Author: Kelly Ye, head of research at Decentral Park Capital, CoinDesk; Translator: Tao Zhu, Golden Finance

Although the history of cryptocurrencies is short, with Bitcoin just turning 15 this year, we have already gone through three major cycles: 2011-2013, 2015-2017, and 2019-2021. The short cycles are not surprising, given that the cryptocurrency market trades 24/7 and has about five times the volume of the stock market. The 2011-2013 cycle was mainly centered around BTC, as ETH was launched in 2015. Analyzing the past two cycles can reveal some patterns that help us understand the structure of the cryptocurrency bull market. History could repeat itself again as the market heats up ahead of the U.S. election and the outlook for liquidity improves.

BTC Leads Altcoins into Rally

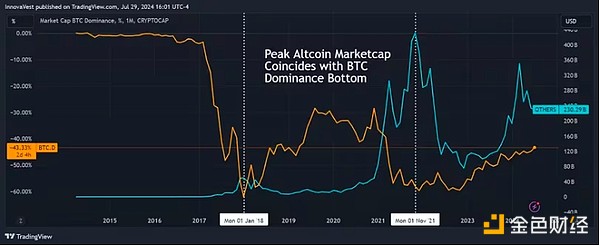

In both the 2015-2017 and 2019-2021 cycles, Bitcoin initially led the market higher, building confidence and setting the stage for a broader rally. As investor optimism grew, capital flowed into altcoins, driving broad market rallies. Altcoin market cap peaks often coincide with BTC market cap dominance bottoms, indicating a rotation of capital from BTC to altcoins. Currently, BTC dominance is still climbing from its post-FTX lows, suggesting that BTC still has more room to run before altcoins catch up.

Altcoins outperformed in the second half of the cycle

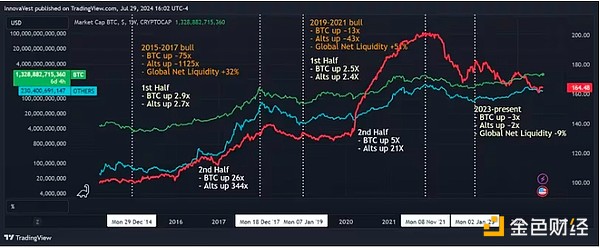

In both major cycles, altcoins significantly outperformed Bitcoin after the initial phase (when both had comparable returns). This trend reflects investors' increased risk appetite and the adaptability of the altcoin market amidst increased risk capital.In the second half of the 2015-2017 cycle, altcoins returned 344x, while BTC returned 26x. Similarly, in the second half of the 2019-2021 cycle, altcoins returned 16x, while BTC returned 5x. After FTX, we are about halfway through the current cycle, with altcoins slightly lagging BTC. This trend suggests that altcoins may outperform in the second half.

Macroeconomic Impact

Like other risk assets, cryptocurrencies are highly correlated to global net liquidity conditions. Global net liquidity has increased by 30-50% over the past two cycles. The recent Q2 sell-off was partly driven by tightening liquidity. However, the trajectory of the Fed’s rate cuts looks favorable as Q2 data confirms slowing inflation and growth. The market now prices in a more than 95% chance of a rate cut in September, up from 50% at the start of the third quarter. Additionally, crypto policy is taking center stage in the U.S. election, with Trump’s support for crypto likely to influence the new Democratic candidate. The past two cycles also overlapped with the U.S. election and the BTC halving event, increasing rally potential. Will it be different this time? While history won’t repeat itself exactly, the rhythmic nature of past cycles — initial Bitcoin dominance, subsequent altcoin outperformance, and macroeconomic influences — set the stage for altcoin rallies. This time, however, could be different. On the positive side, BTC and ETH have entered the mainstream market through ETFs, and the capital inflow from retail and institutional investors has hit a record high.

On the cautious side, altcoins with a larger number and richer variety are competing for investors' capital, and many new projects have limited the circulating supply due to airdrops, resulting in future dilution. Only ecosystems with solid technology and the ability to attract builders and users can thrive in this cycle.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex Beincrypto

Beincrypto Catherine

Catherine Beincrypto

Beincrypto Beincrypto

Beincrypto Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph