作者:DCBot 来源:medium

GMX_V2 成为赌场老板的策略

本文将站在链上流动性提供者(赌场老板)的角度探讨 GMX V2的新机制与参与方案,主要内容有以下四个部分:

GMX 的赌场原理

GMX V2的核心与机制

GMX V2的杠铃组合

GMX V2的对冲方案

GMX 的赌场原理

GMX 运营模式的基于“赌场游戏”的理念,其中流动性提供者(LP)是赌场所有者,经销商是玩家。

该项目在设计当前的运营模式时运用了“赌场老板总是赢”的心态,在此过程中,GMX 已经取得了一定的成功,筹集了约 6 亿美元的 TVL 和数亿美元的交易费用。

GMX V1模型有一些局限性。首先,加密货币市场具有单向趋势的特点(交易者往往要么大量买入,要么大量卖出),因此 GMX 的持仓量通常相当高。此外,GMX v1 没有资金利率机制来监管交易者活动,这意味着当市场走势与其押注一致时,流动性提供者会遭受损失。

GMX V2的核心

保证协议的安全性和平衡性

GMX V2的核心是保证协议的安全性和平衡性,通过修改费用机制来保持多空持仓平衡,以便降低 GMX 在面临剧烈的市场波动时发生系统性风险的概率。通过隔离池的设置,增加高风险交易资产同时控制整体风险。通过与 Chainlink 合作,提供更及时有效的预言机服务,降低价格攻击发生的概率。项目方还考虑了交易者、流动性提供者、GMX 持币人以及项目持续发展的关系,并最终在协议收入分配上也进行了调整和平衡。

GMX V2的机制

1. 隔离池

LP 在 GMX_V2的隔离池中可以进行自由度更高的择时选币与对冲等风险管理。

2. 扩展品种

GMX_V2新增的 SOL/XRP/LTC/DOGE,SOL/XRP 使用原生币作为底层流动性支持,而 DOGE 和 LTC 使用 ETH 作为底层流动性支持。

3. 降低交易费用

GMX_V2降低交易费用,从此前的 0.1% 降低为 0.05% 或 0.07% ,根据开仓是否有利于多空的平衡而收取费用,如果有利,收取较低的费用。

4. 价格影响

GMX_V2增加价格影响费,仓位越大、对多空平衡越不利,则收取越多的费用。价格影响费模拟订单薄交易市场中价格变化的动态过程,也就是仓位越大,对价格的影响越大。这一设计可以增加价格操纵的成本,减少价格操纵攻击,防止价格闪崩或者飙升;并保持平衡的多空持仓,维持较好的流动性。

5. 资金费率

GMX_V2增加资金费率,而资金费率将分段进行调整,强势一方持仓/全仓位在 0.5 – 0.7 之间时,资金费率处于较低水平;达到 0.7 时,将会提高到较高水平,加大套利空间,促使套利资金进入,从而恢复多空平衡。

6. 流动性激励(ARB)

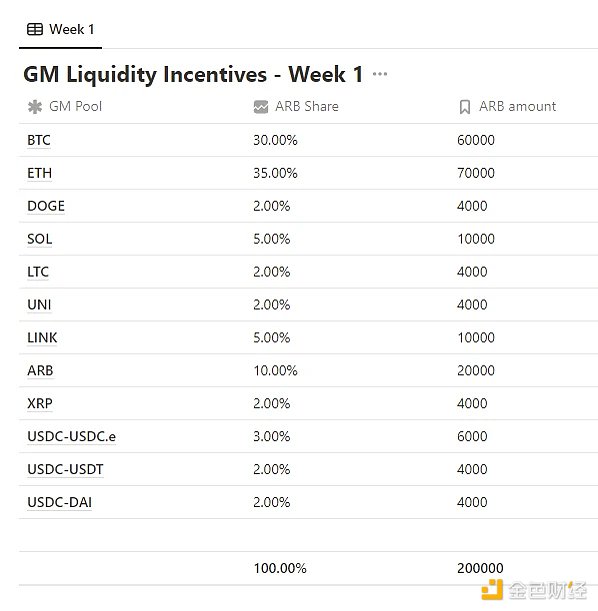

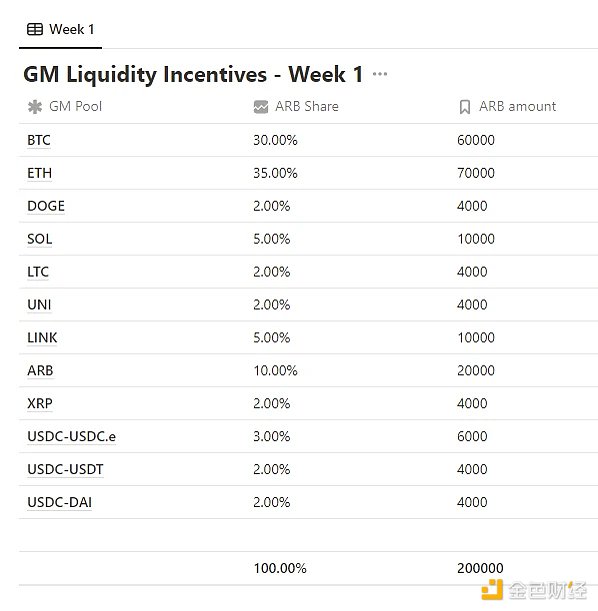

数据来源: https://gmxio.notion.site/GMX-S-T-I-P-Incentives-Distribution-1a5ab9ca432b4f1798ff8810ce51fec3

GMX_V2近期增加流动性激励,以上数据是近期第一周提供的流动性激励 ARB 代币的数据,该激励会每周按照不同品种的激励数量根据相应池子的比例定期发放给 LP。

GMX_V2的杠铃组合

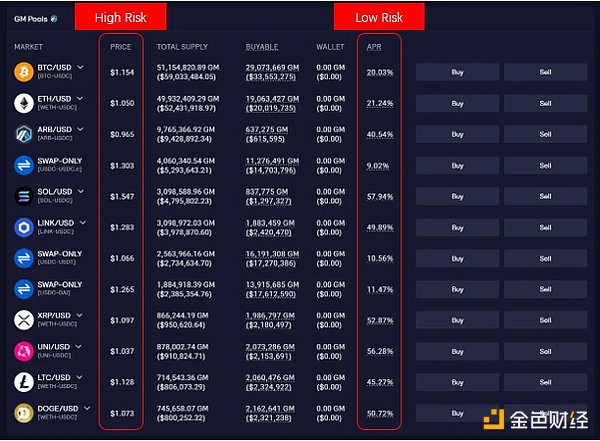

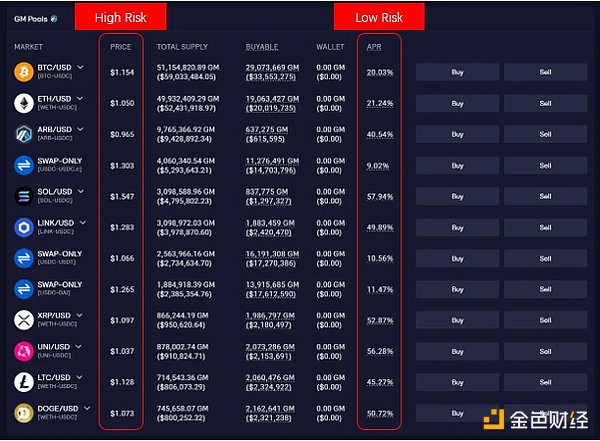

通过 GMX_V2的主要风险收益来源有两部分,一部分属于低风险,另一部分属于高风险,低风险的收益主要有来自交易对手支付的交易手续费与获得每周定期的流动性激励;而高风险的收益主要来源于持币的币价涨跌与交易对手对赌的盈亏。

Price(High Risk): 指的是持币做市商的风险收益来源,主要由代币价格涨跌与交易对手盈亏组成

APR(Low Risk): Base APY 指的是交易对手支付的手续费收入,Bonus APY 指的是流动性激励的收益

选择 SOL(2023.11.13)作为例子

SOL 的 Price 为 1.548 ,由于从 2023 年 8 月 4 日正式上线至今,SOL 价格从 22.79 至今的 58.2 已经有 155% 的涨幅,而建立池子会需要购买大约一半的 SOL 币与 USDC 稳定币,有一半 SOL 贡献了涨幅带来的收益约 72.5% ,代表 Trader 在较大的上涨行情中有 17.8% 的收益,即代表 LP 的 Trader P/L 部分大约损失了-17.8% ;至于 APY,年利率是根据过去 7 天收取的费用计算的。Base APY 取决于整体 SOL 的交易量对应池子的供给量带来的手续费年化收益(45.62% ), Bonus APY 指的是目前第一周 10000 个 ARB 的激励对应池子的供给量带来的激励年化收益(12.32% )。

因此,选择池子需要考虑几个因素,价格上升的动量、交易对手盈亏比、交易量、池子的供给量与交易激励的数量。

GMX V2的对冲方案

如果投资者认为交易对手长期是大概率亏损,希望对冲掉价格大幅上升与下跌带来的盈亏影响,可以使用期货合约与买入期权对冲价格风险。

完全对冲:实时监控池子里拥有的代币数量,在中心化交易所进行完全对冲,其缺点是会有较大的对冲资金占用,在强势上涨时会出现保证金不足导致合约爆仓的风险。

期权对冲:实时监控池子里拥有的代币数量,在中心化期权交易所进行买入看涨与看跌期权,其缺点是需要长期支付期权的费用。

如果专业投资者有择时能力,可以在不利于 LP 的市场环境下进行择时对冲。

择时对冲:专业投资者可以通过市场的趋势与波动率环境来配合趋势策略来进行择时对冲,规避持币做市商在大涨行情时交易对手大幅获利与大跌行情时持币大幅亏损带来的风险。

总结

GMX V2的交付基本符合市场预期,显示 GMX 团队有较强的协议设计能力。从机制来看,V2增加了流动性池子的平衡性,拓展了交易资产的类型,提供了多种抵押物仓位。对于流动性提供者和交易者而言,投资方式更加丰富、风险平衡更好、费用也更低了。流动性提供者能通过 GMX V2实现选币、择时、对冲等方案更好地对赌场策略进行风险管理,长期获得更多元稳定的投资收益。

Edmund

Edmund