Author: Suvashree Ghosh, Ryan Weeks, Emily Nicolle, Bloomberg; Translator: Wuzhu, Golden Finance

The news that Telegram founder Pavel Durov has been detained has caused quite a stir in the crypto venture capital world, where some of the biggest players have invested in digital tokens closely tied to the messaging app.

Pantera Capital Management, Animoca Brands and Mirana Ventures are among more than a dozen companies that have invested in Toncoin, Telegram's blockchain for processing transactions such as instant payments.Pantera, one of the largest crypto venture capital funds, invested more than $100 million in Toncoin earlier this year, people familiar with the matter said.

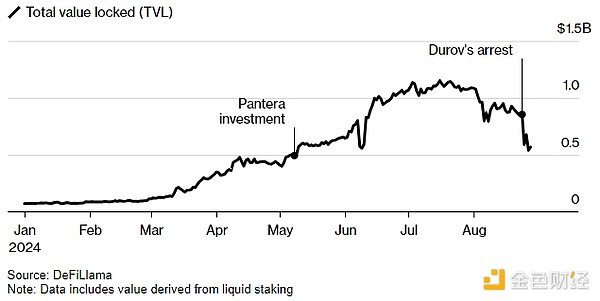

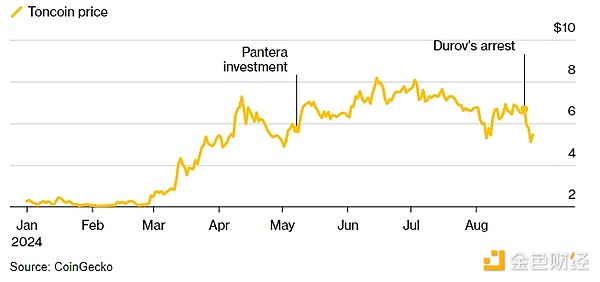

The funds were attracted by a confusing cryptocurrency idea: Telegram would become a digital asset "super app" similar to China's WeChat, with its 900 million users relying on Toncoin for everything from payments to playing blockchain-based games. The token surged fourfold from February to early July, with assets locked on its blockchain, TON, briefly exceeding $1 billion.

But Durov’s detention, accused of not doing enough to combat crime on Telegram, exposed the risks. Durov was charged on Wednesday with participating in the distribution of child pornography and other crimes such as drug trafficking on the app. Telegram said in a statement on Sunday that it complies with European law.

Toncoin plunged about 20% after Durov was arrested outside Paris on Aug. 24, before recovering some of its losses. The total value locked in TON has fallen to $573 million, according to data provider DefiLlama.

The total value of assets locked on the TON network has fallen sharply this year

“Most investors believed that the application itself would obviously promote and drive adoption of the Toncoin network, or at least sow the seeds,” said Lasse Clausen, founding partner of crypto venture capital firm 1kx. “Now we have a black swan event, the company itself and its founders may have some questions about the future.”

The total value locked (TVL) is an indicator of how well a blockchain is being used for its stated purpose, whether it’s gaming or decentralized finance applications.

Venture capital investors who poured money into Toncoin — often with agreements not to sell for at least a year — are now trying to gauge whether France’s move against Durov will cause users to flee Telegram. The app became popular in crypto circles in large part because of a lax regulatory approach that landed him in legal trouble.

Pantera called Toncoin its largest investment but did not disclose how much.A spokesman for the Menlo Park, California-based company, which manages nearly $5 billion, didn’t respond to emails and phone calls seeking comment. The TON Foundation, which manages the blockchain, said in an email that it has never raised money. Animoca Brands didn’t comment on its investment, and Mirana Ventures didn’t immediately respond to inquiries.

Some Toncoin backers see an opportunity. DWF Labs, a cryptocurrency market maker that invested in the token, spent “millions of dollars” on the open market to buy Toncoin after the weekend’s price crash, said co-founder Eugene Ng.

Token trades, liquidity

Over-the-counter investments in projects like TON by venture capital firms and other crypto funds are known as “token trades” because investors receive tokens rather than traditional equity, and they are unique to the cryptocurrency space. To conduct these trades, venture capitalists typically set up separate vehicles, called liquidity funds, designed to hold assets for shorter periods of time. Because many token trades are conducted bilaterally, there are no reliable estimates of their popularity.

For venture capital firms and their investors, tokens have several advantages, most notably that they tend to involve faster exits. One common structure is for tokens to begin unlocking after 12 months, after which investors can gradually sell them. Clausen said the volatility of tokens also gives backers more timely information about the progress of a project.

“If you’re a traditional venture investor with equity, the maturity period is about eight to 10 years, so you really have a lot of years where the company is just doing their thing,” he said.

Token trades can also involve deep discounts. Pantera paid 40% below the market price for Toncoin at the time, said the people, who asked not to be named because the terms are confidential. At the average price of $6.32 when the deal was announced in May, the investment would still be easily profitable.

Toncoin has reversed some of this year’s gains

Pantera’s lockup period is one year, after which it can sell the Toncoin in tranches over several years, the person said.

The other side of token investing is that the assets are extremely volatile — when an investment goes bad, it’s immediately apparent. Funds typically mark to market their holdings regularly, meaning big declines show up immediately in reports to limited partners.

Few examples illustrate this risk better than the collapse of Do Kwon’s TerraUSD stablecoin project in May 2022. Just a few months ago, investors including Three Arrows Capital and Jump Crypto bought more than $1 billion of Luna, a token used to stabilize TerraUSD. When TerraUSD collapsed, Luna became worthless. Three Arrows went bankrupt soon after, setting off a series of failures across the crypto industry.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Davin

Davin decrypt

decrypt Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph