Written by Andrew Kang; Translated by J1N, Techub News

The passage of the Bitcoin spot ETF has opened the door to the cryptocurrency market for many new buyers, allowing them to allocate Bitcoin in their portfolios. But the passage of the Ethereum spot ETF has a less obvious impact.

When the BlackRock Bitcoin spot ETF application was submitted, I was strongly bullish on the price of Bitcoin. At that time, the price of Bitcoin was $25,000. Now, Bitcoin has returned 2.6 times and Ethereum has returned 2.1 times. Since the bottom of the cycle, Bitcoin has returned 4 times and Ethereum has also returned 4 times. So how much upside can the Ethereum ETF provide? I don't think there will be much upside unless Ethereum develops a new model to improve its economic conditions.

I said on June 19, 2023: BlackRock's application for a Bitcoin spot ETF has a 99.8% approval rate, which is the most positive news we have heard recently and may open the floodgates for tens of billions of dollars in capital flows. However, the price of Bitcoin only rose 6%, and the performance of the price did not meet expectations.

Flow Analysis

Overall, while Bitcoin spot ETFs have accumulated $50 billion in AUM. However, when breaking down the net inflows since launch by excluding pre-existing GBTC AUM and swaps (selling futures or selling spot to buy spot ETFs), you get $14.5 billion in net inflows. However, these are not true inflows, as there are many delta-neutral flows to consider, namely basis trades (selling futures, buying spot ETFs) and selling spot to buy spot ETFs. By looking at CME data and analyzing ETF holders, I estimate that about $4.5 billion of net flows can be attributed to basis trades. ETF experts say that large holders such as BlockOne have also converted a large amount of spot Bitcoin into spot ETFs, which is estimated to be around $5 billion. Deducting these flows, we get a true net purchase of $5 billion for Bitcoin spot ETFs

In this way we can simply infer what Ethereum's fund flow will be like. Bloomberg ETF analyst @EricBalchunas estimates that Ethereum flow may be 10% of Bitcoin. This makes the true net purchase flow of $500 million in 6 months and the reported net flow of $1.5 billion. Although @EricBalchunas's prediction is not very accurate, I believe he represents the attitude of a number of traditional financial institutions.

Personally, I think Ethereum flow may be 15% of Bitcoin. Starting with the $5 billion of real net purchases of Bitcoin (mentioned above), by adjusting for Ethereum market cap (33% of Bitcoin) and a ⎡access factor⎦ of 0.5, we get $840 million of real net purchases and $2.52 billion of reported net purchases. There are some reasonable arguments that ETHE (Grayscale Ethereum Futures ETF) has a smaller premium than GBTC, so I think the optimistic case is $1.5 billion of real net purchases and $4.5 billion of reported net purchases. This is about 30% of Bitcoin flow.

In either case, the estimated $1.5 billion of real net purchases for the Ethereum spot ETF is far lower than the current $2.8 billion of funds flowing into Ethereum derivatives, not including spot front-running (referring to market expectations of bullishness and buying spot in advance). This means that the funds flowing into the Ethereum spot ETF before the listing exceeded the estimated funds flowing into the Ethereum spot ETF, so the price of the Ethereum spot ETF has been largely priced in by the market.

Access Factor: Adjusting for the liquidity achieved by the ETF, Bitcoin clearly benefits more than Ethereum given the different holder bases. For example, Bitcoin is a macro asset and is more attractive to institutions with access issues (macro funds, pensions, endowments, sovereign wealth funds). Ethereum, on the other hand, is more of a technology asset and is more attractive to institutions that are not as restrictive in terms of crypto access, such as VCs, crypto funds, technologists, retail investors, etc. 50% is derived by comparing the CME OI (Open Interest, derivatives open interest) to market cap ratio of Ethereum to Bitcoin.

Looking at CME data, Ethereum's OI was significantly lower than Bitcoin's before the Ethereum spot ETF was launched. OI was ~0.3% of supply, while Bitcoin was 0.6% of supply. At first, I thought this was a sign of early days, but one could also argue that this masks the fact that traditional financial funds have a lack of interest in Ethereum ETFs. Wall Street traders prefer to trade Bitcoin spot ETFs, and they tend to have front-line information, so if they don't use the same trading method on Ethereum, there must be a good reason, which may mean that there is insufficient information about Ethereum liquidity.

How did $5 billion push Bitcoin from $40,000 to $65,000?

The most clear and direct answer is that $5 billion alone can't do it. Because there are many other buyers in the spot market. Bitcoin is an asset that is truly recognized as a key portfolio asset worldwide and has many large institutions holding it for a long time, such as Saylor, Tether, family offices, high net worth individual investors, etc. Although Ethereum is also held by large institutions, I think it is an order of magnitude lower than Bitcoin.

Remember that before the emergence of Bitcoin spot ETFs, Bitcoin's highest price had reached $69,000, with a market value of more than $1.2 trillion. Market participants and institutions own a lot of spot cryptocurrencies. Coinbase has custody of $193 billion, of which $100 billion comes from other institutions. In 2021, Bitgo reported an AUC of $60 billion and Binance custodyed over $100 billion. 6 months later, the Bitcoin Spot ETF custodyed 4% of the total Bitcoin supply.

I tweeted on February 12th, expressing my opinion on the size of the cryptocurrency market: I estimate that long-term Bitcoin demand is $40-130+ billion this year. One of the most common pet peeves of crypto investors is underestimating the wealth in the world, people’s incomes, the liquidity of money, and its impact on crypto. We hear statistics about the market capitalization of gold, stocks, real estate so often that crypto can be overlooked by many. Many crypto practitioners are stuck in their own limited thinking, but the more you travel and meet other business owners, high net worth individuals, etc., the more you realize how unimaginable the amount of dollars in the world is and how much of that can go into Bitcoin or other cryptocurrencies.

Let me explain this with a rough demand sizing exercise. The average household income in the United States is $105k. There are 124 million American households in the United States, which means that the total annual income of American individuals is $13 trillion. The United States accounts for 25% of GDP, so the total global income is about $52 trillion. The average global cryptocurrency ownership rate is 10%. In the United States, it is about 15%, and in the UAE it is as high as 25-30%. Assuming that cryptocurrency owners only allocate 1% of their income each year, the cost of buying BTC is $52 billion per year, or $150 million per day.

When the Bitcoin spot ETF was launched, MSTR (Microstrategy) and Tether bought billions of dollars of Bitcoin, and the investors who entered the market at that time also had low holding costs. At that time, it was generally believed that the passage of the Bitcoin spot ETF was a signal for shipment. Therefore, billions of dollars of short-term, medium-term and long-term positions have been sold and need to be repurchased. Most importantly, once the Bitcoin spot ETF flow forms a considerable upward trend, the shorts need to repurchase. Open interest actually dropped before the Bitcoin spot ETF launched, which is crazy.

The Ethereum spot ETF is positioned very differently. Ethereum price is now 4x from its pre-spot ETF low, while Bitcoin is 2.75x. Crypto native CEX OI increased by $2.1 billion, bringing OI close to ATH levels. Markets are efficient. Of course, many crypto natives saw the success of the Bitcoin spot ETF and had the same expectations for Ethereum and positioned accordingly.

Personally, I think the expectations of crypto native users are exaggerated and out of touch with the real preferences of traditional financial markets. This results in relatively high mind share and purchases of Ethereum by those deeply involved in crypto. In reality, for many large non-crypto native capital groups, Ethereum is much less purchased as a key portfolio allocation.

One of the most common pitches from traditional finance is that Ethereum is a tech asset. The global computer, the Web3 app store, the decentralized financial settlement layer, etc. This is a nice pitch, and I bought it in the last cycle, but it is hard to accept when you look at the actual returns.

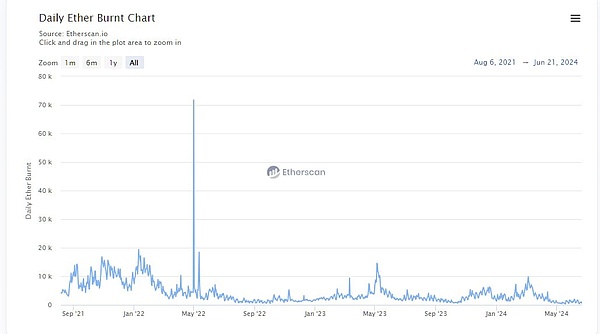

In the last cycle, you could point to the growth rate of fees and point out that DeFi and NFTs generate more fees, cash flow, etc. and make a compelling case for it as a tech investment in a similar perspective to tech stocks. But in this cycle, the quantification of fees is counterproductive. Most charts will show flat or negative growth. Ethereum is a cash machine, with $1.5 billion in revenue in just 30 days based on its annualized rate, a P/E ratio of 300 times, and a negative P/E after adjusting for inflation, how will analysts justify this price to their family office or macro fund bosses?

I even expect the first few weeks of fugazi (usually refers to seemingly large trading volumes that are not caused by actual capital inflows) flow to be lower for two reasons. First, the approval of the Ethereum spot ETF was unexpected, and the issuer did not have much time to convince large holders to convert their Ethereum to the spot ETF form. Second, it is less attractive for holders to convert because they need to give up the yield on Ethereum staked or in DeFi. But please note that the current Ethereum stake rate is only 25%.

Does this mean that Ethereum will go to zero? Of course not, at a certain price, it will be considered worthwhile, and when Bitcoin rises in the future, Ethereum will not necessarily follow. Before the spot ETF is launched, I expect Ethereum to trade between $3,000 and $3,800. After the spot ETF is launched, my expectation is $2,400 to $3,000. However, if Bitcoin rises to $100,000 in Q4 2024 or Q1 2025, then this may push the price of Ethereum above the ATH, but Ethereum Bitcoin will go lower from then on. In the long run, there are some developments to look forward to, and you have to believe that BlackRock and Fink are doing a lot of related work to build some financial infrastructure on the blockchain and tokenize more assets. How much value this will bring to Ethereum and the specific time is uncertain.

I expect Ethereum Bitcoin to continue to trend downward, with a ratio of between 0.035 and 0.06 over the next year. Although our sample size is small, we do see Ethereum Bitcoin making lower highs every cycle, so this should not be surprising.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Brian

Brian Sanya

Sanya Beincrypto

Beincrypto cryptopotato

cryptopotato Bitcoinist

Bitcoinist cryptopotato

cryptopotato Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph