Written by: 0xWeilan, Source: EMC Labs

The cyclical wheel is turning, pushing the market, which was full of fear and hesitation not long ago, into a new stage, and trading has suddenly heated up.

As we predicted: the internal consolidation of the crypto market has been completed, and this month has ushered in an external detonation point - the US presidential election ended on November 6, and Trump, the Republican candidate who is friendly to Crypto, won. The price of BTC has continued to hit new highs, approaching $100,000.

The conclusion of this major event of the year has enabled traders in various financial markets to gradually get out of chaos and uncertainty and return to the established trading rhythm, and US stocks have resumed their rise. "Trump's economic policy" is expected to become the main trading point, and Tesla, MicroStrategy, etc. have become the targets with the largest increase.

BTC suddenly started in the slump at the end of October, overcoming multiple technical suppressions such as the "new high consolidation zone" and the "upward trend line" in one fell swoop, and continuously set new historical highs, with the highest breakthrough reaching US$99,860, and a sharp increase of 37.42% for the whole month.

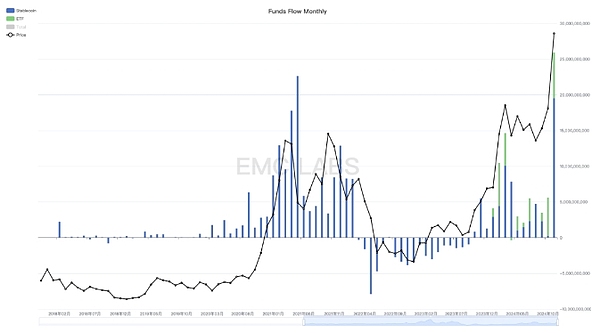

With the trading market heating up, funds ushered in a huge inflow in November, with an inflow of US$25.9 billion for the whole month, becoming the largest month in the history of the Crypto market.

With BTC approaching the $100,000 mark, the continuous inflow of funds finally triggered a sharp rise and general rise in Altcoins represented by ETH.

EMC Labs comprehensively judged from multiple dimensions that the second wave of the "upward period" of the current cycle of the crypto market has started, and funds in the later market will gradually flow into Altcoins to form a general rise.

The high inflation that may be caused by "Trump's economic policy" and the conflict with the Fed's ongoing interest rate cut rhythm have become the biggest uncertainty. However, this uncertainty is only a little discord in the big certainty, which is not enough to change the trend of market operation.

Macro Finance: Trump's Economic Policy

"Trump's economic policy" mainly includes tax cuts and deregulation, protectionist trade policies, energy independence and traditional energy support, fiscal expansion and debt risks, immigration and labor policies, politics and debt management, etc.

These economic policies guided by the spirit of "America First" will pose a great challenge to the existing global trade and financial order, and cause unpredictable conflicts and chaos. Even in the United States, seemingly irreconcilable contradictions will form in the aspects of economic growth, illegal immigration and financial system.

Repatriating illegal immigrants and raising tariffs may push up inflation, while the federal interest rate is still at a high level, inflation rebounds, and interest rate cuts may be hindered. Without a rate cut, the government's fiscal expansion will undoubtedly be more difficult, and the high debt scale will make the US government overwhelmed.

The Federal Reserve, which is in the process of cutting interest rates and shrinking its balance sheet, is also facing a dilemma. The US CPI rebounded as expected in November, while employment data and economic conditions remained good, which means that the need for a rate cut has been greatly reduced. Although the dot plot and the minutes of the meeting released by the Federal Reserve show that a 25 basis point rate cut in December is still a high probability event, the rate cut process in 2025 is likely to slow down.

Powell hopes to uphold professionalism, maintain economic stability, and normalize inflation levels. But Trump has made it clear that he will fulfill his campaign promises through change and conflict - reducing corporate taxes, increasing import tariffs, and providing more domestic jobs. The two propositions are almost irreconcilable, and their contradictions have become public.

Although there is great uncertainty, traders in various markets have already lined up and given decision results - going long on the US economy, the most optimistic result is "high inflation and high growth."

In November, Nasdaq, Dow Jones and S&P 500 recorded increases of 6.21%, 7.54% and 5.74% respectively, while RUT2000, which represents small and medium-sized enterprises, recorded an increase of 11.01% and set a record high.

In terms of U.S. Treasuries, the long-end and short-end yields at the end of the month were 4.177% and 4.160% respectively, both recording a slight decline, indicating that the bearish risk of U.S. Treasuries has temporarily declined.

The U.S. dollar index continued to climb, closing at 105.74 in November, up 1.02% from the previous month. At the same time, the exchange rates of the euro, renminbi and yen against the U.S. dollar all depreciated. Global funds are optimistic about the U.S. financial market in the future, and the trend of snapping up dollar-denominated assets continues.

Correspondingly, gold, which carries global safe-haven funds, fell 3.41% in the month, recording the largest monthly decline in 14 months. As we gradually move out of the post-epidemic era, liquidity is becoming increasingly abundant, and the risk appetite of global funds is increasing. Equity assets, as well as Crypto represented by BTC, are the beneficiaries of this increase.

Crypto assets: BTC hits a new all-time high, Altseason is ready to start

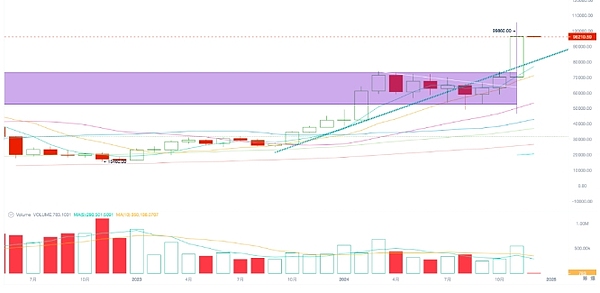

In November, BTC opened at $70,198.02 and closed at $96,465.42, up 37.42%, with an amplitude of 47.12%, and the trading volume was effectively enlarged.

After returning to the "200-day moving average" and crossing the "downward trend line" in November, BTC continued to achieve a landmark breakthrough in technical indicators this month, breaking through the upper edge of the "new high consolidation zone" that had been stuck for 8 months, and once again stepped on the "upward trend line" after a lapse of 4 months.

BTC daily price trend

On the monthly line, BTC has achieved three consecutive months of growth and the volume has continued to expand moderately, showing a benign upward trend.

BTC monthly price trend

In previous research reports, we have repeatedly emphasized that more than 30% of BTC addresses have been transferred in the new high consolidation area from March to October this year. This upward re-pricing has occurred repeatedly in the past cycle and has become the internal structural support for future price increases.

The final breakthrough of prices requires external conditions to stimulate.

The biggest global event in November was Trump's re-election as the US President, and his previous enthusiasm for Crypto and the "promises" during the campaign became the emotional catalyst for BTC to break through the "new high consolidation zone" that had been stuck for eight months.

Is BTC's "Trump market" sustainable? EMC Labs believes that whether it is the "21st Century Financial Innovation and Technology Act" proposed last year, or this year's "US Bitcoin Strategic Reserve Draft", or even the "Bitcoin Bill of Rights" just passed by the Pennsylvania House of Representatives recently, it shows that the United States' adoption of Crypto has gradually shifted from "permission" to "promotion". Its goal is to ultimately gain control of crypto assets represented by BTC and blockchain industries (public chains, infrastructure and decentralized application projects) through laws and regulations and national strategic support, and ensure that the United States gains a dominant advantage in this emerging track.

Therefore, in the next few years, it is foreseeable that the support from US policies and the adoption of Crypto by traditional institutions including financial institutions and listed companies will continue to increase. At any moment in history, the blockchain industry and crypto assets have never been accepted and adopted so vigorously.

Liquidity surges: Two major channels resonate to set a historical record

Continuous capital inflows are the material support for the bull market.

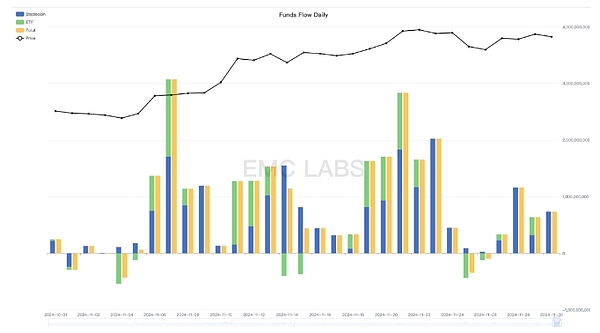

In November, BTC Spot ETF and stablecoin channels had a total inflow of $25.9 billion, setting a record for the largest monthly capital inflow on record. The ETF channel had $5.4 billion and the stablecoin channel had $19.5 billion. In November, the scale of ETF capital inflows exceeded that of February, making it the largest inflow month.

Monthly Statistics of Fund Flows in Crypto Market

Since October, as the US election draws to a close, the ETF channel funds have taken the lead. Since September, the inflow of funds in this channel has gradually increased, with 1.2 billion, 5.4 billion and 6.4 billion inflows from September to November respectively. We have previously emphasized that the funds in the ETF channel have independent will and will gradually control the price trend of BTC. This has been fully reflected in the recent market.

Compared with the "big brother" who bravely shoulders the heavy responsibility, the stable currency channel funds are slightly late to the party. After entering November, the influx of funds began to show a trend of large-scale inflow as the price of BTC continued to break through. However, the inflow of funds in the stablecoin channel reached 19.5 billion US dollars for the whole month, far exceeding the funds in the ETF channel.

Daily statistics of capital flows in the crypto market

On November 22, when BTC hit the $100,000 mark, on-site funds began to start ETH, and the increase on the same day reached 9.31%. In November, the cumulative increase of ETH reached 47.05%, exceeding BTC, and the market seems to be opening Altseason.

EMC Labs believes that after BTC breaks through the $100,000 mark in the future, Altseason will gradually open. After Altseason opens, the market will gradually present: 1. ETH breaks through the historical high; 2. The market rises generally; 3. The main market trend is gradually identified.

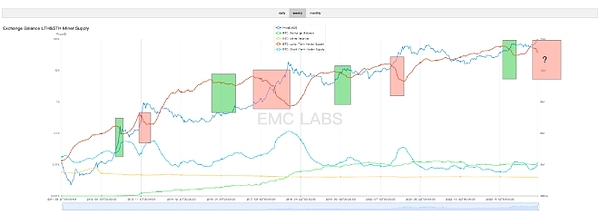

Long-short game: liquidity spawns the second wave of selling

The cycle is a game of collecting and distributing chips between long and short hands within the scope of time and space.

Long hands collect chips during the decline, bottoming and repair periods, and continue to sell during the rise and conversion periods until liquidity can no longer absorb the selling pressure and the market reverses.

Since January 2024, long hands have launched the first large-scale sell-off in this cycle, and then returned to the state of chip accumulation after the market entered consolidation in March. In November, as liquidity recovered and prices hit new highs, long hands have started the second wave of selling, which is also the last large-scale sell-off in this cycle.

15-year history of BTC long-hand selling

As of the end of September, long-hand positions were 14.22 million, and by the end of November, the scale of selling positions reached 13.69 million, and the "selling scale" in two months reached 530,000.

In the rising period, the motivation for long-hand selling is the price increase brought by liquidity, and the price increase is also the self-certification process of the market, which will trigger more capital inflows.

The second sell-off of long-term investors has just been going on for two months. With the continuous increase in liquidity, it is expected to continue in the first half of 2025.

Conclusion

In November, the cycle once again demonstrated its strong market regulation ability.

EMC Labs believes that the fundamental reason for the rise in the price of BTC and the entire crypto market is that on the basis of the complete internal structure, the continued interest rate cuts in major economies around the world and the significant increase in investors' risk appetite are the fundamental reasons. In addition, the significant increase in adoption and expectations of US national policies also provide great emotional and material motivation.

We believe that these external factors will continue to provide dynamic support for the crypto market in the coming year. Therefore, the crypto bull market will continue to rise after the restart, and there will still be twists and turns in the middle, but the second half of the rising period is destined to provide more generous returns for long-term investors.

Jixu

Jixu

Jixu

Jixu Kikyo

Kikyo Hui Xin

Hui Xin Alex

Alex Catherine

Catherine Clement

Clement Jasper

Jasper Jixu

Jixu Hui Xin

Hui Xin YouQuan

YouQuan