Author: FLORIAN STRAUF; Compiler: Frost, BlockBeats

Editor's note: Where will the airdrop or pledge rewards go? Where is it? Perhaps most people have not thought about this issue carefully. As an important part of the blockchain industry, token incentive plans are being widely adopted, but there are not many articles on the market analyzing the incentive effects. Is such an incentive mechanism really effective? This article analyzes the token reward mechanism. BlockBeats compiled the original text as follows:

Someone recently asked me this question: "How do recipients of token rewards handle tokens?" Coins?"

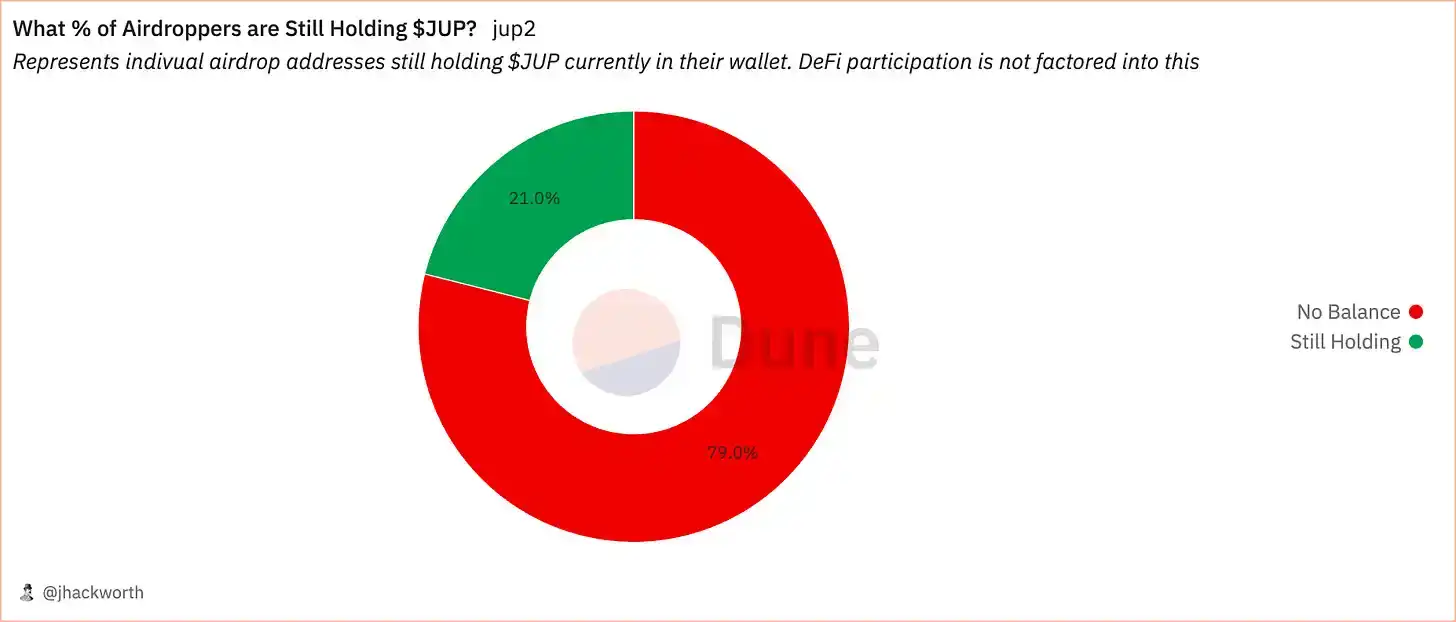

If we look at Jupiter’s recent $JUP airdrops, the answer is that most are selling.

Reward recipients have two options: sell or hold.

If we analyze deeper, selling or holding is a matter of an individual’s risk appetite for holding a token. Typically, cryptocurrency startups are very risky, so there is a threshold for how much money one wants to allocate to the project. If the reward exceeds that threshold and the incentive to hold is not strong enough, they may eventually be sold.

Why rewards?

Rewards are a powerful tool at the disposal of token initiators. There is no cost to mint the tokens, and you can earn a profit by selling them.

Projects receive free funds and can incentivize others (liquidity providers, users, etc.) to interact with the protocol. Doing so steers the market and subsidizes buyers and sellers to drive business.

Promoters may hope that over time, the number of buyers and sellers will allow the market to keep running organically without Internet funding.

There is no doubt that free tokens are a great tool. Almost every project that launches a token uses it for incentives. But the question is, how effective are these incentives?

Is this effective?

Staking rewards are a form of incentive. In its original form, staking was a mechanism in which a proof-of-stake base layer paid minted internet currency to validators.

However, non-base layers have adopted this strategy to pay token holders to retain users. Currently, it is a popular mechanism for many protocol implementations.

If we talk about staking rewards from non-base layers, the goal is usually customer retention, i.e. people being rewarded for holding tokens.

Can token reward activities retain token holders?

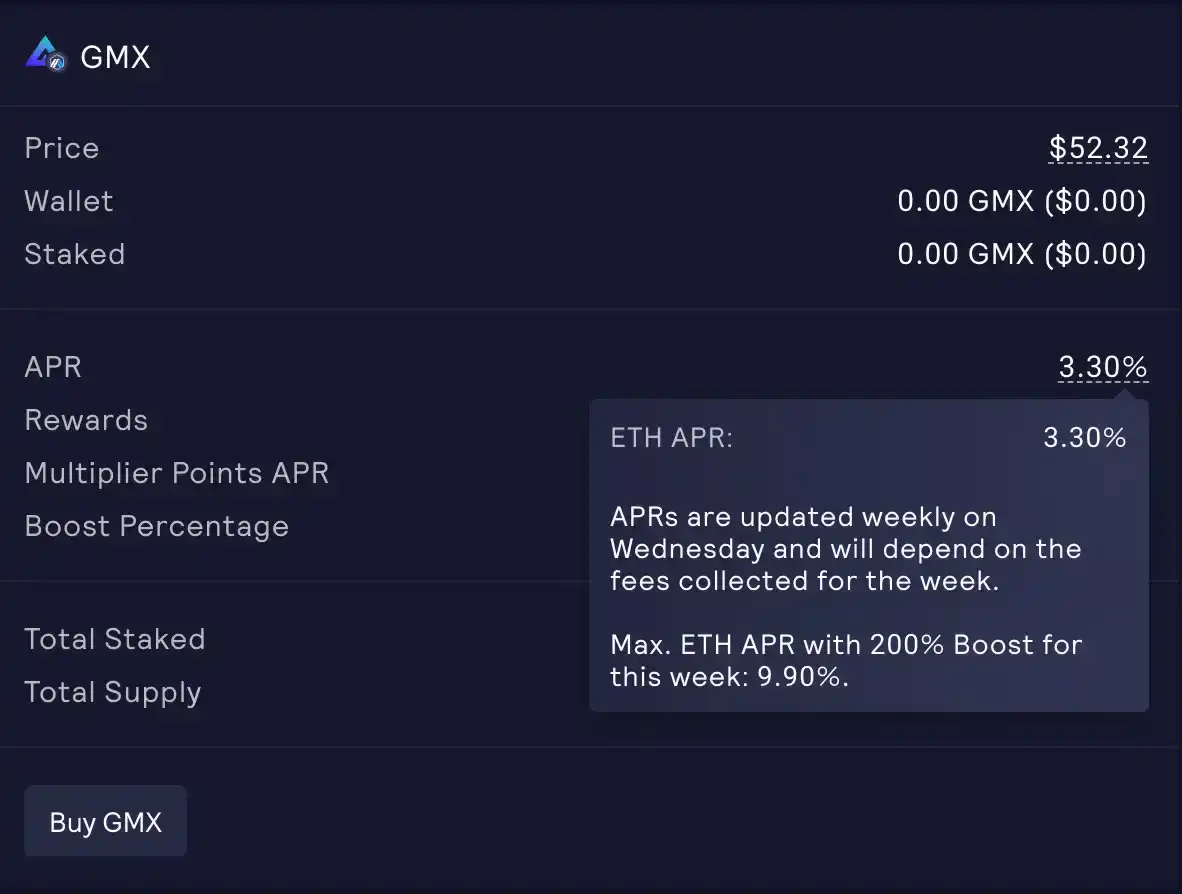

I compare the yield paid by $GMX with the yield of corporate bonds Comparison. Most people are unlikely to hold a risky asset like $GMX with a yield as low as 3-4%. They will do things like buy low and sell high because they see the potential in the project.

In this case, I think the token reward activity will not retain holders, or it will have a very small effect.

Average customer retention rate

Token holders and customers are not the same, but There is some overlap.

Sponsored Business Content

We can use rewards as the cost of retaining customers or token holders. It is similar to dividends as a mechanism for retaining shareholders (except that dividends are not paid in kind).

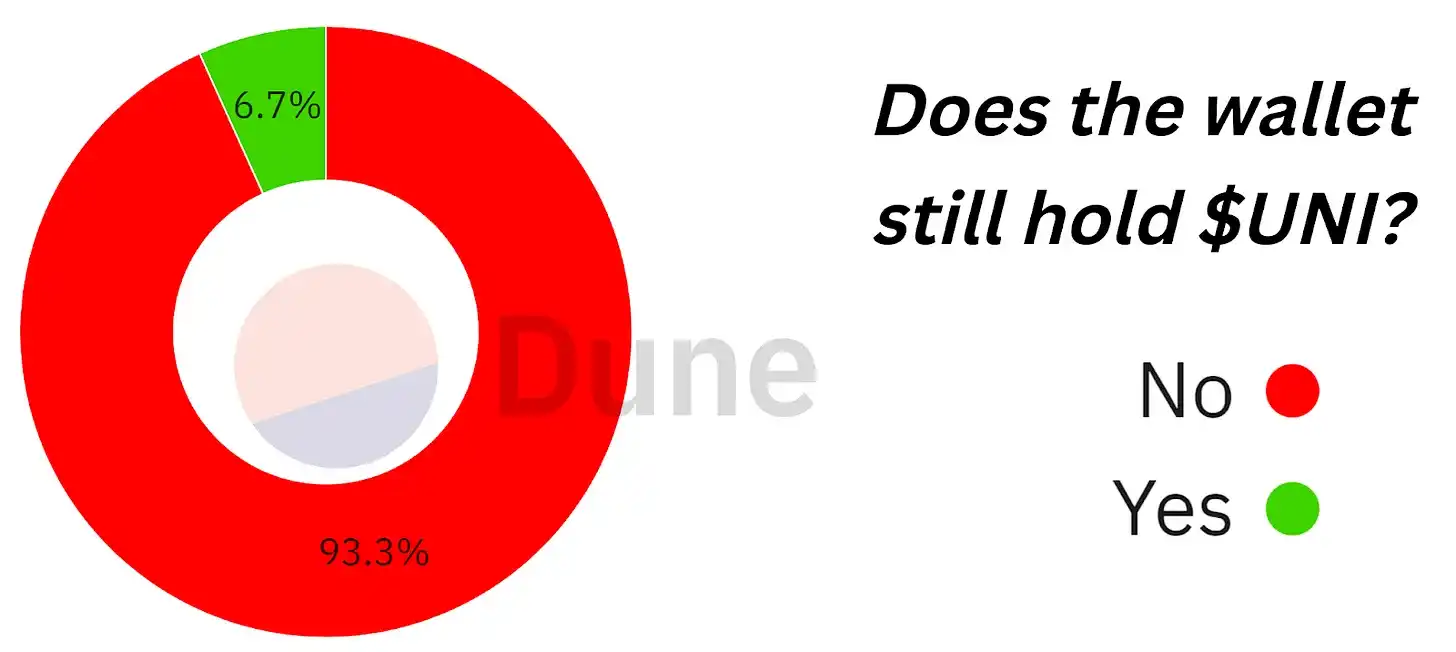

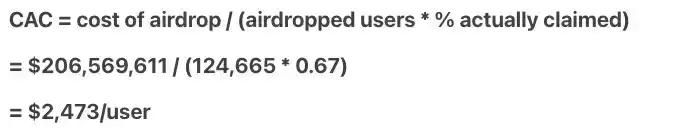

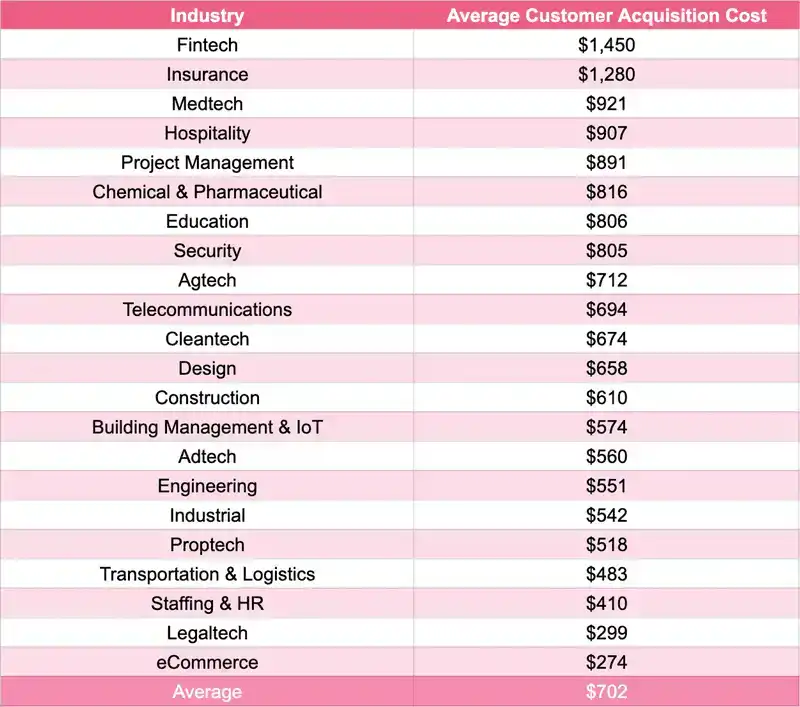

Similarly, airdrops can be regarded as a customer acquisition cost. Unfortunately, there isn’t a lot of data on the effectiveness of staking rewards, but there are some great examples of airdrops.

For example, 7% of airdrop recipients still held $UNI at some point after the airdrop. This somewhat matches Jupiter’s airdrop campaign above.

Kerman Kohli analyzed the customer acquisition cost of Looksrare airdrop in detail. For details, please refer to This article.

Although airdrops and staking are not completely comparable, they both show reward activity has worse user retention, so I think the results are roughly the same.

By the way. This is Jupiter’s airdrop situation:

Dune: https://dune. com/jhackworth/jupiter-airdropDune

Comparison (source):

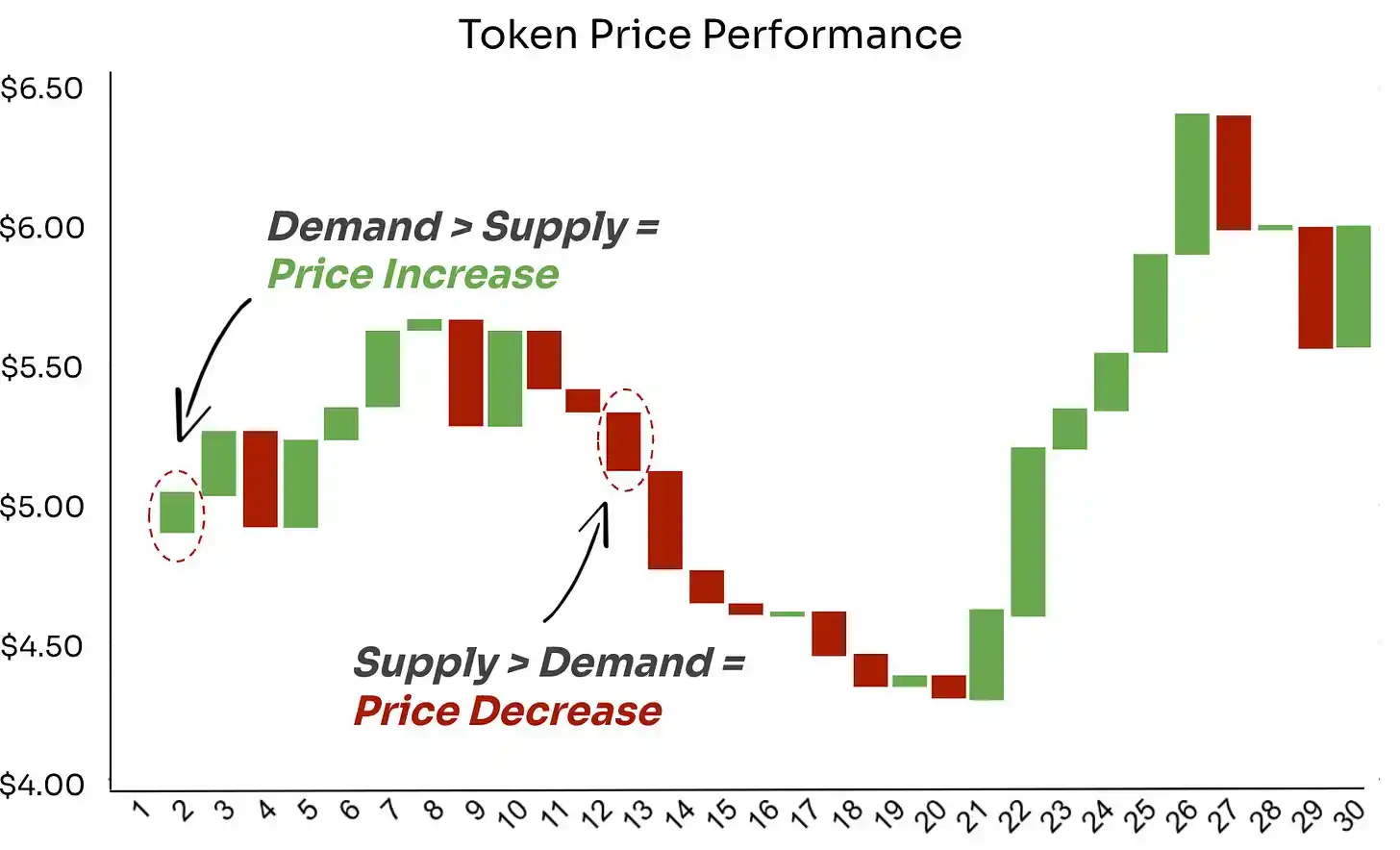

Supply meets demand

The bad thing is that the project not only costs money, but also tokens to acquire client. Many of these coins will eventually become selling pressure in the market.

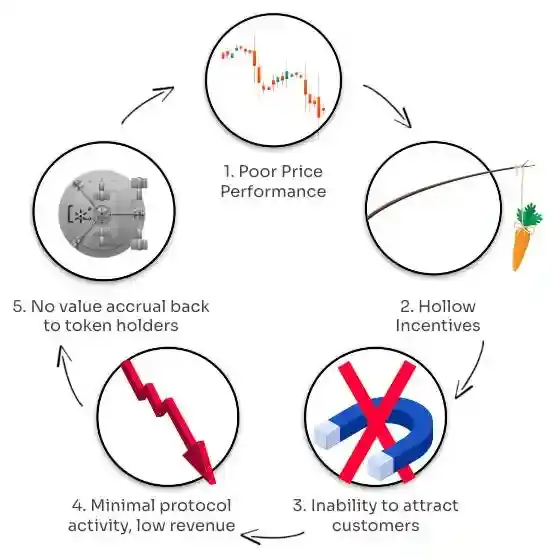

If they do not meet a buyer who can withstand the selling pressure, Token prices may fall, causing incentives to weaken, potentially creating the following cycle.

What I want to say is that token incentives are helpful, but They may not be as effective as people think, and when a currency is in larger circulation, people need to have a strong reason to buy and hold. If users will do this, then it should have generous actual benefits, governance rights, token buyback and other mechanisms, or be a project with stable growth.

Huang Bo

Huang Bo

Huang Bo

Huang Bo Brian

Brian Edmund

Edmund Alex

Alex Bernice

Bernice Brian

Brian Clement

Clement Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph