Introduction:

January 3, 2024, State Administration of Taxation, Shanghai The Municipal Taxation Bureau issued an article on the public account "Common Misunderstandings about Personal Income Tax Business Income and Classified Income", which pointed out:

So the currency circle exploded again, and many friends came Question, Lawyer Shao, does paying taxes on virtual currencies mean that virtual currencies will be legal to trade in my country in the future? Has the country recognized virtual currency? Will the tax bureau check my previous accounts? How much back tax do I have to pay?

I even saw this kind of marketing article that makes people laugh out loud and misleads the public.

So Lawyer Shao feels that it is still necessary to help everyone analyze what is said in the Shanghai Taxation article?

1.Do I need to pay personal income tax when buying and selling virtual currencies?

1. The original text of the Shanghai tax announcement that excited friends in the currency circle is as follows:

Myth3: Individuals buying and selling virtual currencies through the Internet are not required to pay personal income tax.

Correct answer. Personal income taxis required.

"Reply on the Collection of Personal Income Tax on Income Obtained by Individuals from Buying and Selling Virtual Currencies on the Internet" (Guo Shui Han [2008] No. 818) stipulates: Individuals acquire players through the Internet The income from selling virtual currency to others after adding a price is taxable income for personal income tax, and personal income tax should be calculated and paid according to the "income from property transfer" item.

2. Lawyer Shao’s interpretation

First of all, time , the legal basis corresponding to each question and answer in the original article is the "Reply of the State Administration of Taxation on the Collection of Personal Income Tax on Income Obtained by Individuals from Online Trading of Virtual Currencies" that came into effect on September 28, 2008. When is Bitcoin some? ——Proposed by Satoshi Nakamoto on November 1, 2008, and born on January 3, 2009.

From a time perspective, it is obvious that the person who drafted the regulations would not have known the fresh concepts of Bitcoin and Tether at that time.

Secondly, in terms of content, "Individuals acquire players' virtual currencies through the Internet." Obviously, this refers to games. The game currency of the players on the platform is also a "virtual currency". Have friends in the currency circle forgotten?

So, the meaning of this approval is that the income from buying and selling game currency belongs to the "income from property transfer" in personal tax , is subject to tax. It has nothing to do with pie.

The tax bureau must be thinking, what do you want to do in the currency circle, is it a ploy? If you really think so, it’s not impossible to consider...?

2.How far is it from taxing the big pie?

Although this time it was a big mistake, Lawyer Shao believes that the country will continue to regulate cryptocurrency ( To distinguish it from game virtual currency, the following are all described as cryptocurrency) Taxation is a matter of time. The main reasons are as follows:

1. Is there any basis for taxing cryptocurrency?

Since 2013 to the present, relevant departments in my country have issued a series of documents on cryptocurrency. Among them, according to the notice of five ministries and commissions in December 2013, Bitcoin is characterized as a virtual commodity and cannot be used as currency in the market. According to Announcement 94 of 2017, trading of cryptocurrencies between individuals is not prohibited. In subsequent articles, these two views have never been denied.

According to Article 2 of the "Personal Income Tax Law", the following personal income must be subject to personal income tax: "(8) Income from property transfer". Cryptocurrency transactions between individuals, such as U-businessmen who buy low and sell high to earn the difference, or ordinary currency speculators, aren’t the profit from the price difference the income from property transfer under the personal tax law? .

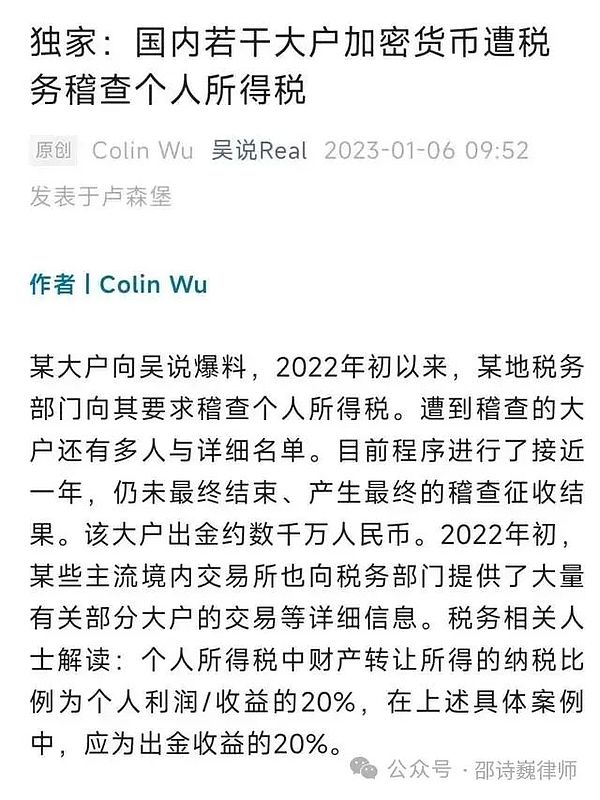

And according to some rumors, some large domestic companies have been asked by the tax department to conduct personal income tax audits.

2. For our country, what are the pros and cons of taxation?

Before promulgating relevant policies and regulations, the country will inevitably fully consider the pros and cons of this decision. So for our country, what are the advantages and disadvantages of taxing cryptocurrency? ——This determines whether cryptocurrency taxation will be implemented domestically in the future.

Lawyer Shao would like to make some brief comments:

A The benefits of taxation:

Of course, the country has more money. Taxation is an important source of national revenue. If the country has more money, it can Use tax policies to adjust the economic structure and strengthen national macro-control. In addition, taxation can also effectively fill the loopholes that some high-income people use to evade taxes using virtual currencies.

B Disadvantages of taxation:

Based on current policies, taxation The department really cannot "act rashly". According to our country's past policies, which include cracking down on ICOs, cracking down on mining, classifying virtual currency-related business activities as illegal financial activities, etc., wouldn't it be wrong if the tax department suddenly imposed a tax on cryptocurrencies? Are the various government departments slapping each other in the face? Isn’t this chaos?

Taxation, the public’s simple understanding is that the country recognizes cryptocurrency as legal. Will it evolve into the public belief that the country encourages the trading of cryptocurrency, triggering a butterfly effect such as nationwide currency speculation? Then it may really affect the status of the RMB as a legal currency in our country (even if we argue that cryptocurrency is not a currency by then, merchandise only). Currency speculation will also lead to foreign exchange trading (using cryptocurrency as a tool to illegally buy and sell foreign exchange, please refer to Lawyer Shao’s previous articles "Introduction to foreign exchange, sentenced to 8 years in prison (Part 1)" "Introduction to foreign exchange, sentenced to 8 years in prison (Part 2)") Illegal activities such as using virtual currency to transfer assets are becoming more rampant. ——In order to collect taxes, will you pick up sesame seeds and lose watermelons? These are bound to be questions that legislators will consider.

C Challenges faced by taxation:

Although cryptocurrencies were It's been around, but it's still new to most people. At present, it is technically difficult to tax cryptocurrencies. Encryption algorithms, smart contracts, and distributed ledgers are concepts that even confuse police officers when handling criminal cases. Want to make a cryptocurrency version of the "Fourth Phase of the Golden Tax"? It is obvious that the corresponding conditions are not currently met.

3. What is the understanding of cryptocurrency in other countries?

Troublesome problems, you might as well see how others deal with them. If you want to impose taxes, you can also refer to the practices of other countries.

As early as 2014, the IRS issued Notice 2014-21, which clarified how cryptocurrencies are taxed. In April 2017, the Japanese government revised the Fund Settlement Act, recognizing Bitcoin as a legal payment method and formulating a series of standards and rules for exchanges. On February 22, 2021, according to South Korea’s Ministry of Strategy and Finance, the South Korean government will tax income from cryptocurrencies and other virtual assets exceeding 2.5 million won within one year at a tax rate of 20% starting next year (but it does not seem to have been implemented yet).

In short, the value of cryptocurrency has been recognized by many mainstream countries, but there are different qualitative distinctions. For example, it is positioned as a commodity, digital asset, and has economic Electronic certificates of value, monetary payment methods, securities, etc. Regarding taxation, some countries have also formulated relevant plans.

Write at the end:

< p style="text-align: left;">Whether cryptocurrencies will be taxed, Lawyer Shao believes:

At some time in the uncertain future, yes. However, how much and how to collect may require solving a series of complex issues, and then on the basis of coordination between various departments, the tax department will issue policies that can truly be implemented.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund JinseFinance

JinseFinance Bernice

Bernice JinseFinance

JinseFinance Zoey

Zoey