credit enhancement, custody), trusted asset management manager, liquidity incentives, etc., form the design prototype of the RWA product.

Basic assets

The primary element of RWA is the underlying assets of the asset package. The underlying assets of RWA are no longer traditional physical assets such as real estate, but credible assets of digitalization and blockchain, or native assets further generated on the blockchain. These digital assets are atomic-level reconstructions of physical assets in the real world, and can also be further combined. Physical assets in the real world need to go through infrastructure conditions such as asset due diligence and confirmation, data on-chain, and asset pooling before they can become the underlying assets on the chain and enter the RWA asset pool. Moreover, the underlying assets in these asset pools can or can produce continuous and stable cash flows.

Physical asset data on-chain, asset pooling, etc. require a series of asset protocols. Based on the RWA asset protocol on the chain, real-world physical assets are converted into various RWA underlying assets on the chain, thereby further becoming the underlying assets of digital financial scenarios on the chain such as asset tokenization, lending, insurance, and income products.

The underlying assets must have clear ownership, which is also one of the most basic prerequisites for asset valuation. Whether it is "ownership" or "usufruct rights", as well as the further separated "operating rights", "leasing rights", "mortgage rights", "income rights" and "disposal rights", they all need to have sufficient and legal authorization procedures. Secondly, the underlying assets must be transferable. Through the RWA asset trusted asset management, the sponsor may need to transfer the underlying assets with clear ownership to the SPV through open or covert transfer. There must be no legal flaws in this link, so it is necessary to confirm whether there are restrictions such as third-party rights.

Cash flow analysis

The equity structure of the RWA product is essentially the expected cash flow, and its structural design mainly comes from cash flow analysis. We need to analyze the business scenarios and transaction payment backgrounds of the underlying assets in detail from the current transaction structure, revenue cycle, cash flow nodes, etc. of the underlying assets, including the level and efficiency cost of the transaction structure, the timeline split of the original revenue cycle, the process nodes and time nodes for generating cash flow, and the cash flow collection method.

The transaction structure of many physical assets in the real world is very complex and intermediary-layered. RWA product design needs to optimize and disintermediate the transaction structure, or it can be a subversive design, such as user-side reverse transactions.

The revenue cycle will affect the revenue structure. For example, the revenue cycle of agricultural and animal husbandry is 6-9 months. First, advance funds, then raise, and finally sell them before cash comes back and settles. To design a new revenue structure, can the revenue cycle be designed in advance, can it be pre-sold or pre-collected? In addition, new cash flow nodes and cash flow collection methods should be further designed. Cash flow nodes should be pre-positioned. In addition, RWA trusted asset management can be combined to design token payment settlement, clearing and automatic collection to realize on-chain cash flow.

Cash flow must have a certain degree of stability. The sales revenue of general commodities, land transfer revenue, mineral resource development revenue, etc. are not suitable as the underlying assets of RWA trusted asset management due to their unstable cash flow. However, if the products sold are water, electricity, gas, heat or other types of daily necessities, the downstream user demand is strong and very stable, or a long-term supply contract has been signed, it can be used as a basic asset for securitization.

Secondly, cash flow must be predictable. RWA trusted asset management is essentially a discount on the future cash flow income of assets. Therefore, when conducting securitization operations, professional institutions are required to predict the cash flow that can be generated by the underlying assets in the future to help investors establish reasonable expectations for future income, and through the trust channel, convert the non-specific cash flow assets into specific trust income rights, so that the underlying assets meet the requirements of assetization.

Rights to income from underlying assets

The most common type of income rights is the leasehold interest in real estate. The owner of the real estate transfers the income from the leasehold of the real estate to the investor. When splitting, it can be divided into daily or weekly leasehold income corresponding to 1m2, which is simple, direct and clear. Leasehold income includes simple leasehold income, i.e. rent or annuity; it can also be designed as complex leasehold income, such as secondary leasehold interests, including a low-risk fixed income and a high-risk floating income, and future cash flows with different interest rates and priorities can be realized through asset tokenization. Complex leasehold interest design can allocate part of the leasehold interest (such as fixed income) to investors, while retaining or conditionally allocating part of the remaining asset interest (such as floating income) to other investors.

As mentioned above, based on the forecast of leasing income, a mezzanine of the trust channel can be established to isolate the leasing income from the value fluctuations of the underlying assets, and only convert the non-specific leasing cash flow assets into specific trust leasing income rights (a simple T-REITs).

Mezzanine and Programmable SPV

The biggest difference between the design model of RWA and asset securitization and REITs is that it makes full use of the technological innovation and smart contracts of blockchain to realize the programmable SPV of the mezzanine, that is, a programmable special purpose entity based on blockchain.

Just like realizing a Defi's "mortgage-lending-liquidity income" financial business combination in a block, on the RWA tokenized value chain, the "asset + cash flow + income model + people" on-chain combination of real-world assets is realized through programmable SPV (Block + smart contract + consensus code), and the code "SPV" can realize intelligent credit enhancement (such as tiered grading, mortgage, insurance, etc.).

The mezzanine and priority and subordinated of a Fund can basically be realized through one or a group of Ricardo-like contracts. The core design idea of programmable SPV is to realize the aggregation and reorganization of tokenized asset elements after RWA asset share through the block of blockchain, thereby replacing the off-chain SPV and realizing a true on-chain native tokenization structure. Another core of programmable SPV is composability. SPVs of different RWA assets can be combined to realize Lego Money.

Trusted Asset Manager

The design model of RWA asset tokenization needs to have an asset management core: the token asset manager, which is also the custody pool for RWA asset tokenization. It governs different RWA token assets, SPV and distribution mechanisms, information disclosure, etc. through consensus algorithms, platform tokens, smart contracts, and programmable codes, and may gradually realize DAO distributed autonomy in the future. However, in the early stages, it may still be necessary to entrust management and operation through managers (GPs) and custodians (Trust) in traditional finance; in the mature stage, trusted and codable management is achieved.

The token asset manager is a one-stop custody of RWA token assets. The issuance, pricing, investment, trading, and liquidation of RWA assets are all handled in one manager and one combination protocol. It can also manage the composability of RWA assets, thereby achieving the synergy of basic assets and programmable development, achieving consistency in risk control, and achieving combination synergy from different angles such as systems, assets, and protocols.

Liquidity Incentives

Different from traditional asset securitization design, RWA asset tokenization can make full use of the characteristics of tokenization to enhance liquidity. By providing new token incentives to investors for continuous investment or trading of RWA asset tokens in the secondary market, more secondary market liquidity can be promoted. This is a unique liquidity incentive that RWA asset tokenization can innovate based on blockchain and smart contracts.

Liquidity incentives are also similar to "liquidity mining" in Defi, which is essentially a multi-level distribution. It further exchanges value for liquidity participation in the secondary market without affecting the original RWA asset tokenization income. Investors can continue to enjoy the original income dividends of real estate tokens while obtaining new liquidity tokens, thus realizing multi-level distribution and liquidity value exchange.

The segmentation and grading of some underlying assets after share will promote liquidity and increase price fluctuations. The price difference caused by price fluctuations will lead to more liquidity, thus creating arbitrage space. For example, taking real estate as an example, since real estate RWA assets are no longer large assets with high abundance, but fragmented small assets, a complex liquidity market will be formed between investors, buyers, sellers and market makers. Long-term investors will consider stable and continuous returns rather than prices, while short-term investors will care about price differences and arbitrage, but the relatively stable return characteristics of real estate will gradually turn over short-term investors.

Of course, in actual RWA projects, it is necessary to use it flexibly. At present, the cooperating securities exchanges, general project consultations start from the perspective of issuing crypto bonds. How is the main credit of the project party or issuer? How is the rate of return of the asset package? How is the cash flow? What are the guarantees or credit enhancement measures? First simply judge whether it is feasible. If it is OK, further analysis will be conducted. An RWA product framework is only used for reference and guidance to better promote the orderly development of RWA!

Anais

Anais