Source: Currency Trader

After the Federal Reserve cut interest rates by 50 basis points beyond expectations, global capital The market has ushered in a historic turning point. Since September 18, global stock markets have continued to rise sharply, with the Shanghai Composite Index soaring 11.8% in four trading days, setting a new four-day rise record in the past 10 years. The hot market even caused the Shanghai Stock Exchange to shut down. Different from the past preference for ‘big and beautiful’ investment styles, small and medium-cap stocks have performed particularly well in this round of gains. The Wind market terminal shows that from September 18 to 27, the S&P 500 index, which excludes the top ten stocks by market capitalization, rose significantly more than the overall index, while the growth rate of the A-share GEM index was also nearly 50% higher than that of the Shanghai Composite Index. It is worth noting that despite the recent tepid performance of Bitcoin, altcoins in the fields of AI, MOVE public chain, chain games and MEME are extremely popular. These phenomena show that as the Federal Reserve enters the interest rate cutting cycle, the focus of funds has gradually shifted from absolute value to price elasticity.

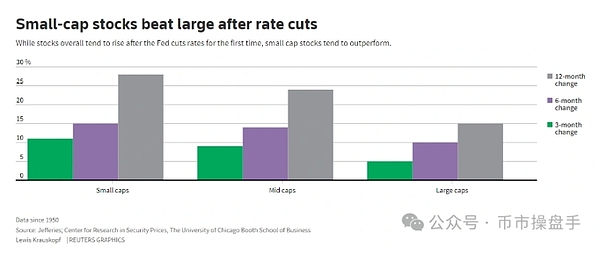

During interest rate cut cycles, small-cap stocks typically outperform large-cap stocks. Since 1950, following the Fed's first rate cut, small-cap stocks have gained an average of 11%, 15% and 28% three, six and 12 months later, respectively, compared with 5% for large-cap stocks, according to Jefferies. , 10% and 15%. The main reasons for the better performance of small-cap stocks are the following two points:

1. Compared with large companies, small companies generally have higher debt levels. Cutting interest rates helps lower borrowing costs, which means lower financial costs and higher profit margins for smaller companies that rely on bank loans and floating-rate debt.

2. The decline in interest rates has made fixed-income financial products such as bonds and bank deposits less attractive, thereby promoting the flow of funds to high-risk and high-yield assets, ultimately leading to an increasing market risk appetite.

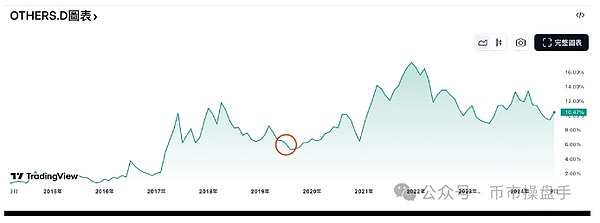

In fact, in In the last round of interest rate cuts, the market value of altcoins increased from 6.07% to 17.37%, an increase of 186%. If historical rules remain valid, altcoins are likely to perform well during this interest rate cut cycle.

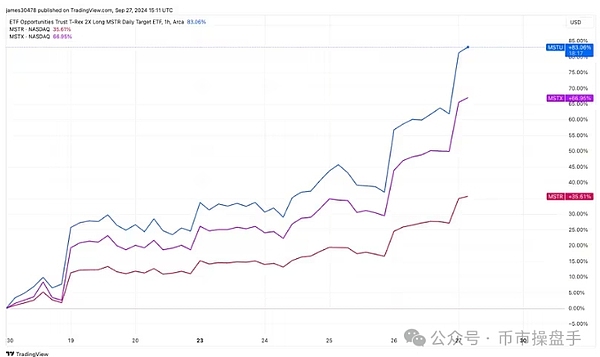

Despite investing in altcoins The possibility of obtaining excess returns is greater, but Bitcoin is still the best win-win strategy during the interest rate cut cycle. According to data from SoSoValue, Bitcoin ETFs have begun to resume inflows since September 9. By September 27, the single-day net inflow into the Bitcoin ETF reached $494 million, almost returning to the level when inflows were strongest in the first quarter. At the same time, Microstrategy, the listed company holding the largest number of Bitcoins, saw its stock price increase by 55% between September 6 and September 27, while the Nasdaq and S&P 500 increased by 8.7% and 7.6% respectively during the same period. Although Microstrategy's Q2 financial report shows that the company's main business is still sluggish and revenue and profits are facing downward pressure, the secondary market is confident in Microstrategy's transformation into a Bitcoin investment fund.

Industry based on Bloomberg According to research data, the MicroStrategy 2X Leveraged ETF issued by REX Shares and Tuttle Capital Management received a large net inflow of US$72 million in its first week of listing, becoming one of the best-performing newly issued ETFs in the market. The previously launched 1.75X Long MicroStrategy ETF (MSTX) has attracted approximately US$857 million since August 15, ranking in the top 8% of many ETFs in terms of gold-absorbing ability. Almost every leveraged fund linked to MSTR has become a popular choice in the market. Judging from data disclosed by the exchange, retail investors account for as much as 80% of the investors participating in MSTR leveraged ETF transactions. Obviously, the issuance of MSTR Leveraged ETF provides a good entrance for retail investors to participate in Bitcoin leverage trading.

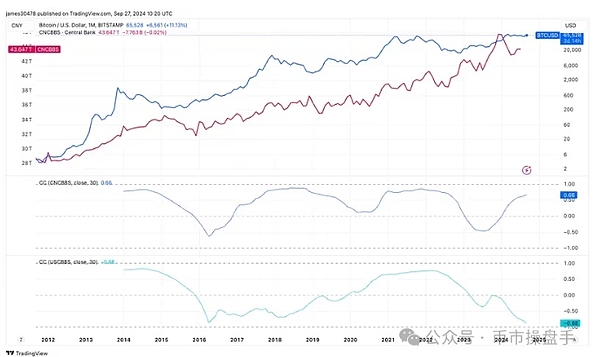

This week, The central bank created structural monetary tools for the first time to support the development of the capital market, which attracted widespread attention from the market. At present, the first phase of 500 billion yuan of swap facilities and 300 billion yuan of re-loans have been implemented, which is expected to bring an increase of up to 800 billion yuan to the capital market. The governor of the central bank revealed at a press conference that if the innovative monetary tools achieve the expected results, the second and third phases will be launched in the future. In addition, Bloomberg and Reuters have recently predicted that China will launch an economic stimulus package worth RMB 2 trillion. This series of measures will promote the further expansion of the central bank's balance sheet.

Regarding the impact of China’s economic stimulus on the crypto market, CoinDesk analysts pointed out that over the past eight years, Bitcoin prices have been positively correlated with the size of the Chinese central bank’s balance sheet, and its 30-day correlation coefficient is 0.66. The correlation has remained positive except in 2016 and from late 2022 to 2023.

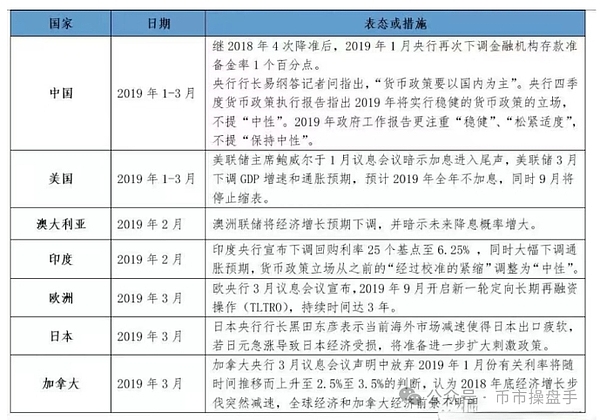

The last round of the Fed's interest rate cut cycle started Previously, central banks around the world had turned to loose monetary policies. After China cut its reserve requirement ratio four times in a row, the scale of social financing has experienced record growth. During this period, Bitcoin rebounded from $3,155 to $13,968, an increase of 343%. At the same time, the chaos of altcoin demons was also staged again during this period. Although the current market size is not the same as in the past, what is certain is that the East's boost to the crypto market is far from over.

The last round of the Fed's interest rate cut cycle started Previously, central banks around the world had turned to loose monetary policies. After China cut its reserve requirement ratio four times in a row, the scale of social financing has experienced record growth. During this period, Bitcoin rebounded from $3,155 to $13,968, an increase of 343%. At the same time, the chaos of altcoin demons was also staged again during this period. Although the current market size is not the same as in the past, what is certain is that the East's boost to the crypto market is far from over.

If the market in 2019 is regarded as an intermediate rebound of the 2017 bull market, then 2024 can be regarded as an intermediate rebound of the 2017 bull market. An intermediate rebound in the market in 2021. If calculated based on the magnitude of the rebound in 2019, the maximum increase in most altcoins can reach 2 to 5 times.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex JinseFinance

JinseFinance JinseFinance

JinseFinance Future

Future Cointelegraph

Cointelegraph